Back in December 2018, when conventional wisdom was falsely convinced by the handshake between Trump and Xi that the tariff war between the US and China would soon end, we warned that not only is the trade war nowhere near over, far from it, but that semiconductors had “become the central battlefield in the trade war between the two countries. And it is a battle in which China has a very visible Achilles heel.”

Today, SaxoBank’s head of equity strategy, Peter Garnry, not only confirms what we said nearly 6 months ago, but also notes that as the trade war evolves into a technology cold, many industries stand to lose but semiconductor companies are more exposed than anything else. “Add in the rising risk of recession and you’ve got what looks like a perfect storm”, he notes ominously.

His full note is below:

In our recent trade war analysis “Are you ready for a Cold War in tech? “ we argued that the world has seen the starting signal of a Cold War in technology between the US and China. The most likely outcome of the US ban of Huawei due to national security issues is that the global supply chain will come under attack the next couple of decades. Many industries from transportation, semiconductors, biotechnology, rare earth minerals etc. will all most likely be deemed of national security to both the US and China. If the rivalry intensifies between the two countries the only sensible trajectory from here is a global supply chain separation. US and China will seek to make themselves independent of each other to limit the political downside risk in an escalating trade and technology war

Semiconductors are bleeding and it will continue

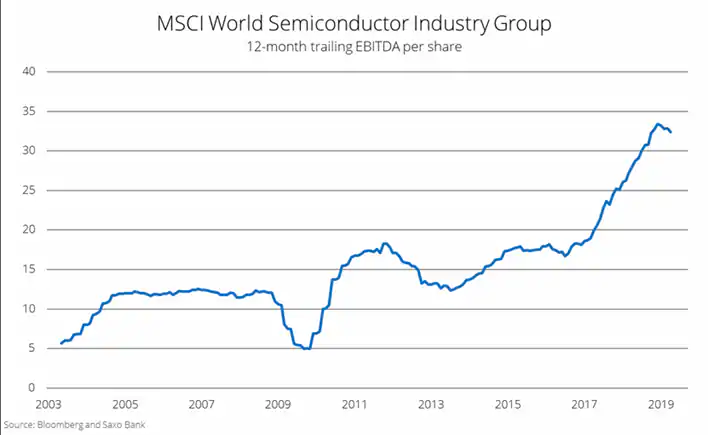

Since the US escalated the trade war by increasing the tariffs from 10% to 25% on $200 billion of Chinese goods on May 6 semiconductors have been tanking. The industry group can be divided into two groups: semiconductor equipment makers and pure semiconductor manufacturers.

We have devised two custom indices tracking those two industries to measure the impact on the global supply chain the trade war. As the chart below shows the semiconductor industry is hurting from the US-China trade war escalation and our view is that it will continue.

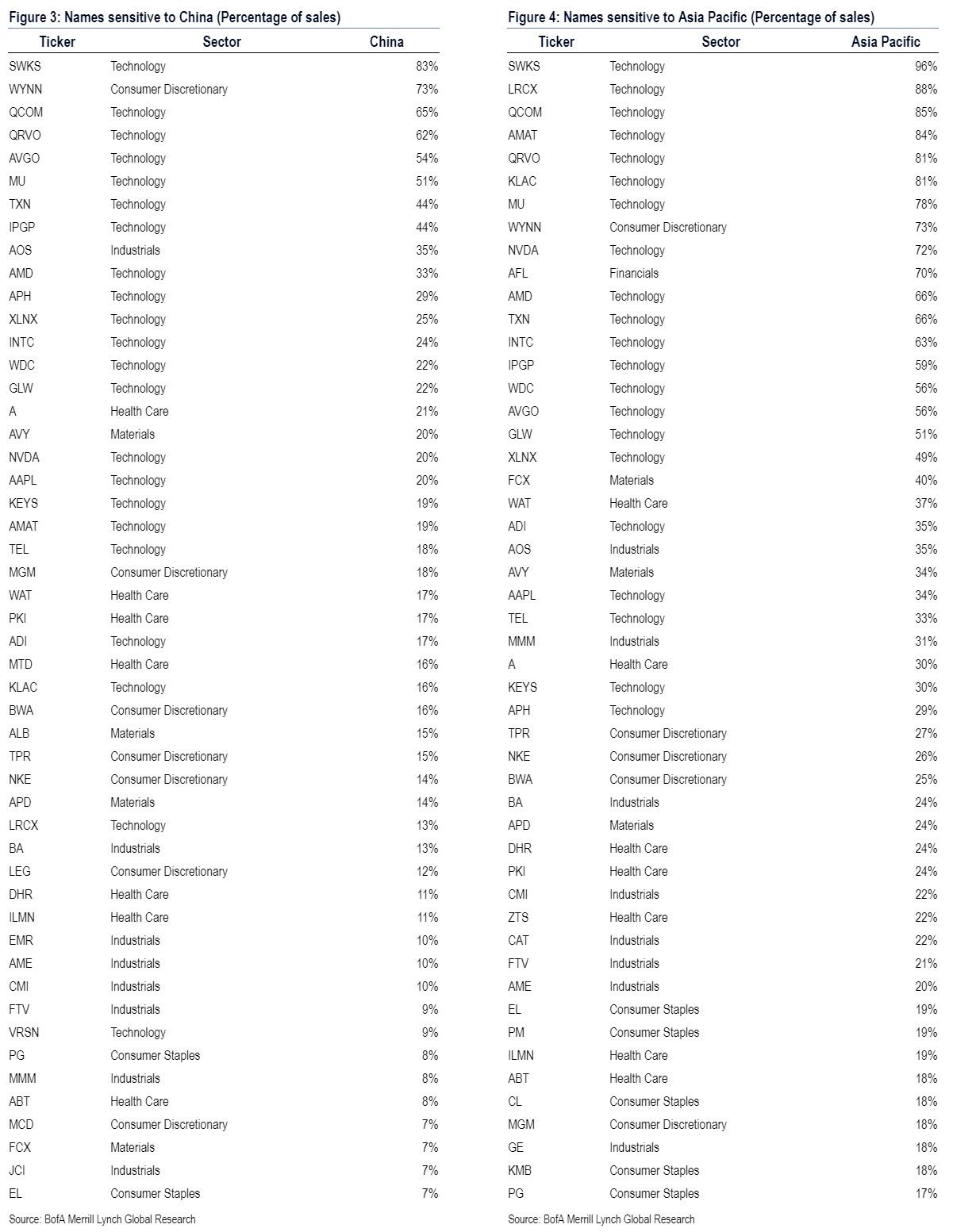

Investors should stay underweight semiconductors. In our last trade war analysis we highlighted the US companies with the biggest exposure to China and the majority of those are in fact US semiconductor companies.

Another reason to be negative on semiconductors is that earnings have most likely topped and valuations will have to reflect this over the next 12 months. We see the risk of recession going up from our standpoint of just three months ago and in the case of a global recession semiconductor companies would be hit the hardest. To make it a perfect storm we also expect it to coincide with the beginning of a new AI winter which will dramatically slow down the growth in semiconductors.

US semiconductor companies have most to lose

If we look at how semiconductor manufacturers are performing based on their geography we see a clear sign that US companies stand to lose the most, together with South Korea. If the global supply chain in the semiconductor industry is being reconfigured US semiconductor companies will lose short-term revenue in China and will have to invest in new manufacturing facilities in other countries.

Chinese semiconductor companies will on the other hand be more directly supported by the Chinese government and thus win out relatively speaking. But what about WTO rules about state support? In our view the WTO framework is at risk of being obsolete as the US is clearly steering away from multilateral trade deals towards bilateral deals. In this world order China would not be accountable for state sponsorship of semiconductors inside WTO.

European semiconductor companies could win relatively in the short-term but they face the risk that Europe eventually choose the US over China in the new political future. The caveat here is that Europe needs strong exports to offset weak domestic growth and here China offers more upside potential than the US economy. European politicians are entering a minefield over the next decade as they feel squeezed between the diverging interests of the US and China.

US equities have broadly outperformed

Outside the casualties in semiconductors the US equity market has in fact outperformed the five countries running the biggest trade surplus against the US. Our trade war ETF basket shows that US equities have outperformed by 22%-points since early 2018 when the trade war broke out. In the markets view trade surplus countries are more vulnerable. Only time will tell whether this is in fact true or not.

via ZeroHedge News http://bit.ly/2WucRzO Tyler Durden