It seems the warnings from PIMCO’s Scott Mather that: “We have probably the riskiest credit market that we have ever had” in terms of size, duration, quality and lack of liquidity, Mather said, adding that the current situation compares risk to mid-2000s, just before the global financial crisis,” are being reflected in pricing and flows.

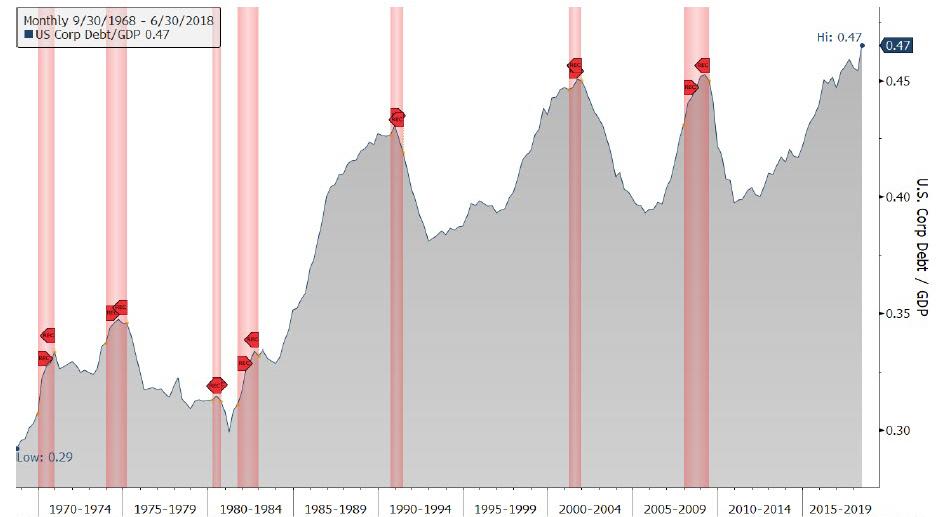

“We see it in the build up in corporate leverage, the decline in credit quality, and declining underwriting standards – all this late-cycle credit behavior we began to see in 2005 and 2006.” One way of visualizing what Mather was referring to is the following chart of corporate debt to GDP which has never been higher. As for the lack of creditor protections, well, just wait until the screams of fury begin after the next wave of bankruptcies.

While stocks have slowly woken up to the realities of the ‘recovery’, credit-markets have started to flash warnings that all is not well…

With some concerned that summer 2019 is echoing the risk-off deluge from Q4 2018…

And, as Bloomberg reports, traders yanked almost $429 million from State Street Corp.’s SPDR Bloomberg Barclays High Yield Bond ETF on Tuesday, the biggest withdrawal since December.

Mather’s rather ominous conclusion:

“I think that’s what you’re seeing now in markets. People are starting to come to a more realistic outlook about the forward-looking growth prospects, as well as the power of central banks to pump up asset prices.“

Considering that the S&P is about a few hundred percent higher than where it would be without central banks “pumping up prices”, the market is about to go through a lot of pain in the near future if the world’s largest bond manager is correct.

via ZeroHedge News http://bit.ly/2QCmU0f Tyler Durden