It’s a question that the financial press – not to mention millions of struggling Americans – have returned to time and time again (recently, it even received its own Vox explainer): If we are truly in the middle of an economic boom, then how come so many Americans, even members of the vaunted middle class, feel like they’re barely treading water?

According to the Fed, roughly 40% of Americans couldn’t cover an emergency $400 expense. Wage growth has been stagnant for decades. Meanwhile, our monetary policy makers point to a lack of inflation in the economy as an excuse for keeping interest rates on hold, even as the man on the street, and even a growing number of economists, contend that prices have been climbing much more quickly than the official data let on.

And we’re not just talking about the obvious factors like rising tuition, rent and health-care costs. It increasingly appears that the central bank is underestimating food inflation, even as the prices of many agricultural commodities remain in a slump (of course, Trump’s trade war isn’t helping).

To the growing list of distressing data points, we can now add one more: Gallup has published a poll showing that roughly 45% of Americans would rate their financial situation as “fair” or “poor” – and that a staggering 70% expected they would be financially better off. And while two-thirds of Americans say they have enough money to live comfortably, another one-third do not. But even more concerning is the 25% of respondents who say they’re constantly worried about not having enough money to cover their household expenses. Roughly the same number said they’re only just making ends meet.

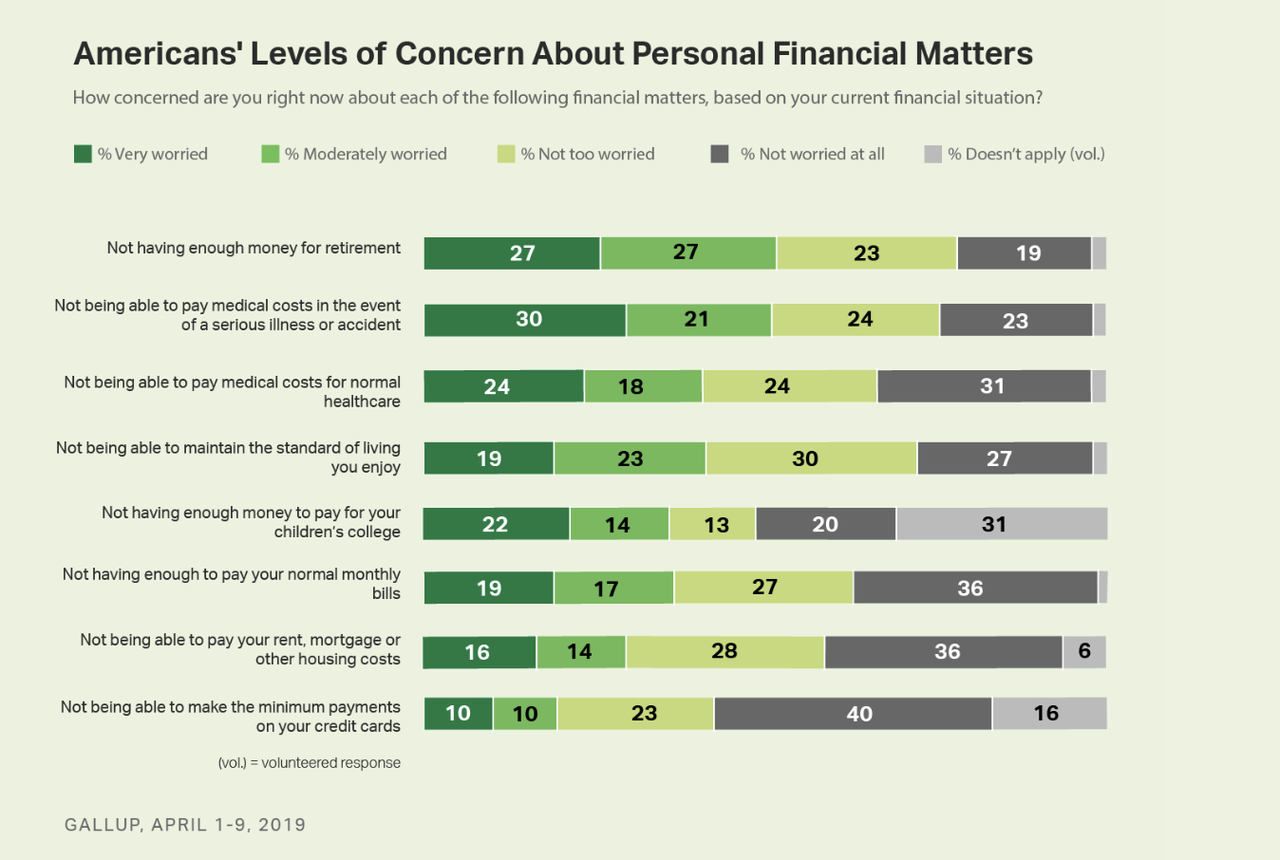

In a ranking of Americans’ financial anxieties, the overwhelming majority of respondents said they’re at least a little worried about being able to afford health care costs and having enough money for retirement.

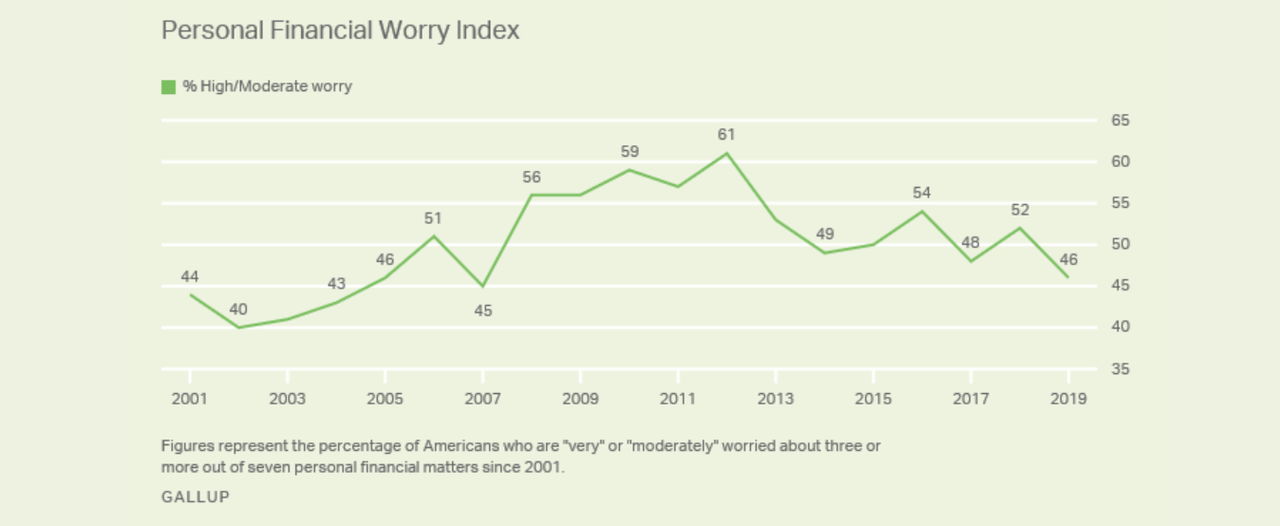

Gallup synthesizes the polling data into what it calls a “Personal Financial Worry” index. This year, 22% of respondents said they were worried about six or seven of the seven items, qualifying them for the “highly worried” category. Another 24% worry about three to five items and are classified as “moderately worried.” The remaining 55% said they have few financial worries, while 30% – the group most likely to have a college degree, gainful employment and the ownership of stocks – are worried about none of the seven.

Americans’ love affair with auto- and student-loans has helped push outstanding consumer credit above $4 trillion. Even though the pace of credit growth slowed last month, once the next recession comes, the number of Americans who are struggling to make ends meet will likely explode higher, while those who are already struggling might quickly find their backs against a wall.

via ZeroHedge News http://bit.ly/2W6zczh Tyler Durden