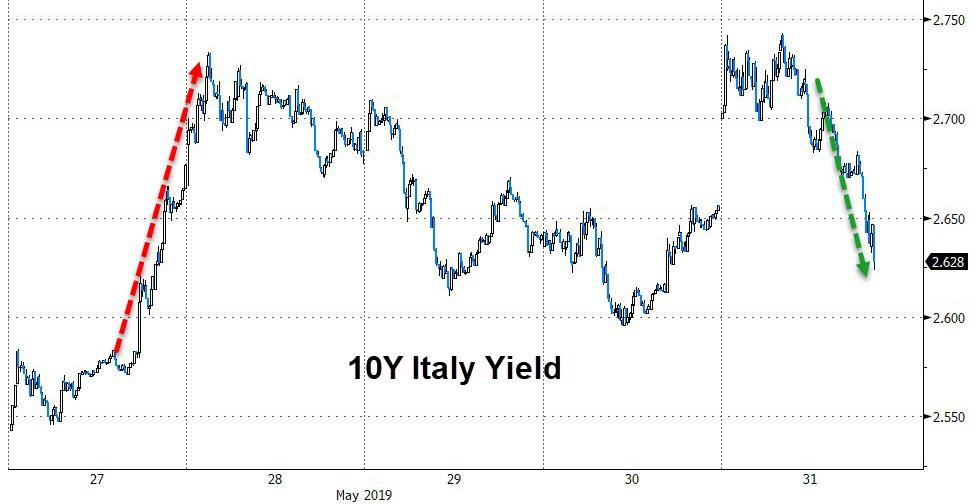

Euro is rallying against the dollar and BTP yields are tumbling after the Italian government has responded to EU concerns (threats of fines) about the southern European nation’s surging debtload.

In what appears like a “say whatever they want to hear” statement, Italian officials promised that the country is planning to reduce the cost of new welfare measures for income support (“citizens income”) and earlier retirement age in 2020-2022, Italian news agency Adnkronos reports.

Additionally, Italy will reportedly tell the EU that its structural deficit can improve without a rise in VAT:

The government is “launching a new spending review and we believe that it will be possible to reduce spending projections for new welfare policies,” news wire cites the letter as saying.

And sure enough, the market is buying it…

Italy told the EU that it expects a drop in bonds yields, lowering borrowing costs as a consequence:

“We are convinced that once the budget program will be finalized in agreement with the European Commission, yields on Italian government bonds will decrease and interest expenditure projections will be revised downwards”

And as can be seen – whether or not Treasury is buying again – that is happening right on cue.

via ZeroHedge News http://bit.ly/2EL9H0x Tyler Durden