Oil prices tumbled overnight on signs that U.S. crude inventories jumped last week (API reported a big build), worrying investors that supplies are swelling at the same time a trade war is threatening demand.

“Selling pressures are returning to the fore,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London. “Swelling U.S. oil inventories represent a major headache for those of a bullish disposition.”

API

-

Crude +3.55mm (-1.8mm exp)

-

Cushing +1.408mm (-800k exp)

-

Gasoline +2.696mm (+500k exp)

-

Distillates +6.314mm (+600k exp)

DOE

-

Crude +6.771mm (-2.0mm exp)

-

Cushing +1.791mm (-800k exp)

-

Gasoline +3.205mm (+500k exp)

-

Distillates +4.572mm (+600k exp) – biggest build since Jan

The API data also showed a combined 9 million barrel increase in distillates and gasoline stockpiles and crude shocked, but last week’s vast difference between EIA and API data should not be ignored. After last week’s de minimus draws in crude (and at Cushing), expectations were for a crude draw but EIA reported a shocking surge in inventories across the board…

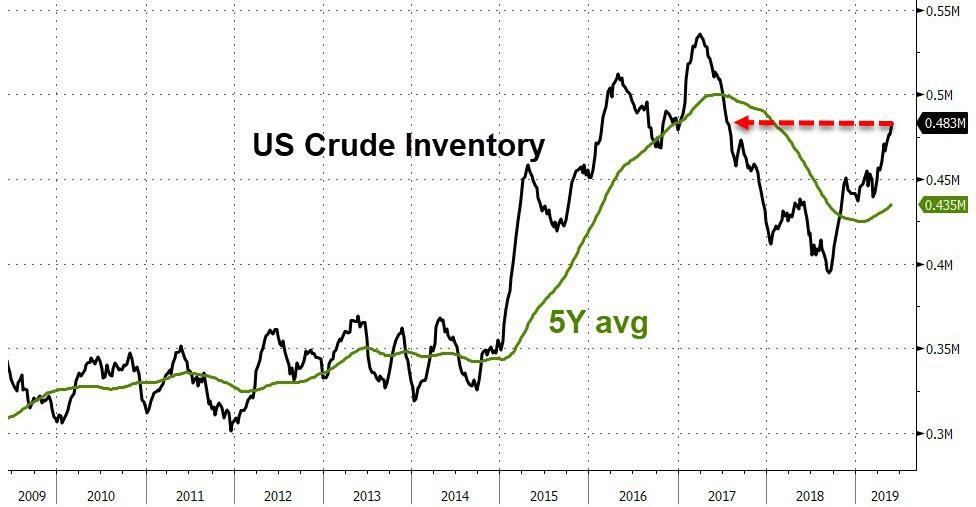

US Crude inventories are at their highest since Aug 2017 (well above the 5-year average).

Additionally, Bloomberg notes that effects from the Midwest and Great Plains flooding are likely to hit Cushing after a key outbound pipeline was forced to shut, while a number of refiners cut runs (refineries have been running below normal for this time of year and at the lowest since 2016).

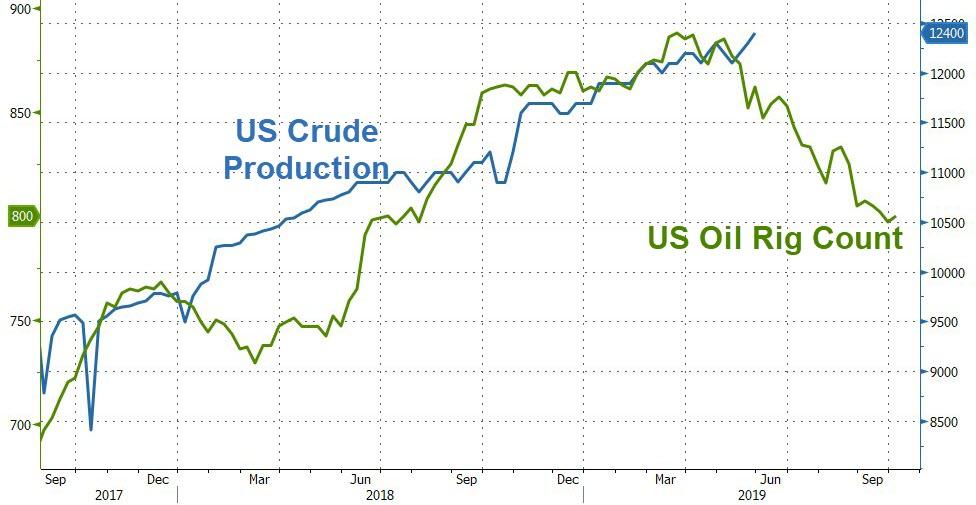

US crude production pushed to new record highs despite the ongoing (slow) decline in rig counts…

Some crazy high-frequency moves in oil prices this morning, well down from last night’s surprise build reported by API, traded below $53 ahead of the EIA data (although algos were pushing it h9igher before the print, which sent prices tumbling)…

A 22 million barrel total build in stocks! Not pretty!

via ZeroHedge News http://bit.ly/2WrwnO8 Tyler Durden