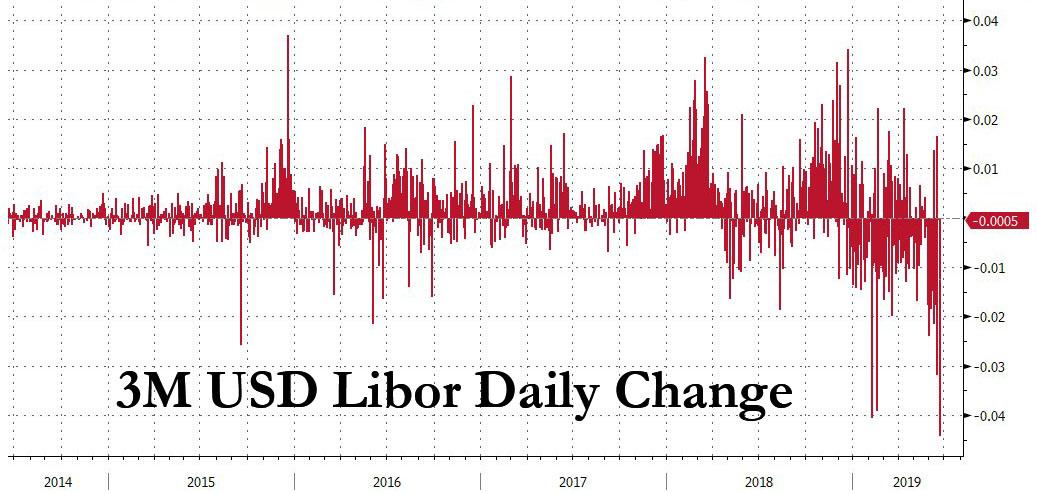

Having been headfaked by Powell in the fourth quarter of 2018 – along with every other asset class – when 3M USD Libor rose from 2.300% to 2.800%…

… Libor has staged a dramatic reversal, largely following the path taken by the effective fed funds rate after the Fed’s dovish reversal, and on Thursday it was fixed lower by 4.3bps, the largest drop since May 2009, falling to 2.34313% from 2.38613% on June 19 as the short end of the fixed-income market catches up in pricing Federal Reserve rate cuts. As a result, the Libor-OIS spread, has narrowed to 17.7bps from 20.6bps prior session.

The drop “is a product of the market catching up in pricing for Fed rate cuts,” said Gennadiy Goldberg, a strategist at TD Securities quoted by Bloomberg. “3m OIS also declined by 1.5bp, but you should see Libor also pricing in some cuts, given the Fed’s dovishness yesterday.”

Meanwhile, in the aftermath of the FOMC announcement, October fed funds futures which indicate the expected level of fed funds after the September FOMC meeting, show a rate of 1.81%; that’s 56bp below the current fed effective rate of 2.37%.

Separately, the effective fed funds rate was unchanged at 2.37% on Wednesday with the Fed’s interest on excess reserves (IOER) rate now at 2.35%, that puts the fed funds rate 2bp above IOER. The effective fed funds rate has been higher than IOER since March 20, when a negative spread emerged between the two benchmark rates for the first time since 2008, and it’s stayed above almost every day since.

via ZeroHedge News http://bit.ly/2IU3IHY Tyler Durden