Stocks up to record highs (Fed and Energy stocks), Bonds (price) up (Fed and Iran safe-haven), Gold up (Fed and Iran safe-haven), VIX up (hedging melt-up gains or levered longs), Dollar down hard (Fed uber-easy and no safe-haven bid?), and Rate-Cut Expectations soared…

Chinese stocks exploded higher overnight in the morning session (as policymakers hinted at more potential easing) but were flat in the afternoon session…

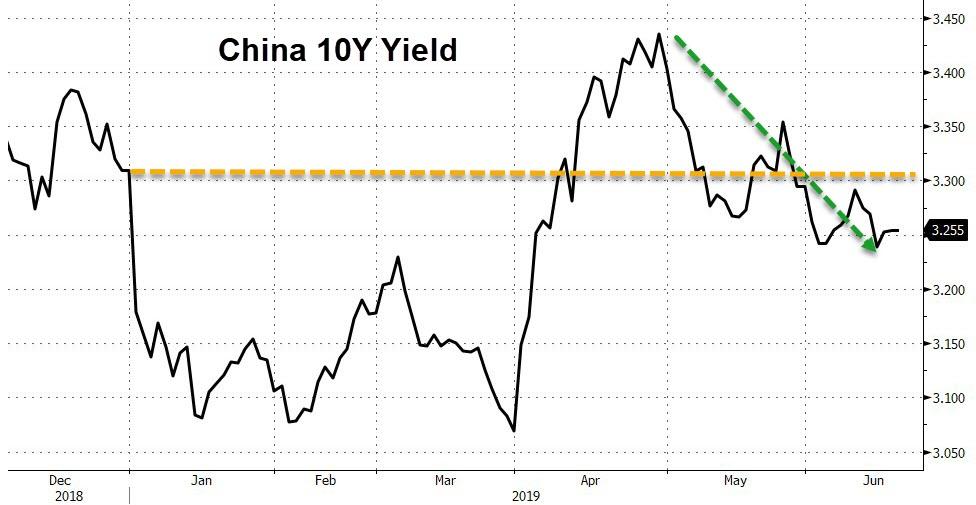

Notably, China’s bond yields are the only ones that are not making new cycle lows…

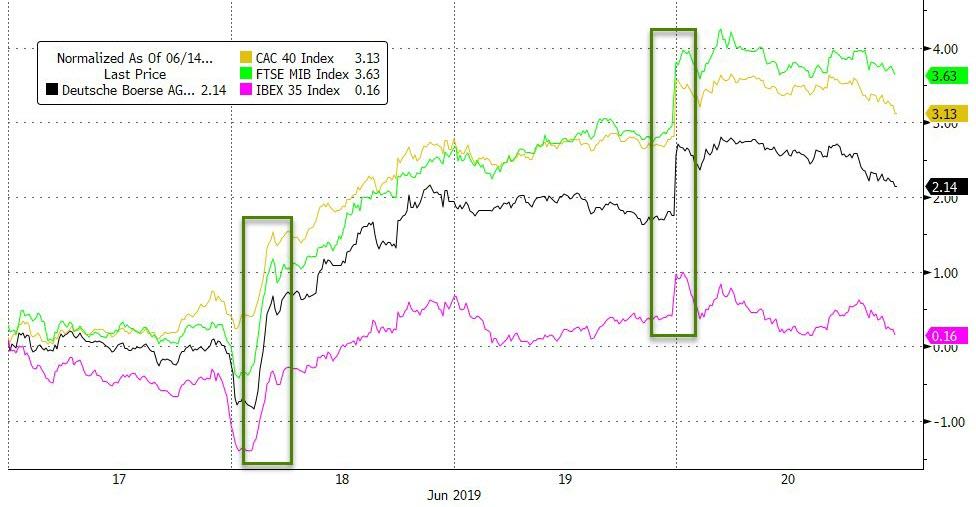

European markets opened exuberantly but faded for most of the day (Spain was red on the day)…

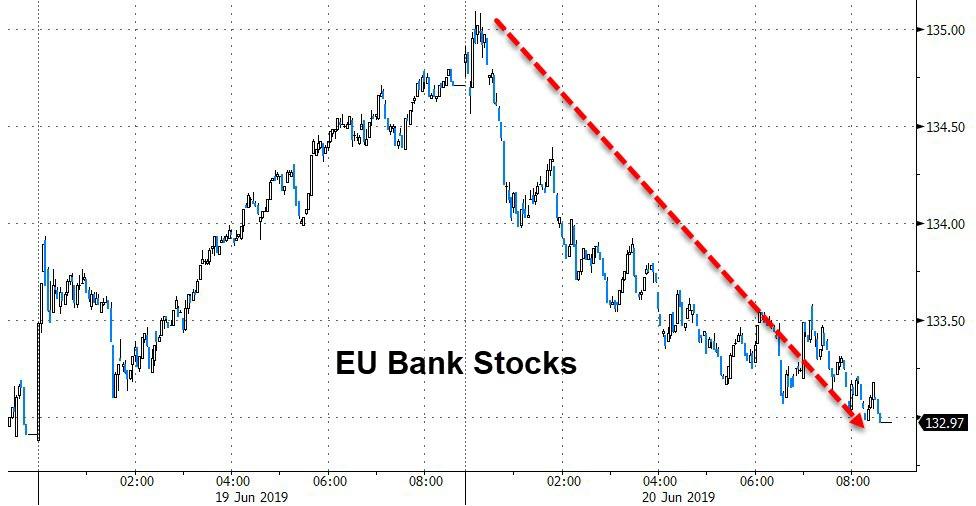

German bund yields fell back to record lows (-32bps) and most of Europe is now in a negative yield…

And as yields tumbled, so did European bank stocks…

US Equities surged overnight, opened at record highs (S&P), but were sold from the cash open, accelerating close to unchanged when Trump warned Iran “made a very bid mistake”… then after he seemed to walk back the event, stocks recovered some of their gains…

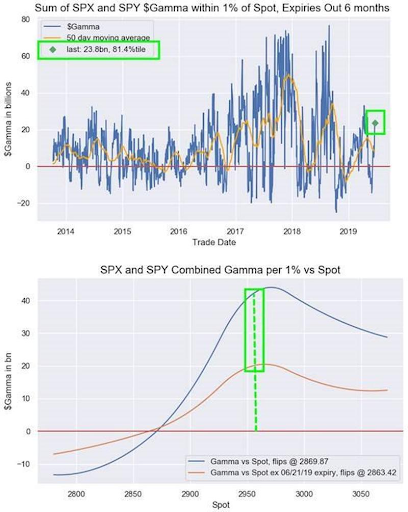

NOTE – remember tomorrow is a quad witch

“We are inclined to believe it has more to do with tomorrow’s quadruple expiry in futures and options markets than a true shift in investor sentiment,” said Russ Visch, a technical analyst with BMO Capital Markets.

“The quality of the rally since late May (narrow participation, extremely light volume) suggest it’s nothing more than a relief rally within an ongoing medium-term downtrend,” he said.

The S&P 500 hit a new all-time intraday high at the open…

NOTE – Previous S&P intra high 2954.13, close high 2945.8)

Late-day buying panic was sparked by all that pre-expiration gamma again…

Cylicals were bid today, catching up to yesterday’s defensive-driven outperformance…

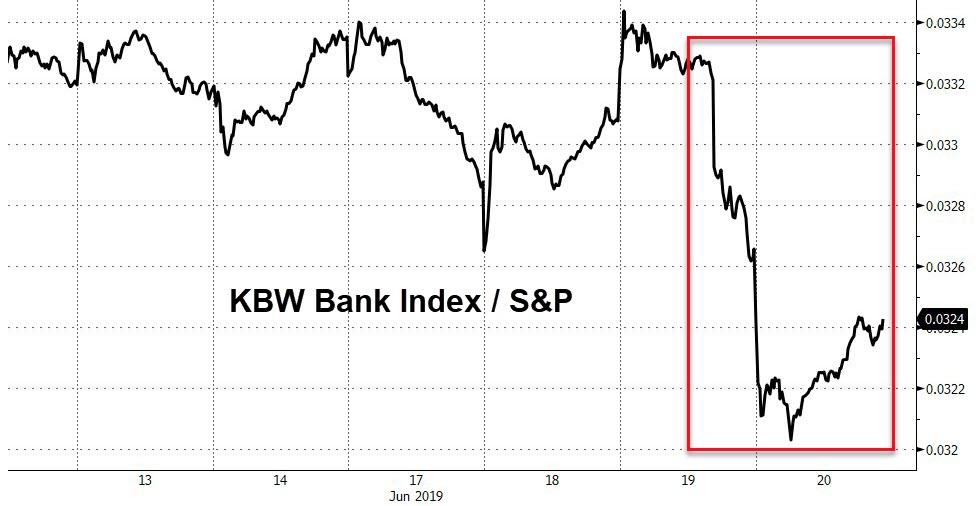

US Bank stocks continue to notably underperform as yields collapsed…

Slack slumped…

TSLA stalled at key downtrend despite market strength…

Despite the equity gains, VIX ended the day higher…

The jaws of death widen…

Treasury yields tumbled…

With 10Y Yields plunging below 2.00%…

And 2Y yields failed to bounce at all today…

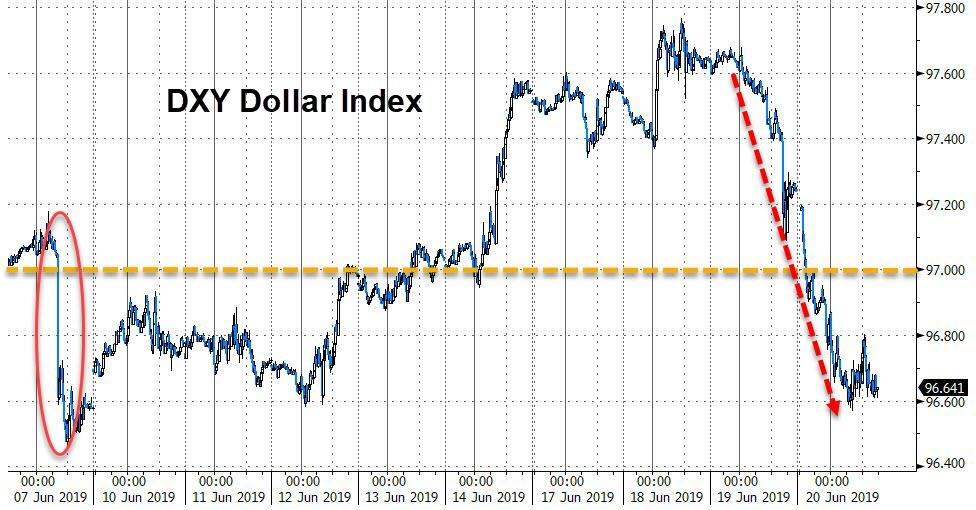

The dollar was dumped – the biggest two-day drop since Feb 2018…and DXY back below the 97.00 level…

Yuan has strengthened notably, trading stronger than the CNY fix for the first time since April

Cryptos were mixed with Bitcoin gains, Litecoin and Ripple fading…

Bitcoin surged back up toward $9500 (highest since May 2018)

Commodities were all higher on the day but Iran dowing a US drone sparked a huge spike in oil…

Gold soared up near $1400 overnight, fell back, then accelerated higher once again as US-Iran headlines hit…

This was Gold’s biggest day since Oct 2018, spiking to its highest since 2013…

Gold in Yuan is at its highest since April 2013…

Oil prices exploded higher (biggest day since 2018) on the US-Iran headlines… (this is the biggest 3-day spike since Dec 2016)

Finally, US (and Europe) markets’ expectations for central bank rate-cuts have collapsed to cycle lows (52bps of cuts in 2019 and 86bps of cuts by the end of 2020)…

Since The S&P 500 record high in September 2018, gold is up 15% and 10Y bonds total return is almost 11% (with stocks unch)…

And in case you’re wondering what’s driving stocks back to record highs… Simple – global money supply has surged once again to rescue markets…

via ZeroHedge News http://bit.ly/2XXwZYI Tyler Durden