The world’s largest bond manager is getting extremely worried about two things that it knows a lot about i) the overall market and ii) the bond market in particular.

Speaking to Bloomberg TV, Scott Mather, chief investment officer of U.S. core strategies at Pimco, joined a bevy of other money managers and warned, in no uncertain terms, that credit market risk is at an all-time high.

“We have probably the riskiest credit market that we have ever had” in terms of size, duration, quality and lack of liquidity, Mather said, adding that the current situation compares risk to mid-2000s, just before the financial crisis.

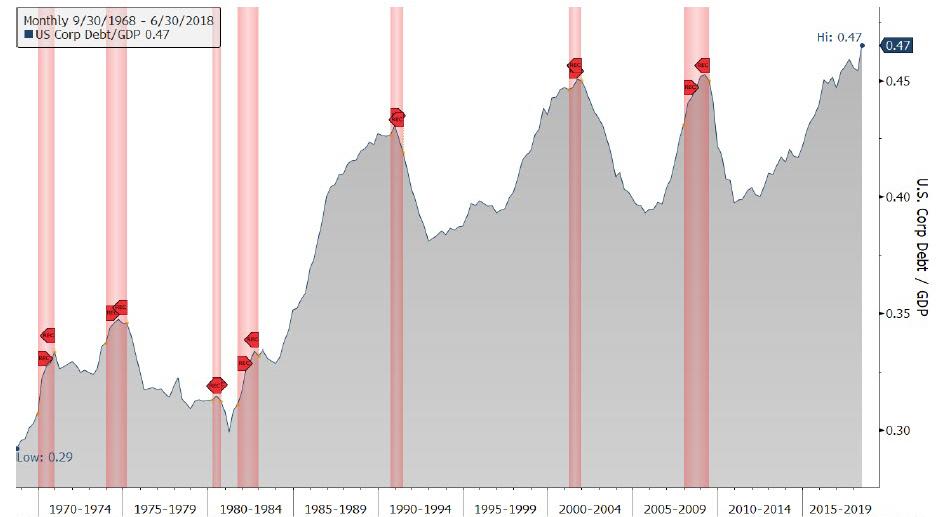

“We see it in the build up in corporate leverage, the decline in credit quality, and declining underwriting standards – all this late-cycle credit behavior we began to see in 2005 and 2006.” One way of visualizing what Mather was referring to is the following chart of corporate debt to GDP which has never been higher. As for the lack of creditor protections, well, just wait until the screams of anger start after the next wave of bankruptcies.

There was a silver lining, with the PIMCO CIO noting that credit is “not at the point where it will fall of its own weight”, yet, “but it certainly is a vulnerability today and all the ingredients are there for that vulnerability to grow” he added, referring to record stock buybacks this year, much of it financed with leverage, and almost all of which has been used to boost stock prices and shrink shares outstanding.

In response, Mather said that Pimco is “much more defensive,” up in quality in credit, and prefers asset backed securities – i.e., leveraged loans which themselves are a pandora’s box just waiting to be opened – to corporate credit.

So is all credit doomed? No: apparently the three-decade long bond bull market which so many experts saw as dead just one year ago, is quite safe now according to Pimco, with the 10Y approaching a 1-handle again: “The U.S. Treasury market is about the only place you could look for large capital gains as we’re seeing in the markets today, versus the rest of the world”, Mather said, why? Because “there’s no hedge to risky assets other than U.S. high-quality bonds, Treasuries.” A handful of gold or bitcoin fans would disagree.

Still, this to Mather is a unique situation and unlike the last recession, when there was a variety of negatively- correlated assets to buy for protection. “People are probably too optimistic about the growth outlook in the US” he concluded.

In a market outlook released earlier by Pimco, the Newport Beach-based firm warned that global growth is expected to be lackluster with low inflation before a recession occurs in advanced economies likely within five years. Financial market vulnerability, following the recent Federal Reserve pivot away from tightening, “has the potential to lead to greater excess in valuations, particularly in credit”, the report warmed.

But wait, there’s more, because if Mather is right, not even bonds will be risk-free soon, as the era where central banks are “powerful in terms of taking volatility out of the market and pumping asset prices up” is coming to an end, Matther warned: “The U.S. is about the only central bank that was able to normalize policy rates, but elsewhere, there is basically no monetary firepower left.”

Well, if he is right and central banks are indeed about to lose control, then investors have far greater things to worry about than whether their paper gains will turn to paper losses overnight – one worry would be whether investors have enough guns and ammo, for example.

Mather’s conclusionL: “I think that’s what you’re seeing now in markets. People are starting to come to a more realistic outlook about the forward-looking growth prospects, as well as the power of central banks to pump up asset prices.“

Considering that the S&P is about a few hundred percent higher than where it would be without central banks “pumping up prices”, the market is about to go through a lot of pain in the near future if the world’s largest bond manager is correct.

Watch the full Bloomberg interview below

via ZeroHedge News http://bit.ly/2QyzLR0 Tyler Durden