There was some confusion this morning when the US Treasury announced it would auction off a 10Year reopening (9-Years, 11-Months), at the odd time and date of noon on Friday, unlike the traditional time of 2pm on Thursday.

So what’s going on. Well, on Thursday, the Treasury Department reminded investors that it announced on May 1, 2019, its intent to conduct a live small-value contingency auction operation in the second calendar quarter of 2019.

The reason: “Treasury believes that it is prudent to regularly test its contingency auction infrastructure. This small-value contingency auction operation will be on June 21, 2019. This will be a 9-year 11-month note auction.” Unlike traditional auctions, this was a small test to make sure the Treasury’s emergency infrastructure is operational, and as the Treasury disclosed, for this live “small-value contingency auction operation”, the following conditions applied:

- Bids shall be submitted by telephone to Treasury’s fiscal agent the Federal Reserve Bank of New York (FRBNY).

- Only primary dealers, as designated by FRBNY, may submit bids.

- Each primary dealer can submit up to 5 competitive bids.

- Net long position (NLP) reporting will not be required for this coupon.

- Each competitive bid must be at a separate yield.

- Customer bids will not be accepted.

- Noncompetitive tenders, including FIMA tenders, will not be accepted.

- SOMA will be accepted.

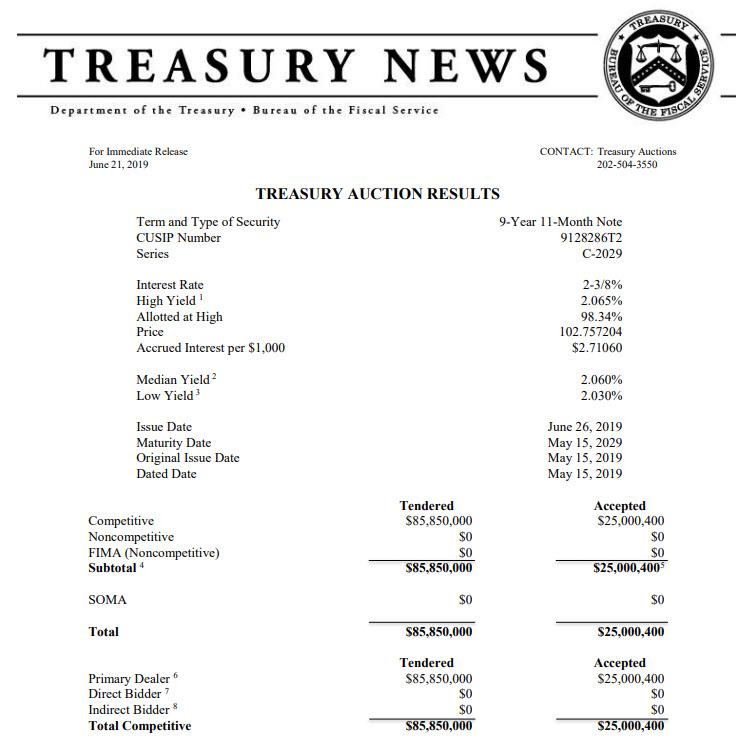

Moments ago the results were announced, and the details were as follows:

- Size: 25 million

- Maturity date: May 15, 2029 (9-year, 11-month reopening on Cusip 6T2)

- Yield allotted at high: 2.065%

- Bid to Cover 3.43

- Awarded to Primary Dealers: 100%

- By implication, awarded to Directs and Indirects: 0%

So while the auction was immaterial from a gross or net debt issuance standpoint, it confirmed that its “contingency auction infrastructure” is operational, which means that under emergency conditions where dealers can only buy US Treasuries via telephone – needless to say those conditions would be especially concerning for the broader US and global economy – the US government will still be able to fund itself.

via ZeroHedge News http://bit.ly/2N0asJH Tyler Durden