MCAM International of Charlottesville has devised a new exchange-traded fund that allows investors to protect their monies from an escalating trade war, reported Financial Times.

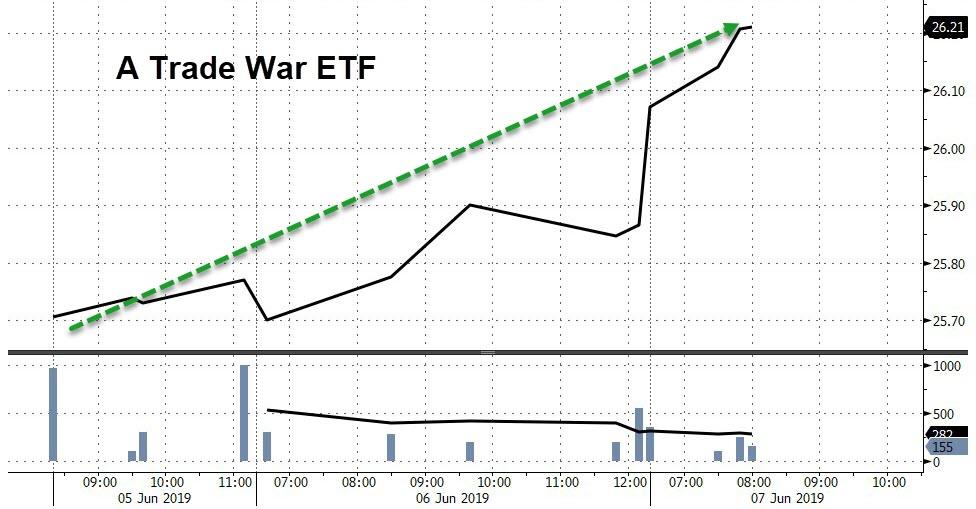

MCAM launched the new exchange-traded fund on Wednesday under the symbol “TWAR.” The new product tracks an index of 120 large and mid-cap companies that are expected to outpreform during a full-blown trade war due to their government contracts.

“There is reason to think that [these companies] will benefit from . . . government protection of some sort,” said David Martin, founder and chief executive of MCAM. “It would be a gross misrepresentation to say they will be insulated, but the expectation is that they will suffer less.”

TWAR also tracks companies that have strong intellectual property portfolios like contracts and licenses.

Martin says companies that have government support are the best defensive plays amid deepening trade tensions.

Top holdings of the fund include General Electric, Cisco, IBM, Edwards Lifesciences, Xerox, AMD, Micron, Dover, Mastercard, and Amazon.

The Times notes that there are 7,774 ETFs and other exchange-traded products in the world. So it might be difficult for TWAR to gain a footing in the exchange-traded products space.

Martin said, in the event of a full-blown trade war, TWAR’s performance should do well.

Not everyone is convinced. One ETF industry expert told the times that he is “a little skeptical given everything that is going on,” adding, “I don’t know how a company that has patents or business with the government will necessarily benefit. It is very difficult to know what president Trump will actually do in the end.”

“It’s extremely difficult to break through the clutter in the ETF space and I do not think this is the way to do it,” said Dave Nadig, managing director at ETF.com.

“I am skeptical.”

And the best way to protect investments during a trade war, as we found out from billionaire Stan Druckenmiller earlier this week, is to sell stocks and pile into treasuries.

via ZeroHedge News http://bit.ly/2wJameA Tyler Durden