While most eyes are focused on the collapse of the US yield curve and its recessionary predictions, there are many other critical issues that are flashing red ‘recession-imminent’ flags…

To keep buying the dip, investors have to ignore…

Bonds… (yields at cycle lows, curve at decade flats/inverted)

Lumber… (one of the most important factors in construction is at its lowest level since April 2016)

Copper…(the commodity with the PhD in economics rolled over ahead of stocks)

Global economic data… (suffering the longest negative streak – 286 days – on record)

Hope… (soft survey data has not picked up the mantle of ‘hope’ that stocks have ridden on since the start of the year)

Money Supply… (the fuel for PPT/National Team pumpathons is starting to run dry again)

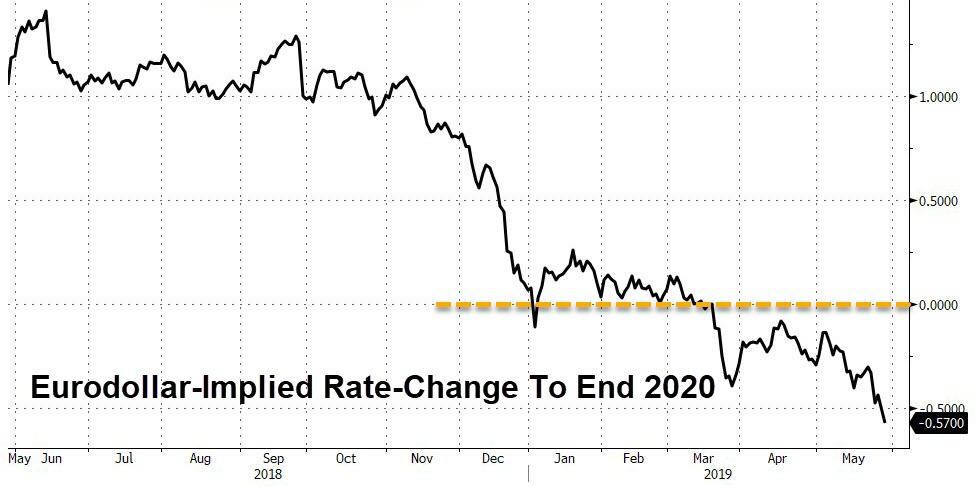

And finally, why – if everything is awesome – is the market screaming for almost 2 full rate cuts by the end of 2020?

via ZeroHedge News http://bit.ly/2MhU5rv Tyler Durden