Heading into today’s session, the mood had already soured on chip names after Broadcom’s dismal guidance cut, which slammed tech names in Asia and Europe, and which pressured the Semiconductor sector lower all day, and also prevented the Nasdaq from turning green all day.

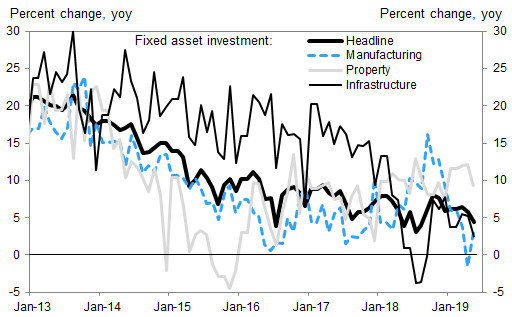

The latest econ data from China did not help, with Industrial Production missing the lowest estimate, and printing at a 17 year low in the latest confirmation that Beijing’s attempt to reflate the local economy is failing, even as retail sales staged a modest rebound from last month’s disastrous print.

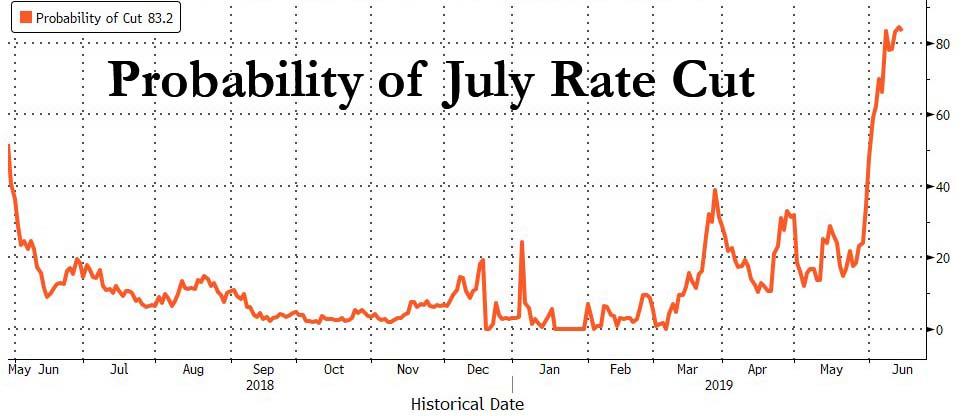

However, while traders were absolutely certain that next week the Fed had no choice but to telegraph a rate cut cycle was imminent, that conviction was dented a bit when the US reported strong retail sales and, more importantly, solid upward revisions to last month’s data…

… although even so, the odds of a July rate cut barely shifted, remaining solidly above 80%.

As such, with no new information about either next week’s Fed cut, or the outcome of the critical G-20 meeting where the fate of the US trade war may be decided (but won’t be) the market meandered, and went nowhere, with Construction and Banks outperforming, while Tech, Energy, and the Russell all underperformed.

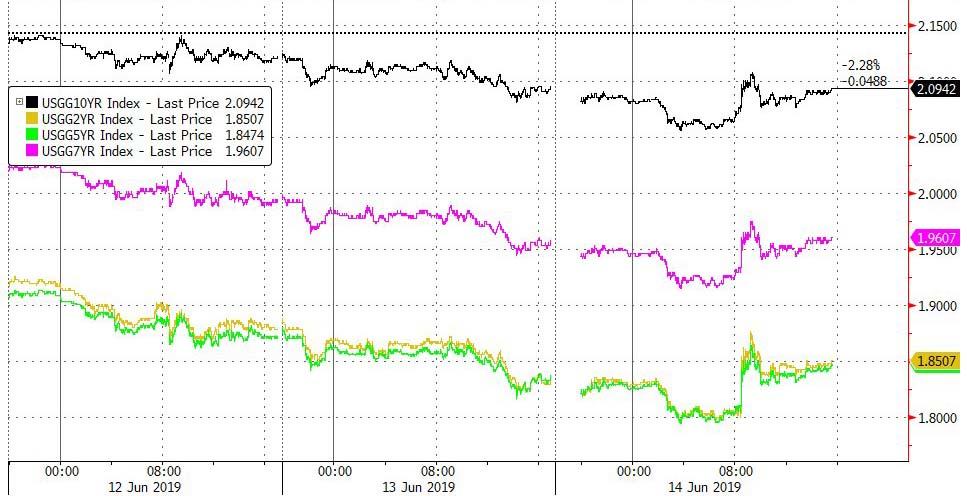

Meanwhile as stocks drifted, so did Tsy yields, with the 10Y yielding 2.09%, after sliding below 2.06% earlier in the session, before rebounding to unchanged, even as the recent trend is clearly lower, and a 1 handle is distinctly possible next week if the Fed does in fact surprise dovishly.

Things were more dramatic in Europe, where the 10Y Bund hit a new negative record of -0.27%…

… as European 5Y5Y inflation swaps also hit a new all time low as central bank credibility is rapidly evaporating.

Worse, as BofA showed earlier, the yield on all global debt ex the US is now at an all time record low as deflation is once again becoming the norm, while the amount of negative yielding debt is back to all time highs.

Well, deflation for everyone but the US perhaps, because in FX, the dollar once again reigned supreme, with the yen, euro and cable all sliding, while the DXY – having rebounded perfectly off the 200DMA – was rising toward its next big resistance level around 98, while the BBDXY emerged back over 1200 offsetting much of the market’s recent fears of a Fed rate cut. It does beg the question: what if anything can bring the dollar lower?

Perhaps the most interesting asset of the day was gold, which increasingly more investing legends are backing into what will be the Fed’s next easing cycle, and which after briefly attempting to breakout above a 2 year resistance, was smacked down, sliding $20 from intraday highs, suggesting that another attempt at a breakout will have to be attempted again next week.

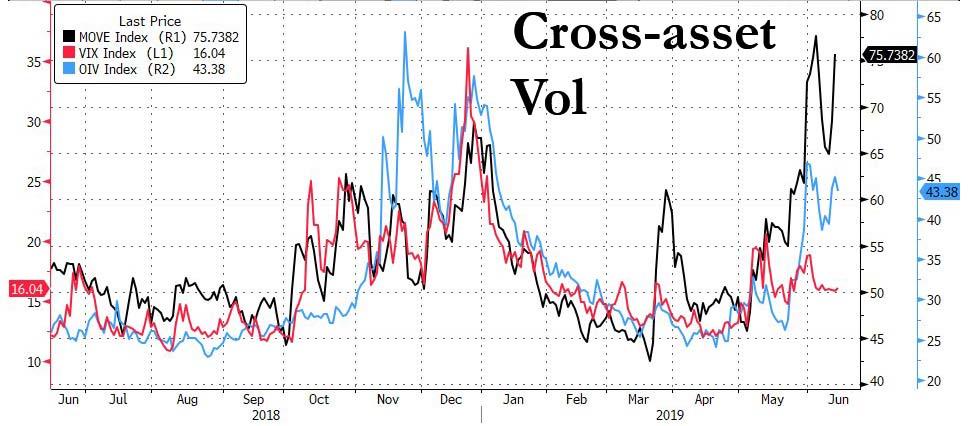

And so, as we enter the most important week of the year, equity traders remain surprisingly calm, even as rate vol continues to soar and commodity volatility is not too far behind.

Still, as we noted earlier, next week could result in turmoil in rates vol, where one or more dealers is said to be nursing a major, $100MM+ loss, and should the Fed turn even more dovish, said turmoil could well and finally migrate to the equity space as well.

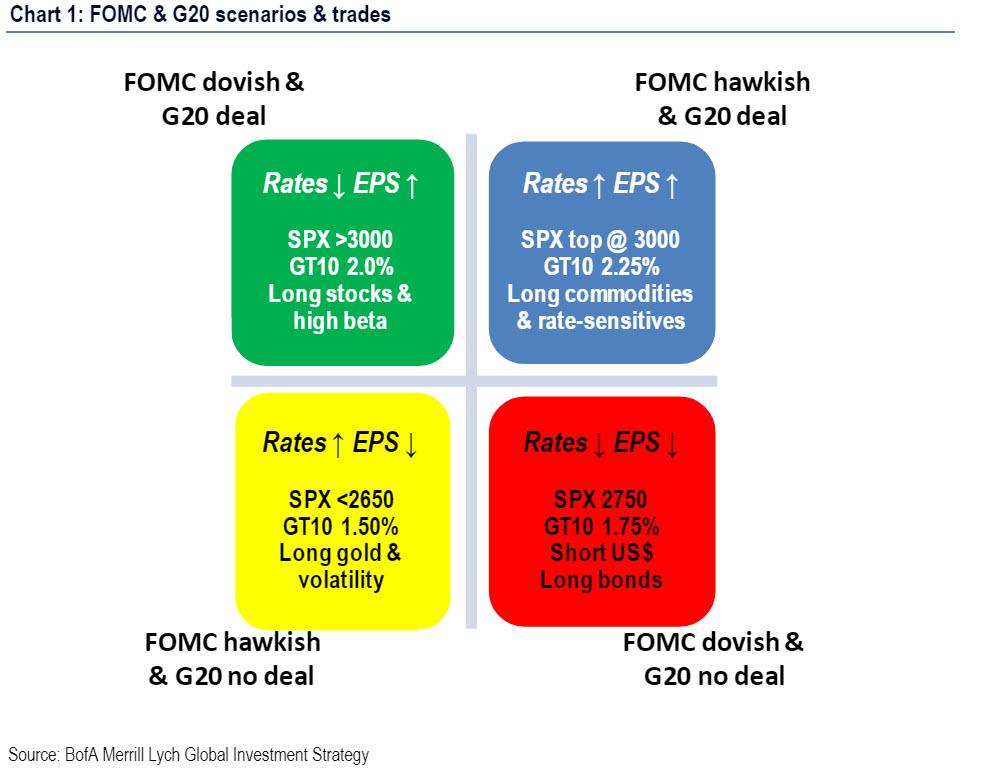

And after what was a largely wasted day, we look toward next week’s fireworks, where BofA laid out a matrix of what to expect between the two key events: the G-20 meeting and the FOMC, and where the range of outcomes could send the S&P from below 2,650 to above 3,000.

In short, brace for a violent return in volatility.

via ZeroHedge News http://bit.ly/2Zth9Fh Tyler Durden