After disappointing (lower than expected) prints in CPI and PPI, inflationista’s last best hope is with import and export prices (which, however, are both expected to slow today).

But that hope was just dashed as Import prices plunged 1.5% YoY (vs -1.2% exp) and Export prices dropped 0.7% YoY.

On a MoM basis, import prices fell 0.3% (headline and ex-petroleum), and import prices dropped 0.2% MoM.

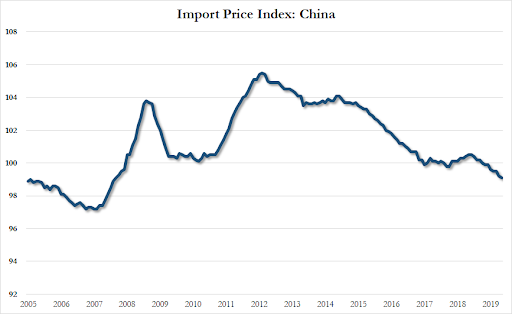

Every sub-index below both import and export prices declined in May as China exported the most deflation since September 2007…

Finally, as a reminder, this data does not include Trump’s new tariffs, but is potentially significantly impacted by the strength of the dollar.

Notably, agricultural export prices fell 5.3% YoY, largest year-over-year drop since April 2016, led by 20.6% YoY decrease in soybean prices. So tariffs are deflationary?

via ZeroHedge News http://bit.ly/2wUflJa Tyler Durden