Last Friday, when discussing the potential consequences of what would happen if the Fed cuts rates, and why BofA believes that such an act would represent a huge risk to the market and economy, is that following the May slump, the foundations for the S&P rising to 3,000 in the summer – which is BofA’s base case – are already there. Which is why, the risk is that the Fed does precisely what the market now expects with certainty, that it cuts rates as soon as July.

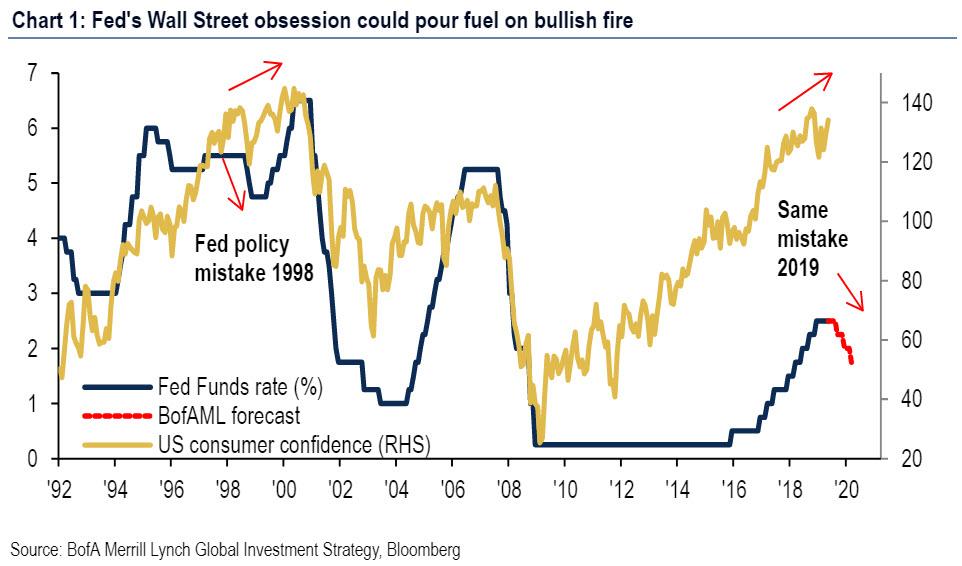

This is shown in the chart below, when in the aftermath of the Asian crisis of 1998, the Fed cut rates only to cause the dot com bubble… and its subsequent bursting and the plunge in rates from 6%+ to just 1% as the first 21st century bubble popped.

It is this risk that, according to BofA, threatens markets now as well: an overly easy Fed cutting rates, only to create a historic meltup just ahead of the 2020 election, and eventually bursting the biggest asset bubble in history. There’s more: the Fed could cut and join the ECB and BOJ among those central banks that are losing credibility, as a result of it “patiently” flipping from hikes to cuts “with no material change in macro.”

* * *

Today, in his latest weekly note, One River Asset Management CIO, Eric Peters – in his traditionally whimsical voice – picks up where BofA’s assessment left off, and reaches a virtually identical conclusion: “the Fed’s going to cut rates when it shouldn’t” which will be “the start of the dollar collapse” and “the start of inflation — that’s what gold and emerging markets are trying to tell us.”

And then it gets worse: “This bubble’s gonna be a big one, not a long one, but a big one…real big,” Peters writes (as usual, in the third person), and concludes “Then the Fed will go one step too far, spreads will blow out, and POP!”

All this, and more in the selected excerpt from Peters’ latest letter blow:

“The bubble is beginning,” bellowed Biggie Too, chief global strategist for one of Wall Street’s Too-Big-To-Fail affairs. “The Fed’s going to cut rates when it shouldn’t,” he barked. Global Trade War thumped in Biggie’s headphones. The beat rhymed with that 1998 tune, Long Term Capital.

“This is the start of the dollar collapse,” said Too. “This is the start of inflation — that’s what gold and emerging markets are trying to tell us.” Biggie closed his eyes and saw flashes of this week’s historic inflows into government bond funds, investors rushing to hedge their stocks just as they exploded higher.

“This bubble’s gonna be a big one, not a long one, but a big one…real big,” hummed Too. “Then the Fed will go one step too far, spreads will blow out, and POP!”

And since besides the Fed, there are only two other relevant topics in the world of finance these days, here are Peters’ latest observations on China…

Negotiators

“To negotiate successfully with foreign states you need to look at things from their perspective,” said the former ambassador and national security council member. “So when negotiating with China over North Korea – where we denied Pyongyang 90% of aid and 30% of oil – we tried to look at it through China’s eyes. They don’t want a Korean war, a flood of refugees,” she said. “So you take that negotiation approach. And if all else fails, I’d could always say: Okay…but you never know what President Trump will do. You just never know.”

“China is our #1 long term threat,” continued the same former national security council member. “They’re building their military. They’re investing around the world and smothering nations in debt, so that they can put in a military installation, or take control of their ports. We helped China get into the WTO. They’ve done nothing but cheat ever since. They’re stealing IP and we’re letting them. The #1 point that stopped the trade talks was IP theft. China was unwilling to be held accountable on IP theft. And that’s one issue we have to get.”

… and Trump:

Politicos

“There are so few restraints around Donald Trump,” said the politico, his decades-long career spent in DC. “You might love him you might hate him, but in terms of talent around him and people who have juice, who will tell him not to do what he wants to do, it’s a different world than it was 18mths ago,” he added. “There’s no Mattis, there’s no McMaster, there’s no Gary Cohen – all those forces of restraint. They’re not just gone, they’ve been replaced by design by people who are much more about letting Trump be Trump. Just look at Mulvaney.”

“As Chief of Staff, Mulvaney is now there to let Trump be Trump, let him say what he wants to say, then build a policy and message around it,” continued the politico. “No one left is going to try and control him or control the information flow to him. And that can work fine in a non-crisis situation. But every presidency is defined by the unexpected.” Sept 11th, Katrina, a cyber-attack. “By some crisis we can’t predict. It’s then that you want the right people in the right seats to help make the right decision. But they can no longer get the best talent.”

“You don’t have a normal planning process in this administration,” added the politico. “They entered office without a plan. They’re in constant survival mode. The White House is simply a reaction to his impulse, instinct and mood,” he said. “Trump moves then things move around him. That’s the opposite of any other White House in memory.” Administration’s typically think themselves into slowness. “Trump threatens tariffs on Mexico, then the White House moves around it to explain it, try to give it coherence, then create policy.”

Some parting thoughts:

China published a government white paper June 2nd titled: China’s Position on the China-U.S. Economic and Trade Consultations. Their Vice Minister of Commerce held a press conference to discuss the matter. The paper’s position will make it hard for Beijing to stand down on a variety of issues that the US insists are vital.

The white paper was 5,000 words. Here are the 250 that most matter: It is only natural for China and the US, the world’s two largest economies and trading nations, to experience some differences over trade and economic cooperation. What truly matters is how to enhance mutual trust, promote cooperation and manage differences. Historical records confirm that China’s scientific achievements and technological innovation are not things we stole or forcibly took from others; they were earned through self-reliance and hard work. Accusing China of stealing intellectual property to support its own development is an unfounded fabrication. Accusations of forced technology transfer are baseless and untenable. Every country has its own matters of principle. On major issues of principle, China will not back down. During consultations, a country’s sovereignty and dignity must be respected, and any agreement reached by the two sides must be based on equality and mutual benefit. Both China and the US should see and recognize their countries’ differences in national development and respect each other’s development path and basic institutions. China strongly opposes the recent US move to increase tariffs and must respond to safeguard its lawful rights and interests. China has been consistent and clear on its position that it hopes to resolve issues through dialogue rather than tariff measures. China will act rationally in the interests of the Chinese people, the American people, and all other peoples around the world. However, China will not bow under pressure and will rise to any challenge coming its way. China is open to negotiation but will also fight to the end if needed.

via ZeroHedge News http://bit.ly/2XwlvuS Tyler Durden