A new report from LendingTree analyzed thousands of MyLendingTree users’ anonymized credit reports in 165 metropolitan cities across California reveals the most debt-ridden places in the state.

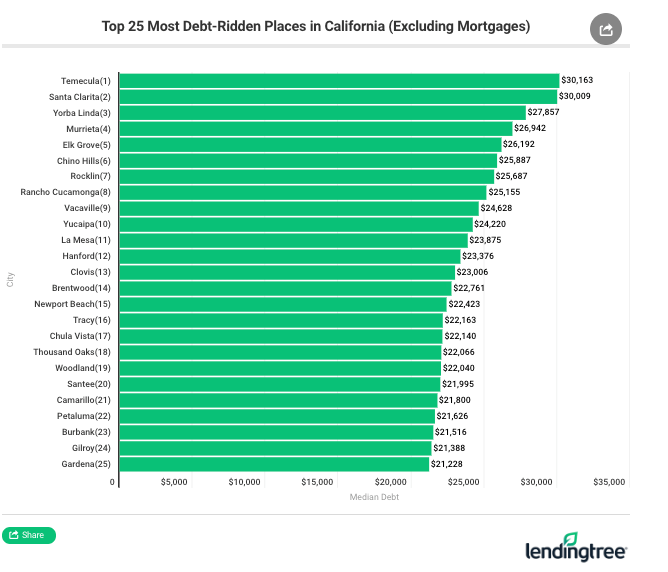

LendingTree found the highest median non-mortgage debt was located in Southern California (SoCal). About 60% of the top 25 cities with the highest non-mortgage debt were located in SoCal cities.

Temecula, a city in SoCal, is the most debt-ridden city in the sate. Its residents had approximately $30,100 in debt, with 41% of their debt linked to auto loans.

Residents of SoCal have some of the highest non-mortgage debt in the state. In Hanford, residents typically had 50% of the non-mortgage debt in auto loans.

La Mesa, a city in SoCal, located 9 miles east of Downtown San Diego in San Diego County, was found to have the most amount of student loan debt than any other city in the state, at 28%, totaling $10,504 per resident.

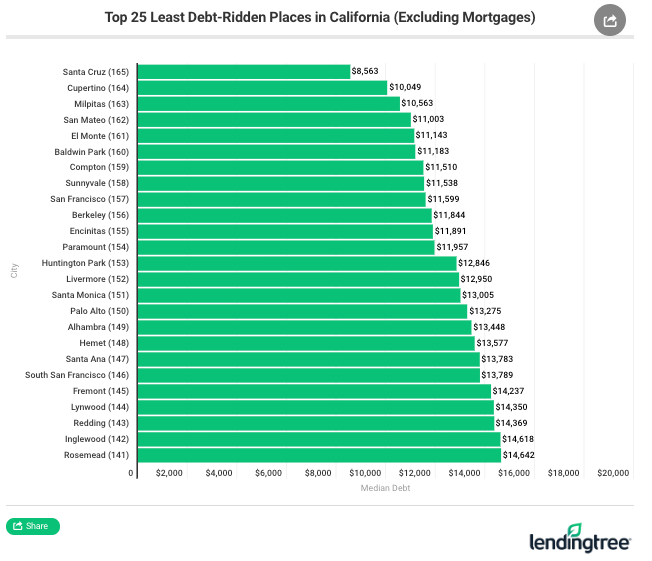

Student loan debt was the largest share of non-mortgage debt in 19 California cities. Berkeley was one of the least indebted California cities (No.156); nearly half of the non-mortgage debt carried by a resident was student loan related.

Non-revolving credit, i.e., credit card, was a top source of debt in only eight of the cities.

Across all cities, credit card and student debt was about 50% of the consumers’ debt portfolio. About 86% of Californians carried a credit card balance, while 19% had student debt.

Santa Cruz, a city on central California’s coast, had the least amount of non-mortgage debt among residents on average was $8,563.

Los Angeles, the largest California city, ranked no. 135 for median non-mortgage debt amount. San Jose was at no. 137, San Francisco ranked no. 157, and San Diego ranked no. 77.

Besides Santa Cruz and San Jose, residents in Palo Alto, Cupertino, and Sunnyvale, also carried some of lightest non-mortgage debt.

And with the US economy cycling down through the summer, the probabilities for a recession in 1H20 have been surging. Californians are in no way shape or form prepared for the next downturn.

via ZeroHedge News http://bit.ly/2RqUVkI Tyler Durden