Following the collapse in both PMI and ISM surveys for US Manufacturing, Services surveys for May were expected to slide (tracking the rest of the world’s give-up of the Services sector outperformance overnight) but as is so typical, the surveys are entirely opposite of one another!!

-

US Services PMI survey dropped to 50.9 – the weakest since February 2016

-

US Services ISM survey jumped to 56.9 – highest since February 2019

Spot The Odd One Out!!

Even more ridiculous is that PMI reports that business expectations are at their lowest level since June 2016, but ISM’s Service employment index rose to 58.1 vs 53.7 – the largest monthly increase in employment index in two years.

Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“The final PMI data for May add to worrying signs about the health of the US economy. With the exception of February 2016, business reported the weakest expansion for five and a half years as a tradeled slowdown continued to widen from manufacturing to services.

“Inflows of new business showed the second-smallest rise seen this side of the global financial crisis as the steepest fall in demand for manufactured goods since 2009 was accompanied by a further marked slowdown in orders for services.

“Employment growth has come off the boil in line with weaker than expected sales and gloomier prospects for the year ahead, albeit still showing some resilience. The survey data are running at a level broadly consistent with around 150,000 jobs being added in May.

“The slowdown has also seen inflationary pressures fade rapidly. Despite upward pressure on prices from tariffs, the rate of increase of average prices charged for goods and services barely rose in May, in marked contrast to the strong rises seen earlier in the year, as increasing numbers of companies competed on price amid weak demand.

“As with manufacturing, the biggest change in recent months has been a sharp deterioration in growth of orders and output at larger companies, linked in part to worsening export trends, trade war worries and rising geopolitical uncertainty.”

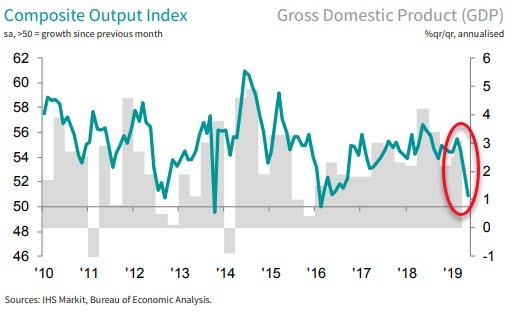

Finally, Williamson notes that “The survey data indicate a deterioration of annualised GDP growth to just 1.2% in May, down from 1.9% in April, putting the second quarter on course for a 1.5% rise.”

Will this bad news be good news for markets?

via ZeroHedge News http://bit.ly/2KsyrOJ Tyler Durden