The verdict on whether trade war with China will escalate to the max has yet to be delivered, but the fallout is already here.

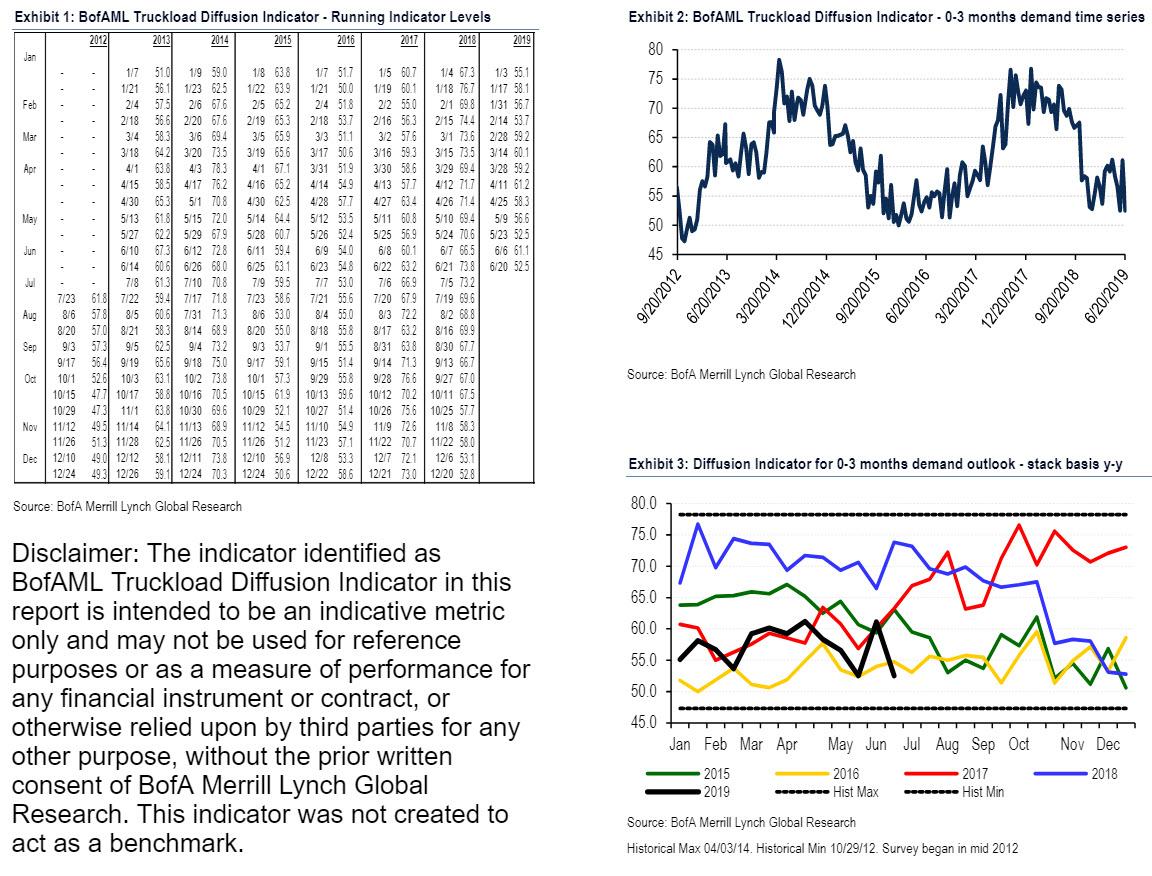

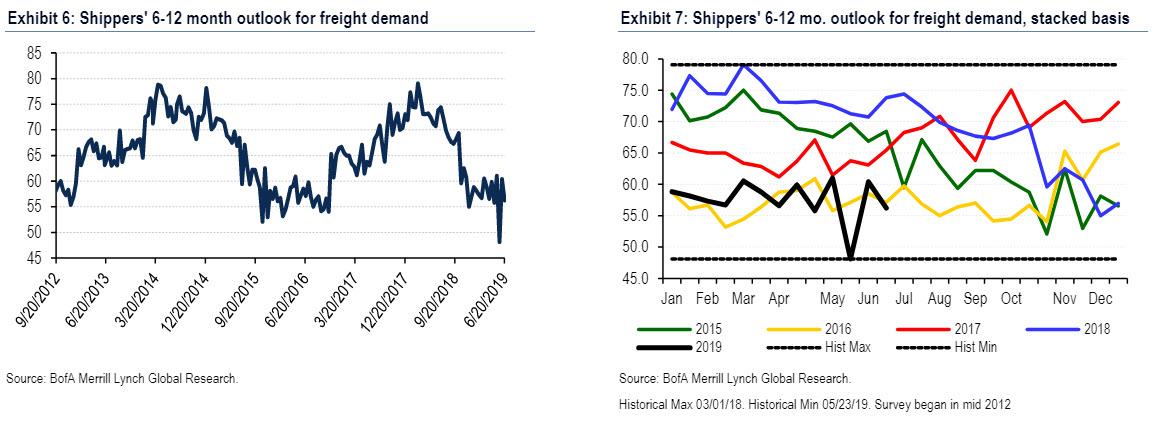

According to Bank of America’s proprietary bi-weekly Truckload Diffusion Indicator for shippers’ 0- to 3-month freight outlook declined significantly this week, to 52.5 from 61.1 last issue, back to the same level it was two weeks ago, hitting its lowest level since October 2016. The 14% sequential decline completely reverses last issue’s surprise 16% increase.

This is how stunning the plunge in the US trucking industry has been: the indicator is down 29% year-over-year, its 21st consecutive and largest year-year decline in the history of the BofA survey, as well as the longest negative year-year stretch since mid-2016.

Furthermore, shippers’ short-term (0-3 month) positive outlooks decreased to 30% from 39% in the June 20 survey, which polled 40 shippers across the U.S. to get current views on freight demand and supply, while Neutral outlooks decreased to 48% from 53%, and Negative outlooks rose to 23% from 8%.

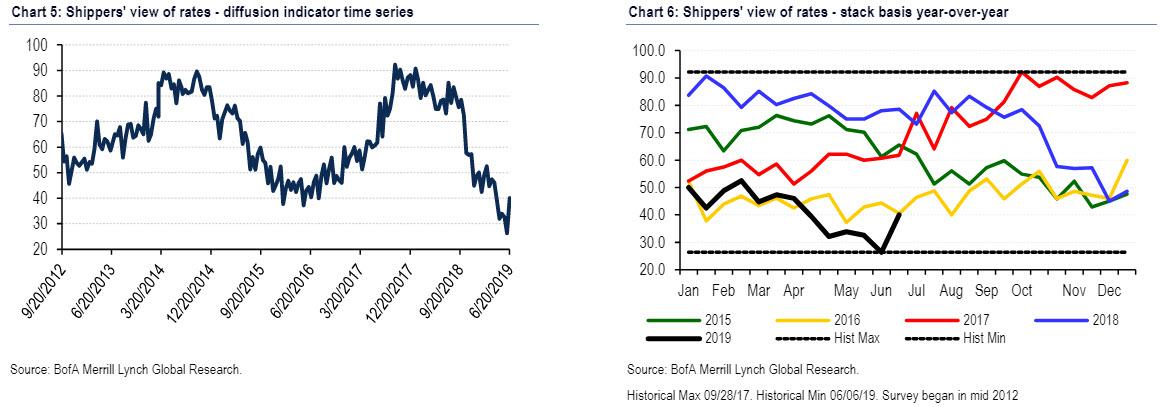

There was some good news: with respect to rates, 33% of shippers expect rates to fall, down from 53% last issue, 55% of shippers expect rates to be flat, from 42% last issue, while 13% of shippers expect rates to rise, from 6% two weeks ago. Also, the Rate Indicator bounced to 40.0 from its all-time low of 26.4 last issue.

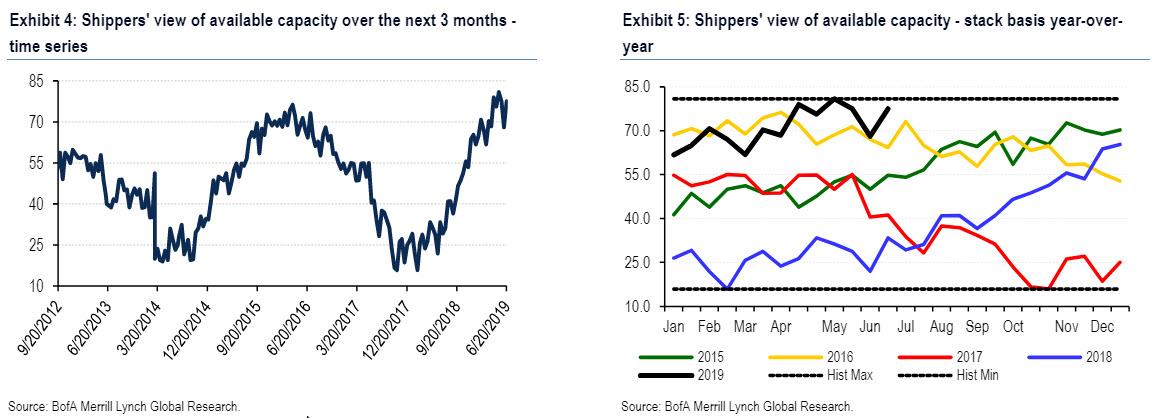

On capacity, 63% of shippers expect capacity to increase, from 50% last survey, 30% expect fleets to remain flat, down from 36% two weeks ago, and 8% of shippers expect capacity to contract, down from 14% last issue.

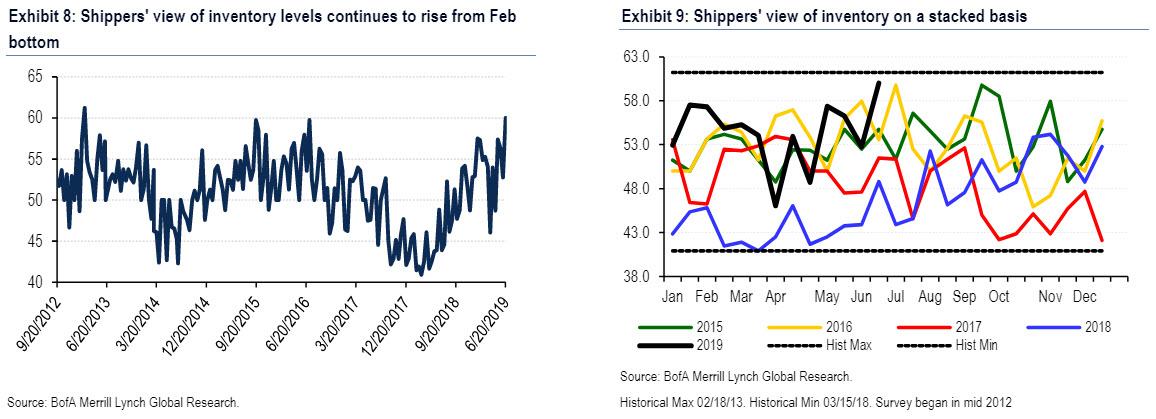

Within their own business, 70% of shippers believe their inventories are balanced, up from 67% last issue, and 5% of shippers believe their inventories are low, down from 14% two weeks ago.

The improvement likely derived from a solid Spring week of weather, pre-shipping ahead of China (and proposed Mexico) tariffs, a 3.3% rebound in that week’s S&P 500, that week’s Road Check, a period where capacity self-removes itself from the market, which can appear to cause a contraction in available supply, and a sharp drop in net orders.

That said, the survey responses demonstrated the key reasons behind the resent plunge in sentiment: Here are some of the shipper comments received by BofA:

- A shipper from the Southeast noted that Florida produce season always has an effect on his company’s Southeastern capacity, so it’s just a matter of how tight it will be. He noted that so far this year, it has not affected his company’s ability to get trucks. He highlighted that “this is the quietest he has seen it in his 20 years in Florida through May and June.“

- Another shipper from the Southeast noted that asset based companies are lowering prices to compete with the spot market, and expects this situation to level out in the next month or so.

- A shipper from the Manufacturing industry noted that dry van and flatbed carriers are lowering rates, even after his company’s 1Q/2Q bids.

- A shipper from the Midwest highlighted the urge for summer to arrive. He noted that consumption of food ingredients like tomato paste (ketchup), sweeteners (beverages), and flour (buns/bread) is off pace likely due to a chilly spring.

- A shipper from the South believes that major weather or hurricane will be the only disruption to the industry.

- A shipper from the Lumber & Wood industry noted that the construction sector is still struggling due to weather issues in key markets her company services. She expects the demand for wood products over the next six months to be flat to less. She highlighted that truck supply isn’t an issue and it helps her company keep rates in check.

Going back to BofA’s trucking indicator, it returned to its downward trend experienced since a mini-peak in mid-April, following a surprising uptick last week. As BofA said at the time, it was “caught by surprise by what was the largest sequential increase in the history of our survey last issue, to 61.1 from 52.5″… but now it has plunged righjt back return to 52.5, not only matching multi-year lows, but its biggest drop in history.

BofA also notes a few truck closings (A.L.A Trucking and Penske Logistics layoffs) which are more in tune with the continued slide in the Indicator. As rail carloads are trending -2.4% quarter-to-date, our survey has hit lows from 2015-2016, and remains less than 10% above all-time lows. We do not anticipate a sharp recovery for carriers, and thus, favor companies with proven skill at navigating cycles, such as Knight-Swift (KNX, $32.61, B-1-7).

via ZeroHedge News http://bit.ly/2x9SXvQ Tyler Durden