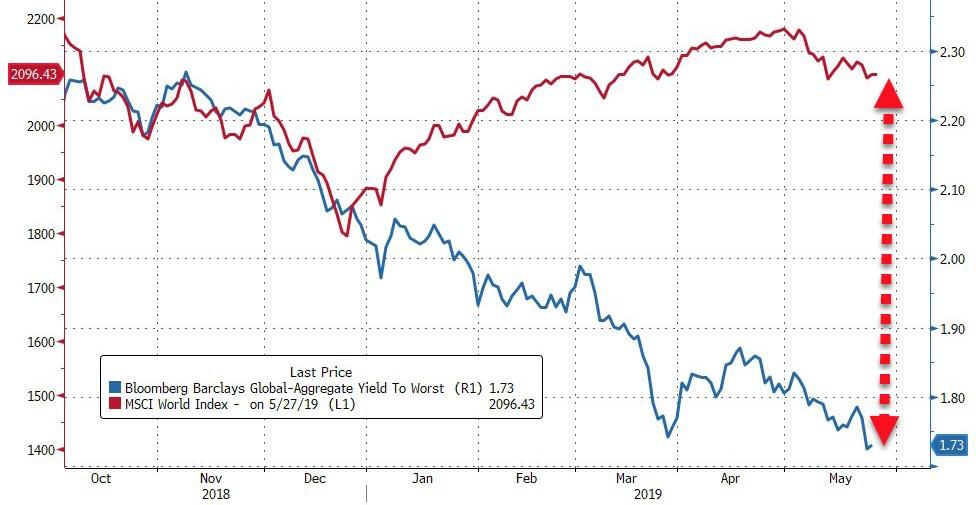

If bonds are right, then stocks are…

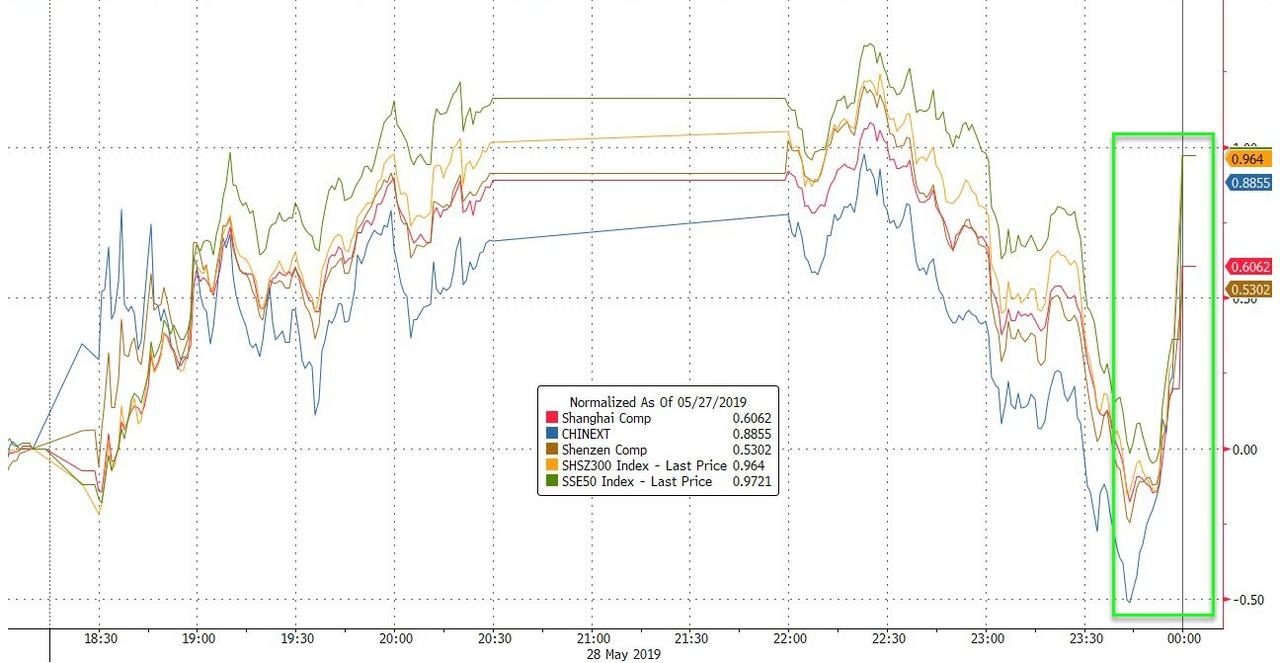

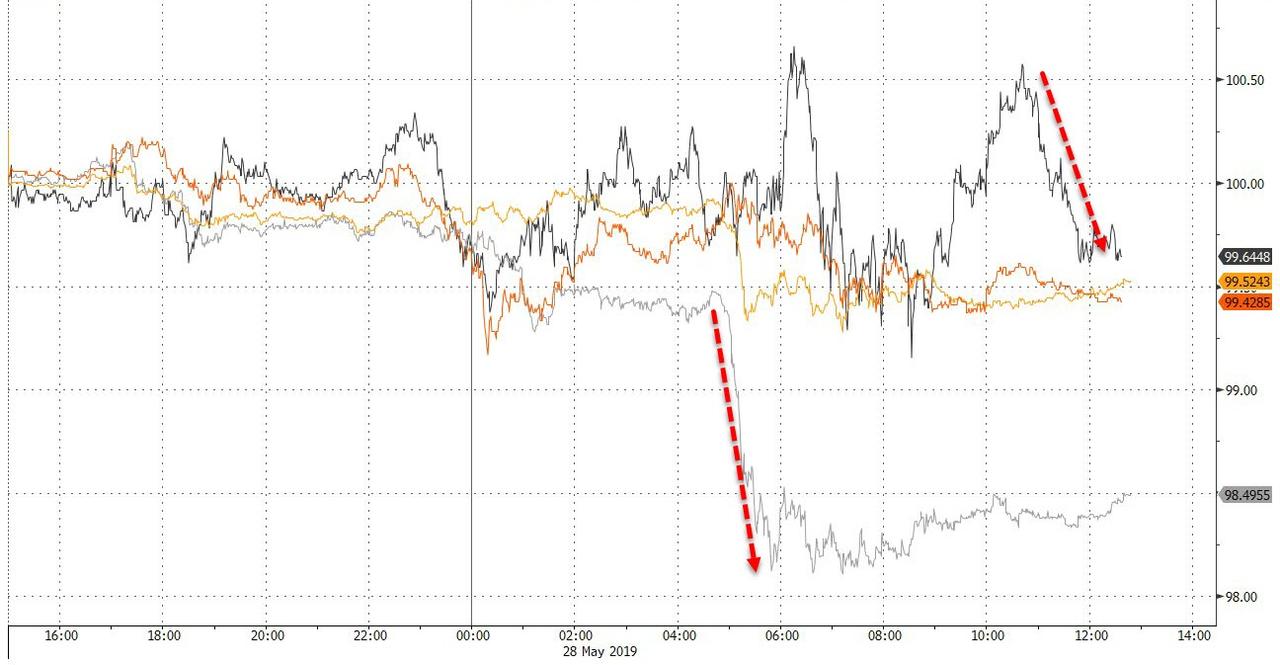

Chinese markets were rescued by a mysterious beneficiary who panic-bid stocks back into the green on the day…

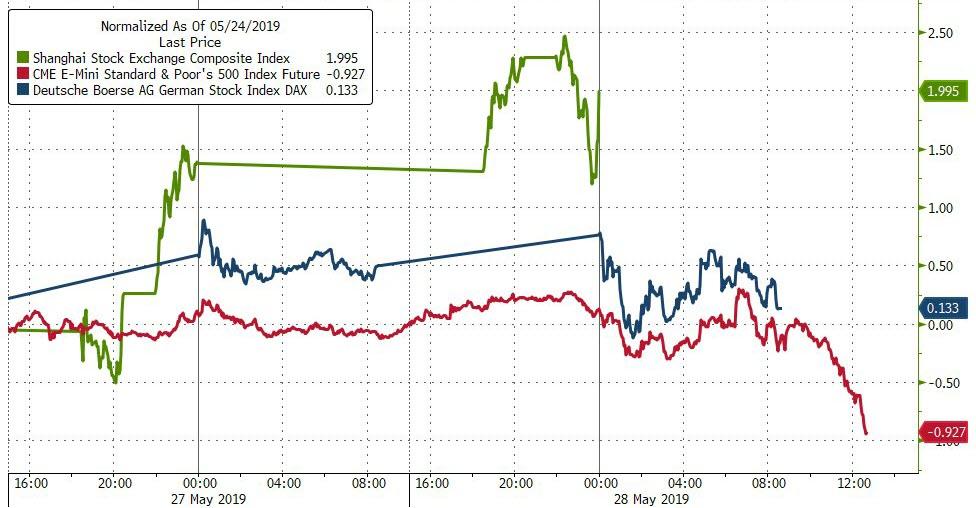

EU markets extended yesterday’s late-day weakness but managed to now ubiquitous bounce – though still ending lower, led by Italy to the downside…

As German bund yields collapsed to within 3bps of record lows…

And US markets followed the overnight excitement, opening higher and accelerating at the cash market open once again. But that did not last… the afternoon was brutal…

And US markets ended much worse than China and Europe…

This despite proclamations that month-end pension rebalancing would spark buying in stocks this week.

S&P closed just above the critical 2800 level…

Semis suffered again with the lowest close since Feb 5th (back below its 200DMA)…

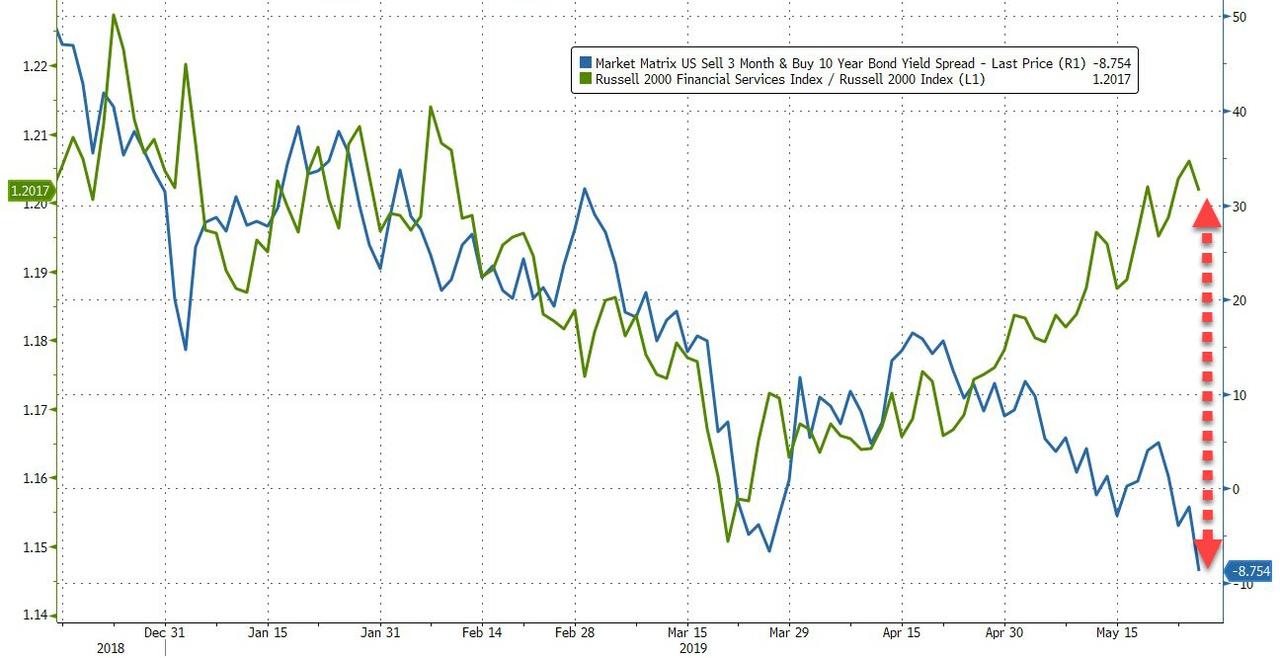

Financials are notably outperforming the market and hugely divergent from the collapsing yield curve…

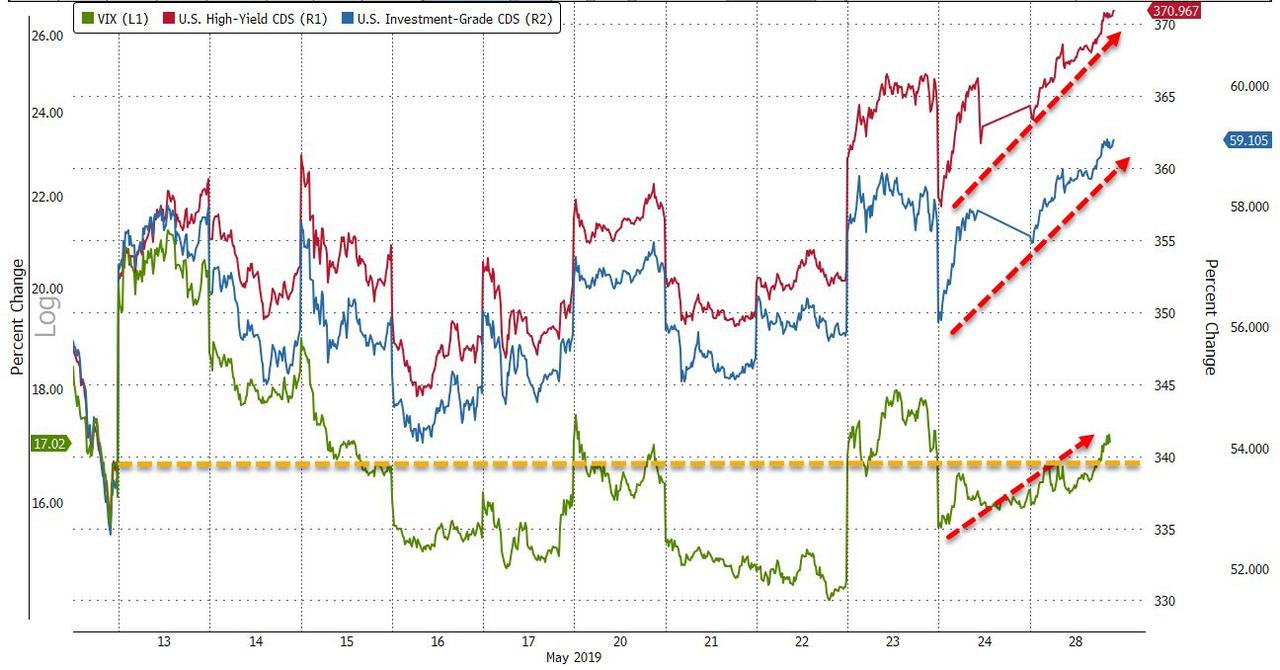

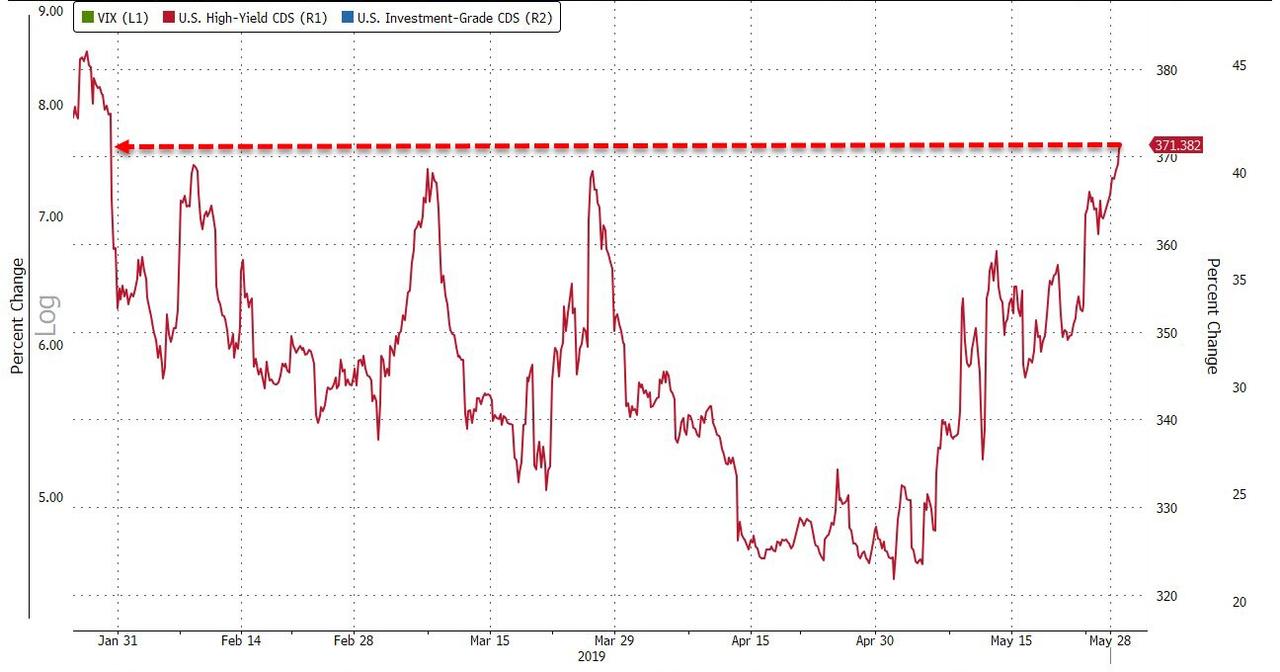

Credit markets are blowing out notably while VIX is holding in for now…

HY Spreads are at their widest since Jan…

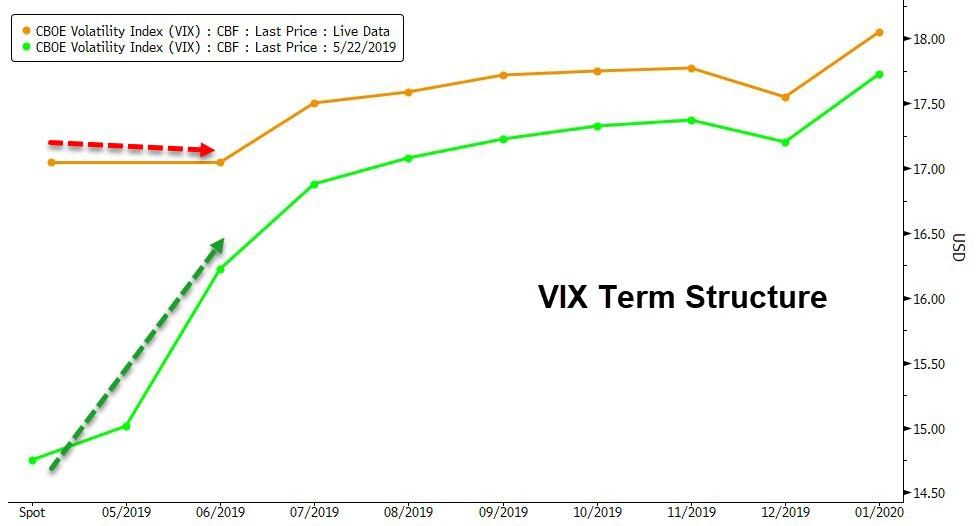

And the VIX term structure re-inverted today…

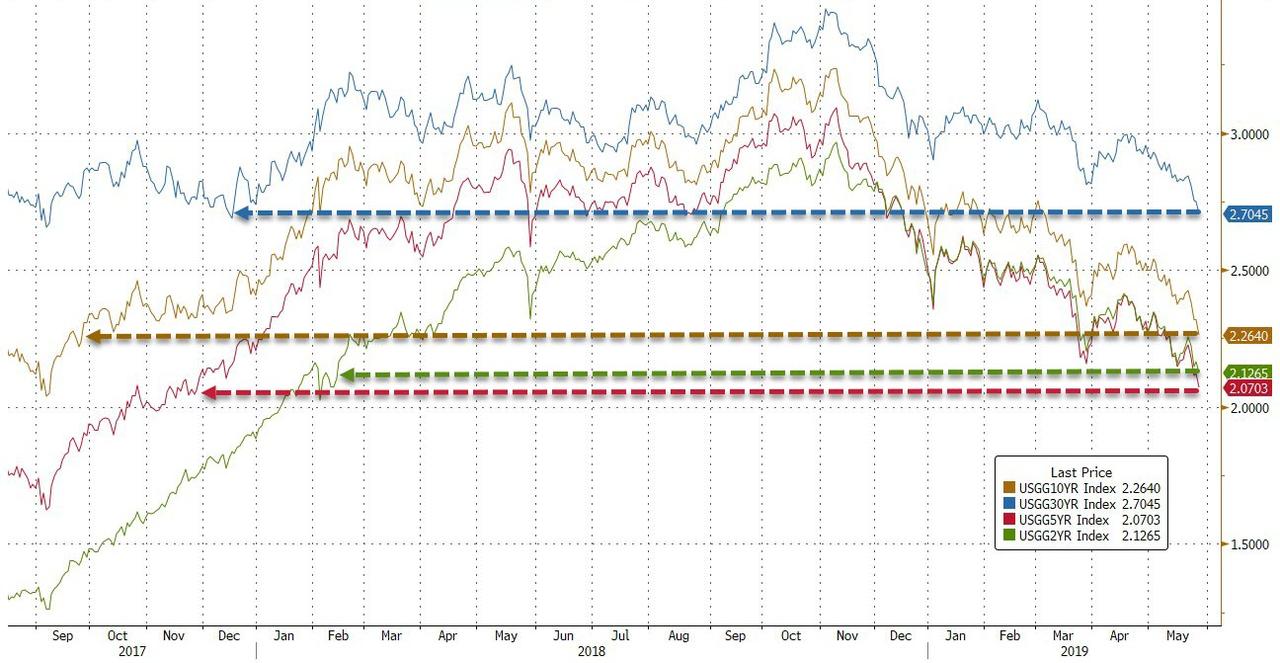

Treasury yields collapsed today on growth fears and a very aggressive 2Y auction…

Pushing to fresh cycle lows…

Collapsing the yield curve (3m10Y to -9bps) to its flattest since August 2007…

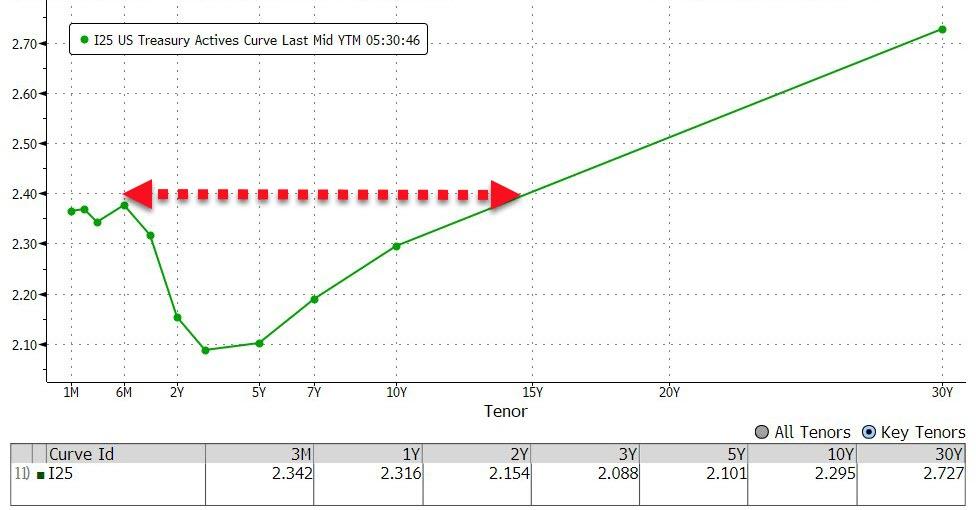

The yield curve is inverted to around 15 years…

And Breakevens collapsed further to critical support…

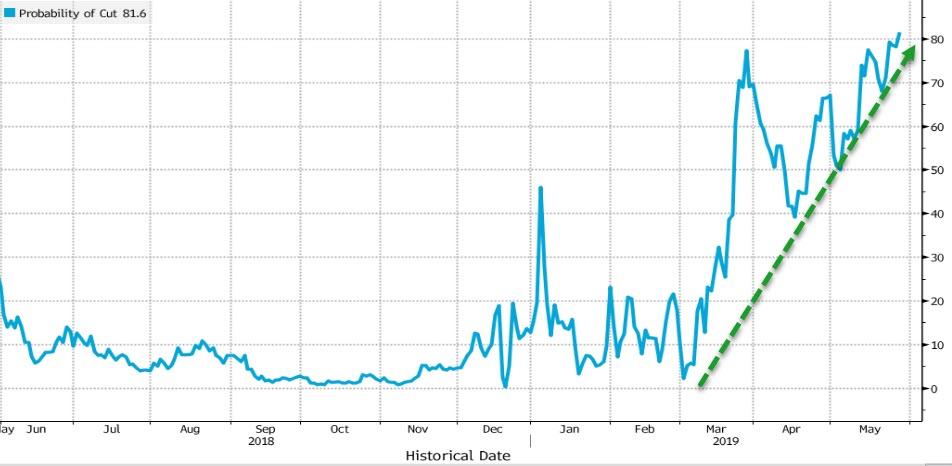

Before we leave bondland, we note that the probability of a rate cut by end Dec is now 82%

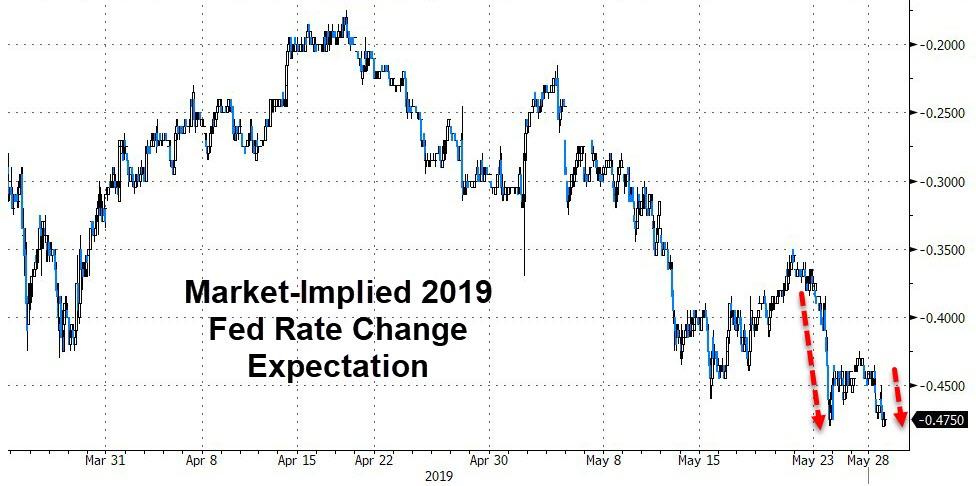

With the market expecting almost 2 full rate cuts now…

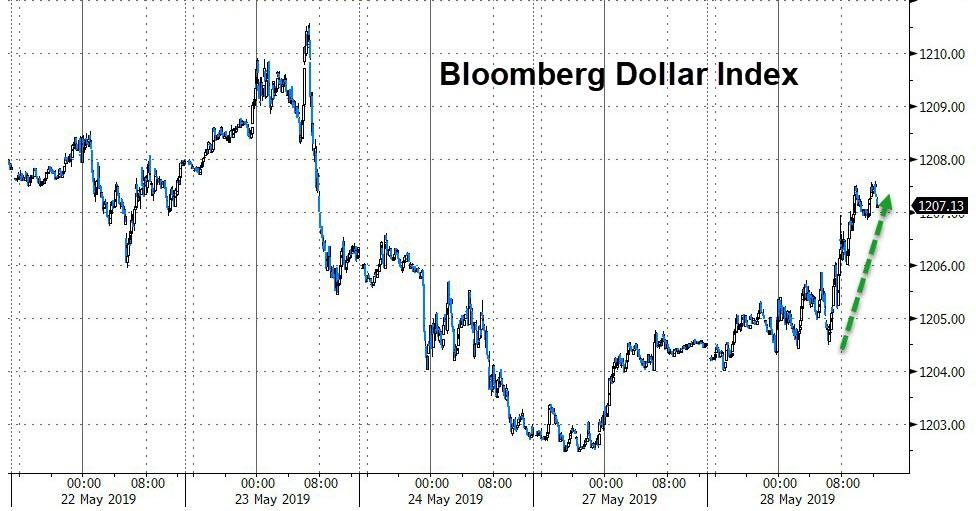

The dollar rallied on the day, erasing over half of the Thurs/Fri losses…

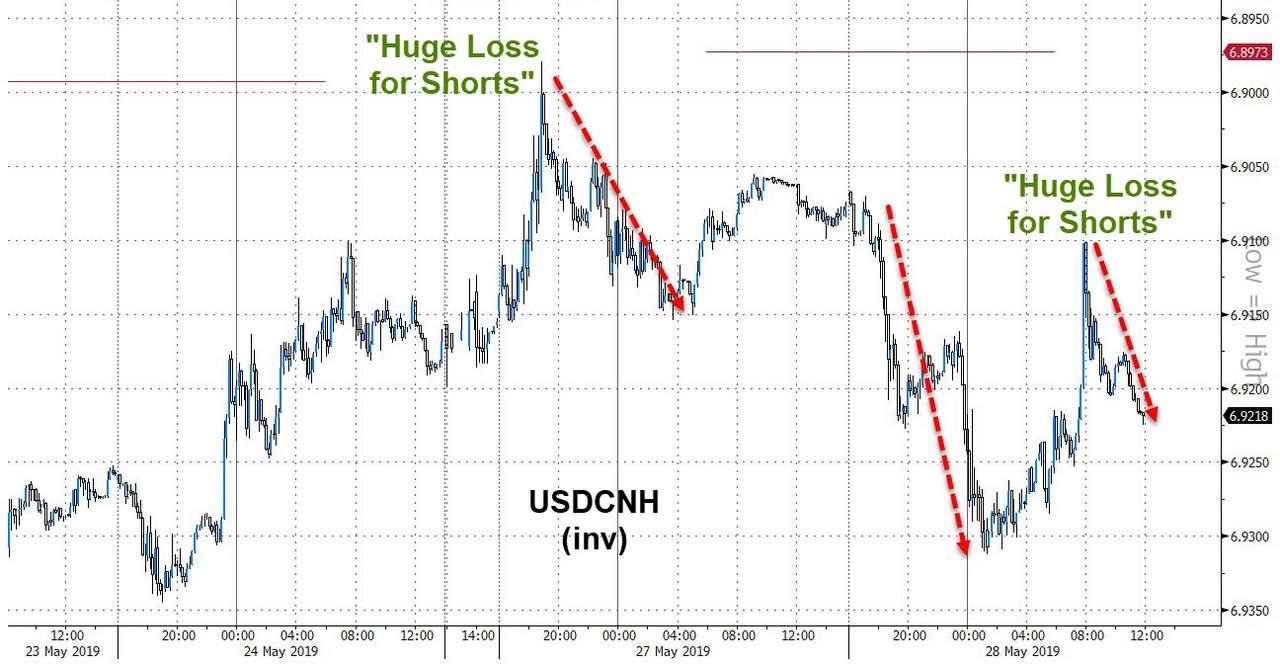

Yuan continued to sink despite another attempt by Guo to threaten shorts today…

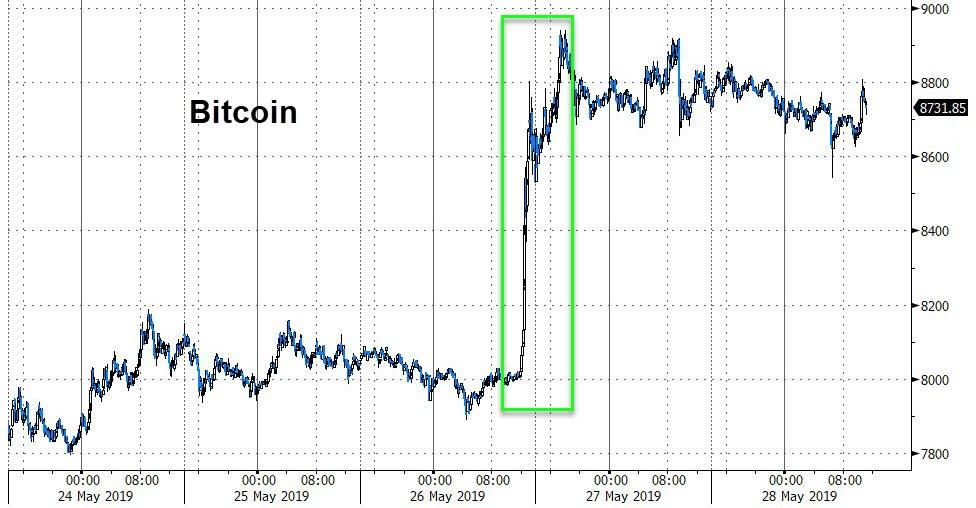

Cryptos held on to their significant gains over the weekend…

With Bitcoin hovering around $8800…

After a few days of outperformance, Silver was slapped lower today as WTI managed gains (despite a strong dollar) early on but faded into the close…

It seems like 14.50 was the buy/sell trigger for silver…

WTI Crude hovered around $59 all day…

Finally, this won’t end well for one completely-convinced cohort of group-thinkers…

And the only support for this is leaving the building…

It’s not Friday anymore… pic.twitter.com/Euk5x4L0eP

— Sven Henrich (@NorthmanTrader) May 28, 2019

via ZeroHedge News http://bit.ly/2JJdRu4 Tyler Durden