The legendary creator of the MOVE bond volatility index and the iconic Merrill Lynch RateLab, Harley Bassman, has opined on the biggest inversion in the yield curve since the financial crisis (3M-10Y dipped as low as -22.5bps this morning), and his view is hardly favorable.

As Bassman notes in his latest note “Can you hear me Knocking”, he reminds his readers that in his February 6, 2019 commentary titled “Wall Street Jenga”, he noted that “December’s initial Yield Curve inversion flashed a signal for a market or economic disruption in Q2-2020 (Eighteen months ahead).” Fast forward to today when he cautions that “this week, these two rates finally inverted.” And in response to those “best and brightest who are bleating how “it is different this time”, Bassman has a one-word answer: “Puff!“

But before being accused of becoming the “next headline seeking pundit calling for a crash” he explains that he is “just saying that important risk vectors are now in disequilibrium, and these cannot be excused by QE, Trump, or the proximity of MMT.“

Additionally unlike skeptics who believe they know the next surprise will germinate; Bassman declines such as task as “such is the definition of a surprise.That said, well-heeled investment professionals are effectively willing to purchase five-year bonds to be issued in 2024 (five years hence) at a rate below today’s risk-free overnight rate.”

This, as he further notes, is “different than a low print on the VIX, which is a derivative of a derivative; these are two of the most heavily trafficked interest rates in the unfettered US Dollar market.”

As such, he adds, “unless this was a ‘quick kiss’ during the holiday shortened Hamptons summer kick-off, I am starting to prepare for a macro-political or -economic disturbance.“

In short, one of the most respected men in financial analysis is bracing for chaos.

So what is he doing?

First, he urges readers “let’s keep out heads clear, it is not time to panic.” That said…

I am not explicitly reducing risk exposure, per se, rather I am adjusting the manner in which I touch it. I am covering (embedded) out-of-the-money option shorts and seeking ways to be long convexity–unbalanced risk in my favor.

What this means in English is that he is covering OTM puts, and instead of buying stocks – in case trade war gets resolved – he is buying some S&P calls with a 3,000 breakeven, noting that “yes, I will miss a small rally; but if the trade war is resolved I will participate in a break out to new highs.”

Bassman is also making levered investments on mid-grade Credit/MBS/Muni Closed-end Funds and Mortgage REITs, which have “taken a beating from the Yield Curve flattening…. Notice that many Muni CEFs trade at a 10% discount to NAVand some REIT’s trade at a discount to Book Value.” His argument for this trade is that if the curve signal is real, the Fed will cut rates next year (or even this year if JPMorgan is right, twice) and will jump the dividend payout. If he is wrong, he can lick his wounds while clipping a 9% coupon.

His proposed trade recos aside, if Bassman is right and there is indeed a full-blown “disruption” next year, this is what he would guess :

- It will not be Brexit or international Trade, these risks are too well trafficked to offer a surprise. The markets may move to adjust, but likely not too abruptly.

- Enacting an ill-conceived immigration policy that substantially reduces the Labor Force Growth rate; however, this is a slow poison, not a quick-shot.

- The most unlikely, so clearly the most surprising, would be if the US Senate swings to the Democrats. If you want a truth stranger than fiction, imagine the President is re-elected but has to manage a unified Democratic congress.

In conclusion, Bassman has a simple warning that has become his mantra: “it’s never different this time“, because…

A P/E of 100 on the Nikkei in 1989 or the NASDAQ in 2000. No-doc 105% LTV home loans in 2006. Pigs can fly if shot out of a large enough cannon; until they come down to earth as bacon.

His parting words take him full circle to the inversion in the product that made him a market legind: “I don’t know how or when it will resolve, but the Yield Curve has inverted in a half-dozen places, and eventually this ends in tears.”

* * *

For those wanting more, his full note is below.

“Can You Hear Me Knocking”, A commentary by Harley Bassman

A devout man was alone in his home when the flood warnings arrived. A police car drove up with an offer to take the man to a dry shelter; he declined saying that G-d would save him.

Soon the waters rose, and he ran up the stairs. Looking out the second story window he saw a Coast Guard skiff pull up with the offer to take him to an upstream dock; he declined saying that G-d would save him.

With the waters cresting, the man climbed to the roof of his house. Wet to his waist, a Navy helicopter hovered overhead dangling a rope and the airman yelled at him to grab a hold; he declined saying that G-d would save him.

The man drowns and was soon elevated to heaven. Upon meeting G-d he asked why such a devout man as he was not saved? G-d replied: I sent you a car, a boat, and a helicopter – wasn’t that enough?

My January 29, 2018 commentary titled “It’s Never Different This Time” highlighted that the projected reduction in G-7 Central Bank balance sheets in Q1-2019 should be a concern since the infusion of liquidity seemed to be well correlated to calming and elevating financial markets.

A year later, in my February 6, 2019 commentary titled “Wall Street Jenga”, I noted that December’s initial Yield Curve inversion flashed a signal for a market or economic disruption in Q2-2020 (Eighteen months ahead).

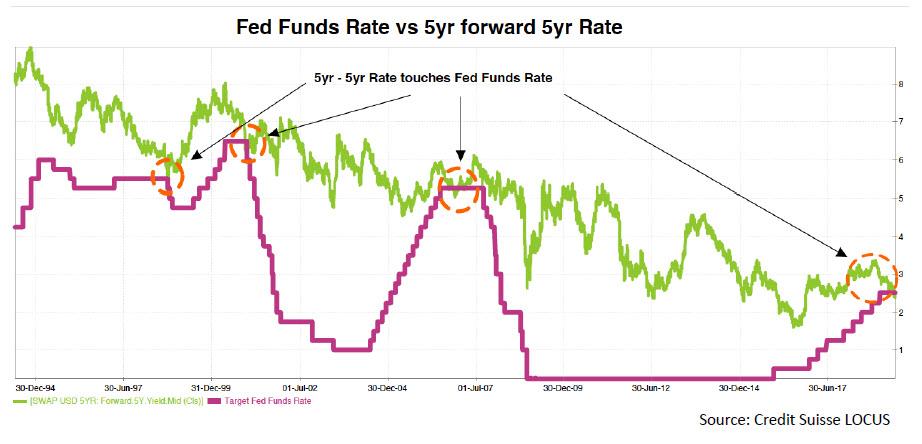

I also offered a special notice that I was keeping an eye on the spread between the Federal Funds rate and the 5-year forward 5-year swap rate (5yr-5yr). While there are many Yield Curve combinations, I like this one since the 5yr-5yr rate is a bit more insightful than the spot Curve and is also a half-step removed from the impact of Quantitative Easing/ Tightening (QE/QT).

This week, these two rates finally inverted on a closing basis.

The best and the brightest are bleating how “it is different this time”: Puff !

I will state for the record that the basic human impulses of Fear, Greed, and Ego (Hubris) have not changed too much since (wo)mankind resided in caves. Moreover, I will NOT be the next headline seeking pundit calling for a crash; rather I am just saying that important risk vectors are now in disequilibrium, and these cannot be excused by QE, Trump, or the proximity of MMT.

Let’s keep our heads clear, it is not time to panic. The S&P 500 is not rich; rather it is on the high side of fair relative to interest rates. Additionally, low Sovereign rates in conjunction with the demographic demand for coupon (retired Boomers need income) will allow most maturing debt to be rolled over. Truth be told, I cannot point to where the surprise will germinate; such is the definition of a surprise.

That said, well-heeled investment professionals are effectively willing to purchase five-year bonds to be issued in 2024 (five years hence) at a rate below today’s risk-free overnight rate. This is different than a low print on the VIX, which is a derivative of a derivative; these are two of the most heavily trafficked interest rates in the unfettered US Dollar market.

Unless this was a ‘quick kiss’ during the holiday shortened Hamptons summer kick-off, I am starting to prepare for a macro-political or -economic disturbance.

What am I doing ?

I am not explicitly reducing risk exposure, per se, rather I am adjusting the manner in which I touch it. I am covering (embedded) out-of-the-money option shorts and seeking ways to be long convexity – unbalanced risk in my favor. Volatility is still relatively cheap; a six-month out-of-the-money call option on SPY has an Implied Volatility of about 13%. So instead of being outright long equities, I might buy the K = 295 call at ~5 points with a break-even of 300 (SPX = 3000). Yes, I will miss a small rally; but if the trade war is resolved I will participate in a break out to new highs.

I love mid-grade Credit/MBS/Muni Closed-end Funds and Mortgage REITs.

These assets have taken a beating from the Yield Curve flattening. There may still be some dividend trims as cheap legacy funding debt is renewed at higher rates, but that is already priced in. Notice that many Muni CEFs trade at a 10% discount to NAV and some REIT’s trade at a discount to Book Value. If the Curve signal is real, FED rate cuts next year will jump the dividend payout. And if I am wrong, well, I can lick my wounds while clipping a 9% coupon. To be clear, this is a levered investment; but it is linear, not convex risk.

For the professionals, I am still long the five-year Yield Curve option I recommended in “Catch a Wave” – June 27, 2018. These options now cost a bit more, but not enough to skip this ticket. This option cannot be re-created by a combination of vanilla options, and it has a terrific Vega-kicker since Volatility will increase significantly when the Yield Curve steepens.

As noted, by definition a surprise cannot be anticipated; but if the traditional signals ring true and we have a disruption next year, what might I guess ?

1) It will not be Brexit or international Trade, these risks are too well trafficked to offer a surprise. The markets may move to adjust, but likely not too abruptly.

2) Enacting an ill-conceived immigration policy that substantially reduces the Labor Force Growth rate; however, this is a slow poison, not a quick-shot.

3) The most unlikely, so clearly the most surprising, would be if the US Senate swings to the Democrats. If you want a truth stranger than fiction, imagine the President is re-elected but has to manage a unified Democratic congress.

It’s never different this time. A P/E of 100 on the Nikkei in 1989 or the NASDAQ in 2000. No-doc 105% LTV home loans in 2006. Pigs can fly if shot out of a large enough cannon; until they come down to earth as bacon.

I don’t know how or when it will resolve, but the Yield Curve has inverted in a half-dozen places, and eventually this ends in tears.

Are you listening ?

via ZeroHedge News http://bit.ly/2W6YT2G Tyler Durden