Alt-headline: “Markets Jump On Optimism US Economy Sliding Into Recession”

Japanese game shows are the craziest. pic.twitter.com/nti6OlOBFZ

— Only In Asia (@Crazyinnasia) June 7, 2019

But, for those relying on help to save the day, The Fed won’t cut rates until stocks plunge, which won’t happen because the Fed is expected to cut if stocks plunge…

Never mind that – just buy it!!!

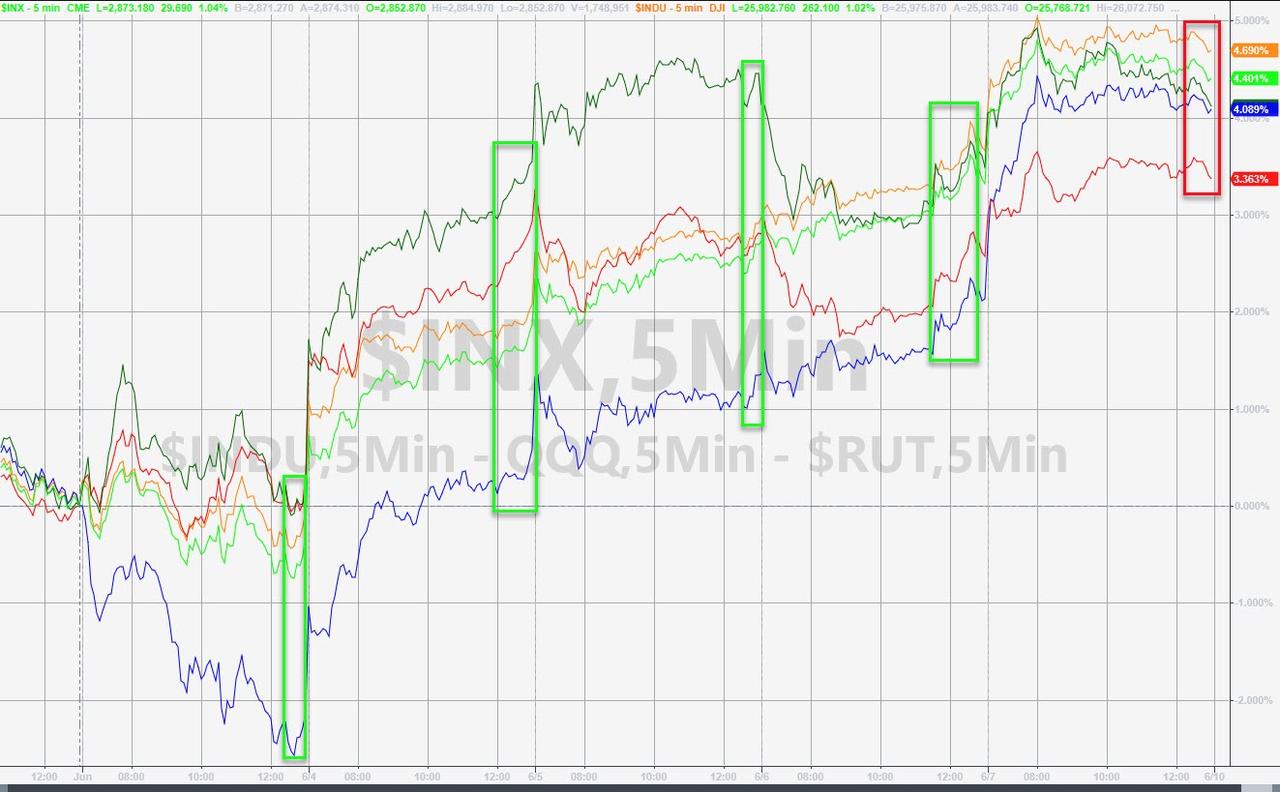

NOTE – after being panic-bid every day into the close, Friday saw weakness.

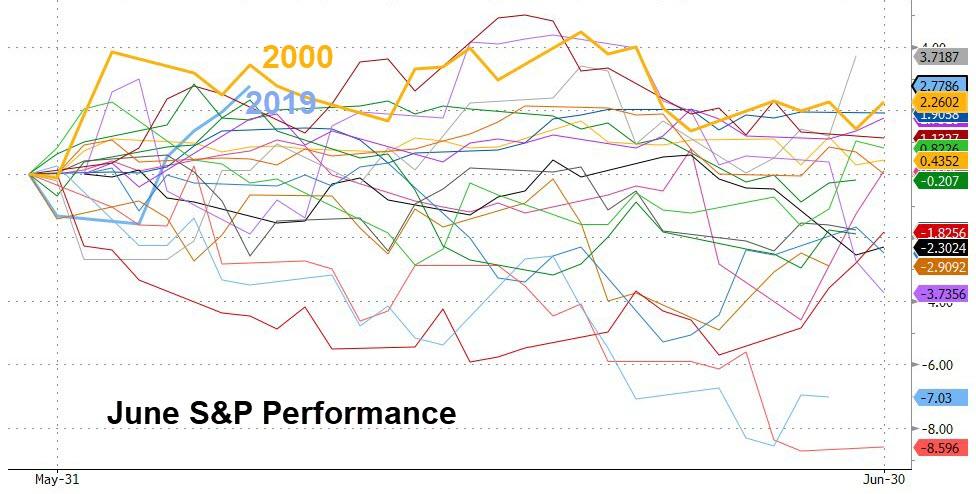

This was the best start to a June since 2000…

And best week since November for US stocks…

NOTE – we have seen this pattern before and it did not end well.

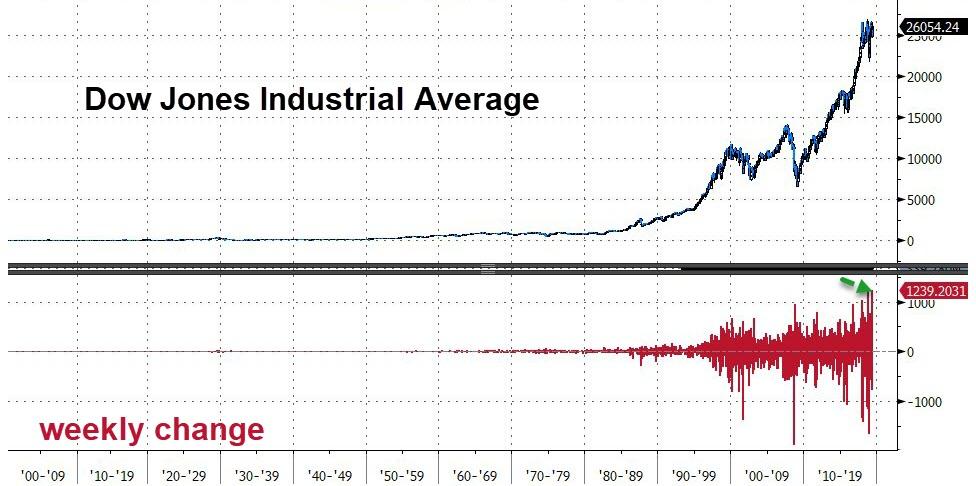

While a somewhat nonsensical way to look at things, we note that this week saw the biggest point gain for the Dow in history…

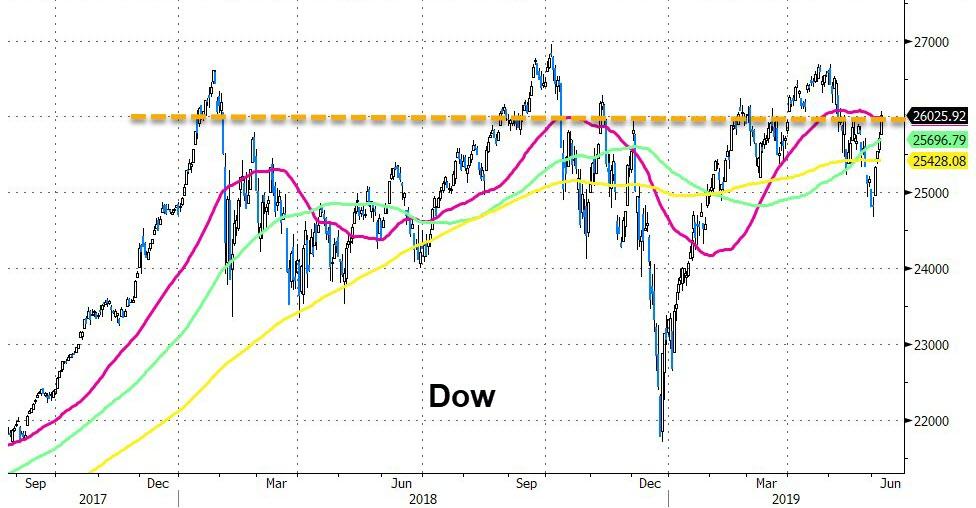

Dow 26,000 remains a key level… (Dow crossed above all its major moving averages this week)…

But The Dow ended back below 26k…

Intraday, Dow futures went nowhere from the European close onwards today…

US Materials stocks soared…

Having their best week in 10 years…

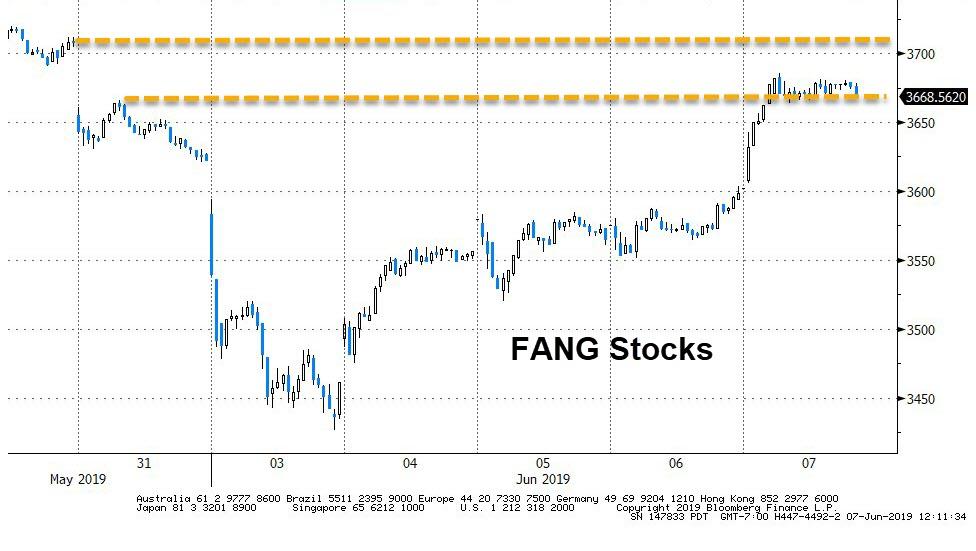

FANG Stocks surged on Tuesday and Friday …

MSFT hit a new record high above $1 trillion market cap today…

After the initial surge on Tuesday, Defensive stocks have notably outperformed Cyclicals…

VIX and Stocks dramatically diverged today (upside call-buying or downside-protection bid?)

While US markets soared, Chinese stocks tumbled, breaking below key support levels and entering a bear market…

But European markets also surged this week…

And this chart sums it all up…

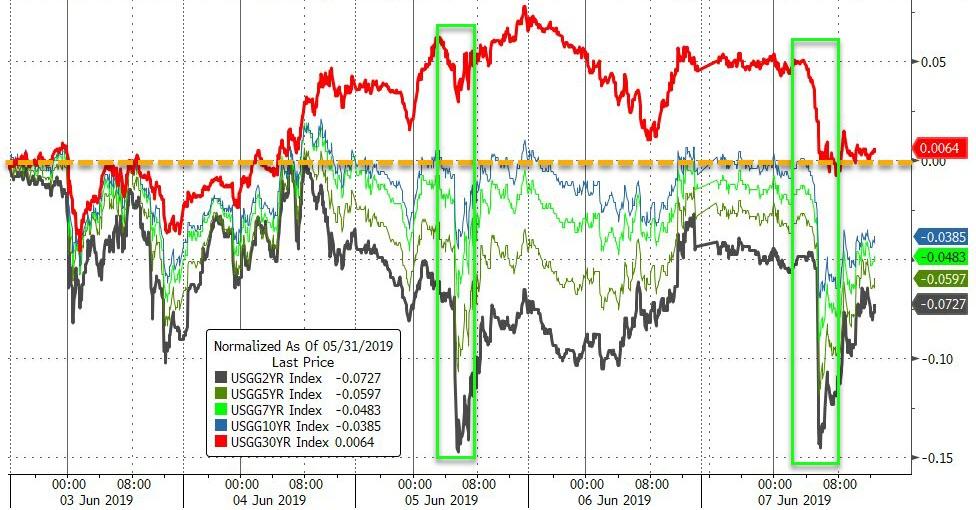

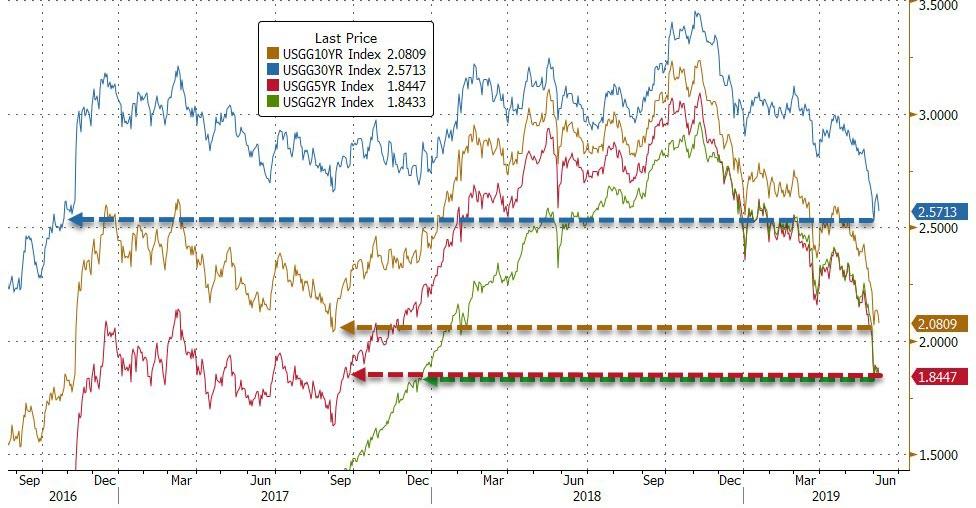

Treasury yields are lower today, shifting most of the curve notably lower on the week (30Y underperforming)

Yields touched new cycle lows intraday today…

But 10Y Yields have traded in a tight range all week…

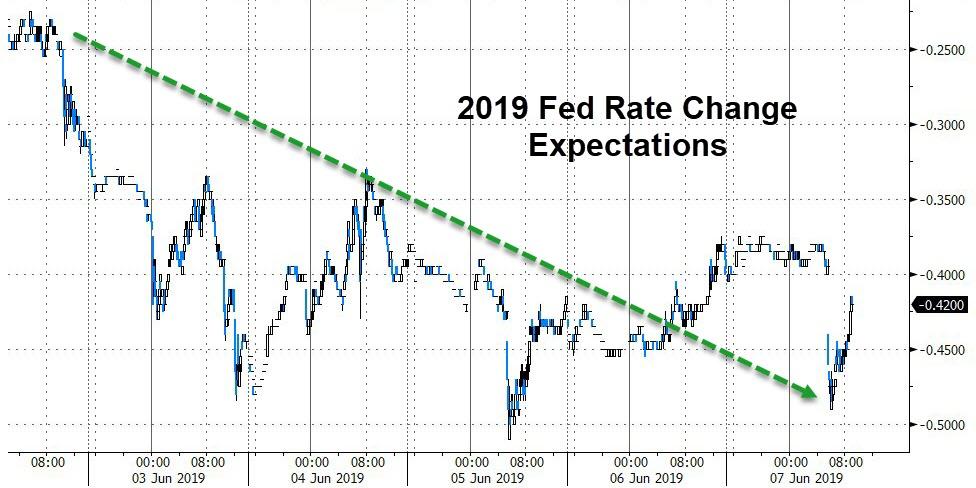

On the week, expectations for rate-cuts in 2019 continued to escalate as various Fed heads jawboned the markets higher with promises of rate-cuts…

Bond volatility has exploded – idiosyncratically – this week…

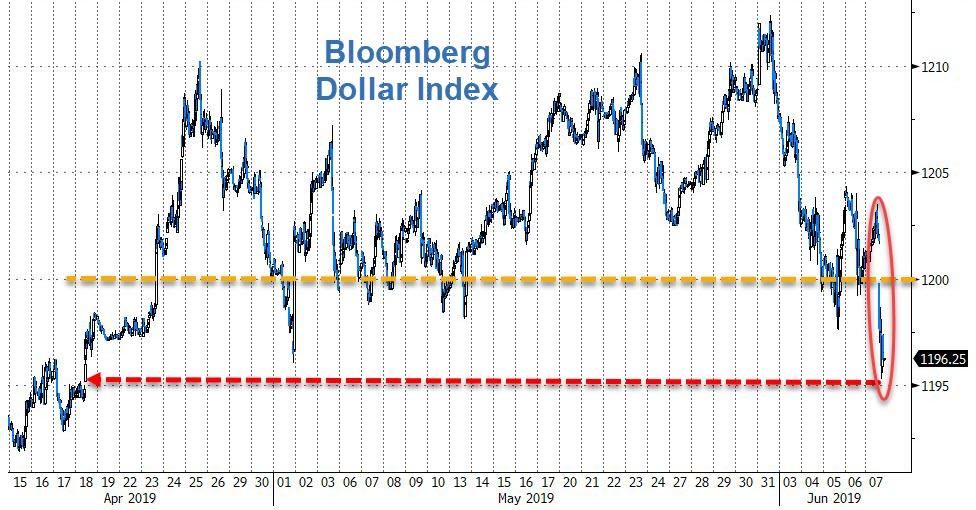

The Dollar plunged this week – its worst since March 2018…to its lowest since mid-April…

While the dollar tumbled, so the yuan tumbled even further against the dollar, testing below the recent lows of the range (down to the weakest since Nov 2018) before bouncing back today…

NOTE – look how tight the range has been in the last few weeks.

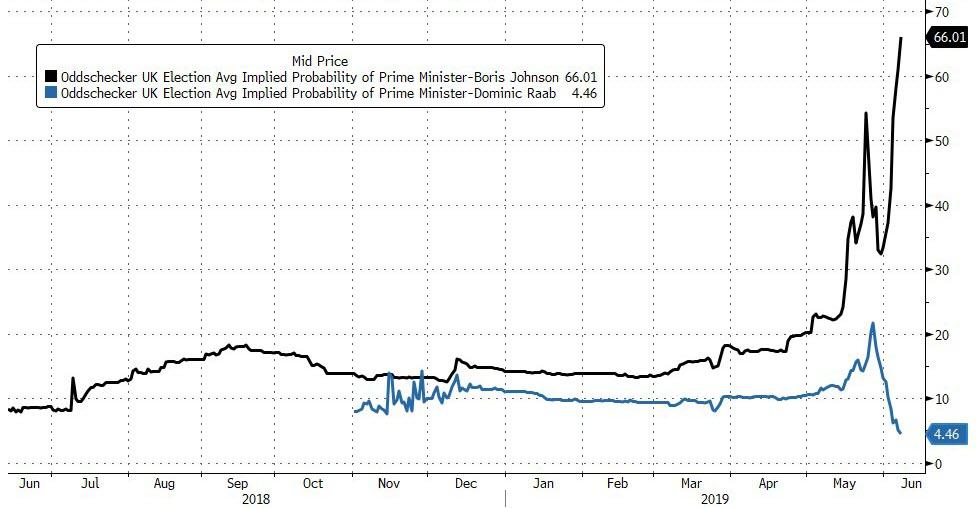

Cable rallied on the week – for a change…

And we note The BoJo is now at 66% odds of winning.

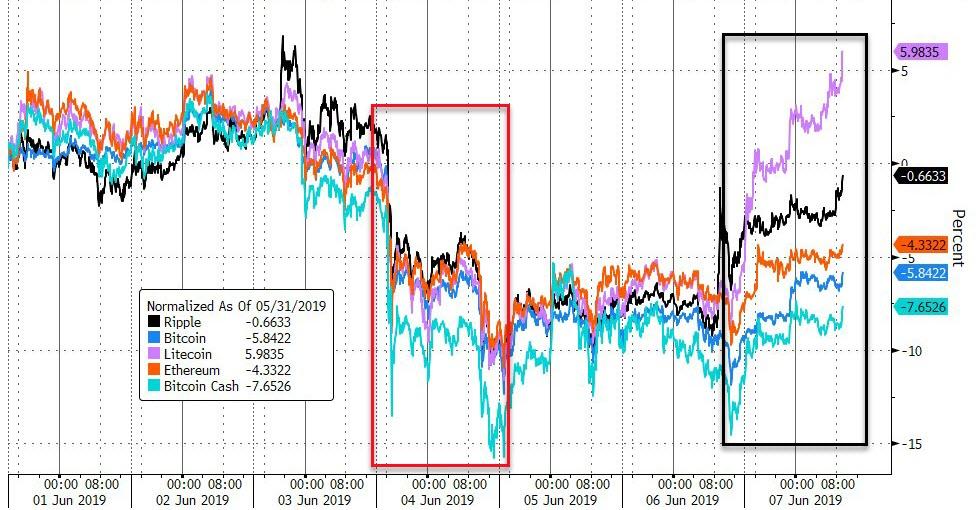

Cryptos rallied to end the week, lifting Ripple to unch and Litecoin into the green…

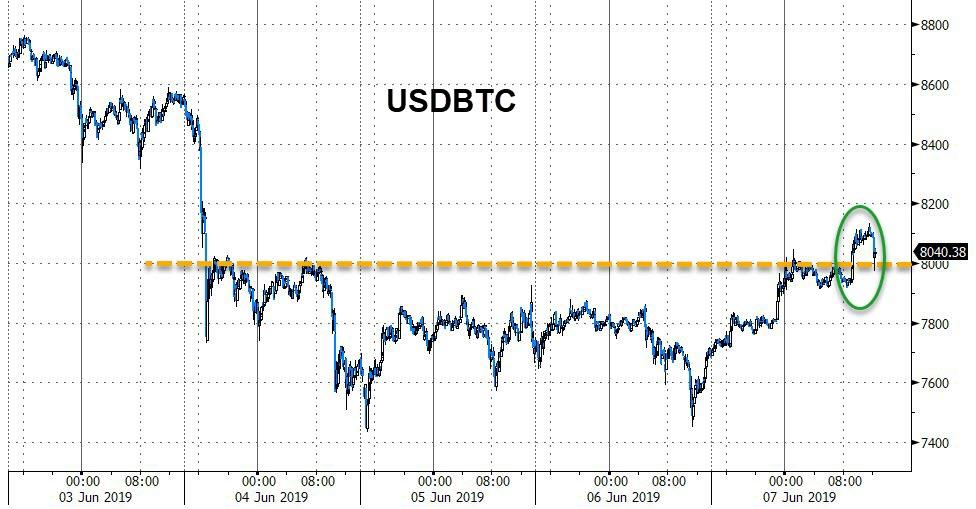

Bitcoin back above $8k today…

PMs led the week (as the dollar tumbled), oil bounced today back into the green for the week, but copper dipped…

Dr.Copper is down 8 weeks in a row (the most since Oct 2016 – after Brexit)…

What is that saying about the economy?

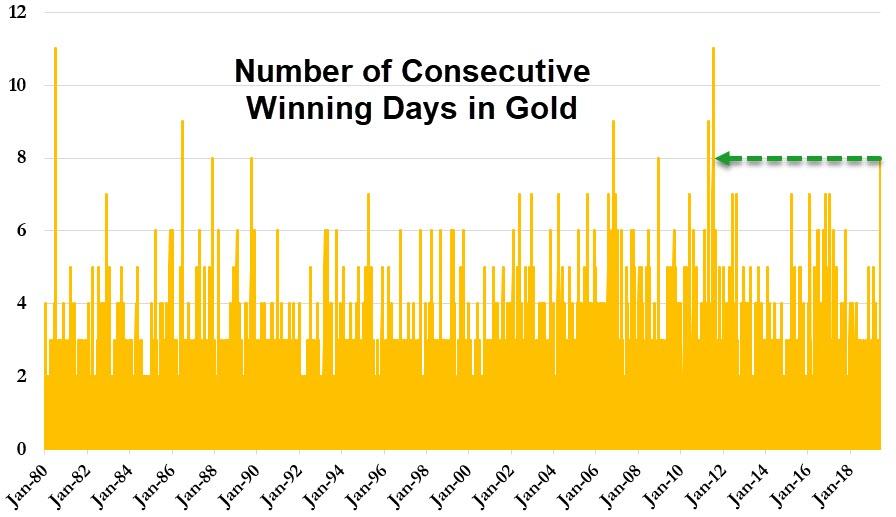

Gold had its best week since April 2016 and is up 8 days in a row…topping the Maginot Line of $1350…

$1350 has been a line in the sand for gold for a few years…

This is the longest win streak for gold since 2011

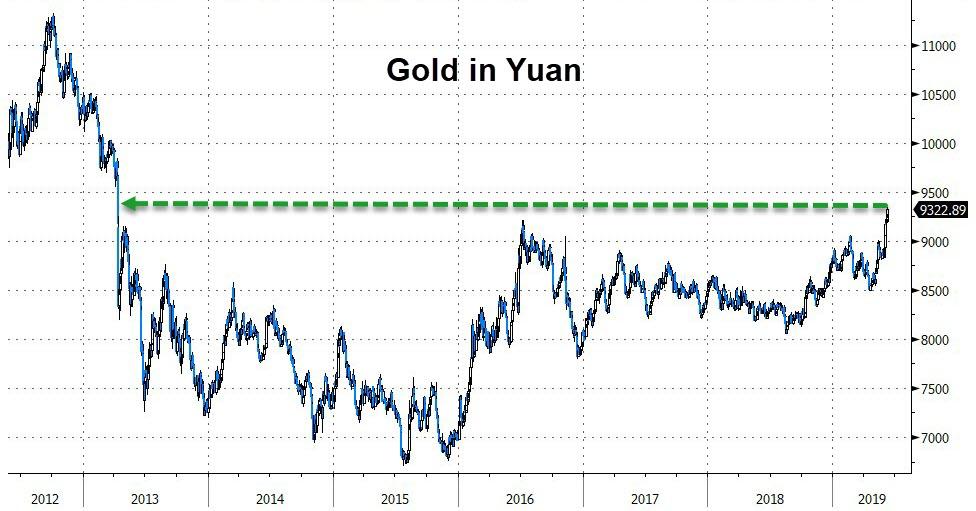

Gold in Yuan surged on the week to its highest since April 2013…

So, Finally, what drove this week’s almost unprecedented surge in stocks?

Simple – Trump launching Mexican, Indian trade war; US labor market cracking; US GDP slowing; German manufacturing collapsing; S. Korean export drop needs a bigger chart; Global PMIs plunging; bond yields crashing…

And 13 Fed Speakers all singing dovishly from the same plunge-protecting hymn-sheet.

Bad news is good news once again…

Global economic surprise data has now been negative since April 2018 – the longest period on record.

* * *

Bonus Chart: Trading at 27x forward Sales, Beyond Meat sums up the entire market…

It’s fake!

via ZeroHedge News http://bit.ly/2KB39FE Tyler Durden