Now that the Fed’s capitulation is complete and “Powell has thrown in the towel”, bending the knee to Trump, the event baton passes from central banks to politicians this week with the big highlight being the G-20 summit and a potential meeting between President’s Trump and Xi. Prior to that, DB’s Craig Nicol writes that there is still the possibility of a confrontational speech on China by Vice President Pence. Meanwhile, data highlights include PCE inflation in the US and preliminary June CPI reports in Europe. We’ll also get plenty of survey data in the US. Fed Chair Powell will speak and part two of the Fed’s stress tests results will be released.

Touching on those in more detail, the G-20 summit in Osaka next week will take place on Friday and Saturday. Expectations are that Trump and Xi will meet on the sidelines of the summit to continue trade negotiations that had seemingly broken down last month. Rhetoric in recent days from both sides has signaled an openness to resume discussions and consensus expects a talk but no deal driven by the intuition that both sides would still like to avoid an economically fatal escalation in tensions, and given that both heads of state would be personally invested in this meeting. The main thing to watch in this case is how short the fuse is on a final deal; i.e. if and for how long the next round of US tariffs are put on hold. In any case, the meeting should provide some direction for markets on where the trade war is heading next.

Prior to this, on Monday US Vice President Pence is tentatively scheduled to give a speech on China. This is the speech which was initially scheduled for the anniversary of the Tiananmen Square massacre, which President Trump delayed to avoid potentially raising tensions with Beijing ahead of a potential meeting with Xi at the G-20. Therefore, it remains to be seen if the speech will still go ahead for the same reason. Bloomberg have reported that there are staff-level disputes over the actual content of the speech with some advocating for a delay. However the same story also suggests that Trump supports Pence in delivering it.

As for data, we’ll have to wait for Friday for the main event with the May PCE inflation report in the US. The consensus is for a +0.2% mom reading for the core PCE which would leave the year-on-year rate at +1.6% and therefore below the Fed’s target. We will also get preliminary June CPI readings due in Europe including data for Germany and Spain on Thursday, and France, Italy and the Euro Area on Friday. The IFO survey in Germany on Monday is also worth a watch.

Other data worth flagging in the US includes the preliminary May durable and capital goods orders data on Wednesday and the third and final revision of Q1 GDP on Thursday. The current expectation is for growth to be lifted one-tenth to +3.2%. Also worth flagging are the various regional Fed surveys. We’ve got June surveys due from the Dallas Fed on Monday, Richmond Fed on Tuesday, Kansas Fed on Thursday and then the Chicago PMI on Friday. A reminder that two of the June surveys that we got this week – the empire manufacturing and Philly Fed business outlook – were mixed. The June consumer confidence reading is also due on Tuesday and final revisions to the June University of Michigan consumer sentiment on Friday.

As for Fedspeak, Powell is due to speak on Tuesday evening in New York to a council on foreign relations. On the same day we’re also due to hear from Williams, Bostic, Barkin and Bullard at separate events. Harker also speaks this weekend on Sunday.

Over at the ECB we’re due to hear from Nowotny on Thursday while the BoE’s Carney and colleagues testify on the May inflation report on Wednesday. Also worth flagging at the Fed will be Thursday’s results from part two of its annual bank stress tests. This will confirm which banks have sufficient capital to increase dividends and share buybacks. The results from part last Friday showed that, surprise, all banks passed.

As for other things to watch out for next week, this weekend leaders from the Association of South Asian Nations meet for their annual summit. On Tuesday President Trump’s Middle East advisers are due to hold an economic development summit in Bahrain. On Wednesday NATO defence ministers are due to meet in Brussels for two days of talks. Also on Wednesday, twenty contenders for the Democratic presidential nomination are due to debate over two nights including Senator Elizabeth Warren and front runner Joe Biden. Finally, on Thursday the Mexico central bank rate decisions is due.

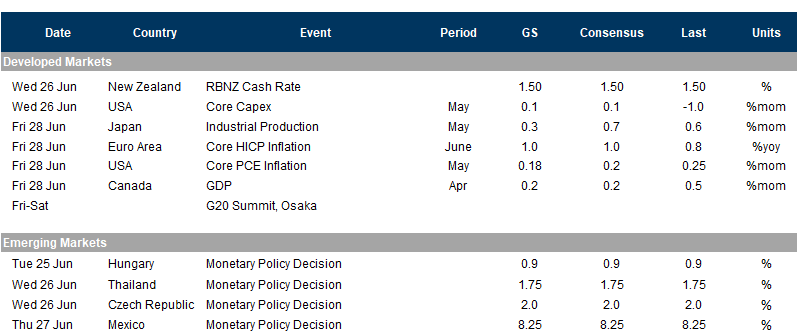

Courtesy of Deutsche Bank, here are the key events broken down by day:

- Monday: Data releases include the June IFO survey in Germany as well as the May Chicago Fed survey for May and Dallas Fed survey for June in the US. Elsewhere, US Vice President Pence is tentatively scheduled to give a speech on China.

- Tuesday: Overnight, the BoJ minutes will be released while data in Europe includes June confidence indicators in France and June CBI survey data in the UK. In the US we’ll get the April FHFA house price index, April S&P CoreLogic house price index, June Richmond Fed survey, May new home sales and June consumer confidence. The Fed’s Powell, Williams, Bostic, Barkin and Bullard are all due to speak.

- Wednesday: Data in Europe includes July consumer confidence in Germany while in the US we’re due to get the preliminary May durable and capital goods orders data, May advance goods trade balance and May wholesale inventories. The BoE’s Carney, Cunliffe, Tenreyro and Saunders are due to testify before the Parliament’s Treasury Committee on the May inflation report. Meanwhile, NATO defence ministers will meet in Brussels for two days of discussions, while the contenders for the US Democratic presidential nomination will start two days of debates.

- Thursday: Overnight, May retail sales data in Japan is due to be released along with May industrial profits in China. In Europe we get preliminary June CPI readings in Germany and Spain while in the US the third reading of Q1 GDP is due along with the latest weekly jobless claims reading, May pending home sales and June Kansas Fed survey. The ECB’s Nowotny is also due to speak, while part two of the Fed’s stress test results will be released.

- Friday: The G-20 meeting in Osaka will begin, continuing into the weekend with the expectation that President’s Trump and Xi will meet on the sidelines. The data highlight is the May PCE inflation report in the US. Prior to that we’ll get May industrial production and employment data in Japan, preliminary June CPI in France, Italy and for the Euro Area, and final Q1 GDP revisions for the UK. In the US we’ll also get the May personal spending and income data, June MNI Chicago PMI and final June revisions for the University of Michigan consumer sentiment survey.

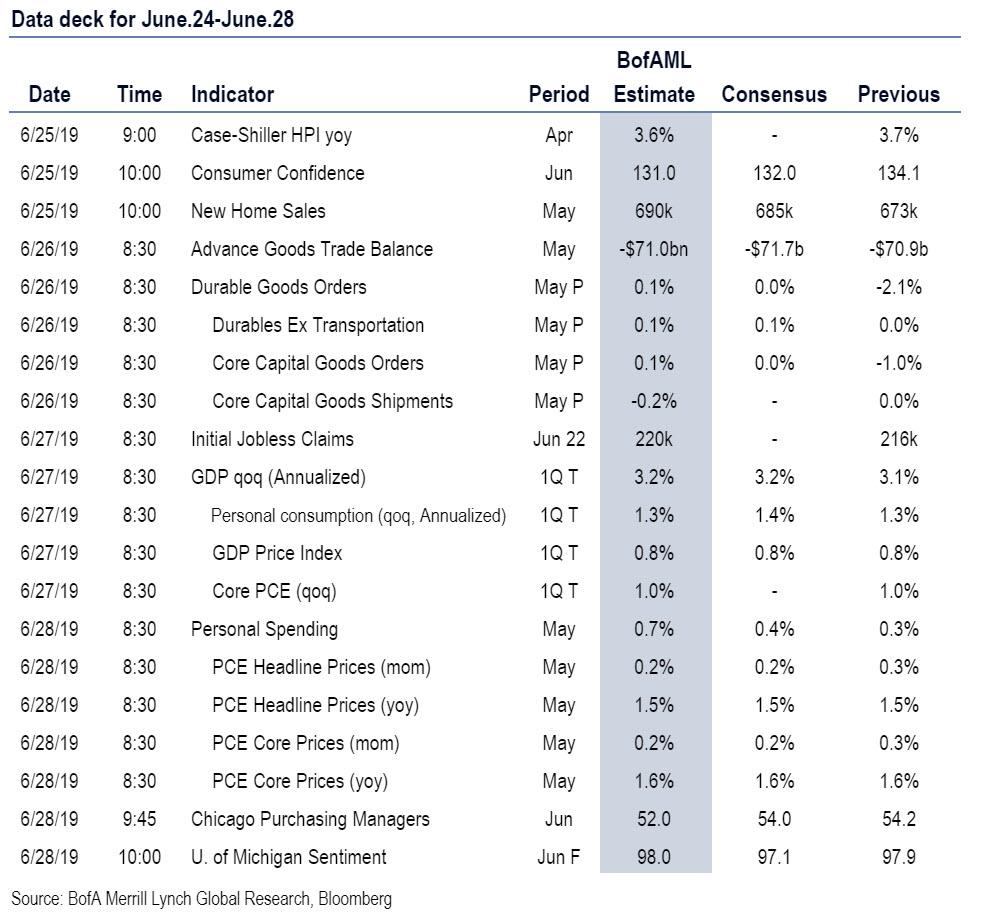

Finally, focusing on just the US, Goldman writes that “the key economic data release this week is the core PCE report on Friday. There are several scheduled speaking engagements from Fed officials this week, including from Chair Powell on Tuesday. The G20 Summit will take place on Friday and Saturday, June 28-29 in Osaka, Japan.”

Monday, June 24

- There are no scheduled major economic data releases.

Tuesday, June 25

- 08:45 AM New York Fed President Williams (FOMC voter) speaks: Federal Reserve Bank of New York President John Williams will give opening remarks at the OPEN Finance Forum in New York. Prepared text is expected; audience Q&A is not expected.

- 09:00 AM FHFA house price index, April (consensus +0.2%, last +0.1%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, April (GS +0.2%, consensus +0.1%, last +0.1%): We estimate the S&P/Case-Shiller 20-city home price index increased by 0.2% in April, following a 0.1% increase in March. Our forecast largely reflects the appreciation in other home prices indices such as the CoreLogic house price index in April.

- 10:00 AM Conference Board consumer confidence, June (GS 132.1, consensus 131.0, last 134.1): We estimate that the Conference Board consumer confidence index declined by 2.0pt to 132.1 in June, reflecting a drag to confidence from negative employment headlines.

- 10:00 AM Richmond Fed manufacturing index, June (consensus +4, last +5)

- 10:00 AM New home sales, May (GS +1.4%, consensus +1.8%, last -6.9%): We estimate that May new home sales rebounded by a modest +1.4% in May from a 6.9% decline in April. Single family permits declined in the two prior months, and mortgage applications were somewhat weak.

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Federal Reserve Bank of Atlanta President Raphael Bostic will speak on a panel on housing issues in Atlanta.

- 01:00 PM Fed Chair Powell (FOMC voter) speaks: Federal Reserve Chair Jerome Powell will give a speech on monetary policy and the economic outlook at the Council on Foreign Relations in New York. Prepared text and audience Q&A are expected.

- 03:30 PM Richmond Fed President Barkin (FOMC non-voter): Federal Reserve Bank of Richmond President Barkin will participate in a moderated discussion on the outlook for US-Canada business relationship.

- 06:30 PM St. Louis Fed President Bullard (FOMC voter) speaks: St Louis Fed President James Bullard will give welcoming remarks at a lecture at the St. Louis Fed.

Wednesday, June 26

- 8:30 AM Durable goods orders, May preliminary (GS -4.0%, consensus flat, last -2.1%); Durable goods orders ex-transportation, May preliminary (GS flat, consensus +0.1%, last flat); Core capital goods orders, May preliminary (GS +0.1%, consensus +0.1%, last -1.0%); Core capital goods shipments, May preliminary (GS -0.3%, consensus +0.1%, last flat): We expect durable goods orders retrenched by 4.0% further in May, mostly reflecting a further decline in commercial aircraft orders. We estimate core capital goods orders edged up by 0.1% and core capital goods shipments declined by 0.3%, as global manufacturing trends remain soft.

- 08:30 AM Advance goods trade balance, May (GS -$70.9bn, consensus -$71.4bn, last -$72.1bn): We estimate that the goods trade declined slightly to $70.9bn in May, following a decline in inbound container traffic.

- 08:30 AM Wholesale inventories, May (last +0.8%): Retail inventories, May (last +0.5%)

Thursday, June 27

- 08:30 AM GDP (final), Q1 (GS +2.9%, consensus +3.2%, last +3.1%); Personal consumption, Q1 (GS +0.9%, consensus +1.0%, last +1.3%): We expect a two-tenths downward revision in the final estimate of Q1 GDP to +2.9%, mainly reflecting an expected downward revision to consumer spending, partially offset by an upward revision to state and local government spending.

- 08:30 AM Initial jobless claims, week ended June 22 (GS 220k, consensus 218k, last 216k); Continuing jobless claims, week ended June 15 (last 1,662k): We estimate jobless claims increased by 4k to 220k in the week ended June 22, after decreasing by 6k in the prior week. There are no auto plant shutdowns this week.

- 10:00 AM Pending home sales, May (GS +1.5%, consensus +1.0%, last -1.5%): We estimate that pending home sales rose by 1.5% in May based on regional home sales data, following a 1.5% decline in April. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

Friday, June 28

- 08:30 AM Personal income, May (GS +0.4%, consensus +0.3%, last +0.5%); Personal spending, May (GS +0.6%, consensus +0.5%, last +0.3%); PCE price index, May (GS +0.15%, consensus +0.2%, last +0.31%); Core PCE price index, May (GS +0.18%, consensus +0.2%, last +0.25%); PCE price index (yoy), May (GS +1.45%, consensus +1.5%, last +1.51%); Core PCE price index (yoy), May (GS +1.54%, consensus +1.6%, last +1.57%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose 0.18% month-over-month in May, or 1.54% from a year ago. Additionally, we expect that the headline PCE price index increased 0.15% in May, or 1.45% from a year earlier. We expect a 0.4% increase in personal income in May and a 0.6% increase in personal spending.

- 09:45 AM Chicago PMI, June (GS 53.0, consensus 53.8, last 54.2): We estimate that the Chicago PMI declined by 1.2pt in June, following a 1.6pt increase in May. Previous regional surveys have been weaker, but the Chicago survey timing suggests some scope to outperform.

- 10:00 AM University of Michigan consumer sentiment, June final (GS 97.5, consensus 97.9, last 97.9): We expect the University of Michigan consumer sentiment index to edge down by 0.4pt to 97.5 in the final estimate for June. The resolution of the trade and immigration dispute with Mexico concluded after the preliminary reading, but we expect a possible drag from negative employment-related headlines. The report’s measure of 5- to 10-year inflation expectations dropped by four tenths to 2.2% in the preliminary report for June.

- Source: Deutsche Bank, Goldman, BofA

via ZeroHedge News http://bit.ly/2WVDE4g Tyler Durden