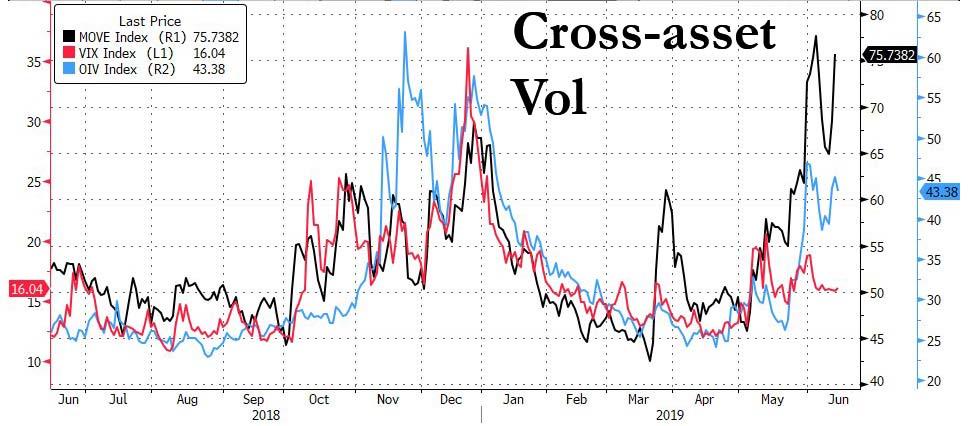

Just days before the FOMC meeting we showed that while equity volatility had remained oddly subdued heading into the event risk of the FOMC/G-20 double whammy, both rate and commodity vol had spiked to levels indicating a prevailing sense of nervousness with the broader market, at least as expressed by non-equity investors.

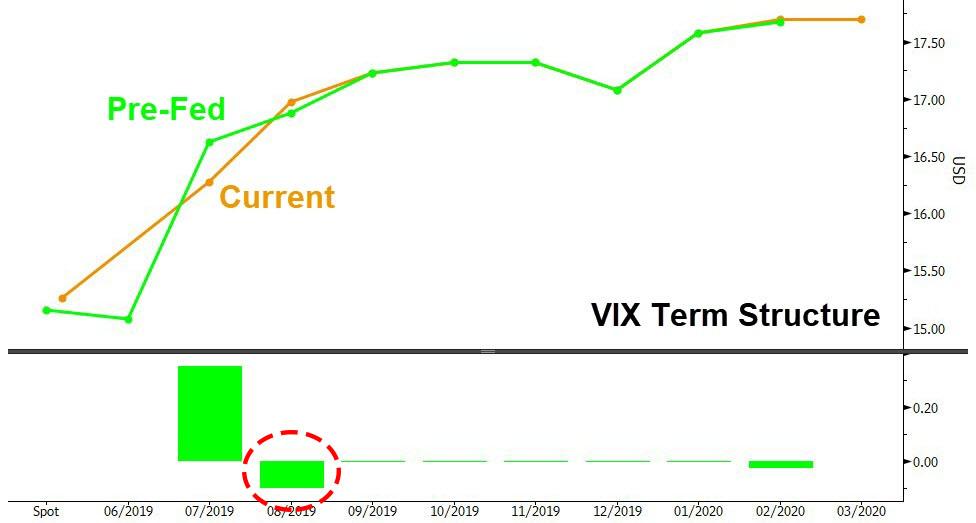

Then, in the immediate aftermath of the dovish Fed announcement which saw the Fed lose its “patience” and guide to a July hike (with the market now pricing in roughly 30% of a 50bps double-cut next month), spot and July VIX, which expires pre-FOMC, fell sharply on the news but have bounced since while the belly of the curve is now higher than before the meeting.

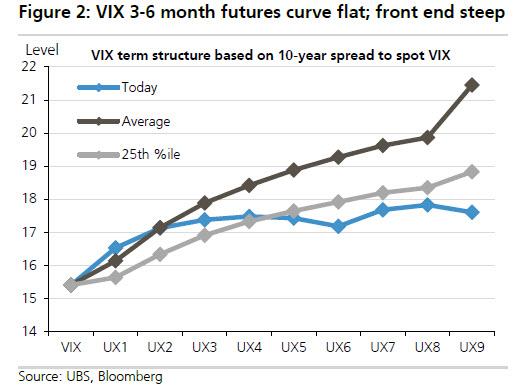

Commenting on the recent moves in the VIX curve, UBS’ Stuart Kaiser writes that it “is quite flat with slopes at each point well-below average other than the very front end (Figure 2).”

As a result, UBS notes that 3-6 month futures have minimal roll-down and levels about 5 points below the 20 typical during stress periods, and estimates that VIX fair value is in the 17-20 range.

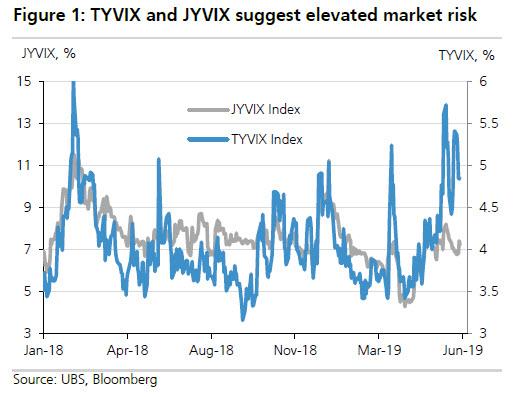

Meanwhile, as noted above volatility was far more bouncy across other assets, with both yen and 10-year Treasury VIXs have also risen after initial declines suggesting surprisingly little change to the already nervous cross-asset market risk sentiment (Figure 1).

UBS further predicts that with G20 next weekend and ISM and payrolls reported the following week implied volatility is likely to find support near current levels until holiday timing pulls it lower.

The bottom line: the Fed bought some (very near term) vol reprieve but, like a true addict, the market is already looking for the next fix and the central bank “catalyst” that will ease any potential build up in anxiety, as manifested by the modest increase in forward VIX, manifesting itself by the belly of the curve higher than pre-FOMC. Having learned that they can order the Fed to do just about anything, traders are already outlining their ultimatum to Powell, that any surprise in July, and the previously stock market gets it.

Meanwhile, even as UBS notes that it is “tactically positive global equity markets and estimate about 3.5% upside to fair value, all else equal, from a 25bps lower discount rate consistent with revisions to the long term dot”, the risk remains that the Fed’s string is getting too long and soft to push on it: as Kaiser concludes “the challenge for risk assets will be balancing lower rates with the slower growth outlook necessary to justify them.“

Said otherwise, rates are lower for a reason, and while for now the house of cards remains comfortably erect, as low interest rates remain a bullish catalyst for stocks, there will come a time when not even Millennial equity traders will be able to avoid the recessionary subtext that ever lower inflation breakevens and rates imply, and that there is only so much the Fed can do to prevent a recession while keeping risk assets at all time high. It goes without saying that should the PIMCO nightmare scenario come true, according to which “central banks’ control over market is coming to an end”, then all bets are off.

via ZeroHedge News http://bit.ly/2NljaT8 Tyler Durden