After yesterday’s torrid, euphoric surge on the back of Draghi’s dovish deluge and Trump’s announcement of a G-20 meeting with Xi, world stocks were rather muted, holding near two-week highs on Wednesday, and in the case of the S&P500 just shy of all time highs as investors bet on a worldwide wave of central bank stimulus…

… amid growing expectations that the United States and the euro zone may deliver interest rate cuts as early as July.

Which of course has put Powell in a very difficult position: with Trump demanding by the day, if not hour, that the Fed cur rates, just how does the Fed Chair pull it off without looking political when since the March FOMC meeting: i) stock prices are higher; ii) the unemployment rate fell to a 50-year low; iii) growth forecasts have improved; iv) the tariffs on Mexico that prompted the latest calls for rate cuts have been taken off the table. We’ll find out in just over 6 hours.

Meanwhile, Draghi already capitulated “pre-emptively” on Tuesday, frontrunning the Fed, when in one of the biggest policy reversals of his eight-year tenure, Draghi flagged more easing if inflation failed to pick up, firing up markets and resulting in one of the biggest one-day moves in global stocks of 2019.

But, as Reuters notes, some caution seeped in after the previous day’s frenzy. German and U.S. bond yields, which hit record lows and two-year lows respectively after Draghi’s comments, inched higher to trade just off those levels.

European shares slipped off six-week highs in early trading (although they have since rebounded) and Wall Street futures indicated a slightly weaker opening on Wednesday. Most of the concern is down to the U.S. Federal Reserve’s meeting, the decision of which is due at 1800 GMT. It is widely expected to follow the lead of the European Central Bank and open the door to future rate cuts.

“It should be really clear to absolutely everyone that this is a monetary policy turning point … Those rate cut expectations have now shifted much closer,” said Ulrich Leuchtmann, head of currency and emerging markets research at Commerzbank, quoted by Reuters. “Of course the other question is: What is the Fed doing? If the Fed takes the fundamental risk of political pressure seriously, they cannot do anything today,” he said, noting that Trump’s strident calls for lower interest rates posed a dilemma for the Fed.

Meanwhile, futures are almost fully priced for a quarter-point easing in July and imply more than 60 basis points of cuts by Christmas. As for Europe, markets have almost fully priced a cut in September, though some analysts, such as those at Germany’s Commerzbank, now say rates will be cut in July, rather than in the last quarter of the year as they had predicted earlier.

The risk is that for all the clamor for easing creates risks that policymakers will disappoint.

“Market expectations for a dovish shift are nearly universal, the only question seems to be the degree,” said Blake Gwinn, head of front-end rates at NatWest Markets, referring to the Fed. “Markets will be looking for validation of this pricing. We think this represents a fairly high bar for the Fed to deliver a dovish surprise.”

It wasn’t just central banks though: Bullish market sentiment was reinforced by news that Trump will meet Chinese leader Xi Jinping at the G20 summit this month, even though many doubt the two men can reach a breakthrough on ending their trade dispute.

MSCI’s global equity index rose 0.4%, adding to Tuesday’s 1% gain, as Asian shares excluding Japan followed the lead of their European and U.S. counterparts to jump almost 2% — their biggest one-day rally since January as investors bet on a possible easing of U.S.-China trade tensions. Technology shares led the rally after President Donald Trump said he would meet Chinese counterpart Xi Jinping at the G-20 summit next week. All markets in the region were up, with Hong Kong and Taiwan leading gains, while Australian stocks hit an 11-year high. The Topix gauge climbed 1.7%, as Keyence and SoftBank provided the biggest boosts. Construction stocks rose after a magnitude 6.7 earthquake struck off the northwest coast of Japan.

Over in China, the Shanghai Composite Index closed 1% higher, as brokerage shares jumped on a media report that China encouraged banks to boost liquidity support for securities firms. The S&P BSE Sensex Index fluctuated, with Kotak Mahindra Bank rising and Mahindra & Mahindra declining. India’s second-biggest life insurer said it was time to take money out of the nation’s equities.

In rates, the yield on 10-year Treasuries pared some of the drop from a day earlier, after reaching the lowest level since September 2017 at 2.016%, a world away from the 3.25% top touched in November last year. The yield rose slightly from those lows but is down some 60 bps since January, while that of Japan’s benchmark sank to the lowest since August 2016 at -0.145%. German yields were close to the minus 0.33% record low hit on Tuesday, while Japanese yields

The fallout in currencies has been significantly less, mostly because it is hard for one to gain when all the major central banks are under pressure to ease. The euro did pull back after Draghi’s comments, but at $1.118 it touched only a two-week low. The dollar eased slightly on the yen to 108.3, but was flat versus a basket of currencies. The yuan touched three-week highs versus the dollar on the trade news. The pound gained for a second day.

In commodities, the rate-cut buzz kept gold just off 14-month highs at $1,345.16 per ounce. Brent crude futures however slipped 0.6% to $61.75 a barrel, pressured by economic growth worries.

Expected data include mortgage applications. Oracle and Steelcase are reporting earnings

Market Snapshot

- S&P 500 futures little changed at 2,924.50

- STOXX Europe 600 little changed at 384.68

- MXAP up 1.8% to 157.98

- MXAPJ up 1.8% to 518.37

- Nikkei up 1.7% to 21,333.87

- Topix up 1.7% to 1,555.27

- Hang Seng Index up 2.6% to 28,202.14

- Shanghai Composite up 1% to 2,917.80

- Sensex up 0.1% to 39,086.68

- Australia S&P/ASX 200 up 1.2% to 6,648.13

- Kospi up 1.2% to 2,124.78

- German 10Y yield rose 2.2 bps to -0.298%

- Euro up 0.09% to $1.1204

- Italian 10Y yield fell 18.0 bps to 1.753%

- Spanish 10Y yield rose 4.2 bps to 0.435%

- Brent futures down 0.5% to $61.82/bbl

- Gold spot down 0.3% to $1,342.61

- U.S. Dollar Index little changed at 97.60

Top Headline News from Bloomberg

- Facing pressure from Wall Street and President Trump, Fed Chairman Powell and his colleagues may be running out of patience

- President Trump said he had a “very good” phone conversation with Chinese counterpart Xi. The two will hold an extended meeting at the G-20 summit on June 28-29, Trump said on Twitter

- Boris Johnson extended his lead over his rivals in the race to become Britain’s next prime minister and looked poised to pick up more votes as the hardest Brexiteer in the contest was eliminated

- Trump administration is weighing three sanctions packages to punish Turkey for its purchases of the Russian S-400 missile-defense system, according to people familiar

- Japan’s exports fell for a sixth month as U.S.-China trade tensions add to concerns about global demand and economic growth

- President Trump asked White House lawyers earlier this year to explore his options forremoving Jerome Powell as Fed chairman, according to people familiar

- Trump officially announced his campaign for re-election, delivering a speech thick with grievance in which he warned of a dark future for America if his opponents win in 2020

- An OPEC committee sees global oil inventories contracting by almost 500,000 barrels a day if the group continues restraining supply in the second half of the year, a delegate said

- China is stepping up efforts to avert a funding squeeze among the nation’s banks and securities companies after a rare government seizure of a small lender triggered concerns about a vital part of the nation’s financial plumbing.

- Wednesday’s Federal Reserve rate decision carries more wild cards than most. While market participants don’t expect a rate cut this time around, they do see lower rates this year

- The Trump administration is weighing three sanctions packages to punish Turkey over its purchases of the Russian S-400 missile- defense system, according to people familiar with the matter. The most severe package under discussion between officials would all but cripple the already troubled Turkish economy

Asian equity markets rallied across the board as the region followed suit from the heightened global risk appetite due to a double dosage of optimism from ECB President Draghi’s hints of potential easing and after US President Trump confirmed a meeting with his Chinese counterpart at the G20. ASX 200 (+1.2%) and Nikkei 225 (+1.8%) were higher with Australia led by energy names after a surge in oil prices and with outperformance also seen in the trade sensitive industries such as tech, materials and miners, while the Japanese benchmark gapped above the 21K level fuelled by favourable currency flows and strength in commodity-related sectors. Hang Seng (+2.5%) and Shanghai Comp. (+1.0%) were buoyed after US President Trump announced the resumption of US-China trade talks and that he will be conducting an extended meeting with Chinese President Xi at the G20 following “a very good” telephone conversation between the 2 leaders, while the PBoC were also supportive with the announcement of liquidity injections through reverse repos and its medium-term lending facility. Finally, 10yr JGBs were higher after the dovish comments from ECB’s Draghi added to the declining global yields narrative which saw a drop in 10yr JGB yields to their lowest since August 2016, while the BoJ also kick starts its 2-day policy meeting where they are expected to maintain current policy settings and reaffirm guidance of keeping rates at very low interest rate levels for an extended period of time at least through around Spring 2020.

Top Asian News

- Agung Jumps as Jakarta Issues Permit for Reclamation Projects

- Nomura Jumps on $1.4b Buyback, Governance Tweaks

- Boutique Firm Led by Ex-UBS Banker Said to Bid for Abraaj Funds

- KKR Is Said to Near Partial Exit From $2b Helicopter Firm

European equities are tentative [Eurostoxx 50 Unch] as the region gears up for the FOMC rate decision later today (Full preview available in the Research Suite). Sectors are mixed, underperformance is seen in defensive stocks with healthcare, utilities and consumer staples all lower. In terms of movers, STMicroelectronics (+3.2%) and Infineon (+2.7%) shares gained following a broker move at Morgan Stanley and Bernstein respectively. On the flip side, Steinhoff (-6.5%) opened at the foot of the Stoxx 600 after the Co.’s delayed 2018 results posted losses, whilst Belgian retailer Colruyt (-12.2%) plunged on disappointing earnings.

Top European News

- Airline Shares Fall as HSBC Sees More Profit Warnings Ahead

- Piraeus Tests Risk-Hungry Market With CCC Rated Greek Bank Debt

- U.K. Inflation Returns to BOE Target on Air Fares, Car Prices

- German Property Stocks Fall on Fears of Rent Regulation Ahead

In FX, relatively tight lines are being drawn ahead of the FOMC in G10 land, as is often the case, but the Greenback has clawed back some losses against EMs after Tuesday’s euphoria over the US and China reopening lines of communication on the trade front. However, the index is braced for the Fed within a confined 97.683-553 range, and seemingly reluctant to breach chart/psychological resistance or support around 97.639 (61.8% Fib retracement of pull-back from 98.373 ytd peak to recent 96.451 low) and 97.500 respectively in the run up – see the Ransquawk Research Suite for a full preview.

- GBP/CHF – Bucking the overall muted trend, Cable has continued its recovery towards 1.2600 after broadly in line with forecast UK CPI and PPI data and ahead of the BoE tomorrow, while Eur/Gbp has also retraced further to test 0.8900 compared to circa 0.8975 before ECB President Draghi’s apparent dovish Sintra revelations. Similarly, the Franc is consolidating back above parity and over 1.1200 vs the single currency as markets tread more cautiously in wake of yesterday’s risk-on session.

- EUR/JPY/CAD/AUD/NZD – All narrowly mixed vs the Buck, as noted above, with the Euro licking wounds inflicted by latest dovish ECB vibes and back on the 1.1200 handle where extremely heavy option expiry interest is anchored (5.2 bn 10 pips either side of the big figure). The Yen is also wary of BoJ guidance skewed towards ongoing or even more stimulus, and bound by hefty expiries as 2.95 bn rolls off at the 108.00 strike and 1.3 bn between 108.30-40 vs the 108.25-61 range so far. Elsewhere, the Loonie awaits Canadian CPI data and is holding above 1.3400 with decent expiries from 1.3350-70 (1.2 bn) in close proximity, while the Aussie and Kiwi are both maintaining their recovery momentum over 0.6850 and 0.6500 respectively ahead of RBA Governor Lowe and NZ Q1 GDP, with the former not unduly ruffled by the latest in a growing list of calls for more rate cuts.

- EM – The Lira is back on the rack and underperforming amidst the general retracement noted above, and the renewed threat of US sanctions against Turkey has lifted Usd/Try off recent lows to 5.9150+ at one stage. Elsewhere, the Rand has unwound some of its Eskom-related outsize gains despite firmer the forecast SA CPI, with Usd/Zar rebounding through 14.5000.

In commodities, WTI and Brent futures are marginally lower on the day as yesterday’s upbeat sentiment in the complex somewhat wanes ahead of today’s DoE release. Last night’s API numbers showed a slightly narrower-than-forecast draw in crude stocks (-0.81mln vs. Exp. -1.1mln) . Traders will be keeping an eye on the more widely followed DoE numbers for any short term direction (crude stocks expected to draw by 1.077mln barrels), ahead of tonight’s FOMC meeting. On the OPEC front, the oil producers have decided to hold the OPEC meeting on July 1st and the OPEC+ meeting on the 2nd following weeks of indecisiveness. Elsewhere, gold is unwinding some of its risk premium amid President Trump and his Chinese counterpart showed willingness to reignite US-Sino trade talks at the G20, albeit the yellow metal is certain to be swayed by tonight’s Fed meeting and presser. Meanwhile, copper is little changed but holds onto most of its trade-driven gains. Finally, Dalian iron ore futures spiked higher by almost 6% as the base metal followed the broad rally across assets.

US Event Calendar

- 7am: MBA Mortgage Applications -3.4%, prior 26.8%

- 2pm: FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

Wherever you’re reading this, get comfortable as this is a long one today after probably the biggest day of the year for market moving news. We’ll start by recycling the famous quote, “When the facts change, I change my mind. What do you do?”.

After yesterday’s huge day in financial markets it no longer feels appropriate to be tactically underweight credit. To recap, we decided to move to this position in May as the trade escalation left us feeling that weak markets or poor economic data were needed to push the US and China into meaningful talks. To be fair we did initially see weak markets and slipping economic data but then came a huge change in market pricing of central bank activity, first in terms of the Fed and then the ECB, culminating in Draghi’s extremely dovish signal yesterday. If that wasn’t enough, our weekend sources in Washington which we detailed on Monday were proved correct as Mr Trump tweeted just after the US open that he will meet with China’s President Xi at next week’s G-20. So the balance of risks (and there still are a lot of risks) have become more balanced and more supportive of the carry trade of which credit is a key one. So the path of least resistance now seems tighter for credit, with European credit likely to be additionally propped up by expectations that CSPP is a step closer after yesterday (see this note from last week for more on how to assess the probabilities of this). The risks to the view is that the events of the last month are already leading to a global slowdown that central banks can’t do much about and/or that the Trump/Xi G20 talks end up going nowhere and we get the final round of tariffs applied very soon after and then further escalations. The next hurdle is today’s FOMC which is another much anticipated moment. The market and Mr Trump have put a lot of pressure on the Fed. It’s hard to imagine that they’ll disappoint given all that’s going on but we should note that under Mr Powell, nine out of ten FOMC meeting days have seen equities down. We’ll preview in full below.

Before we go through the details of Mr Draghi and Mr Trump’s significant comments, respectively, it’s worth starting with markets where we can now list new all-time yield lows for 10y bonds. Germany, Denmark, Netherlands, Austria, Finland, Sweden, France, Belgium, Slovakia, Ireland, Slovenia, Latvia, Spain, Portugal, Cyprus and Croatia all experienced this yesterday. Indeed it wouldn’t be a surprise if we missed one or two. Bunds rallied -7.6bps to close at the eye wateringly low level of -0.322%, OATs hit an intraday low of -0.004% – the first time they have been below 0% – while yields in Sweden and Austria closed at -0.027% and -0.052%, both below 0% for the first time too. BTPs also rallied -18.5bps which is the biggest one-day move since October. If you want a scary example of just how extreme the rates move was, then Austria’s 100y bond rose 5.5pts yesterday, taking it to a cash price of 156.9. That means it has jumped nearly 40pts YTD already, equivalent to a -61.2bp fall in yield so far in 2019. The coupon on that bond is 2.1% and the yield is now just 1.14%. Oh, and it has a duration of 51.8! You’d be hard to pressed to find many fixed income assets which have delivered a bigger return YTD. Yesterday’s moves were even more remarkable since they were driven by collapsing real yields as inflation expectations perked up. The European five year-five year inflation swap rate popped up 8.9bps to 1.23%, which is still extremely low by historical standards but was the biggest rise since March 2012.

The move for European rates reverberated throughout the US too. Indeed 10y Treasuries rallied -3.5bps (though they were down -7.9bps before the Trump tweet) and are now down to 2.060%, the lowest level since September 2017. They have held that level overnight also. The 2s10s curve also dipped to 19.15bps (-2.8bps on the day). The amount of negative yielding debt in the world now is around $12.5tn and the most ever. Oh, and the Bund curve is now negative out to 18 years. The other side of the coin for markets was a big rally for risk. The STOXX 600 (+1.67%) had its best day since January. The DAX, CAC and FTSE MIB also all closed up more than 2% while in the US the S&P 500, NASDAQ and DOW ended +0.97%, +1.39% and +1.35%, respectively. Despite the yield move, banks rose +1.54% in Europe (possibly on hints of tiering alongside rate cuts) and +1.79% in the US. EM equities also finished +2.44%, their best session since January, while HY credit spreads were -10bps and -6bps tighter in Europe and the US, respectively. Oil also rallied +3.79%, helped by the improved risk sentiment but also by news that the OPEC+ group will meet to discuss a possible extension to their supply cuts. Finally the euro finished down -0.21% – a fairly modest move all things considered, though -0.43% from its pre-Draghi level.

Overnight in Asia markets are following Wall Street’s lead with the Nikkei (+1.71%), Hang Seng (+2.37%), Shanghai Comp (+1.50%) and Kospi (+1.11%) all posting decent gains. In rates, yields on 10y JGBs are down -2.1bps to -0.158%, thereby hitting the lowest yield since July 2016 and testing the limits of the BoJ’s target range. In other news, here in the UK, the Times reported overnight that the Labour Party leader Jeremy Corbyn will today back a move to change the party’s Brexit policy and support a second referendum in all circumstances. This supposedly follows rising internal pressure from his own MPs. Meanwhile, as we go into the print, Bloomberg is reporting that the Trump administration is weighing three sanctions packages to punish Turkey over its purchases of the Russian S-400 missile-defense system. The Turkish lira is trading down -0.71% on the news.

Back to Draghi, where the most significant statement was “in the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required”. He added “in the coming weeks, the Governing Council will deliberate how our instruments can be adapted commensurate to the severity of the risk to price stability” and that “further cuts in policy interest rates” remain part of the ECB’s toolkit. The plural “cuts” didn’t go unnoticed, and nor did the reference to “how” instruments can be changed, rather than “if.” Draghi went on to say that the “APP still has considerable headroom,” possibly signaling a relaxation in the 33% country limit on purchases. Peter Praet, former ECB Chief Economist whose term ended 3 weeks ago, also added to Draghi’s comments by saying that the ECB will look at tiering if a rate cut moves onto the agenda. There’s little doubt that this counts as a u-turn compared to the June meeting, as evidenced by markets yesterday. The ECB has joined the Fed and the question is how much easing is there to come. Markets are now pricing in around 9bps of cuts by the September meeting, plus another 5bps between September and December. So fully pricing at least one 10bps cut before the year is out. We should also note that overnight, anonymously sourced articles (per Bloomberg) said both that rates will the primary tool before restarting QE and that the options are still being considered.

Beyond the immediate implications for rates, the shift by the ECB will have reverberations throughout and beyond the euro area. It will likely become increasingly difficult for other major central banks, like the BoE, BoJ, and BoC, to tighten policy in the face of European easing. Perhaps more interestingly, there will likely be increased focus on the fiscal authorities to act in concert with the central bank. Draghi devoted a section of his speech to discussing fiscal policy. He said it “should play its role” and that monetary easing works best “if fiscal policies are aligned with it.” He also criticised the fiscal response post-crisis, where he argued that the countries with fiscal space should have made better use of their position by pursuing more expansionary policy, rather than the several percentage points of GDP of tightening that we ultimately got in the event. So the ECB this week have definitely stepped up pressure on governments to do more. Ironically by doing more themselves they actually take pressure off governments to some degree!

Trump had his own say on the ECB, tweeting that “Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easy for them to compete against the US. They have been getting away with this for years, along with China and others” and that “German DAX way up due to stimulus remarks from Mario Draghi. Very unfair to the United States!” Later in day, news broke that the White House legal office had considered the potential for Trump to demote Fed Chair Powell, to take his chairmanship away but not fire him. It is not clear if that would be legal, but in any event White House economic advisor Kudlow told reporters that Trump is not currently considering that option. However, when reporters asked the President directly about Powell after markets had closed, Trump responded “let’s see what he does.”

It was Trump’s tweet about a “very good telephone conversation” with President Xi of China that was more significant for markets though. Trump confirmed that the two would have an “extended meeting” at the G-20 meeting and that the respective teams of both would begin talks prior to this. Chinese state media confirmed that Xi and Trump had spoken by phone and that Xi had agreed to meet at the G-20. Significantly, Xi also said that the two had agreed that “trade teams should keep talking to solve issues”. While it’s still hard to predict, at the very least this feels like the timeline for any escalation has been pushed back, while the prospect for an agreement has risen. So it was unsurprising to see risk do so well on the back of the headlines.

One final note to add on yesterday’s trade and political news. USTR Lighthizer testified for the Senate and discussed the administration’s trade policy. He didn’t provide much new information, but did say that the apparent deal to avert tariffs with Mexico makes it “more likely” that the administration reaches a deal with China. He also said that tariffs have proven to be a useful negotiating tool, and talked up the odds of trade deals with Japan and Europe, though legislators indicated that many roadblocks remain.

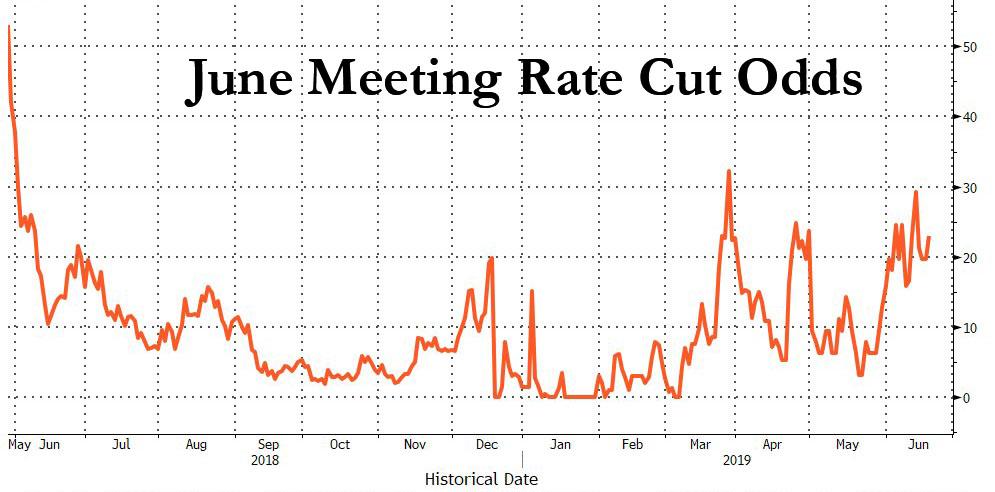

What a time to have a Fed meeting then. The market is pricing in a fairly small chance of a rate cut today – 20% to be precise – and it does feel like the big question is how much the Fed swings to endorsing market pricing which is still for 83bps of cuts over the next 12 months. Our US economists expect the statement to drop its “patient” narrative and adopt language similar to Powell’s recent statement that the Committee will “act as appropriate to sustain the expansion.” This shift should signal that downside risks are building and that the Committee stands ready to lower rates in the coming months if the macro and markets environment justify it. The dots should show some movement in this direction, with the median dot likely to be flat in the coming years and some individual dots calling for cuts this year, but the SEP should stop short of having the median dot imply cuts. Powell’s press conference is likely more important than the dots and this is his chance to reinforce the dovish tilt. More from our US economists can be found here .

Turning quickly to yesterday’s economic data, which was understandably overshadowed by the other news. The highlight was Germany’s ZEW survey. The expectations measure fell -19pts to -21.1, the sharpest drop since July 2016 and the lowest level since November. On the other hand, the current situation measure fell only -0.4pts to 7.8, slightly better than expected. Euro area core CPI was confirmed at 0.8% yoy. In the US, housing starts fell -0.9% mom in May, worse than expected, but the prior month was revised 1.1pp higher to 6.8, leaving the trend steady. Building permits rose 0.3% mom, a touch better than the 0.1% expected.

To the day ahead, where the obvious highlight is the aforementioned Fed meeting. Away from that we’ve got May PPI data due out of Germany this morning, and the May inflation data docket from the UK along with the June CBI survey. Sintra also continues so expect more headlines there. Finally the Tory party leadership debate will see another round of voting.

If you’ve got this far well done…… and thank you!!!

via ZeroHedge News http://bit.ly/2IoZ9q6 Tyler Durden