With stocks 1% away from record highs and bond yields (and the curve) tumbling as market expectations for multiple rate-cuts surge, Fed Chair Powell is going to have to thread a very fine needle today – shifting Fed indications towards the market’s view without panicking markets over “what he knows that we don’t.” And of course, Trump will be watching closely…

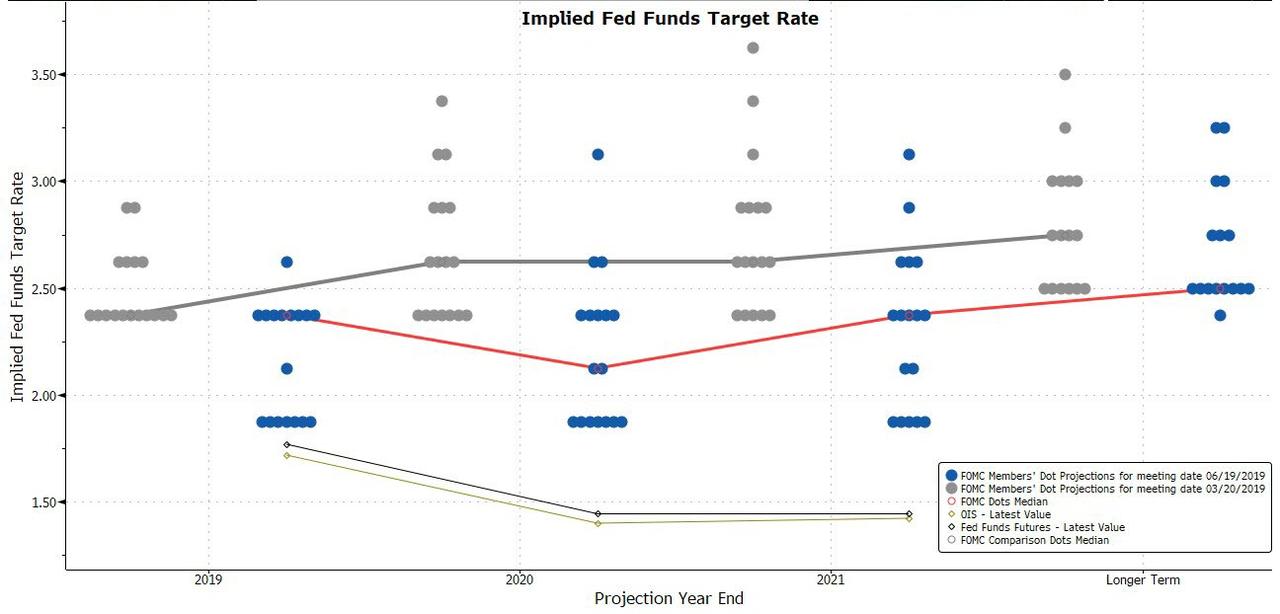

Offering Powell some room for maneuver is the fact that June rate-cut expectations are around 23%, but July expectations are over 80%, so the dots better adjust soon.

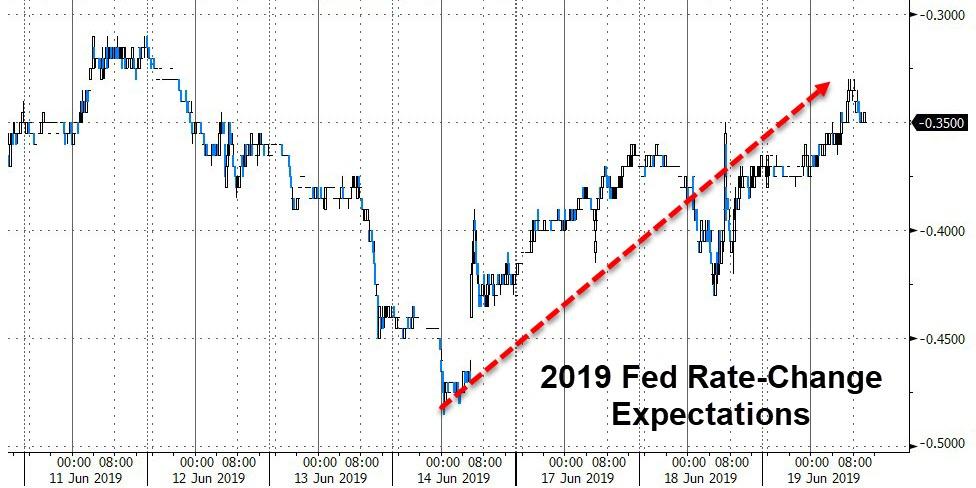

And the market is pricing in two cuts in 2019 and 3 by the end of 2020, though we note that the last two days have seen a significantly hawkish shift in the 2019 rate expectations…

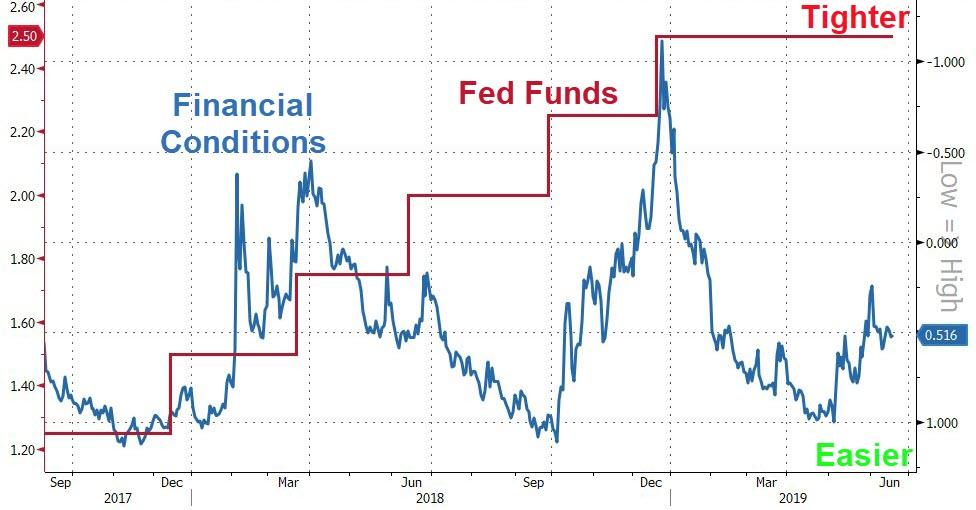

And considering that financial conditions are back near record easiness, what will The Fed cutting rates actually achieve other than to maintain equity prices that have levitated on this hype?

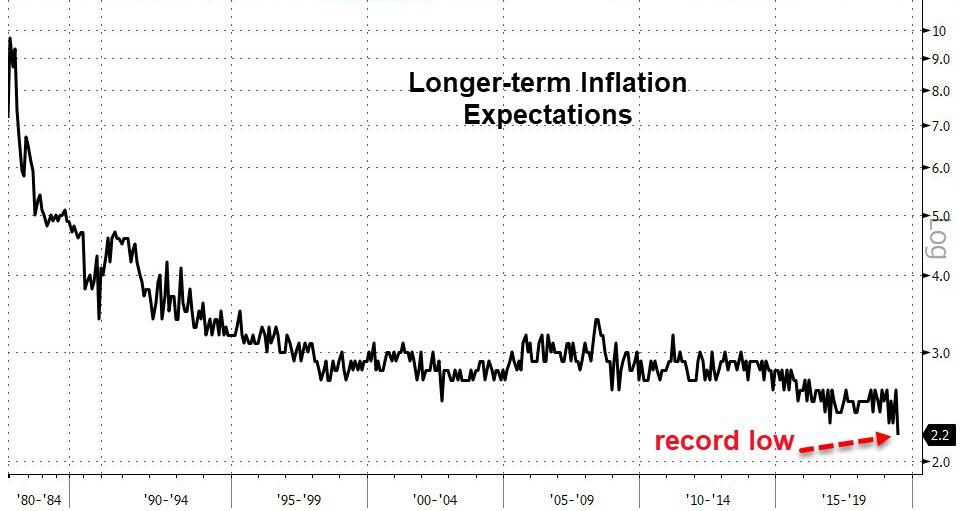

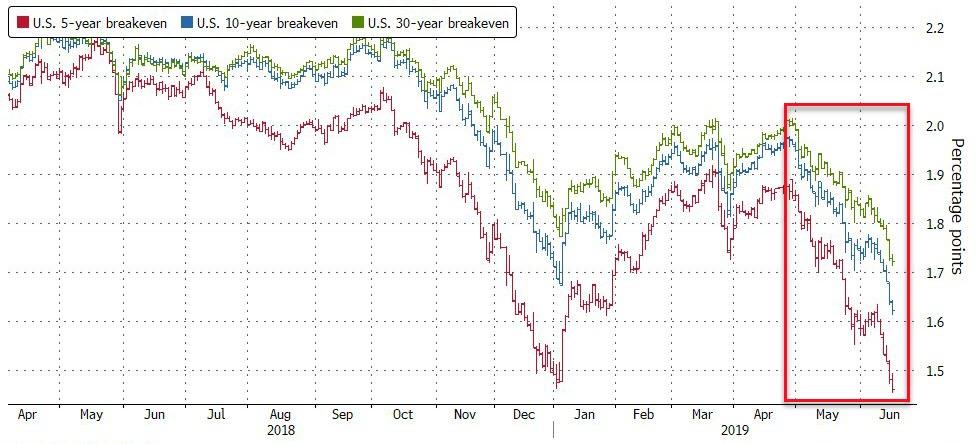

Survey-based inflation expectations are at record lows and market-based inflation expectations are crashing.

So, what will Powell do?

Bloomberg Chief U.S. Economist Carl Riccadonna:

“The markets are leaning hard in favor of monetary-policy easing. Fed officials are no doubt disconcerted by recent signs of dimming global- and domestic-growth prospects, cooler inflation and mounting evidence of trade-war casualties. Still, we believe they will avoid fully pivoting from `patient’ to proactive until there is more data at hand.”

And here is what he did…

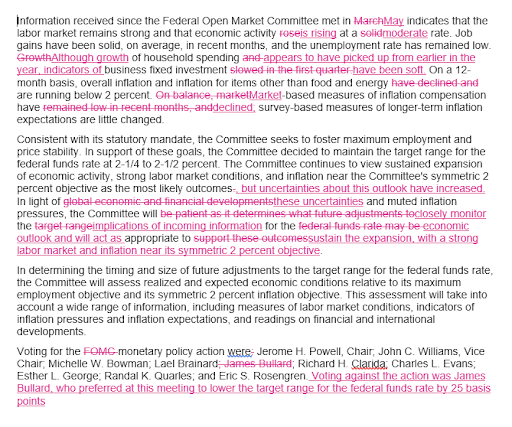

Fed keeps rates unchanged but removes reference to being “patient” on rates while adding that “uncertainties” around its outlook have increased, even if did not warn of “material downside risks” to outlook.

The FOMC says it will “act as appropriate to sustain the expansion” and “closely monitor” incoming information, language that echoes Powell’s recent speech but is new to the statement.

The Dot Plot adjusted dramatically lower…

For 2019, 8 Fed officials see lower rates with 7 of them seeing 2 cuts this year (and 1 seeing one cut).

For 2020, one additional official joins the cut camp, shifting the median down… but in 2020, the median moves back to 2.4%. The long-run neutral rate comes down to 2.5% from 2.8%, a major move.

Full Redline below:

* * *

Finally,what happens next?

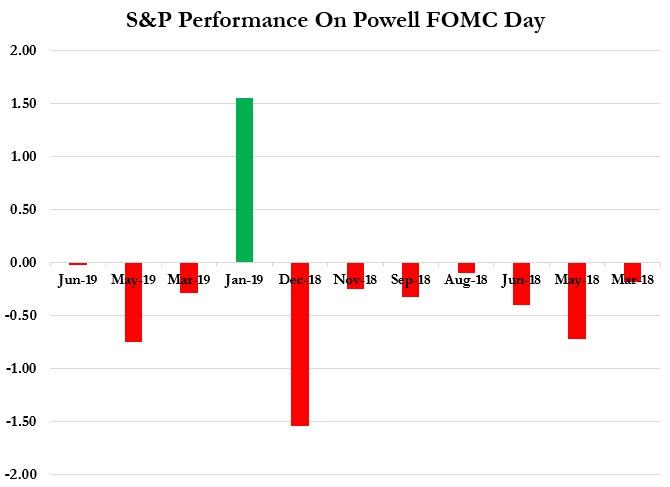

As Deutsche strategist Alan Ruskin pointed out, since Powell took over the leadership at the Fed in February 2018, risky assets have tended to trade down on FOMC decision days. The S&P 500 declined on the day of nine of the past 10 meetings presided by Powell, with a median drop of 0.29%.

The only exception was in January when the Fed, in a dramatic flip-flop, announced that it’s done with rate hikes.

And as Powell hints at rate-cuts, we note two things…

Fun historic fact:

Every single time the Fed cut rates when unemployment was below 4% a recession immediately ensued & unemployment shot to 6%-7%.

Again: Every. single. time. pic.twitter.com/OyV8lNkRwz— Sven Henrich (@NorthmanTrader) June 19, 2019

With the exception of 1967 and 1996, every initial Fed rate cut has been associated with an oncoming or ongoing recession. Be careful what you wish for. pic.twitter.com/SaWvQjrNOq

— John P. Hussman (@hussmanjp) June 18, 2019

So just when he thinks he will preempt the recession, the lagged impact of the lowest starting point for a rate-cut cycle will be unable to avoid a recession slapping into the US economy (and being ignored by US stocks).

via ZeroHedge News http://bit.ly/2WTogKF Tyler Durden