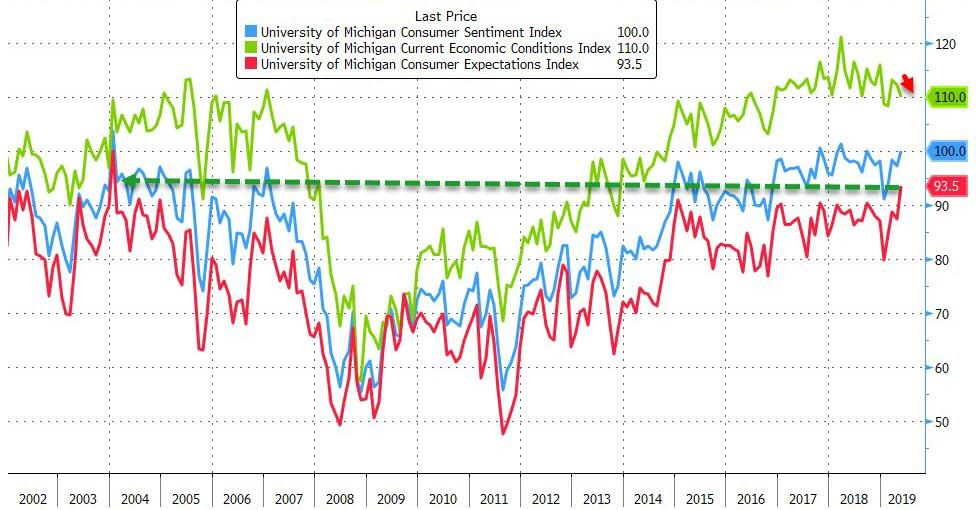

UMich Sentiment survey ‘expectations’ soared in the preliminary data sending the headline to its highest since Jan 2004, but the final prints were marked down notably.

Against expectations of 101.5, and flash print of 102.4 (highest since Jan 2004), the final data for UMich sentiment printed 100.0 (the highest since Aug 2018 only)

This is still the highest “expectation” print since Dec 2003 (albeit notably lower from 96.0 flash to 93.5 final) and current conditions slipped from 112.3 in April (112.4 flash) to 110.0 final for May.

Middle-income Americans saw sentiment weaken as the top and bottom income cohorts rose…

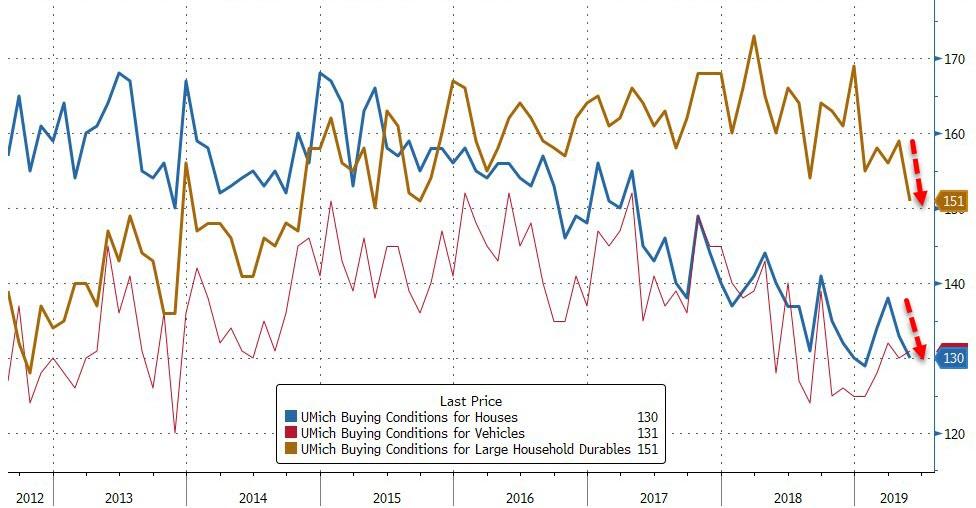

Buying attitudes towards homes and household durables tumbled…

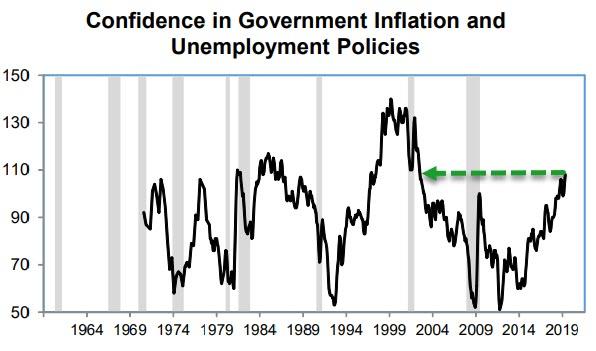

As UMich notes, the combination of higher inflation and lower spending provide conflicting signals for monetary policy, with the divergence further heightening if, as is likely, the trade war escalates. Will the Fed risk higher inflation with lower interest rates, or risk higher unemployment with higher interest rates? Either choice would threaten the highest level since 2002 in consumer confidence in the government’s policies to keep both unemployment and inflation at reasonably low levels (see the chart below).

The economic optimism now expressed by consumers is characteristically different than when the Index first reached the May level in the mid 1960s.

In the earlier era, optimism was primarily based on expected growth in incomes, in the current era, optimism is based more on expected income and job security. The shift is partly the legacy of the Great Recession and partly due to an aging population. This shift has been reflected in personal economic evaluations as well as in political choices.

The proportion of consumers who anticipated an economic downturn during the next five years fell to 38%, the lowest level since 2004.

via ZeroHedge News http://bit.ly/2YWK4RX Tyler Durden