As the boom in mortgage applications and refinancing activity last week would suggest, the return of interest rates toward multi-year lows this year is helping to pump more froth into the already bubblicious American housing market.

But while somebody will inevitably be left holding the bag when the bubble bursts, for now, at least, the inexorable rise in American home prices has bequeathed an outsize benefit on at least one group of people: American homeowners who were stuck with underwater mortgages following the last housing bust.

However, even with average national home values back above their pre-crisis highs, CoreLogic’s most recently quarterly survey of national homeowner equity found that there are still 2.2 million homes underwater in the US – a sign of just how bad the last bubble was, and a warning for where we might be headed.

The percentage of homes with underwater mortgages in the US has shrunk between Q4 2018 and Q1 2019 by a full percentage point to just 4% of all mortgaged properties (or just 2.2 million homes). On a YoY basis, negative equity fell 11% from 2.5 million homes, or 4.7% of all mortgaged properties.

However, in terms of national aggregate value, negative equity climbed slightly to approximately $304.4 billion at the end of the first quarter of 2019, an increase of $2.5 billion, from $301.9 billion in the fourth quarter of 2018.

To be sure, this represents a massive shift from the final quarter of 2009, when negative equity peaked at 26% of all mortgaged residential properties.

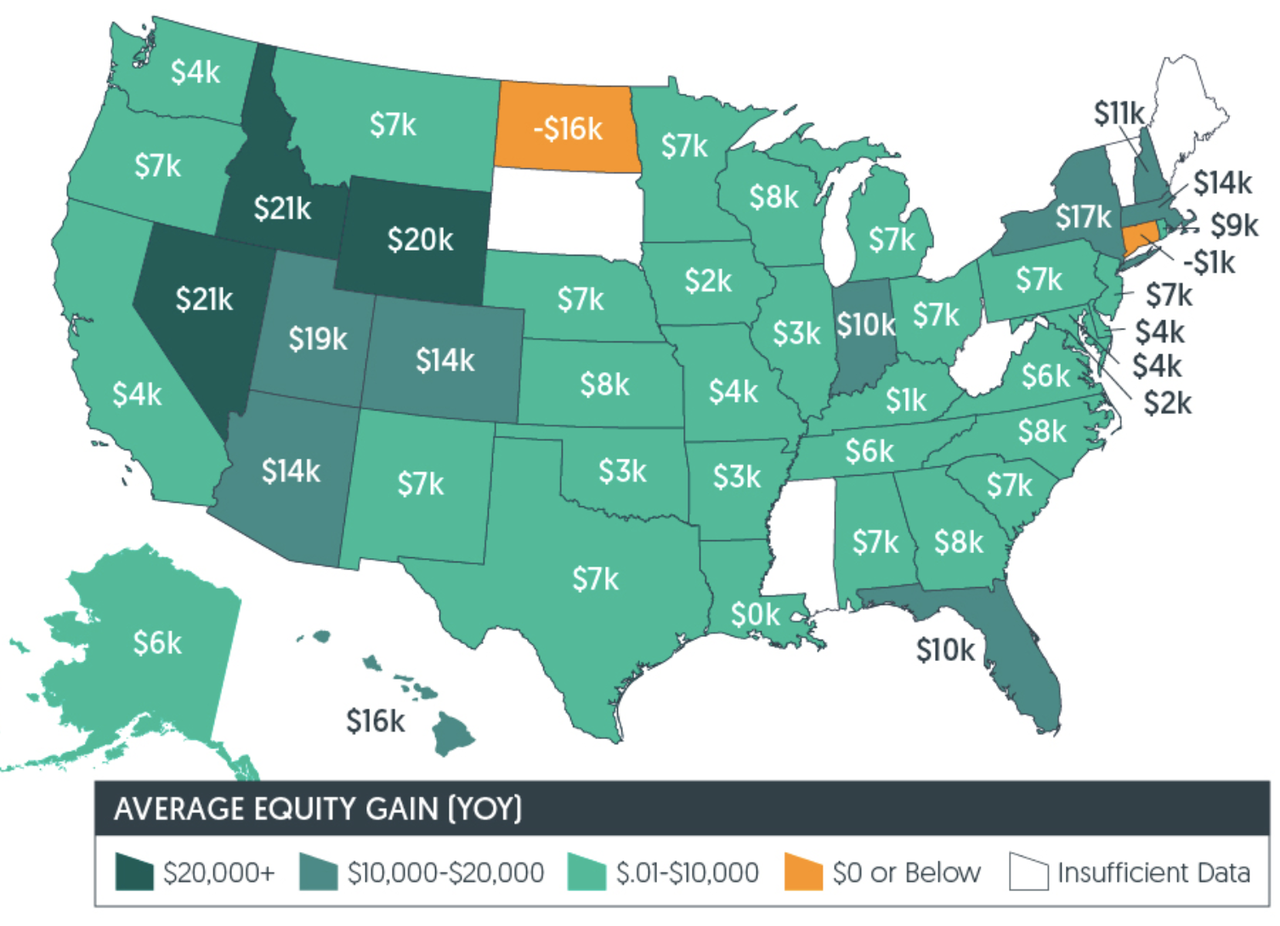

The national aggregate value of negative equity was approximately $304.4 billion at the end of the first quarter of 2019. This is up QoQ by approximately $2.5 billion, from $301.9 billion in the fourth quarter of 2018. Over the full year, the average homeowner gained approximately $6,400 in equity. Nevada homeowners saw the highest increase, with an average of $21,000 (likely thanks to that flood of California refugees fleeing to Sun Belt states for more affordable lifestyles.

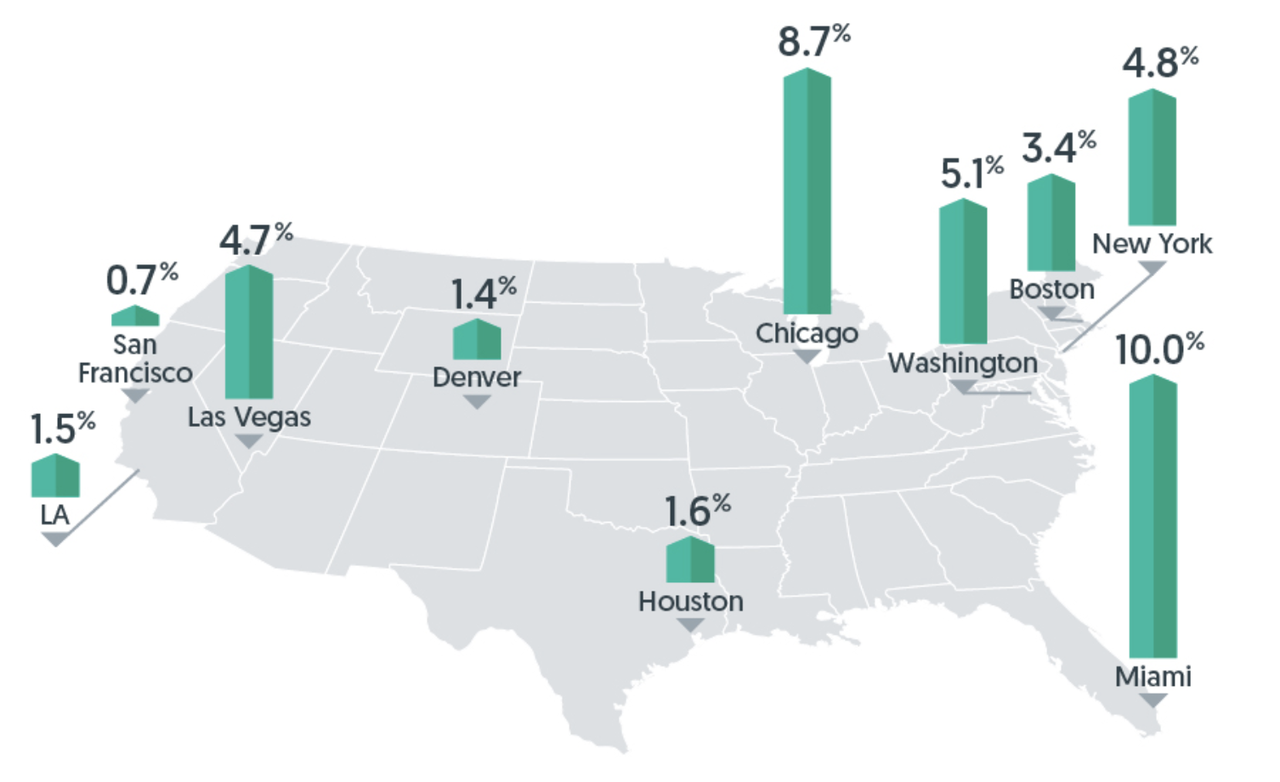

Some of the frothiest housing markets (think San Francisco and the rest of the Bay Area) are now the least burdened by negative equity. But it’s almost more surprising that even in San Francisco, still nearly a full 1% (0.7%) of mortgaged properties are underwater, though that is the lowest rate in the nation. The scars of the housing crisis are even more visible in some of the hardest hit markets, despite the torrid recovery: Las Vegas (4.7%), Chicago (8.7%) and Miami (10%) still have among the highest rates of underwater mortgages in the country.

Either way, with home prices at such unaffordable level, homeowners who suffered through the crisis might be thinking one of two things: Those who were underwater but have seen their equity miraculously right-sized might be so amazed by the turnaround in their fortunes, that they might soon start seeking buyers, hoping to get out ahead (and possibly downsize) before the whole thing comes crashing down again.

And those whose homes are still under might finally be ready to cut their losses, before another down turn drags them all the way back to square one.

via ZeroHedge News http://bit.ly/31EvvF5 Tyler Durden