For months now the markets have been in denial that ECB President Mario Draghi has any answers to the Euro-zone’s problems. Today’s statement confirms what anyone with eyes to see has been saying.

There is no Plan B.

Draghi started the year saying he would end his various QE programs and by June he’s not only put them back on the table (New TLTRO in September) but has now opened up the possibility of taking rates lower.

Draghi told an ECB conference in Sintra, Portugal, that “further cuts in policy rates… remain part of our tools.” He added that there was “considerable headroom” to re-start bond purchases, which inject newly created money into the financial system in the hope of boosting lending and economic activity.

Draghi has been exposed as swimming naked, as Warren Buffet would put it.

The fun part is that Draghi used the cover of Trump’s trade war with everyone to justify a policy that was inevitable anyway.

In response, President Trump piled on accusing Draghi of being a currency manipulator. And then announced his upcoming meeting with Chinese Premier Xi Jinping to hammer out a trade deal.

But, as I’ve pointed out in the past, Trump doesn’t have a serious offer on the table for China.

Trump backed himself into a corner with China, essentially demanding it give the U.S. ultimate say over its fiscal, monetary and trade policy.

The Chinese aren’t going to agree to that any more than the Palestinians are going to agree to a Palestinian State in name only, administered like a Native American reservation by Israel.

Lebanon is not going to accede to Pompeo’s demands to remove Hezbollah from its government. North Korea isn’t going to give up its nukes so the U.S. will allow it to trade with dollars. Negotiations with Trump are nothing of the sort.

They are terms of surrender.

And Trump, in full re-election mode, is running around telling his MAGApede followers, “China broke the deal.”

There never was any deal. There was a draft agreement China took back to Beijing and altered to suit the demands of any sovereign nation. And Trump threw a temper tantrum which is creating massive uncertainty all across the capital markets.

So don’t have any hopes of seeing a deal with China that is substantively different than the one we currently have. Because Xi is no more going to cave to Trump’s idiotic demands than Draghi will admit central banking is a failure.

I’ve warned readers time and again that Trump is an economic ignoramus. Draghi’s dovishness is a response to the very policies Trump has implemented. Sanctions and tariffs on everyone that looks at him sideways creates uncertainty.

Uncertainty creates fear. And fear means deflation. In a confidence-based system a lack of it leads to hoarding of the currency most needed by everyone to do business.

This isn’t rocket science folks, but it is beyond the ken of His Orangeness.

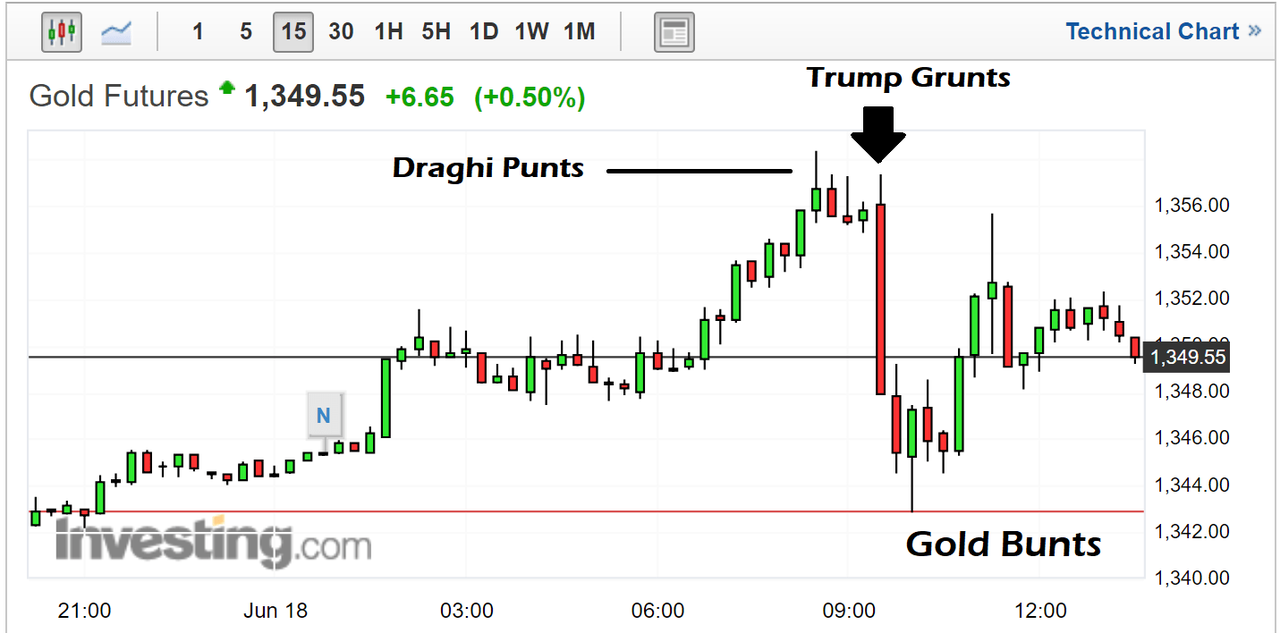

So, while markets soared on the news that the ECB would commit hari kiri gold pumped and then dumped just as quickly as Trump took hold of the algorithms for a Warhol-like fifteen minutes.

Gold continues to struggle to find a perch above $1350 getting rebuffed every time it gets there by the flimsiest of excuses. Today it was Trump’s tweet about meeting with Xi.

Gold was up on the news of the ECB loosening things up even more. Then it was sold on the idea that China and the U.S. would kiss and make up, freeing up trade. At this point there is little rhyme or reason as to what’s happening in the gold market.

I noted this with Friday’s action for my weekly post over at Money and Markets.

So the day-to-day movements can be hard to parse. After an explosive couple of weeks gold moved to briefly touch $1,360 to end the week before pulling back hard to $1,340. At the same time the euro and the British pound reversed their short-term rallies to continue sinking into oblivion on Brexit-anxiety as Boris Johnson handily won the opening round of the Tory leadership struggle.

On Friday a weak euro sent gold down. Today it rose until Trump got his mitts on it. It is interesting to note that intraday volatility is rising as the bulls keep pushing it up against the massive overhead resistance in place since the high put in just after the original Brexit vote in July of 2016.

The fight for this level is intensifying as bulls keep pressing but the demand for immediate dollars is strong enough that we see violent dumps into strength.

Remember, no one important wants to see gold rise through the cap currently in place. When it does it will be the biggest tell of all that Draghi, Jerome Powell at the Fed and the rest of the central bankers don’t have any answers for what is happening.

And we’re going to find out tomorrow just how few answers they have. I’m still of the opinion that Powell will hold off on a rate cut here to keep the Fed’s reputation and independence intact, as least nominally. The more Trump screams, the less likely the Fed will cut until it looks like their idea.

Trump will bitch but it won’t matter. The Fed will hold off here as long as possible even though the yield curve inversion gets deeper. The stock markets are still near record highs, hated on poor fundamentals, so the Fed doesn’t have to act here.

There is something else that has the markets spooked. The U.S. Dollar LIBOR curve is now also inverted, signaling short-term funding worries.

The announcement earlier in the week that Deutsche Bank is looking at spinning off a “Bad Bank” may be part of what we’re looking at here. As Jeff Snider wrote about on Monday, if DB bet wrong on a global reflation for 2018-19 which failed in a big big way last year then it would account for why there has been such a rush out into sovereign debt as DB is sitting on a mountain of bad bets which need to be cordoned off.

And that’s probably why Draghi’s position has so thoroughly shifted in the past two meetings. Trump is irrelevant in this mess, except that his misunderstanding of the situation can and will lead him to pour gasoline on an already roaring fire while he rails about trade theft.

But look carefully at what’s happening. I reiterate what I’ve been saying for months. Gold is strong alongside the a rising dollar. Equities continue levitating and safe-haven sovereign bonds continue to defy gravity right alongside them.

This isn’t a recession that has the markets spooked. It’s something far larger. Draghi’s admitted defeat, joining Kuroda at the Bank of Japan. All that’s left is Powell. If he surprises with a rate cut expect gold to explode and the dollar to briefly sell off before turning higher as the smart money understands what it really means.

* * *

Support for Gold Goats ‘n Guns can happen in a variety of ways if you are so inclined. From Patreon to Paypal or by your browsing habits through the Brave browser where you can tip your favorite websites (like this one) for the value they provide.

via ZeroHedge News http://bit.ly/2x1yjxI Tyler Durden