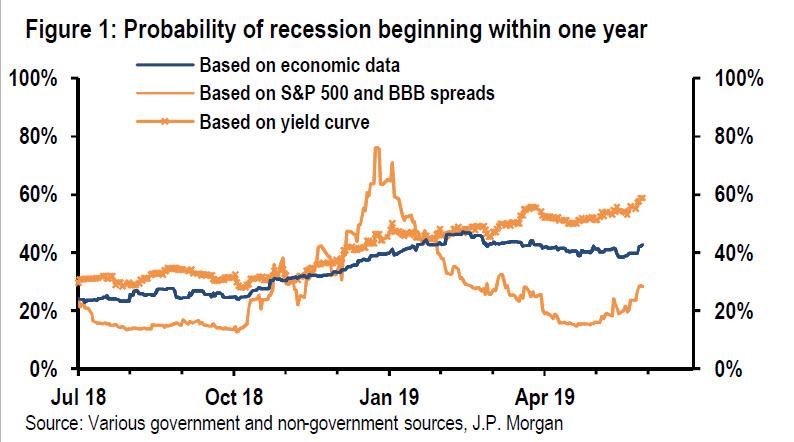

While Morgan Stanley signaled that the probability of a US recession in one year is now 60%, the highest it has been since the global financial crisis, judging by JPMorgan’s global manufacturing PMI, we may already be there.

“Trade tensions have re-emerged at a critical moment in the global cycle. Corporate confidence is weak, and we argue that the outcome of trade talks will be key to the global growth outlook.”

JPMorgan piled on, saying the probability of a U.S. recession in the second half of this year has risen to 40% from 25% a month ago, while Barclays now expects a worst case scenario of a recession in 9 months.

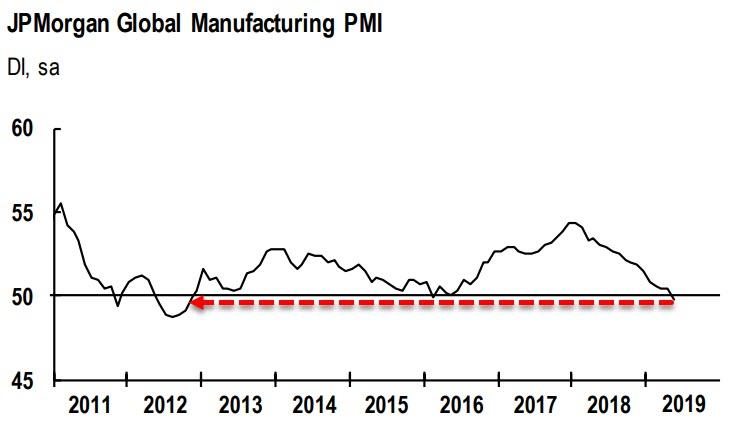

All of which is a major problem for global manufacturing as Markit reports that Global PMI surveys, led by the US plunge, signalled that manufacturing downshifted into contraction during May, down an unprecedented 13 straight months.

Business conditions deteriorated to the greatest extent in over six-and-a-half years, as production volumes stagnated and new orders declined at the fastest pace since October 2012. The trend in international trade continued to weigh on the sector, with new export business contracting for the ninth month running. Business optimism fell for the second month in a row and to its lowest level since future activity data were first collected in July 2012.

This real-economy shift fits with the market’s recent regime change:

“The overall market reaction of equities down and yield curves flatter shows a broad re-pricing lower of global growth expectations,” Goldman Sachs’ strategist Ron Gray wrote in a report.

“Macro data have not been very supportive and the 2018 narrative of slowing global growth has re-emerged.”

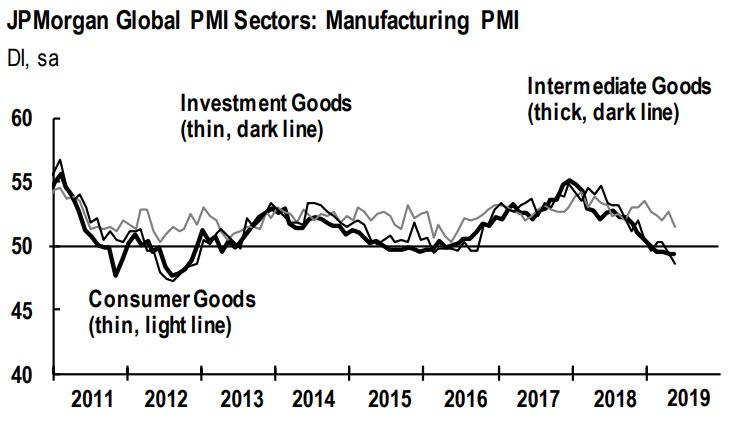

Markit continues, noting that downturns continued in the intermediate and investment goods industries, which both saw output and new orders fall further during May. Although the consumer goods sector fared better in comparison, with production and new business rising, rates of expansion eased.

The downshift in growth in the US was the main driver of the slowdown in global manufacturing, as the US PMI slipped to its lowest level in almost a decade (September 2009).

… and all of this happened before President Trump re-launched the trade war.

None of which bodes well for global stocks…

via ZeroHedge News http://bit.ly/2EUJSv8 Tyler Durden