Submitted by Michael Every of Rabobank

Ups and Downings

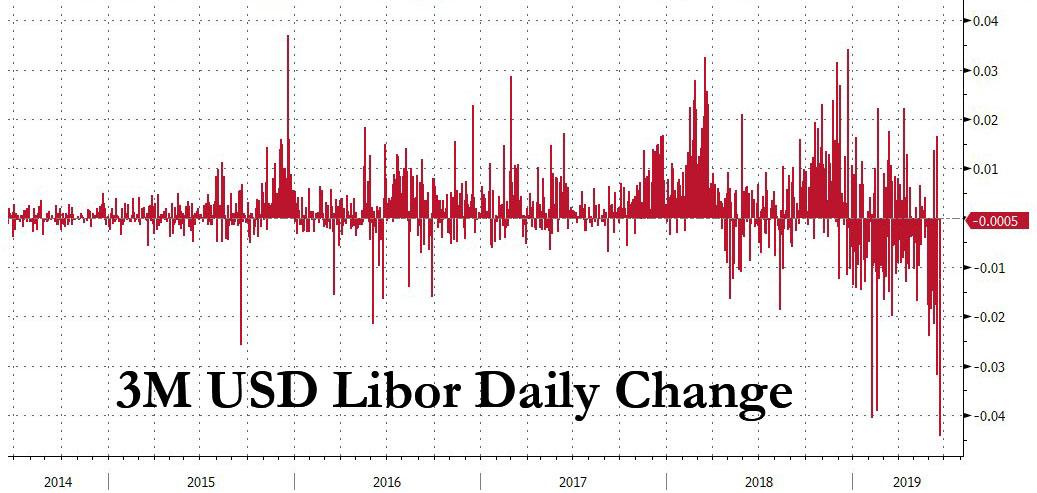

One Bloomberg headline says it all for markets: “All Time Highs in Everything American As Risk Rally Crescendoes” Yes, the S&P and Dow are at all-time highs and the talk is of when, not if, US bond yields hit all-time lows even before the Fed has made its first cut in this cycle. Indeed, USD Libor plunged the most in a decade yesterday and the US 10-year is flirting with below 2%, while there is chatter of both sub-1% and sub-zero. Frankly, would you rule either scenario out?

That will put even more pressure on the ECB and the BOJ and the PBOC to keep slashing rates too. Yet two of the three already have rates below zero, so what can they do? Either face a deflationary slump, or kick out the jams on fiscal policy. Of course, that takes us to lunatic monetary policy and lunatic fiscal policy combined, and a not very covert attempt at currency depreciation. Yet this was always the likely endgame in my eyes, not the recovery and rate normalisation we have been mis-sold for years. It certainly isn’t the sudden “But how did we get here?!” revelation this all seems to be for some (…he writes, thinking of that market talking-head who was speaking of 4% US 10-year yields not so very long ago.)

Meanwhile, in China it isn’t the cost of money that’s the issue, it’s the quantity – which is effectively limitless (just look at all the build-now-ask-questions-never projects permanently underway). However, money won’t flow where they want it to because China is suffering from both Soviet-itis, with its profitless look-at-me! gigantism, and New-normal-osis, where new credit can’t get to the parts of the economy which would benefit most from it.

Of course, US President Trump is not going to stand still if he sees other economies trying to do more on the monetary front when they are already below zero or providing endless free money….and that takes our problems to a whole new level. If you really understand that dynamic it isn’t an upper for equity markets, but for bond yields the path is unobstructed, fifty-feet wide, smooth as glass, and brilliantly lit. In short, I am talking about geopolitical risk, which naturally emerges when a financial and economic paradigm is no longer working – and can anyone claim that ours is working particularly well? (Besides the imminent “Dow 27,000!” baseball-cap-wearing crowd.)

Indeed, overnight we saw Iran shoot down a high-altitude US drone–or for the cynics, did America shoot down its own drone?–and an initially hawkish response from Trump that had many scrambling for cover. Fortunately, the president again then made clear he genuinely isn’t trigger-happy, suggesting Iran might have shot down the drone because of ‘fat finger’ error. Even so he laid down a clear red line: oil tankers and drones are fair game – but if one American life is lost, all bets are off.

As I tried to point out earlier this week, this drone downing is because US, and USD, hegemony is being pushed back at. The awesome power of the demand for the greenback, and for US Treasuries, is unlikely to abate in a world of trade tensions and sanctions that stifle the flow of USD to China, Iran, Russia, and North Korea while there is no alternative architecture to replace its functionality. All of these states are being stifled as a result without a shot being fired. Yet all have awesome power of their own unrelated to finance or money. The strategic imperative therefore remains for them to shift towards that other sphere, or to threaten to, especially with the US making clear even one American soldier’s life is precious.

What goes up and what goes down if the US stands up for itself? And what goes up and what goes down if the US backs down? And won’t there be continued pressing if the US does back down? Consider that dynamic–rather than baseball caps–very, very carefully. So let’s watch what China’s Xi and North Korea’s Kim have to say at the end of their two-day pow-wow; and let’s watch Turkey closely, where President Erdogan is threatening to put tariffs on the US if Washington DC sanctions it for buying Russian weapons, and to buy alternatives to the US F-35 fighter jet (from Russia or China). Unsurprisingly, it was TRY and not USD that went down 1.6% on that headline.

In a very different sphere the UK and Europe are also seeing their own ups and downings. Boris Johnson is clearly on the up, and he will now face Jeremy Hunt in a final, rolling stand-off to be the next British PM, a contest which appears merely perfunctory at this stage. His own future Chancellor, Philip Hammond, however, has come out to say he will do everything he can to thwart the Hard Brexit that Johnson is not afraid of. As a result, I suspect Hammond will be around as long as a US navy drone over the Straits of Hormuz.

Meanwhile, in Europe there is no agreement on any of the candidates for any of the top jobs (you know, the unelected positions that hold the real power). “Electing a Pope is easier,” says the Irish PM. So Europe is divided, most so on the key Franco-German axis, and has no game plan to move forwards when Brexit, Italy, Iran, China, and the threat of a slump and deflation must be dealt with. At least 10-year Greek bond yields are down to record lows of around 2.57%… though didn’t they first come up with the term Pyrrhic Victory?

via ZeroHedge News http://bit.ly/2N3TI4d Tyler Durden