Don’t look to the Fed to explain today’s torrid, global rally: according to a controversial take by BMO’s bearish technical analyst, Russ Visch, yesterday’s FOMC announcement was a non-event “as markets shrugged off the interest rate decision and follow-up presser with Chairman Powell”, and today’s action has an entirely different catalyst, resulting in “no change” to Visch’s short-term outlook.

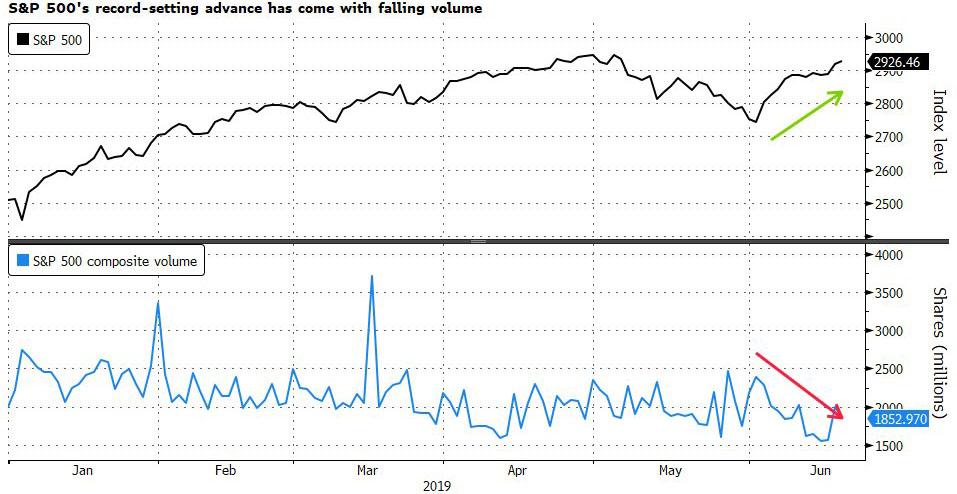

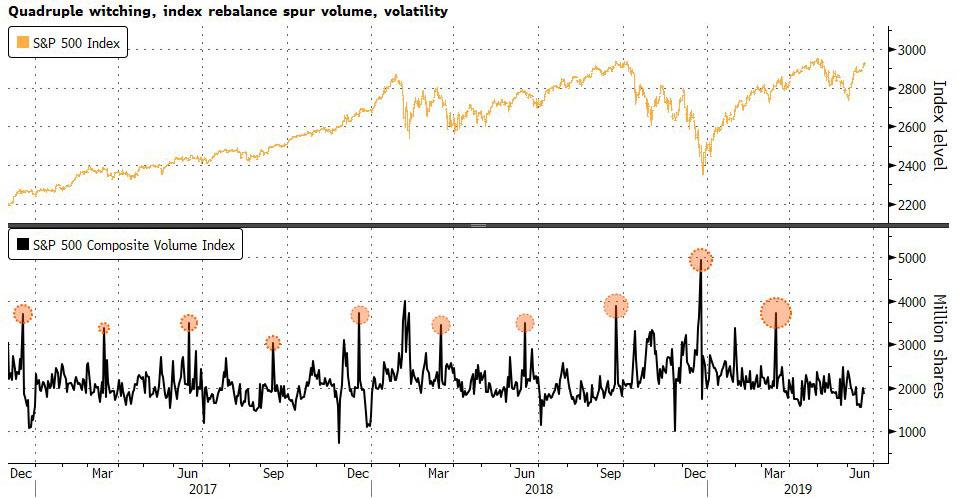

And in another contrarian take, Visch claims that “the quality of the rally since late May (narrow participation, extremely light volume) suggest it’s nothing more than a relief rally within an ongoing medium-term downtrend” as shown in the chart below.

So if not the Fed, what is behind today’s buying panic which sent the S&P to new all time highs? As Visch writes, “we are inclined to believe it has more to do with tomorrow’s quadruple expiry in futures and options markets than a true shift in investor sentiment.” His conclusion:

As of today, the major averages are very near to overhead resistance levels while at the same time short-term momentum gauges are now at/near overbought extremes, all of which suggests upside is likely limited from here.

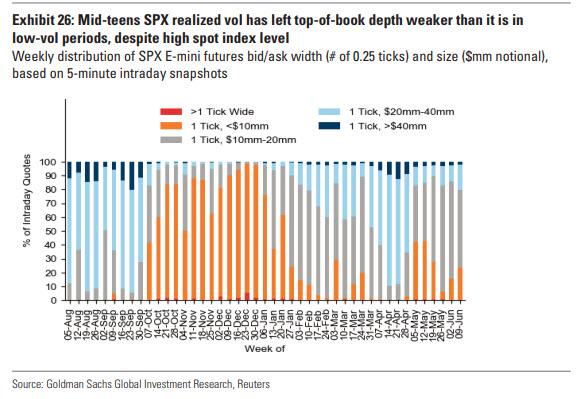

Whether or not Visch is right may be secondary to the technical is in the market which, due to shrinking liquidity has become especially sensitive to reversals and headline risk: indeed, as Bloomberg writes, “a minor technical adjustment could spark a big upside move when liquidity is thin.” such as right now, when according to Goldman the top-of-depth for the S&P is weaker than it is in low-vol periods despite the record high level of spot.

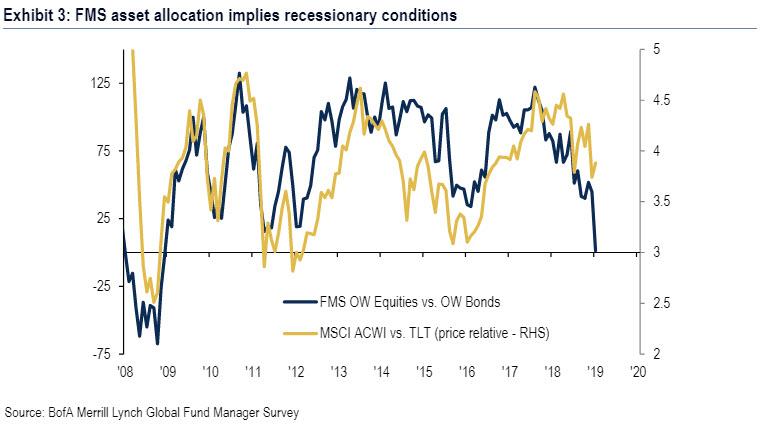

Meanwhile, although the S&P 500 has advanced every week this month, daily trading on exchanges has stayed below the 2019 average in 10 out of 11 days. Add to this the results from the latest BofA Fund Manager Survey which found that investors are the most bearish they have been since the financial crisis…

… and even a small bullish catalyst could unleash a giant rally.

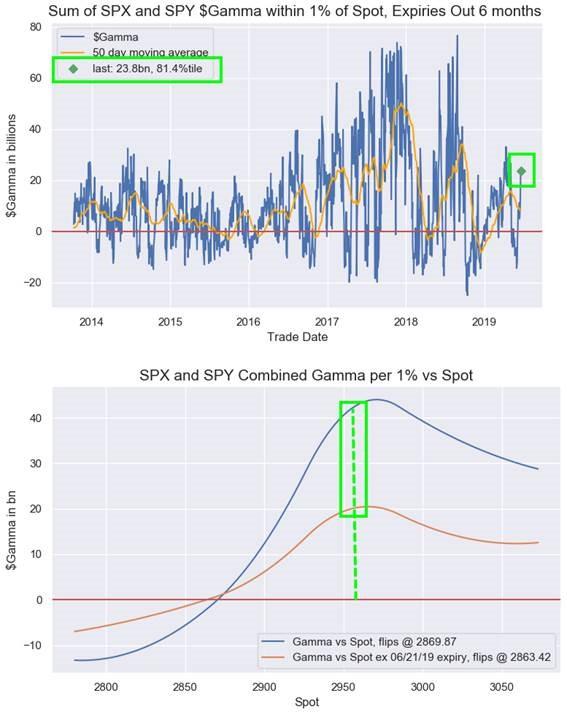

Separately, Nomura’s Charlie McElligott also attributed today’s rally to a technicality, and the result of another local gamma maximum, as “as options overwriters roll their in-the-money calls out and thus create big notional Delta to buy” around the S&P strike price of 2,950.

While it is unclear what the result of tomorrow’s option expiration will be on stocks, one can be certain that it will be a monster: the last time a “quadruple witching” and an S&P 500 rebalancing took place, on March 15, almost 11 billion shares changed hands, 39% above the 3 month average, and according to Bloomberg this time, the rebalancing alone could force about $24 billion of trades, compared with $26 billion a year ago, S&P Dow Jones estimated on June 14.

So what happens after Friday? One scenario, that sees the S&P slide next week only to spike even higher, was laid out by McElligott, who predicted that near-term moves may head-fake sentiment in the coming days. As the Nomura strategist writes, “it is worth nothing that there is a ‘sequencing risk’ set-up with this week’s trade into next week and thereafter which could head-fake sentiment”:

- Witness this type of “force-in grab” into Stocks on account of the powerfully dovish CB moves this week, on top of the remarkable Equities “under-positioning” I’ve been highlighting the past few months

- This then corresponds with the already VERY bullish analog / seasonality for SPX into the June serial Op-Ex (tomorrow), as options overwriters roll their in-the-money calls out and thus create big notional Delta to buy

- But then dangerous the week AFTER Op-Ex (next week), you lose this overwriter “Delta buying” impulse (1w after June Op-Ex SPX perf -1.4% median and 87% of time LOWER, contingent on rallying the 1m into Op-Ex) and 37% of the Gamma expires tomorrow ($4.2 of the $9.4B at this monster 2950 SPX strike)

- Additionally you then too see the downgrade to the corporate buyback “bid,” as we are now deeply embedded within the “Buyback Blackout” window (over 75% of SPX companies within their blackout now)

- The market then risks “mis-reads” this potential FLOW-CENTRIC weakness in Equities next week as some sort of “fading the Fed”—when in fact it’s almost entirely mechanical in nature

- This type of head-fake could in fact see more shorts added and sentiment purge, which then perversely is the fodder for a melt-up into SPX 3000s

via ZeroHedge News http://bit.ly/2Zzpojf Tyler Durden