It was only days ago that we noted JD Power’s pessimistic look at bloated inventory and stuffed channels in the automotive industry. Now, a new Bank of America note echoes the magnitude of the problem. “The peak in auto sales is clear,” the bank concludes.

The note points out that inventory for light trucks and SUVs is climbing to “uncomfortably high levels” which are indicative of even more softening in automotive sales at a time when producers have been too optimistic about demand. Recall, JD Power had stated, days ago:

Inventory is starting to become a serious issue across all U.S. automakers. On average, new vehicles sold in May spent 74 days on dealer lots, the highest level for the month of May since 2009 when the industry was plagued with the looming effect of the Great Recession. 29% of vehicles sold so far in May have sat on lots for 90 days or longer, up from about 25% last year.

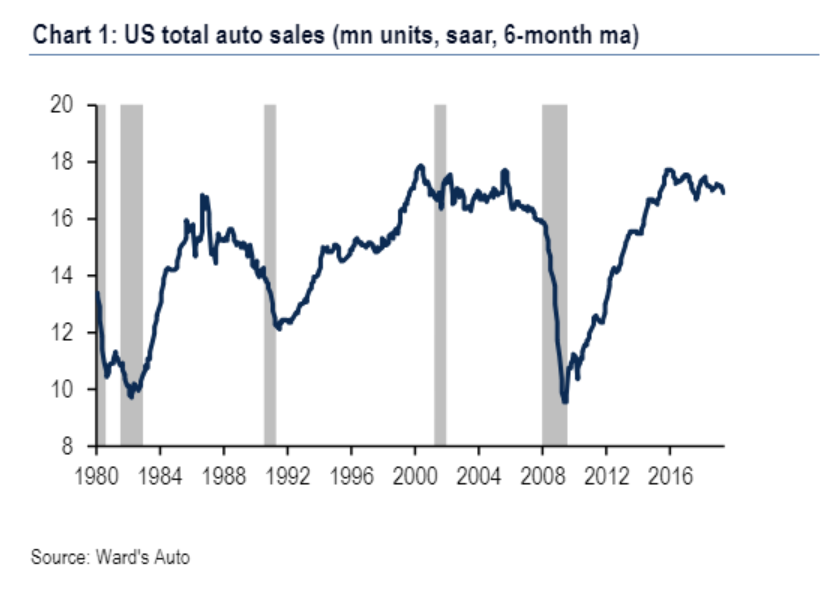

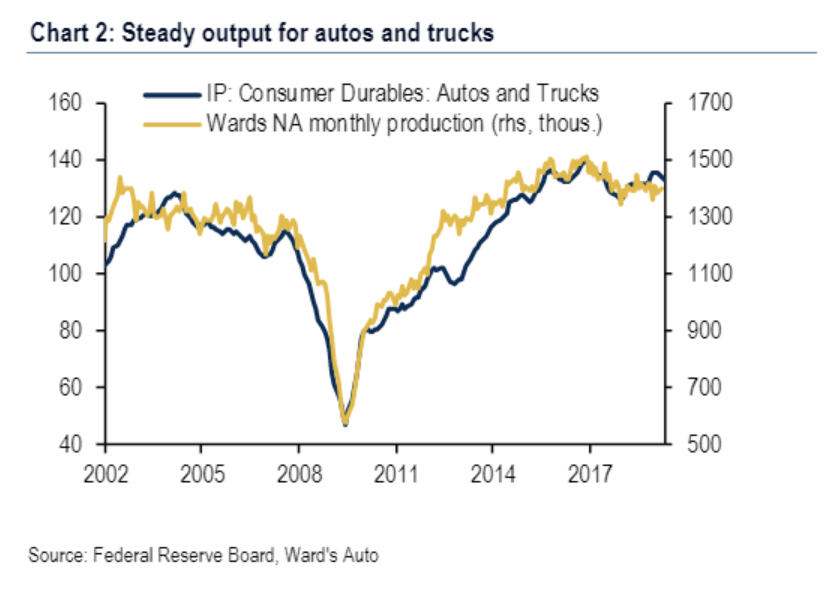

While Bank of America attributes much of the downturn in the manufacturing sector to the ongoing trade war, it singles out the automotive industry as a specific area for concern. Calling the problem a “classic story of demand/supply mismatch”, the bank points out that producers continue to ramp up output at a time when demand has softened. It’s easy to see in the two following charts – one showing auto sales topping out and the other showing output and production not falling.

The note shows that total auto sales have appeared to peak…

…while at the same time output remains high…

Additionally, the note provides a glimpse at skyrocketing light truck inventory and poor consumer confidence data when asked about whether or not it was a good time to purchase vehicles.

The University of Michigan shows that buying conditions for autos have been edging lower since spring 2016 and currently stand at the lowest since mid-2012, according to the note.

The poor consumer confidence number has been a result of higher prices, as we detailed in our previous write-up. And, very simply, the note says “the auto cycle has peaked”.

The bank’s auto analyst, John Murphy, expects “further slowdown with sales averaging 16.3mn saar this year, reaching a trough of around 13-14mn saar in 2020.” He also says that new sales will head lower “largely due to the ‘tsunami’ of used vehicles supply, which depresses the prices of used vehicles (making them more attractive than new) and reducing residual/trade-in values (curbing turnover of the auto stock).”

B of A also examined lending conditions, noting that even though rates have come down, lending standards have tightened:

The interest rate on auto loans has come down along with the drop in market rates. This should incrementally support demand for autos. However, according to the Senior Loan Officer Survey (SLOS), lending standards for auto loans have been tightening since 2016 which can be seen through an increase in credit scores of auto origination.

As Chart 5 shows, the median credit score on an auto loan is now 710, significantly higher than the low of 683 in 2015 and nearly back to recessionary tightness. While this will help credit quality and reduce the rate of delinquencies – a positive in the long-run – it also curbs demand in the short-run.

In our view, the peak in auto sales is clear and we will likely see some softening going forward, but we do not expect a sharp drop. The labor market is still solid with a healthy pace of job growth and the emergence of wage inflation.

The note also shows a stunning rise in the amount of announced job cuts in the industry, another topic we tackled earlier this month. We pointed out that countries like China, the United Kingdom, Germany, Canada and the United States have all seen at least 38,000 job cuts over the last six months in the automotive sector. And, based on B of A’s outlook, this could just be the beginning of larger cuts to come.

This chart shows all of the job reductions announced and reported over the last six months.

Finally the note concludes by pointing out that autos will continue to serve as a drag on the broader economy.

“Autos influence GDP through consumer spending and production, with inventories serving as the residual between what is produced and sold. When sales weaken, it will lead to weaker consumer spending which will typically be partly offset by higher inventories. Producers will respond by cutting output and inventories will be reduced appropriately. The decline in inventories is what causes the drag to GDP growth,” the bank said.

B of A concluded:

“Motor vehicle output added an average of 0.2pp / year to real GDP growth from 2010 to 2018 after slicing a half of a percentage point in each 2008 and 2009. Motor vehicle production is already on course to be a drag this year, slicing 0.14pp from 1Q GDP growth. We expect it to cut nearly 0.2pp to annual growth this year. Relative to last year, that is a reversal of 0.4pp. It doesn’t feel great but it is manageable.”

via ZeroHedge News http://bit.ly/2MrXowt Tyler Durden