When there was just over 24 hours left until the Fed’s much anticipated, perhaps historic Wednesday FOMC meeting, which has been called “Powell’s most important day”, as that’s when the Fed Chair may unveil his first easing cycle, Mario Draghi confirmed that “investors could still be shocked” when early on Tuesday he announced at Sitra that unless everything worked out, the ECB would soon find itself cutting rates again.

This “break back” by Draghi towards policy-easing and QE set-off a further escalation into what Nomura’s Charlie McElligott called the Global Bond/Duration rally which has then fed into Risk-Asset outperformance, which then got further wind when Trump tweeted that he and China’s Xi held a phone call, and the two would meet at next week’s G-20 summit in Osaka, even if China was quick to point out that the phone call – and thus meeting – was at Trump’s request.

This phone conversation between Xi and Trump was made at the request of US side. The two presidents agree to meet at G20 and they will discuss fundamental issues in China-US relations. Will the deadlock be broken? I feel Beijing has a cautious attitude. https://t.co/rT6WgHbhpe

— Hu Xijin 胡锡进 (@HuXijin_GT) June 18, 2019

So in what many saw was a “preemptive” jawboning by Draghi to frontrun the “preemptive” signal for a “preemptive” rate cut by Powell, following this morning’s said ECB escalation in which Draghi 1) communicated a sense of “urgency” on stimulus/cuts if the outlook does not improve; 2) said that more rate cuts are part of the toolkit; 3) stated QE still has considerable headroom (i.e. more asset purchases), the Nomura strategist there is a “growing-sense or even outright concern in the market that June Fed “cut” odds are in-fact too LOW as these “statements” to the market are often-times coordinated in nature.”

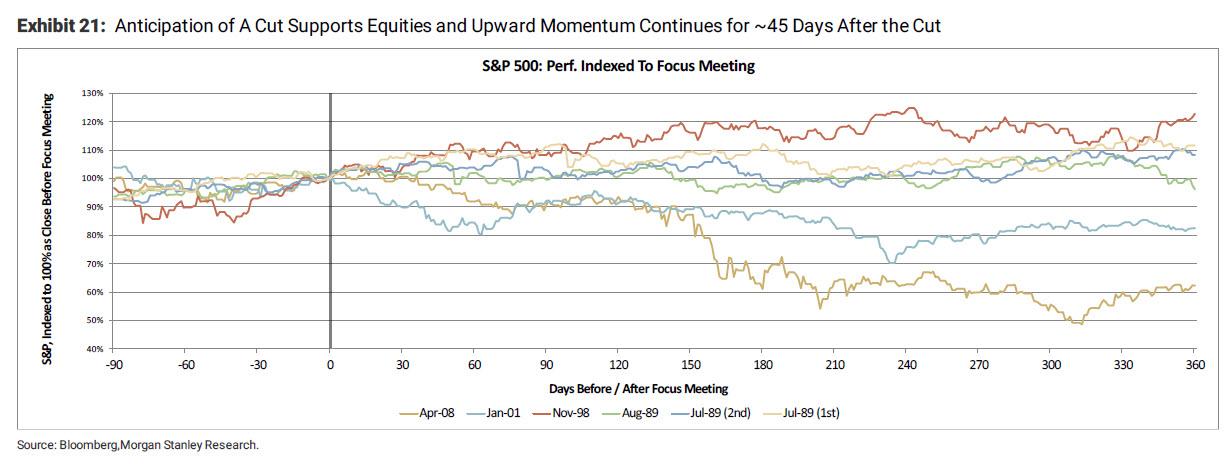

As a reminder, the market is pricing in a 20% chance of a rate cut tomorrow, and 82% for July, with another 2-3 rate cut by the end of 2020. Furthermore, as we discussed yesterday, any time the market has priced in a 50%+ probability of a rate cut the Fed has never disappointed.

Meanwhile, the ECB’s action has dramatic dovish consequences:

Bunds exploding higher (along with Equities, Credit and Gold “bid”) while the Euro is hammered, as the market prices in a 10bps ECB policy cut by Dec ’19 with many banks now calling for a cut by Sep meeting.

In what was perhaps the most important price move, EU 5y5y inflation swaps, which are +7bps currently (would be the third largest upside’ move since 2009) after having collapsed to all-time lows yesterday…

Still, as McElligott notes, “the Fed HAS TO be conscientious of the market-pricing such a powerful “dovish” outcome (boosted optically by the recent Dealer rate vol desk forced Gamma Grab” into the front-end), as any “disappointment risk” would see a de facto tightening of financial conditions and risk another “4Q18 tantrum” scenario.“

Yes, dear readers, it may now be the case that even thanks to Draghi’s bluster, the Fed’s threshold for what is not a hawkish surprise was just pushed out even further.

This has major implications for what will happen tomorrow at 2:01pm, even beyond what we discussed previously when we assumed the most dovish case where the Fed cuts preemptively in less than 24 hours.

As McElligott explains, with so much money into this trade already (with its high cost of carry and high +++PNL waiting to be monetized), said “disappointment risk” could drive profit-taking which could develop into something much uglier when considering the length in “Long Duration / Long Rates / Long USTs / Long Receivers & Curve Caps” trade, particularly across the Leveraged- and Target-Volatility- universe. Then again, that doesn’t appear to be the case today when the market, trading just shy of all time highs, is still euphoric from the fact that Trump just got a trade deal with China succeeded in getting Xi to meet him.

For what it’s worth, McElligott writes that he still believe that “dovish guidance via “lower dots” and the likely announcement of an earlier end to QT will be enough to assuage the market until July’s Fed meeting, as traders will rationalizing “looking-through” this June meeting (simply a delay of the inevitable), and further firm the belief in a July “big-bang” Fed cut expectation.

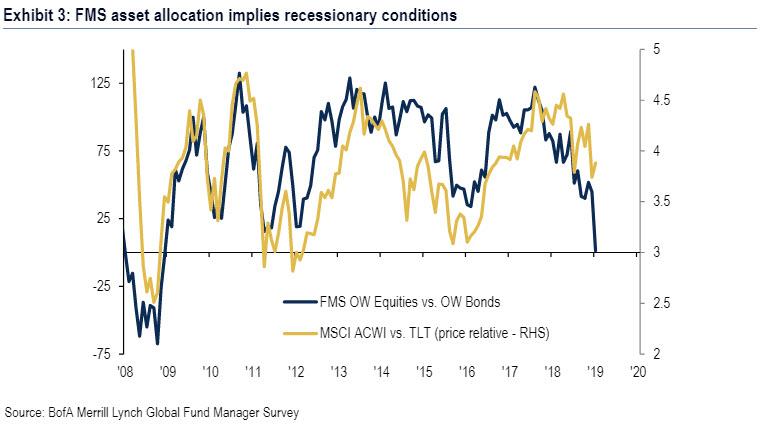

But in the meantime, what today’s cross-asset market response following Draghi’s surprise suggest is this: investors are positioned for “worst-case” outcomes in both Global Growth-, Global Inflation- and Trade / Tariffs-, which makes sense considering the mood in the latest BofA FMS Survey indicated that investors are the most bearish they have been since the financial crisis, implying that the US economy is in “recessionary conditions”… which of course is a paradox considering where the S&P500 is…

However, according to McElligott, “the risk is that there is considerable chance of AGAIN being caught ‘flat-footed’ by a heavy-handed Central Bank policy response,” who so far every time in 2019 have over-delivered vs market expectations, thus opening the potential for an Equities “right tail” being priced-back-into the collective imagination.

In other words, after Draghi’s shocking statement, nothing Powell says may be seen as dovish enough.

To summarize, we quote the Nomura strategist:

That as it currently stands, a market priced for “worst-case” outcomes in Global Growth-, Global Inflation- and Tariffs– (i.e. the largest MoM decline in the BAML FMS Global Growth Expectations survey’s history dating back to ’95) remains at risk of being caught flat-footed by heavy-handed Central Bank policy response—who continue to “over-deliver” versus even such extended market “dovish” expectations

As for the final question, what “worst-case” positioning looks like, here is the answer:

Total “buy-in” to the “Slow-flation” narrative, i.e. “Long Duration” in both Fixed-Income and Equities (Risk Barbell of Long Low Volatility and Secular Growth vs Short Value / Cyclicals—all to reduce exposure to the slowing global business cycle

Luckily we don’t have to wait long for the answer; tune in at exactly 2pm tomorrow to find out if Powell once again managed to “surprise” the market – if not so much Trump – with his dovish generosity, or if his luck has finally run out, largely thanks to his, and Trump’s new friend, “Mario D.”

via ZeroHedge News http://bit.ly/2ZG7zPR Tyler Durden