After decades of unrestricted money printing, debt accumulation, and financial bubbles, millennials are still hibernating in their parents’ basements.

The homeownership rate among these young adults (under 35 years old) is currently at 1994 levels. Back then, a 30-year loan yielded over 9%. Today it’s a little under 4%.

Mother Jones examined mortgage rates and looked at monthly payments as a percentage of income, indicating average monthly home payments nationally for young adults has relatively stayed the same over the last several decades.

The average monthly home payment for Los Angeles, New York City, and Atlanta have been stable since 1994:

But with the “greatest economy ever,” why hasn’t the millennial homeownership rate risen?

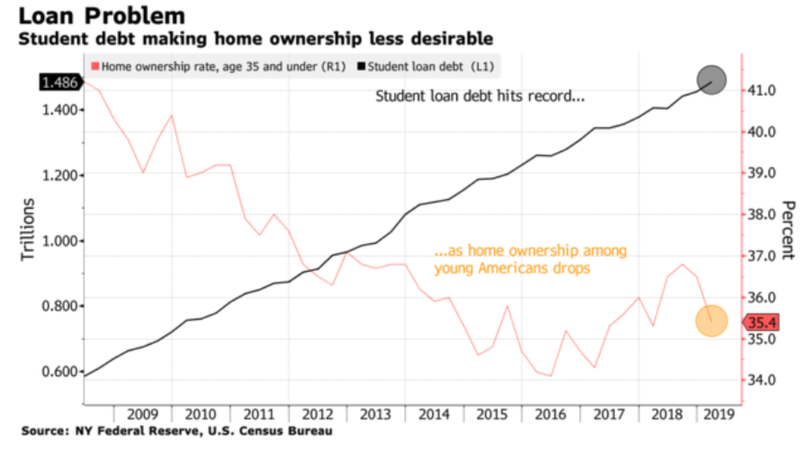

Well, that it’s an easy one – debt loads held by millennials exceeded well over a $1 trillion at the end of last year. On top of that, 60% of them don’t have $500 in savings, which is also contributing to their inability to buy a home.

Financial stress among this heavily indebted generation is showing up in record debt delinquencies of student loans.

Student loans “have completely broken with the business cycle,” NY Fed researchers wrote in a report earlier this month that showed student loan growth continued to increase even as other forms of debt growth slowed.

While the student loan bubble is set to implode in the next downturn, young people might not be able to buy homes until the mid-2020s, this is primarily due to their credit reports would be so devastated in a recession that lenders would have to deny young applicants on tighter lending standards.

Even though average monthly mortgage payments have been relatively the same cost from two decades ago, young adults today are financially challenged with insurmountable debts that inhibit them from purchasing a home, another clue that the American Dream has died for the millennial generation who will be a majority of the workforce in the next five years.

via ZeroHedge News http://bit.ly/3187iqd Tyler Durden