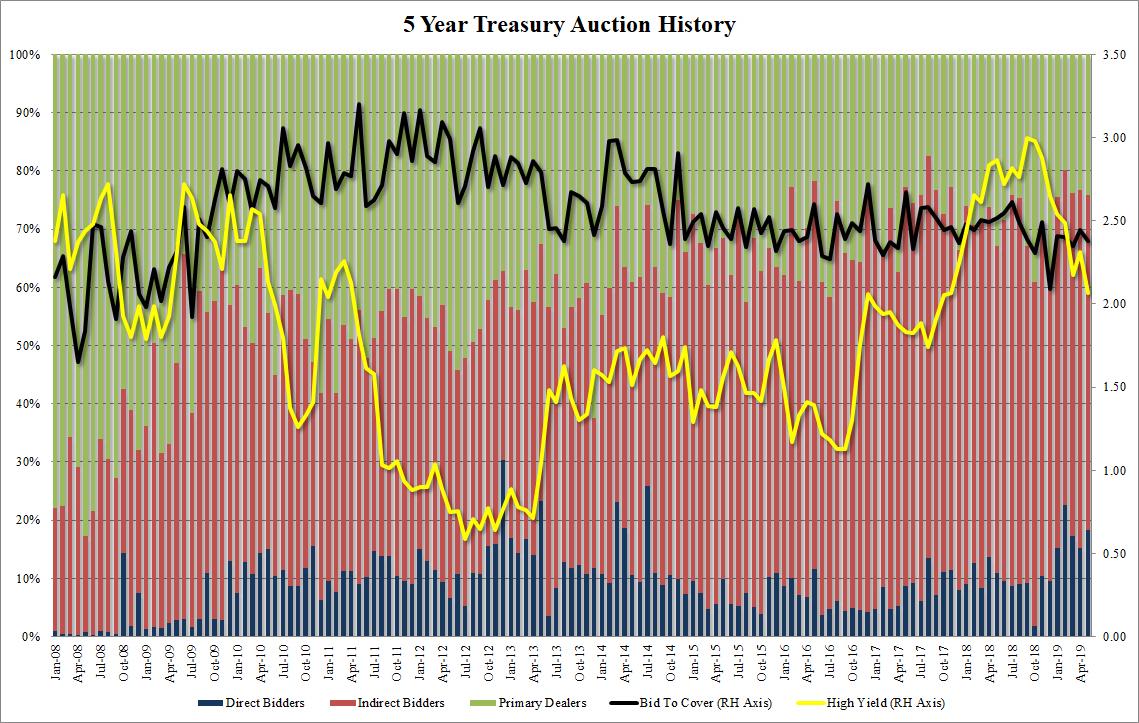

While it may not be quite as strong as this morning’s spectacular 2Y auction, moments ago the US Treasury sold $41 billion in 5Y notes, with the yield stopping at 2.065%, once again stopping through the 2.068% When Issued, sharply down from April’s 2.315% and the lowest yield since October 2017.

The internals, while not nearly as impressive as today’s first auction, were also impressive, with the Bid to Cover sliding modestly from 2.44 to 2.38, just above the 6 auction average of 2.37. Indirects took down 57.5%, just below the 58.6% average, and while it was shy of the near record surge in 2 Year Direct takedown, the directs were allotted 18.4%, well above the 15.3% in April, leaving 24.1% to Dealers, which was also the highest since January.

In summary, it may not have been spectacular, but it certainly was solid, and with just the 7Y coupon auction left, any speculation that China may be selling, or boycotting US paper, has been pushed to the backburner for now.

via ZeroHedge News http://bit.ly/30OCYkl Tyler Durden