Gold!!! Dramatically outperforming since The Fed capitulated…

The market’s response to Powell’s promises this week… It’s Never Enough!!

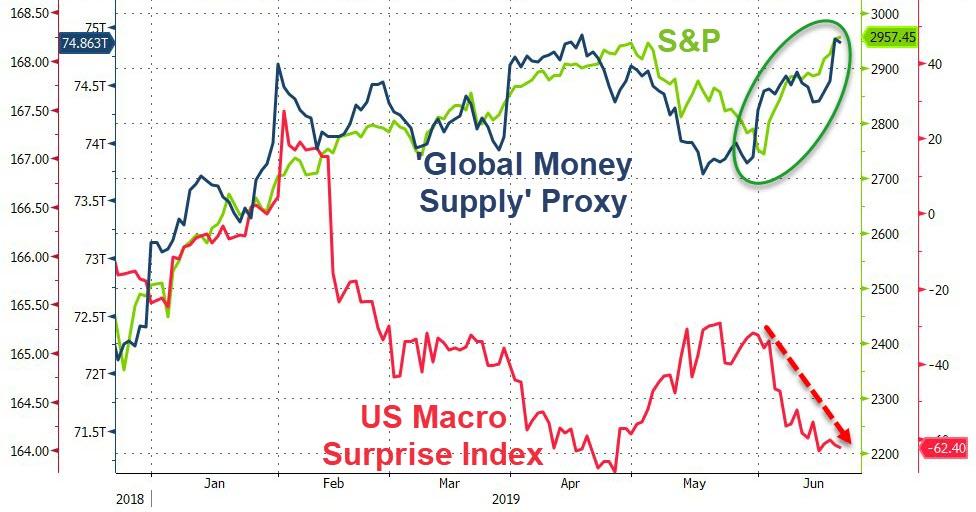

Global stocks are pushing up near record highs once again (but BAML points out that consensus 12 month forward global EPS growth expectations has turned negative (-0.3%) for first time since Sept’16)

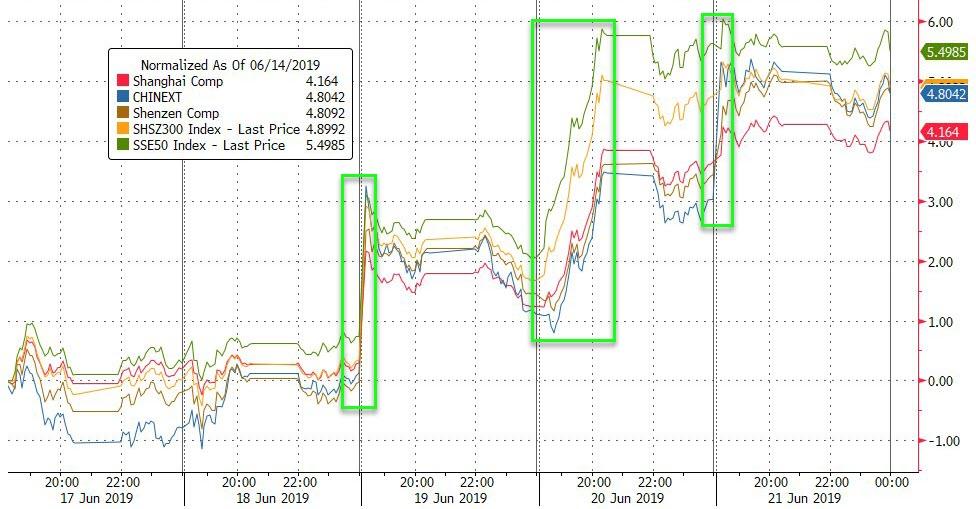

Big week in Chinese stocks with SHCOMP back above the crucial 3000 level (barely)…

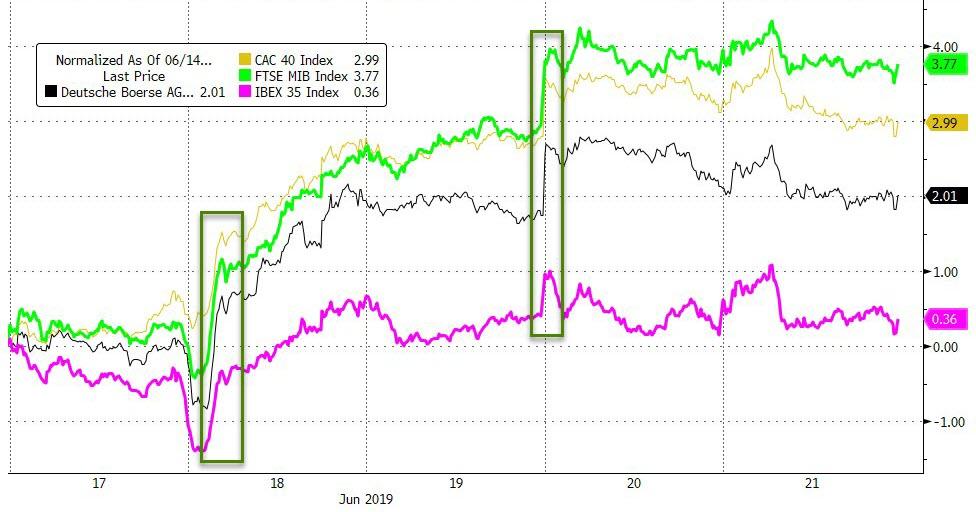

Spain barely managed gains on the week (despite the world’s central banks all promising moar) but Italy outperformed…

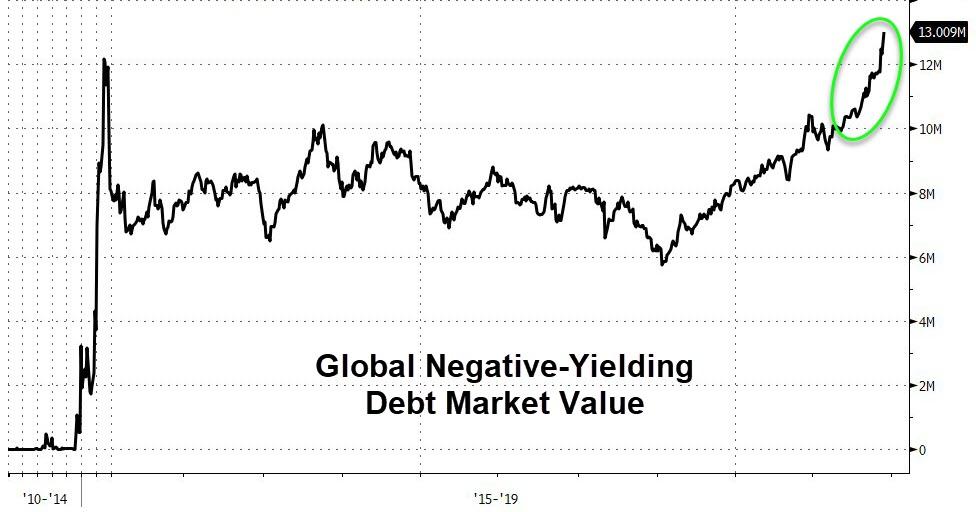

Global negative-yielding debt exploded this week, now at a record $13 trillion market-value…

Not surprising with so much of European sovereign debt now trading below 0…

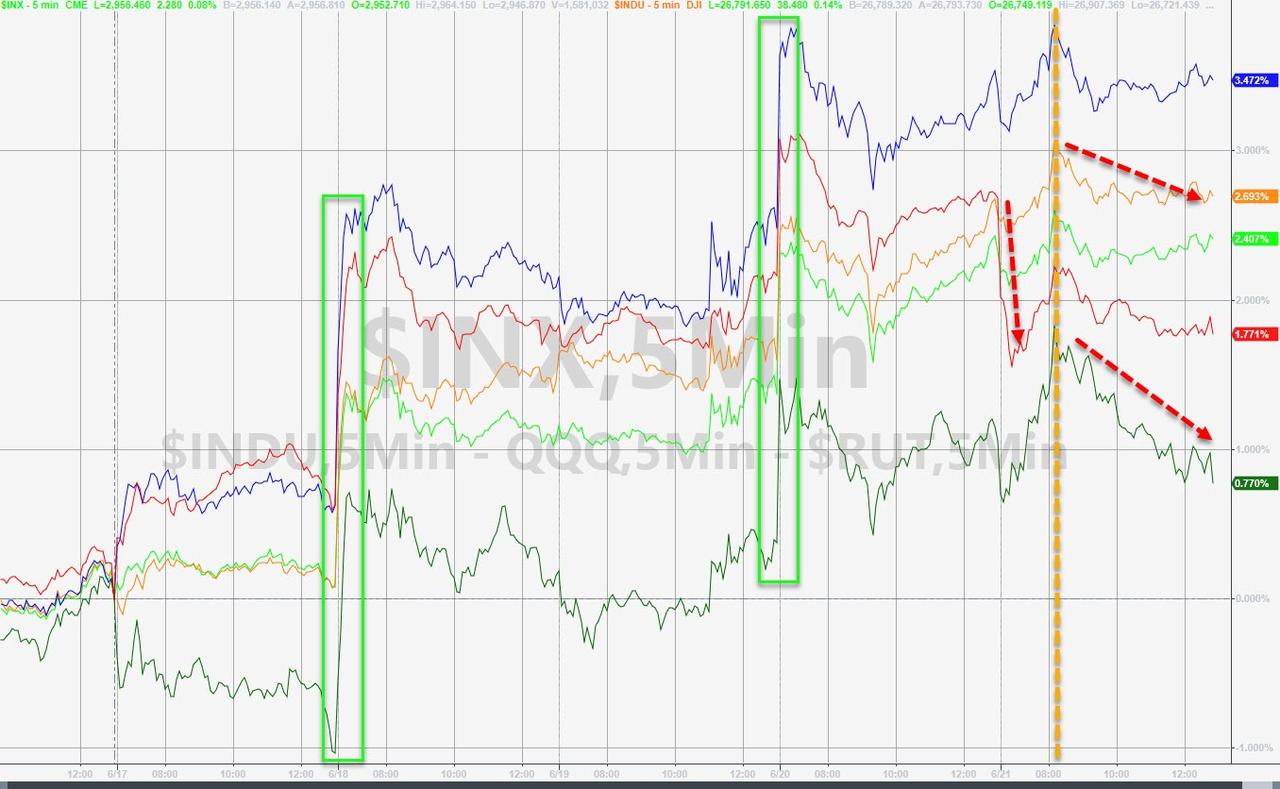

US equity markets love war, love dismal economic data, and love Fed promises of moar liquidity – that’s all there is really…Nasdaq outperformed, Trannies were the laggard but still managed decent gains.

Small Caps are unch post-Powell…

And today saw stocks peak at the European close and fade the rest of the day to all close red with Small Caps the biggest losers…weak close as quad witch volumes hit

Transactions on S&P 500 stocks spiked on the quadruple witching open, when options and futures on indexes and stocks expire.

“They amplify/exacerbate moves in the markets as institutions update large derivatives positions,” Russ Visch, a technical analyst with BMO Capital Markets.

“My general advice is to be wary of any outsized moves in quad expiry weeks because it may be nothing more than someone getting caught on the wrong side of a trade and/or unwinding a big position.”

S&P is on target for the best June since 1995

Intraday, markets surged on headlines that VP Pence would cancel his China-Bashing speech (which he already had) citing “progress” with China, but that was dismissed by Chinese media demanding all sanctions be dropped before talks could progress. Peter Navarro also took some of the shine off the week when he warned of no deal being a possibility at around 1400ET but that didn’t last long. Still, given that it was a quad witch, the pinning around unchanged today was notable and then an ugly close…

The Dow broke above the Jan 2018 high level that has been resistance since…

Will it hold?

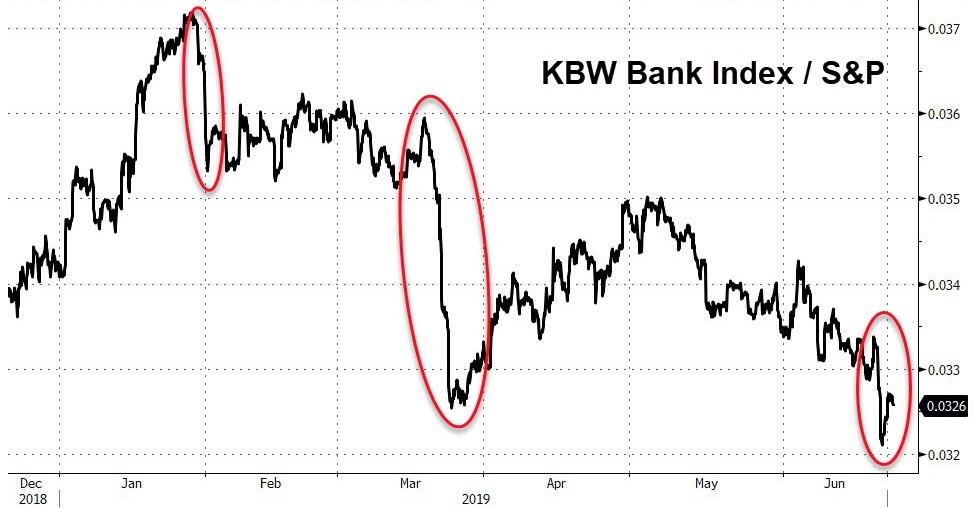

Bank Stocks are at their weakest relative to the S&P since Sept 2016…

VIX decoupled from stocks today as – odd as it may seem – some investors decided to hedge…

Global bond yields are collapsing as global stocks soar back to record highs…

Treasury yields tumbled in the middle of the week…but rebounded notably today (on thin volumes) leaving 30Y underperforming – unchanged…

10Y Yields managed to scramble back above the crucial 2.00% level today as stocks were bid…

The yield curve steepened notably on the week (which is the signal for imminent recession as the curve shifts from deep inversion to steepness once again)…

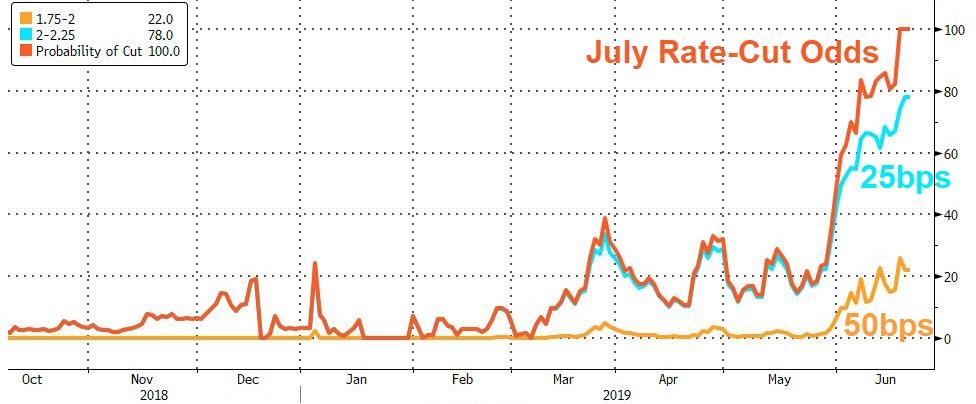

Markets are now convinced 100% that The Fed will cut in July (22% chance of 50bps cut and 78% chance of 25bps)

The Dollar (DXY) suffered its worst week since Feb 2018 (down over 1%), dumping to its lowest weekly close since March …

But most notably, the dollar puked below its 200DMA… (this is the biggest penetration of the 200DMA since May 2017)

Yuan mirrored the USD, spiking to six-week highs before fading today…

Bloomberg’s Robert Fullem notes that Chinese iron ore prices are soaring but the Australian dollar isn’t, splintering their typical relationship.

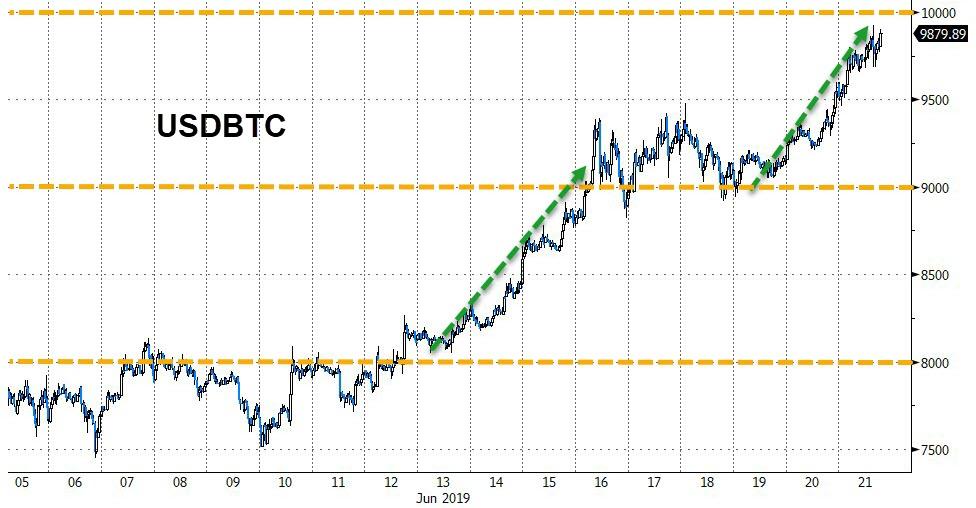

Bitcoin surged this week, nearing the $10,000 Maginot Line…

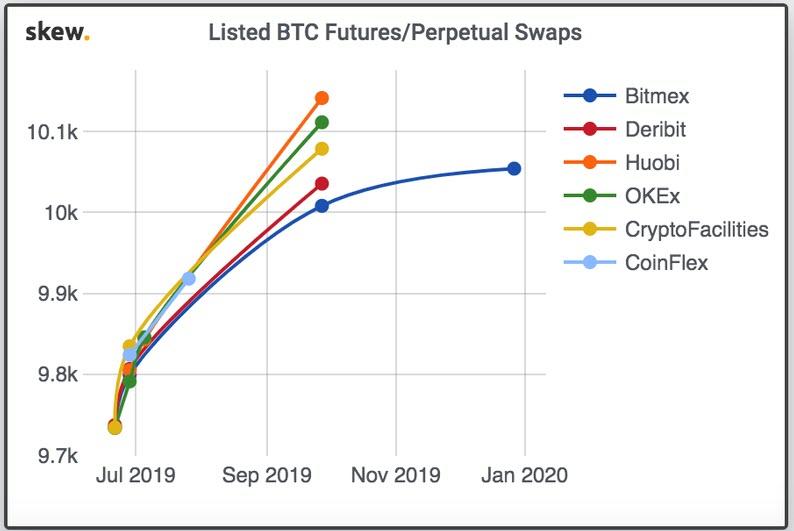

Bitcoin futures did get above $10,000 however…

More notably, all September futures have already breached $10k on the crypto native platforms.

All the major cryptos gained (shrugging off any FacebookCoin angst)…

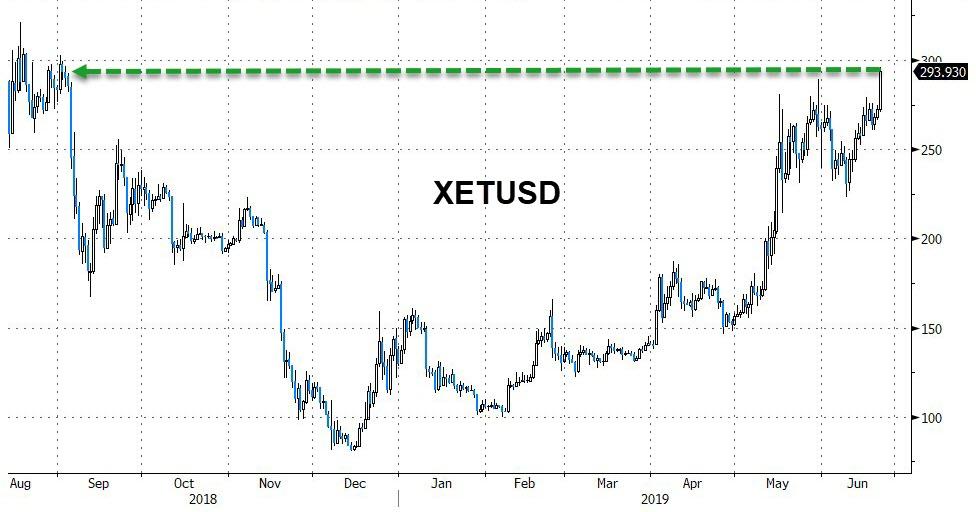

Ethereum surged late in the day, topping $295 for the first time since Sept 2018…

A weak dollar and safe-haven flows from Iran sent all commodities higher this week…

Oil surged this week on Iran tensions, jumping 9.5% – the best weekly gain since Dec 2016 (Trump election reflation euphoria)…

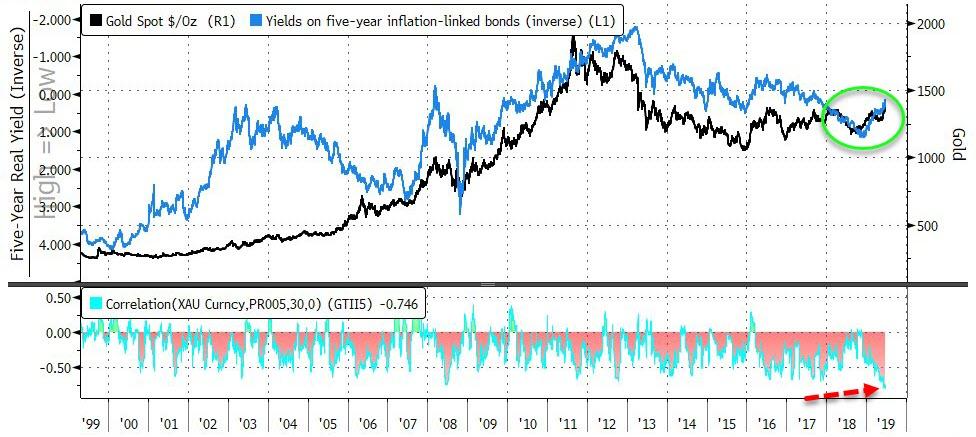

Gold is up for the 5th week in a row, topping $1400 with its best week since April 2016, pushing to its highest since Sept 2013…

As Bloomberg’s Ye Xie notes, Gold and real-yields have never been as tightly bound as they are now. That probably means the metal’s rally has squeezed as much as it can from the bond market, which has priced in a fair amount of rate cuts. For bullion to climb further, it’ll need help from the dollar. The 30-day correlation between rates on five-year linkers and gold prices reached -0.79 this week. That’s even tighter than during the global financial crisis. The post-crisis average is -0.3.

The stronger correlation means that buying gold is essentially buying inflation-linked bonds. It’s a bet that real yields will keep falling, which increases the appeal of assets that don’t offer yield. But without a weakening dollar, there’s a limit to the gold rally.

Finally, some chart food for thought…

It’s all about Fun-Durr-Mentals…

Stocks are Cheap…

How expensive are equities? Price/tangible book at 10.8x is nearly double the historical norm, a record high that is 24% above the dotcom bubble peak and represents a 3 SD event. In a word – froth. pic.twitter.com/NlnUtpz5Pi

— David Rosenberg (@EconguyRosie) June 21, 2019

Because all that matters is central-bank-liquidity…

via ZeroHedge News http://bit.ly/2Y3LQAT Tyler Durden