Authored by Richard Breslow via Bloomberg,

The news has been sordid. Markets are decidedly unsettled. And the mood among traders is one of resignation. It’s been the first day of this sell-off that I’ve not heard much, if anything, about bounces or oversold conditions. In fact, quite the opposite. Analysts are embracing the price action and arguing that even these levels reflect too much optimism. Self-inflicted wounds can be the most devastating.

Nevertheless, it’s a new month and probably worth taking some stock as to where we stand. We have a habit of extrapolating moves ad infinitum and creating narratives to bolster the case. On the back of proper forward guidance or hard economic trends that is an example of resolve and discipline. In explaining what may be current themes it works until it doesn’t. Especially if traders are trying to navigate waters roiled by behavior that can’t be made an input for any model.

The S&P 500 has fallen right into major-league support. Whether it holds or not will be a big deal in setting the tone for the coming month. There are technical levels galore between the current price and 2700. Including the important retracement level at 2715 of the move from last December’s low to May’s high. Remember how bullish everyone was a mere month ago? If stocks are going to hold, this is the zone.

Not coincidentally, the Nasdaq 100 and the Russell 2000 have also fallen into areas that need to hold. There aren’t any bellwethers playing the which-one-doesn’t-belong game. It looks like it is sink or swim together. And all of these indexes are trading off the same news. Oddly enough, or perhaps not, there are any number of other global indexes that have similarly fallen toward important pivots. This is true in Europe as well as Asia. It’s going to be an interesting week.

Of course, it would be a lot easier to be more constructive on risk assets in general if the move lower in sovereign yields wasn’t so relentlessly impulsive. But here, too, there is reason to watch things closely. In November of 2016, 30-year Treasury yields took off from a base of c. 2.50% and we never saw that level again. Until now. And you don’t need a chart to validate the assumption that 2% in the 10-year is a big deal.

There have been a lot of analysts throwing in the towel on West Texas crude. Before you do, watch whether today’s bounce off the lows holds. This is a market with scope to move. But there is a lot of support down here and the market bounced where it should have. And, frankly, some of the price targets being thrown out there seem very aggressive.

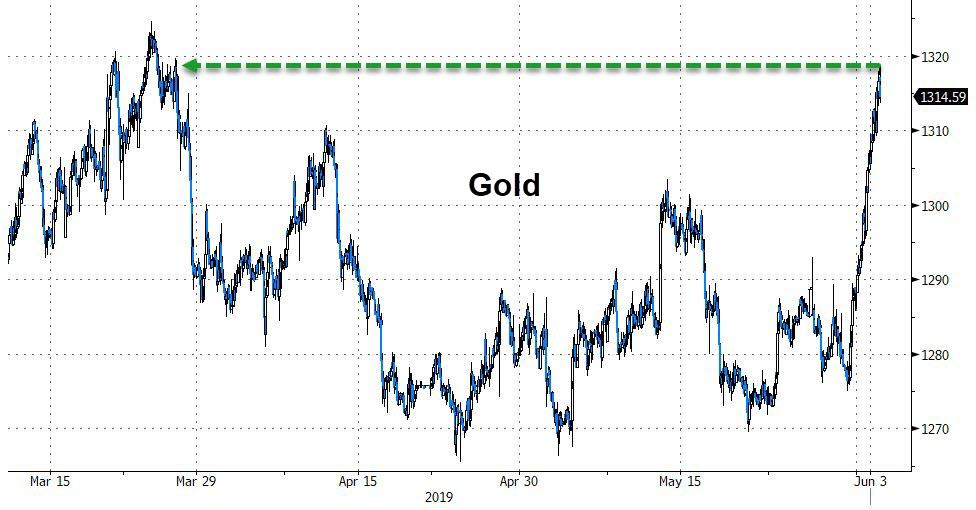

The move in gold is actually impressive and significant. And yet it feels late to the party. I suspect it is back in the category of everyone should have some in their portfolio, but I’m not sure if the message it is sending is actionable in the broader context

June follows May. And we’ll see if prices continue on or correct.

There are a ton of levels to help define which will be the case. The central banks should step back and see how the news plays out. Their models don’t capture what is going on either.

via ZeroHedge News http://bit.ly/2JTiim4 Tyler Durden