After a strong 2Y, mediocre 5Y, we concluded this week’s trifecta of coupon auctions with, as one may expect, an abysmal sale of $32 billion in 7Y bonds.

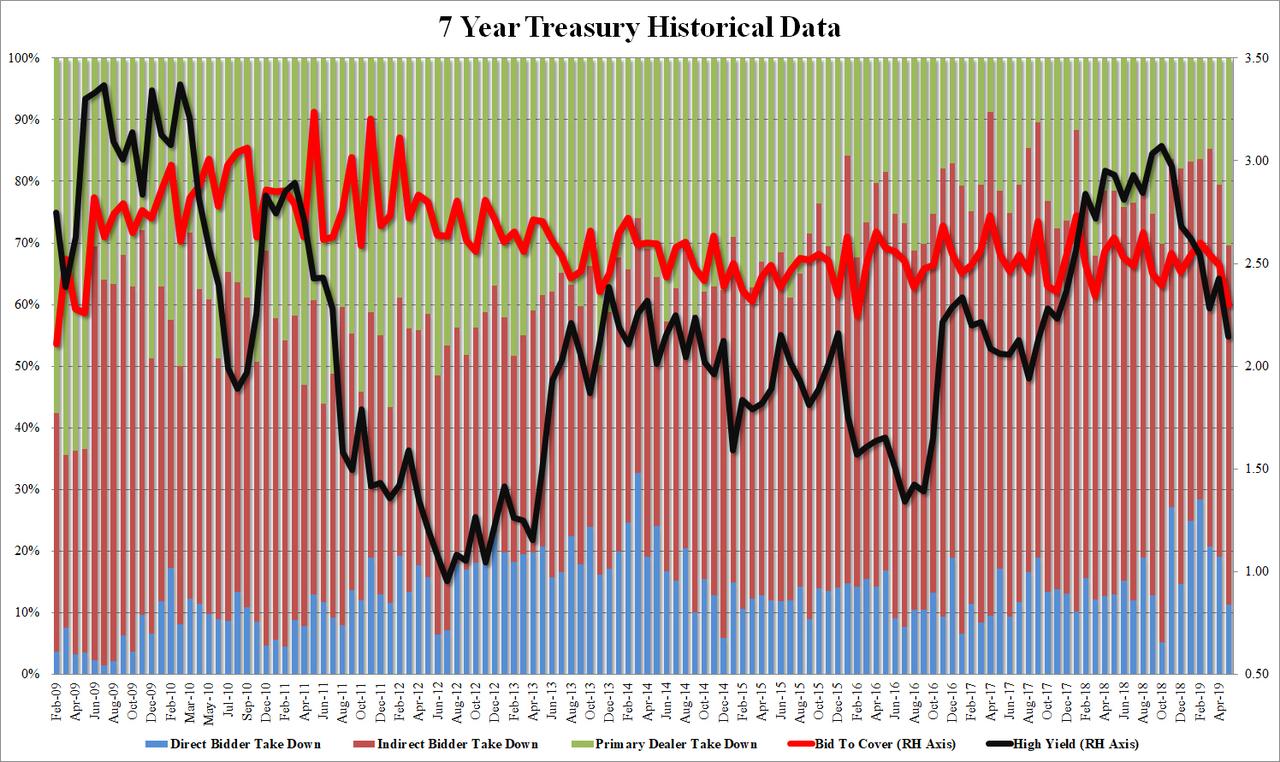

With yields sliding lower all day, perhaps it had to do with the concessions into the 1pm auction, but whatever the reason, the 7Y auction stopped at a high yield of 2.144%, which while the lowest since September 2017, also tailed the When Issued by 1.9bps, the biggest tail in at least 4 years.

The internals were just as ugly, with the Bid to Cover tumbling from 2.492 to just 2.298, not only far below the 6 auction average of 2.53, but the lowest since February 2016, and second lowest since 2009.

And with both Direct and Indirect takedown sliding, as Directs took down only 11.3% from 19.1% last month, and half the 6 auction average of 22.5% and Indirects ending up with 58.3% of the auction, Dealers we left holding 30.5% of the auction, the highest percentage since March 2018.

Overall, a dismal auction, although one which can perhaps be ignored as it took place on a day when the 10Y yield tumbled to the lowest in almost two years. Or maybe not, because once the market digested just how ugly the auction was, the 10Y promptly sold off, and in just a few minutes wiped out all of the day’s gains.

via ZeroHedge News http://bit.ly/2Mgu7o8 Tyler Durden