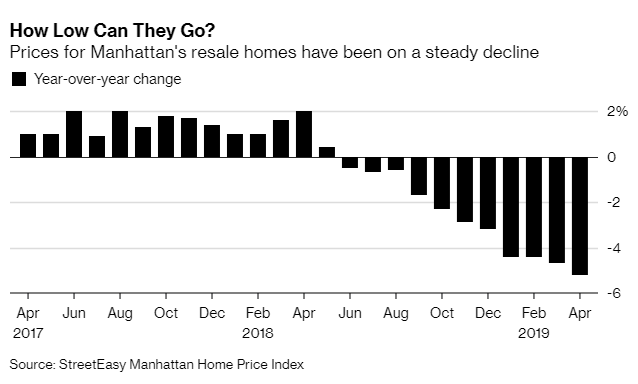

Proving that higher prices aren’t always better news, housing in Manhattan may finally be catching a bid after a nearly yearlong slump in prices has plunged far enough to finally attract buyers. Additionally, inventory growth finally looks to be slowing down.

Manhattan home prices were thrashed again in April, falling the most since 2010 – but this time, there may be somewhat of a silver lining. The falling prices caused buyers to “pounce”, resulting in 1,193 homes under contract during the month – more than any month since April of 2015, according to data provided by Bloomberg and StreetEasy. Perhaps deflation is not so evil after all.

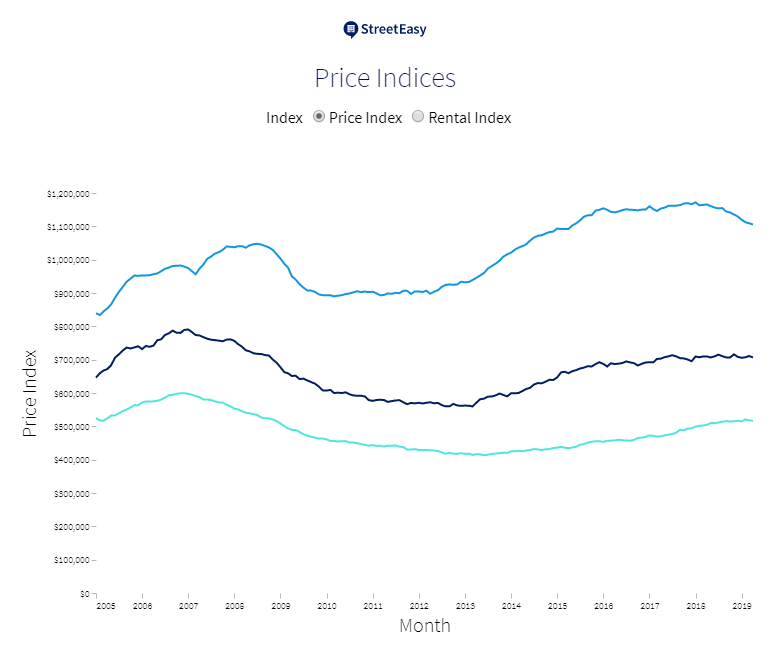

StreetEasy’s price index fell 5.2% from a year ago to $1.11 million. The index measures change in resale prices for the same properties over time. It was the largest decline in the index since April 2010, when the index dropped 6.1%.

The newfound bid for homes could be a sign that Manhattan’s market may be emerging from a drought of buyers, who had been previously been sitting on the sidelines, scared of overpaying for properties. As prices move toward more realistic buyer expectations, capital has been put to work.

Grant Long, senior economist at StreetEasy said: “Sellers are finally getting that many of their price expectations were not realistic. They’re lowering their prices to a point that’s attractive to buyers.”

Here are some of StreetEasy’s additional findings:

- The most homes went into contract since 2015. The number of pending sales in Manhattan increased 26.6% from last year, up by more than 250. The number of homes entering contract in Upper Manhattan doubled year over year, from 66 to 132.

- Inventory growth slowed. While sales inventory growth remained in the double digits at 10.8%, it still moved at the slowest pace in 13 months. The volume of new inventory hitting the market shrank by 9.6% over last year.

- As sellers priced homes more strategically from the start, fewer made price cuts. The share of homes with a price cut fell slightly for the first time in 13 months. Some 14.1% of Manhattan homes saw a price decrease in April — down 0.6 percentage points from last year. The share of price cuts fell the most in the Upper West Side — down 2.1 percentage points to 14.2%.

- Luxury home inventory dropped slightly. The number of homes for sale priced within the top 20% of the market fell by 0.3%, the first year-over-year decrease in inventory since February 2018.

Recall, in early May, we wrote that inflated and overpriced retail real estate in Manhattan was turning the city into a “wasteland”. Later, the Post wrote an article confirming our writeup from late March which pointed out that high prices were driving businesses out of town:

If you want to see the future of storefront retailing, walk nine blocks along Broadway from 57th to 48th Street and count the stores.

The total number comes to precisely one — a tiny shop to buy drones.

That’s right: On a nine-block stretch of what’s arguably the world’s most famous avenue, steps south of the bustling Time Warner Center and the planned new Nordstrom department store, lies a shopping wasteland.

It appears that, despite what central bankers think, the only logical, and natural, response to high prices is, gasp, low prices. Unfortunately, while the Federal Reserve may be willing to ease back on US home prices, it has so far refused to do the same to the stock market. And just like unsustainably high prices resulted in the bursting of the housing bubble in 2007, so the inability of the market to deflate to a fair value will be the reason behind the next great bubble burst.

via ZeroHedge News http://bit.ly/2EzUYW6 Tyler Durden