After a decade of misery and a string of taxi driver suicides, New York City is finally taking action to assist cab drivers who have seen their net worth and livelihoods decimated by ridesharing services.

On Wednesday, Corey Johnson, the speaker of the City Council, unveiled a package of bills preventing the medallion crisis from happening again, according to the New York Times. Johnson said: “It’s clear that we need to take legislative action to protect medallion owners and drivers from predatory actors, including lenders, medallion brokers and fleet managers.”

Mayor Bill de Blasio also announced a separate set of initiatives, including eliminating as much as $10 million in fees to taxi medallion owners and allowing drivers to obtain financial counseling. The mayor also said he would extend the city moratorium on approving additional vehicles from ride hailing services like Uber and Lyft for another year. The city is also set to impose limits on how long these cars can linger in Manhattan without passengers.

The efforts represent the city’s first steps to address a crisis that has already led to financial ruin – and sometimes suicide – for many cab drivers. But the plan doesn’t do much to rescue those who are already saddled with debt after purchasing a medallion. Bhairavi Desai, the leader of the Taxi Workers Alliance said: “We need to do much more. There’s a recognition that it will take some time to get there. But that process needs to begin immediately.”

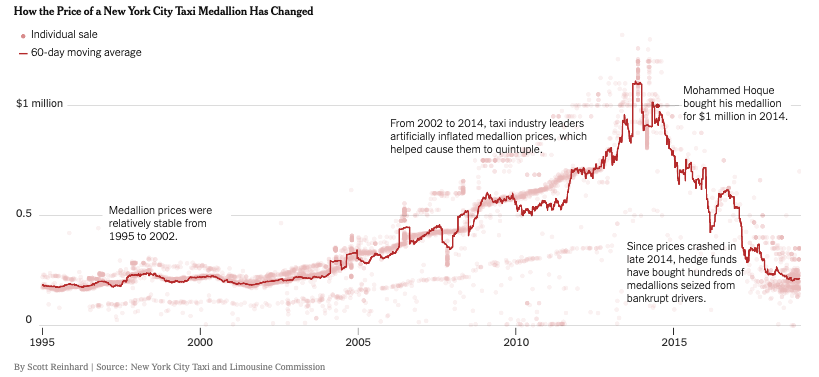

The announcements came as a result of a New York Times investigation that revealed that taxi industry leaders had created a financial bubble in the medallion market. Not unlike the housing market bubble, industry leaders helped artificially inflate medallion prices to $1 million in 2014 from $200,000 in 2002 and made hundreds of millions of dollars by channeling purchasers into loans that many couldn’t afford.

Now, with the collapse of the industry, those loans have put immense pressure on many cab drivers. Some who sold taxi medallions years ago were calling them “better than the stock market”. And after the bubble burst, the government was nowhere to be seen. More than 950 cab drivers filed for bankruptcy and thousands more have struggled to survive.

The city Taxi and Limousine Commission declined to comment on the plan and agency officials have previously said that they did not have the power to regulate lending practices prior to the industry being disrupted by ridesharing services.

Lenders also denied wrongdoing – big surprise – saying that their practices had been approved by lenders. Meanwhile, Uber is doubling down and criticizing the mayor’s proposal to extend the moratorium. A spokeswoman for Uber, Alix Anfang said: “The mayor’s cap will create another medallion system, the same kind that bankrupted drivers and enriched lenders.”

Uber also sued the city in February, a case which is still pending. The day after a New York Times investigation appeared, New York attorney general Letitia James opened an inquiry into lending practices and the mayor ordered an investigation of medallion brokers. Both reviews are still ongoing.

The legislation is being spearheaded by Mr. Johnson, the speaker, as well as Councilman Ritchie Torres of the Bronx, who leads the Council’s oversight and investigations committee. A joint hearing will be held with the council transportation committee on June 24.

Torres said: “I look forward to questioning the Taxi and Limousine Commission about its role in the crisis. Not only did it fail to protect medallion owners from predatory forces, it was one of the predatory forces. There’s a sense in which the T.L.C. was a speculator masquerading as a regulator.”

One of the additional measures before the council requires TLC officials to scrutinize the financial resources of medallion buyers and block sales that may involve unaffordable loans. The city may also seek to ban the use of so-called “confessions of judgment” in Medallion loans. Many drivers had signed those documents, “in which borrowers admit defaulting on a loan and authorize a bank to do whatever it wants to collect.”

City legislation would also direct the TLC to create yet another government agency: an “Office of Financial Stability to monitor the health of the industry, collect disclosures from medallion owners and assess the integrity of medallion brokers and fleet owners.”

Several members of the council said they support the legislation but want the city to find a way to bail out the owners that are already in debt. Proponents are hopeful that the bills pass before the end of next week.

“Well, we have to give everything we’ve got for the next two weeks,” said Assemblywoman Yuh-Line Niou of Manhattan.

via ZeroHedge News http://bit.ly/2WETNeh Tyler Durden