After confidently denying for months that there is a chance of an aggressive escalation in the US-China trade war, Goldman finally moved toward joining what has now become a virtual sellside consensus call that the feud between China and the US will become worse before its get better, when on Monday the bank said that “additional trade-related actions taken over the last several days further raise the risk of additional US tariffs on imports from China and further reduce the chances of a formal agreement at the June G20 meeting”, yet even then adding that “while there is substantial uncertainty, we believe the odds are slightly greater that further US-China tariff escalation is avoided. That said, this is a close call and without additional signs of progress over the next few weeks, implementation of the next round of tariffs on $300bn of imports from China (“List 4”) could easily become the base case.”

In light of the latest developments, which have seen the bilateral trade war mutate into a global tech war targeting various key Chinese companies, with Australia, New Zealand, the UK and Japan all siding with the US in refusing to supply Huawei with critical components effectively jeopardizing the continued existence of the Chinese telecom giant, it now appears that implementation of the 4th round of tariffs is virtually certain.

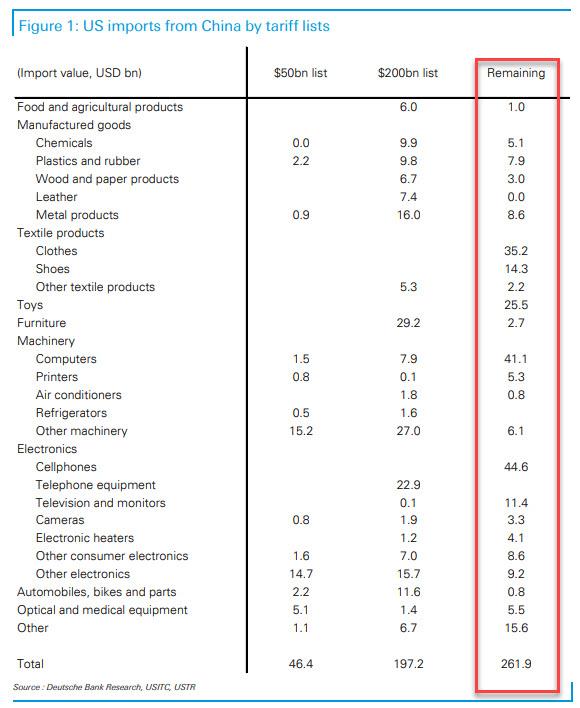

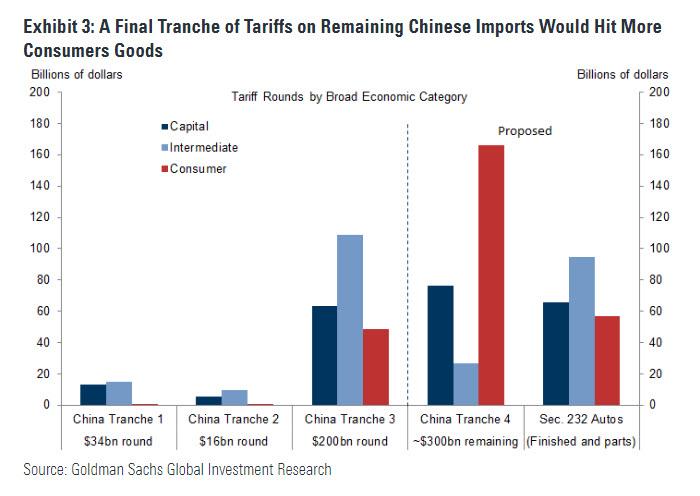

This, in turn, prompted Goldman last week to warn that a burst in US inflation is likely in the near future, since the final tranche of tariffs would affect mostly consumer goods…

… and the result would be higher prices for a wide range of goods for two reasons: i) the costs of US tariffs have fallen entirely on US businesses and households, with no clear reduction in the prices charged by Chinese exporters; ii) the effects of the tariffs have spilled over noticeably to the prices charged by US producers competing with tariff-affected goods.

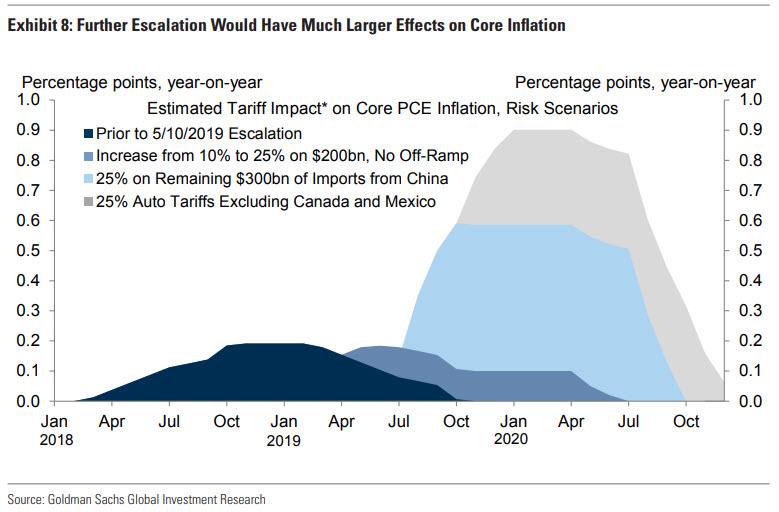

In other words, if the trade war escalates further from here, the inflation impact could become quite large, and Goldman calculates that imposing 25% tariffs on roughly $300bn of remaining Chinese imports would have a peak effect of 0.5pp on core PCE, while auto tariffs would have a roughly 0.3pp peak effect. These considerably larger effects reflect the much larger share of consumer goods that would be affected. If all proposed tariffs were implemented within a year, the total impact on core PCE would peak at around 0.9pp.

But what about the impact of escalating trade war, and the imposition of “Tranch 4” tariffs on markets?

That’s the topic that Goldman’s economists discussed in a note published overnight, in which the bank tries to estimate “the impact of trade tensions on key asset markets and the FCI, and simulate the impact of different policy scenarios.”

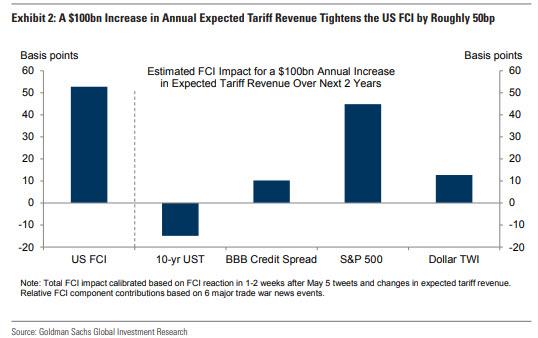

The bank’s big picture prediction is that a $100bn increase in annual expected tariff revenue for two years tightens the bank’s Financial Conditions Index by 50bp, “mostly driven by a decline in equity prices with dollar appreciation and credit spread widening playing a smaller role. A decline in Treasury yields provides only a partial offset.”

To drill down the impact of this wholesale tightening in financial conditions on various asset classes, Goldman then looks at the recent escalation from Trump’s tweets, which Goldman economist David Choi describes as “the cleanest ‘out of the blue’ surprise of the trade war.” Specifically, the bank estimates that expected tariff revenue over the next two years “:increased by around $40bn in the days surrounding President Trump’s tweet, with the chances of 25% tariffs on $200bn worth of imports increasing from roughly 0% to 100% over the next quarter, from 0% to 30% from 2019Q4 and after, and the chances of further escalation rising as well.”

How about market impact?

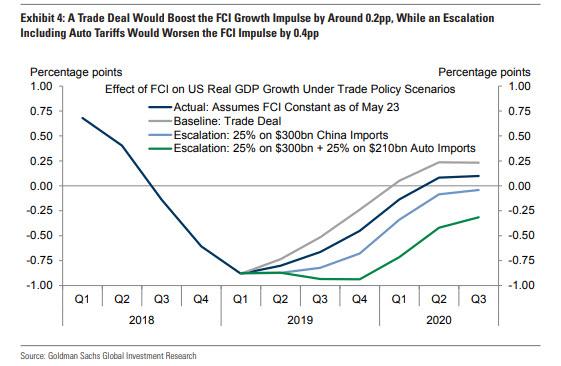

First, Goldman calculates the impact of its bullish, baseline case which consists of “a deal and a staggered reduction of the tariffs in place now”, and estimates a roughly 4% increase in the stock market, with an overall FCI easing of 20bp boosting the FCI growth impulse by 0.2%. However, now that further escalation appears virtually assured, the bank also projects that the imposition of tariffs on the remaining $300bn of imports from China would lead to a roughly 4% additional decline in equity prices and a 25bp FCI tightening. Goldman also sees a 15bps decline in 10Y yields under this scenario.

Finally, in the worst case scenario, which adds auto tariffs (which would increase the expected tariff revenue by a cumulative $75 billion), Goldman predicts a total 7% decline in equity prices, a 40bp FCI tightening and a 0.4% deterioration in the FCI growth impulse. Furthermore, in this scenario, Goldman would also expect a 20-25bp decline in yields, and 1-2% appreciation in the dollar.

The impact on Financial Conditions from these three scenarios relative actual, is shown in the chart below, and is summarized as follows: “Further escalation resulting in tariffs on the remaining imports from China would lead to an additional 0.25pp FCI drag on growth, while auto tariffs on top of that would lead to a 0.4pp deterioration in the FCI growth impulse for a peak net drag of almost 1pp”

In an amusing footnote, Goldman states that it sees “the risks as skewed toward larger market impacts in the escalation cases , if non-tariff measures are implemented as well”, a list of which was provided earlier by Barclays and noted here, while the worst market impact would occur “if sentiment deteriorates nonlinearly”, in other words if the market responds even more adversely in a way that Goldman can’t predict. Which, of course, means that Goldman’s entire attempt to model the impact of trade war is an exercise in futility as there will always be a “nonlinear deterioration” in sentiment.

Yet here a bigger problem emerges: assuming that even Goldman’s relatively rose “worst case” scenario is correct, it would only hit stocks by 7%, resulting in a drawdown of only 200 S&P points, and leaving the S&P 500 comfortably above 2,600. That in itself presents a circular problem, because as Deutsche Bank’s Jim Reid noted today, echoing what we said earlier this week, “Falling asset prices might be the only way for markets to get the [trade war] resolution they desperately want.“

And while we know that JPM’s Marko Kolanovic was wrong, predicting that Trump would only suffer a 4% drop in the S&P before he returned to the negotiating table, the question is what is Trump’s breaking point. In December, the S&P dropped as low as 2,350, which is roughly when Trump and Xi reached a trade war truce. This also means that Trump’s breaking point may be as low as 2,350 on the S&P, some 500 points, or almost 20% lower.

In which case, Goldman’s prediction of a modest, 7% pullback in a “worst case” scenario is impossible by definition, as it means that there would be nothing adverse about the market to force trade war to end, and instead it would continue indefinitely, resulting in sharply lower corporate earnings, a sharp hit to the US, Chinese and global economy, and ultimately, a global recession, in the process creating a feedback loop where the longer trade war drags on, the bigger the market drop. Then again, this may be precisely how Goldman hedges by warning that the risk is skewed toward larger market impacts due to a “nonlinear deterioration in sentiment.”

Goldman’s conclusion: “while the direct growth effects of the trade war are likely manageable, our findings show that the impact of financial conditions poses significant downside risks to growth.” Which also happens to be the most bearish Goldman has been on the potential impact of the escalating trade war between the two superpowers.

via ZeroHedge News http://bit.ly/2JYqKiW Tyler Durden