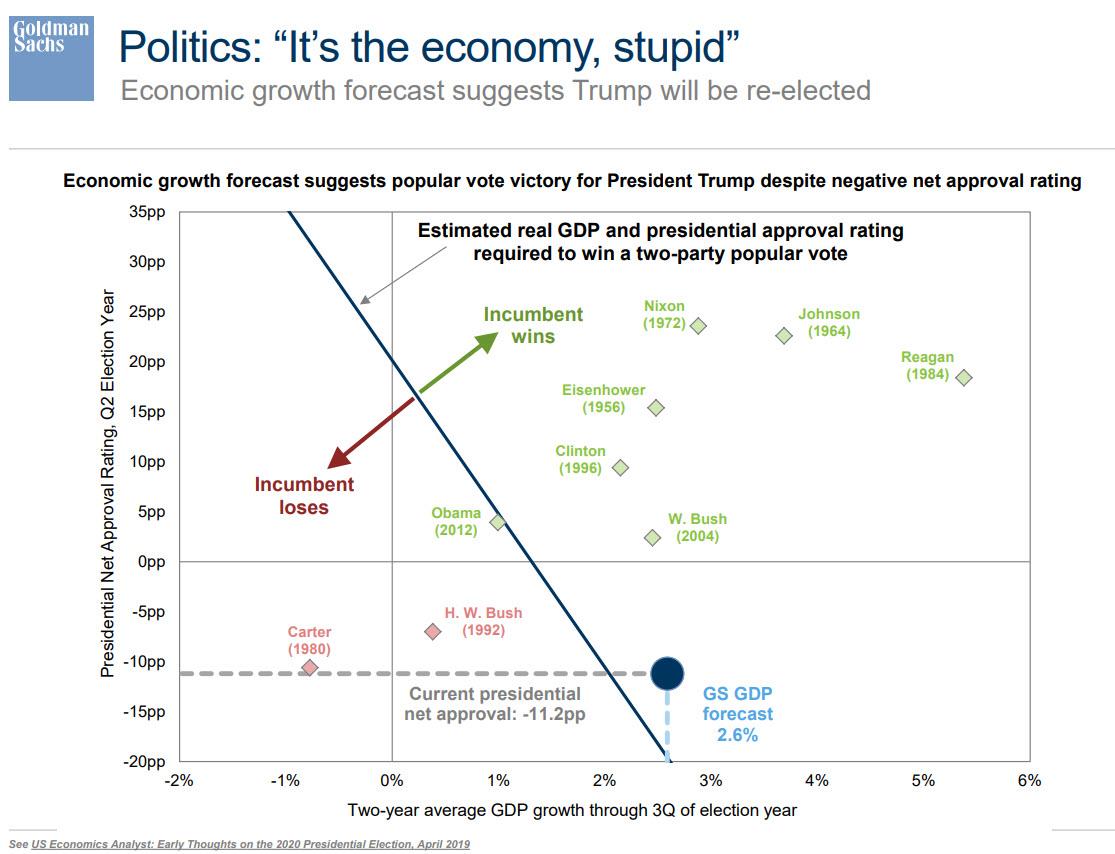

There is a reason why Trump is so transfixed on the state of the economy: according to an analysis by Goldman, when it comes to politics, “it’s the economy, stupid”, and specifically the seasonally-adjusted economy, i.e., GDP.

What Goldman means by that is that Trump’s re-election chances will depend on two things: the president’s net approval rating on one hand, and the two-year average GDP growth through the third quarter of election year (in this case Q3 2020). And as the chart below shows, with Trump having one of the worst net approval ratings of all time, below even that of Jimmy Carter, what Trump does have going for him is the solid – for now – economy, thanks to a trailing two-year GDP which will be around 2.6% next September.

As a result, Goldman claims that according to economic growth forecasts, Trump will-be re-elected…

… unless GDP (any by implication, the market) crashes in the upcoming 16 months, sliding below 2.00%.

There is another reason why Goldman believes Trump will be re-elected: according to the bank’s economist Alec Phillips, incumbent presidents carry a 5 to 6 percentage-point edge over rival candidates in the popular vote. “The advantage of first term incumbency and the relatively strong economic performance ahead of the presidential election suggest that President Trump is more likely to win a second term than the eventual Democratic candidate is to defeat him,” said Phillips.

In some more good news for Trump, who is obsessed with the current level of the S&P. Well, if Goldman is right, he doesn’t have to be. Historically, Goldman has found that variables such as employment and income are better indicators of an election result than market-based forces such as equity or oil prices.

Which is why instead of focusing so much on pushing the S&P higher, which only affects a relatively small group of potential voters, Trump should be far more careful what impact his policies (and tweets) will have on the broader economy, which after an impressive 3.1% jump in the first quarter, is expected to slump to just above 0% in the second.

via ZeroHedge News http://bit.ly/2HLlw8H Tyler Durden