With the US and UK closed for holiday, European shares rose on Monday led by automaker stocks following confirmation of merger talks between Fiat Chrysler and Renault, which sent the two companies surging…

… and after European parliamentary elections saw pro-Europe parties cling to a majority despite major gains for nationalist eurosceptic parties in Italy and France, where Macron was narrowly defeated by Marine Le Pen in a major blow to the deemed successor of Angela Merkel.

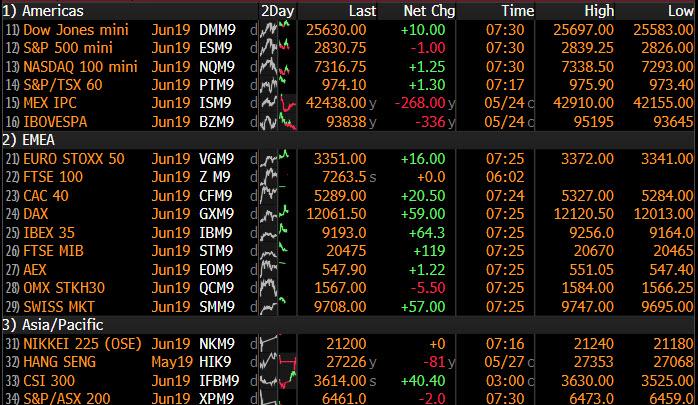

The pan-European STOXX 600 added 0.4% with all major European indices in the black, however trading volumes were thin as US and United Kingdom markets are closed for market holidays. Auto stocks climbed 1.8% as Italian-American carmaker Fiat Chrysler confirmed it had made a “transformative merger” proposal to French peer Renault in a deal which would create the world’s third-biggest carmaker. Shares of both companies rallied.

European sentiment was also boosted as pro-European parties retained a grip on the EU parliament, provisional results from the bloc’s elections showed, “though eurosceptic opponents saw strong gains” according to Reuters. Most notably, Europe’s centrists got crushed as the centre-left and centre-right parties lost their combined majority for the first time in 40 years as the FT reported.

That said, investors had been worried about eurosceptic parties gaining a 30% vote share – the level at which they could seriously disrupt European governance and the region’s ability to show unity in addressing key concerns like a global trade war. But while far-right, nationalist or anti-EU groups came out on top in Italy, Britain, France and Poland, they failed to alter dramatically the balance of pro-European power in the EU assembly.

“The impression of a fragmented political system remains, but perhaps when all is said and done, the message will be that Brexit has reduced appetite to leave the EU,” said SocGen FX strategist Kit Juckes.”In the simple world of FX a possible crisis is averted, leaving us with familiar issues. Europe needs more growth and while EU leaders argue over who gets which top jobs, it needs easier fiscal policy perhaps most of all,” Juckes said.

The euro initially rallied above $1.12 but by 0920 GMT the single currency was struggling, down 0.1% at $1.1195.

Europe’s gains followed a similar push higher across Asian markets, where shares rose but remained near 4-month lows. Asian stocks edged up, led by material and consumer discretionary firms, after rising on Friday. Most markets in the region advanced, with China, Indonesia and India leading gains. The Topix gauge rose 0.4%, driven by Takeda Pharmaceutical and SoftBank Group. The Shanghai Composite Index advanced 1.4%, with CSC Financial and China Life Insurance providing the biggest boosts. The S&P BSE Sensex Index climbed as much as 1%, as HDFC Bank and Housing Development Finance led a rally.

US equity futures traded in a narrow range, and after posting modest gains following the European open, gave up all their upside.

As always, the latest Trump trade commentary defined trader sentiment. During a state visit to Japan, Trump said the U.S. “isn’t ready to make a trade deal with China” adding that “they probably wish they made the deal that they had on the table before they tried to renegotiate it.” Speaking at a joint press conference in Tokyo alongside Japanese leader Shinzo Abe, Trump also said that “they would like to make a deal. We’re not ready to make a deal.”

Trump said American tariffs on Chinese goods “could go up very, very substantially, very easily.” His comments came after trade talks between the two countries stalled earlier this month. Each side has since blamed the other, and Trump has threatened billions more in tariffs.

Offsetting some of that gloom, Trump also said that he thinks “in the future China and the United States will absolutely have a great trade deal, and we look forward to that. Because I don’t believe that China can continue to pay these, really, hundreds of billions of dollars in tariffs. I don’t believe they can do that.”

With the US closed, bullishness prevailed modestly, with the MSCI world equity index ahead by 0.1%.

Emerging-market assets were steady as traders awaited the next chapter in the U.S.-China trade standoff. Trading was muted with the U.S. and U.K. markets closed for public holidays.

“In a nutshell, there is nothing really new here, but a sustained flow of mixed news is maintaining a cap of appetite for EMs, particularly those countries that are integrated with China and commodity exporters,” Credit Agricole SA strategists, led by Sebastien Barbe, wrote in a report.

Turkey’s lira climbed for a third day, its longest streak since February, after Turkey’s central bank increased reserve requirements for foreign-exchange deposits by 200 basis points.

Meanwhile, the yuan climbed to its highest in more than a week as China warned traders against shorting it. The currency jumped as much as 0.22% on Monday morning before paring its gain. Guo Shuqing, the head of China’s banking and insurance regulator, said in a speech on Saturday that speculators “shorting the yuan will inevitably suffer from a huge loss.” He joined a chorus of officials and state media outlets who have voiced support for the nation’s currency in recent weeks. “There is less fear that the Chinese yuan will depreciate past 7 against the USD, for now,” DBS Bank Ltd. economists Philip Wee and Eugene Leow write in a note dated Monday.

Meanwhile, the fallout from the government taking control of China’s Baoshang Bank hit the nation’s bond market, pushing up funding costs for lenders and yields on government debt.

European government bond markets were little moved with the spread between the German 10-year bond yield and the Italian 10-year government bond yield little moved after initially narrowing. Spanish and Portuguese bond yields hit record lows.

Elsewhere, U.S. President Donald Trump’s visit to Japan was overshadowed by trade tensions. Trump pressed Japanese Prime Minister Shinzo Abe to even out a trade imbalance with the United States.The yen fell 0.2% against the dollar to 109.495 but remained close to four-month highs hit earlier in May as traders looked for safety in the face of mounting trade-related woes. The South Africa’s rand underperformed peers after debt-laden state power utility Eskom Holdings SOC Ltd. said Friday its chief executive officer will step down. Hungary’s forint held on to most of the gains against the euro from Friday as investors awaited a rate meeting on Tuesday for clues of potential policy action in June.

Finally, the pound held around $1.2703. Sterling had bounced back from a near five-month trough of $1.2605 after British Prime Minister Theresa May last week named a date for her to step down – triggering a leadership contest during which investors fear the risk of a no-deal Brexit will rise.

In commodities, oil prices were mixed following losses from last week when crude dropped the most this year. Concerns the Sino-U.S. trade war could trigger a broad economic slowdown have sent this year’s oil rally into reverse, although OPEC’s supply cuts provided some support. Front-month Brent crude futures rose 0.1% to $68.80 per barrel while U.S. West Texas Intermediate (WTI) crude futures shed 0.5% to $58.33 per barrel.

Iron ore continued its rally, on concern there’s a global shortage in the seaborne market. And Bitcoin climbed to the highest level in a year, after surging almost 70% this month.

Top Overnight News from Bloomberg

- China advised traders against shorting its currency, with a regulatory official warning that speculators “shorting the yuan will inevitably suffer from a huge loss”

- With nearly all the vote counts complete from the European Parliament elections, Nigel Farage’s Brexit Party — which wants the U.K. to leave the EU without a deal — was in first place, followed by the Liberal Democrats

- Mainstream EU parties held their ground against the assault from populists in elections for the bloc’s Parliament as the highest turnout in two decades looked set to reward pro-EU Liberals and Greens

- Matteo Salvini is set to make his League party Italy’s biggest political force while falling short of the knockout blow that would allow him to seek the premiership, according to projections of votes in the European Parliament elections. French President Emmanuel Macron suffered a narrow defeat to Marine Le Pen’s nationalist movement in the European election

- South Korean won advanced for a fourth day after the authorities stepped up their attempts to jawbone the currency in the past week

- Philip Hammond warned Conservative leadership candidates that a government that tries to force a no-deal Brexit on Parliament risks being brought down in a no-confidence vote

- President Donald Trump acknowledged on Sunday a trade deal with Japan wouldn’t occur during his trip to Tokyo, saying that nothing would be finalized until after Japan’s elections in July

- President Jair Bolsonaro called on lawmakers to further his reform agenda, starting with the approval of a crucial pension bill in Congress, after thousands of government supporters took to the streets in more than 100 cities across Brazil on Sunday

via ZeroHedge News http://bit.ly/2wmJcdd Tyler Durden