Via Political Calculations blog,

Warren Buffett is a legendary investor, one of the few who has consistent beaten the odds by beating the S&P 500, which has earned him the nickname “The Oracle of Omaha”.

Buffett has attained that status by investing the resources of his company, Berkshire Hathaway in other companies, either buying their shares, as in the case of companies like Coca-Cola and JPMorgan Chase, or buying entire private companies, including household names such as See’s Candy and Geico.

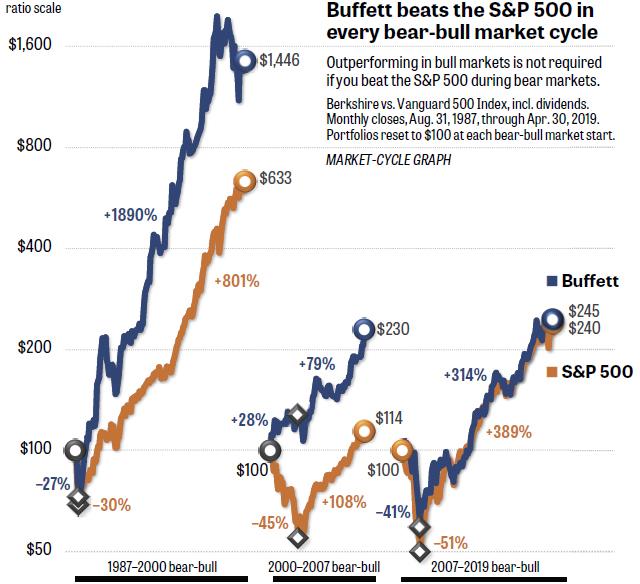

If you go back over 30 years, you can see that the cumulative value of Buffett’s investments, as measured by Berkshire Hathaway’s stock, has outperformed the S&P 500. Brian Livingston did just that, going back to 1987, in the following chart, which compares the total return of BRK.A against the total return of the S&P 500:

From 31 August 1987 through 30 April 2019, BRK.A has had an average annualized total return of 14.9%, while the S&P 500 has returned 9.4%.

Livingston then did something in his analysis we don’t see very often. He broke up Buffett’s investment performance history into three major periods of interest, discovering something a lot of people miss about Buffett’s track record as an investor. Most of his outperformance with respect to the S&P 500 came early in this period, where his ability to pick winning investments has declined over time, which you can see in Livingston’s second chart:

Livingston makes the point in the chart that Warren Buffett bested the S&P 500 in each of these periods, but the thing that stands out to us is that the margin between the two has narrowed as the years have passed. To the point to where from 2007 to the present, Buffett’s investing prowess has been consistent with the S&P 500’s return, where whether he is beating the index depends almost wholly on random chance for how BRK.A stock compares with the S&P 500 on a given day.

It’s no wonder then why the aging billionaire is leaving instructions for his estate to invest in the S&P 500 for the benefit of his survivors after he passes away:

The Oracle of Omaha even said he’s instructed the trustee in charge of his estate to invest 90 percent of his money into the S&P 500 for his wife after he dies, Buffett told CNBC’s Becky Quick in an exclusive interview on “Squawk Box” on Monday.

“There’s been no better bet than America,” he says.

Performing as well as the S&P 500 is so difficult that the index outperforms most active money managers. As diversified investments go over long time horizons, the S&P 500 is very hard to beat.

via ZeroHedge News http://bit.ly/2KjwvZC Tyler Durden