Albert Edwards, who is traditionally seen on Wall Street as a permabear, has been having one heck of a year.

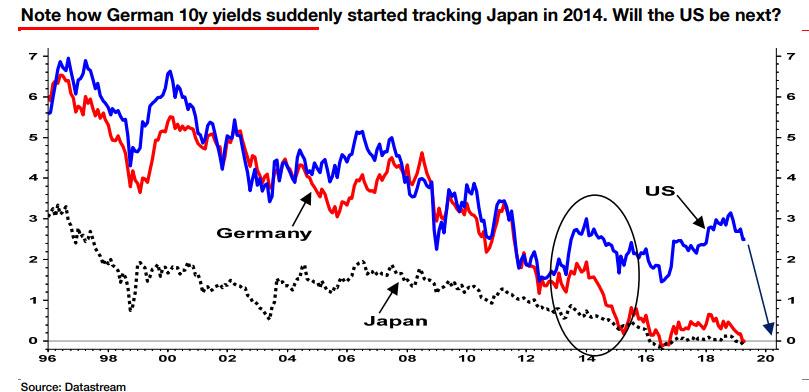

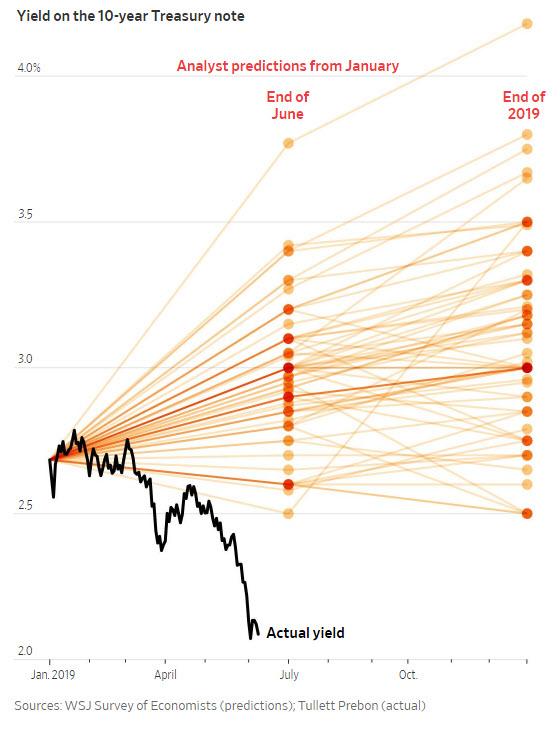

While the financial media peanut gallery takes exorbitant joy of mocking Edwards’ gloomy predictions, which it tends to equate with forecasts of crashing equities even if Edwards doesn’t actually make equity trade recos, the truth is that Edwards was alone against consensus, predicting months earlier that US bond yields could tumble, chasing both Germany and Japan into sub-zero territory.

And as the deflationary “Ice Age” unexpectedly re-emerged in May with a bang, Edwards was right and everyone else was dead wrong.

This is how Edwards recapped his take on the recent – and future – moves in bond yields:

A key part of the Ice Age has been the prediction that US and European 10y government bond yields would fall to levels never previously seen – replicating Japan’s experience. We were told that this would never happen in the west because policymakers would not make the same mistakes Japan made! But with European yields plunging to new negative lows and the US yield curve giddy with inversion, the sceptics are now seriously contemplating the brave new world in which US 10y bond yields fall below zero.

So in addition to taking a well-deserved victory lap in being the sole strategist to get the move in yields correctly, Edwards instead doubles down, and predicts that it is about to get a lot worse as “there is an earthquake happening in government bonds.” What’s behind this ongoing tremor? Why central banks, as usual. To wit:

One thing that amazes me about the current cohort of global central bankers is the lack of insight into the fact that their extreme loose monetary policy and financial repression may actually be making deflation in the real economy worse despite clearly succeeding in creating rampant inflation in financial assets. To be sure some of the major players in the central banking orbit, such as ex-Fed Governor Kevin Warsh, have broken out of the QE group-think that grips the minds of central bankers. Warsh has openly stated that financial repression has exacerbated, rather than cured, our economic ills.

To be sure, the thesis that the Fed is stimulating asset (hyper)inflation while depressing the broader economy and crushing the middle class, is hardly new: we have been preaching just this since 2009, and we are glad that this perspective is finally starting to attract more followers. In fact, none other than the world’s largest bond manager recently predicted that the Fed is on the verge of losing control over the markets (for those confused, that’s the “game over” phase for the 10 year bull market). Which is why we can commiserate with Edwards, who writes that “the foundering of the current economic cycle and the imminence of its likely end has rammed home to investors the clear failure of financial repression to generate anything other than the most feeble of economic recoveries and no sustainable cyclical upturn in economy-wide inflation – either in wages or in prices.“

Of course, another thing we have spent much of the past decade is comparing the Fed to the USSR’s centrally planned regime and “five-year plans”, and that’s what Edwards also touches on today, noting that the Fed’s failure to stimulate the economy, “has nurtured the current trend towards even looser monetary policy via the increasing influence of the Modern Monetary Theorists“, i.e., helicopter money socialists who promise everything, but can only guarantee currency destruction and hyperinflation.

Edwards also mentions a breath of potential fresh air amid the Fed’s ranks in the face of the likely new Fed nominee, Judy Shelton, who “compares the Fed interest rate setting with the USSRs Gosplan”, something we have done for years. We can assure readers that anyone who is willing to call out the Fed and tell the truth about the dogma behind its actions, will never be admitted on the actual Fed, so there little point in discussing Shelton’s fate: she will never make it through the nomination process.

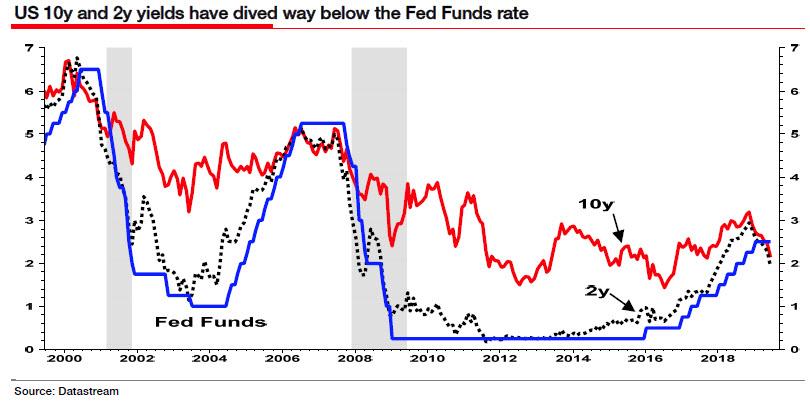

That, however, doesn’t mean that one can just stick their head in the sand and pray that the US economy is doing well. It isn’t. In fat, as Edwards notes, “the rumblings of the US bond market have now turned into an ear-piercing scream that a recession is close and the Fed needs to start cutting rates quickly” (even if, in an ironic twist, the futures market is already pricing in the next rate hike cycle after the fed cuts rates 3-4 times between now and the end of 2020).

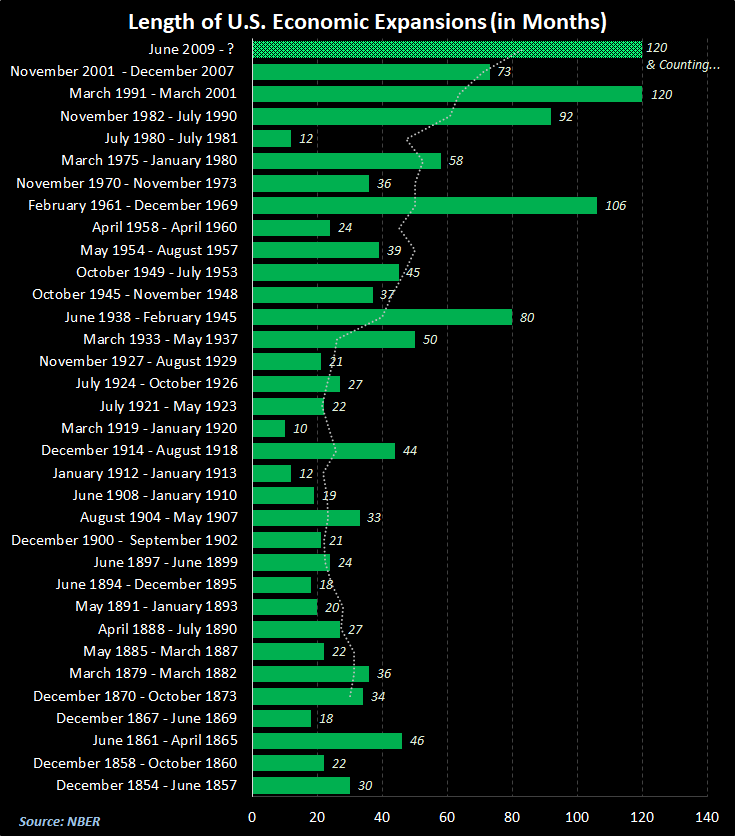

Worse, a recession may not only be close, it may in fact be in the readview mirror; This is notable because with the US economy on the edge of the longest expansion on record – recall that in July, this will become the longest U.S. economic expansion on record at 121 months. (charted below is the length of past expansions 1854-today)…

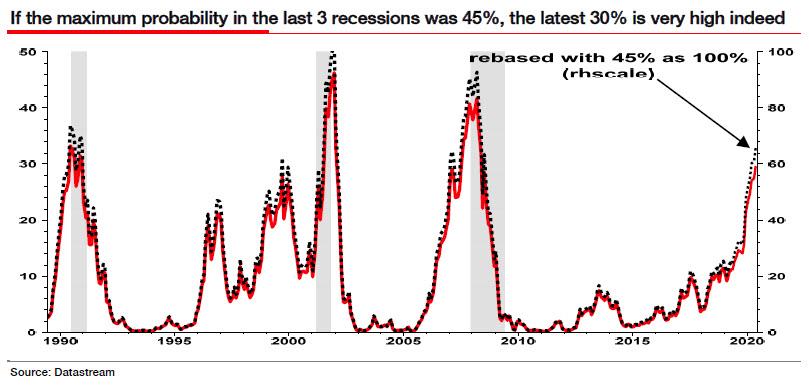

… Edwards quotes fellow market skecptic, David Rosenberg, who has reviewed the NBER website for the criteria they use for dating the start of a recession and he thinks that the recession likely started in Q1. He notes the latest probability from the NY Fed model has reached 30% but as the NY Fed model only reached a high of 42% during the 2008 recession the deepest since the Great Depression , and if one rescales the probabilities, the current probability of recession is above 65%.

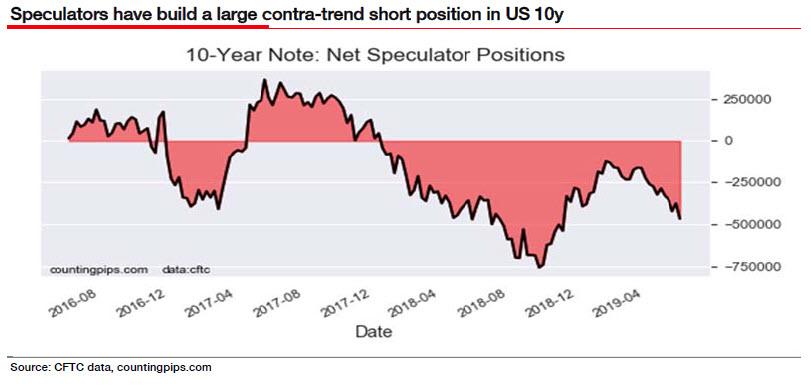

So going back to the chart above, when will US 10Y yields also succumb to the ongoing quake and tumble toward zero at first, and then, below it? That, to Edwards, “will involve a bull steepening as both 10y and 2y yields decline further, accompanied by cuts in the Fed Funds rate.” In practical terms, a key impetus that will drive 10y TSY yields still lower in the near term is the rebuilding over the last few weeks of a large speculative short position in 10y bonds: “This bet on rising yields risks a rapid unwind.”

via ZeroHedge News http://bit.ly/2wUDz68 Tyler Durden