Authored by John Rubino via DollarCollapse.com,

The past few years have been a feeding frenzy for most major asset classes. Stocks blew through previous highs, as did trophy real estate, fine art, and, most recently, Treasury bonds.

A big part of the reason for what came to be called the everything bubble was the sense that with everyone else making easy money, the worst possible fate was to be stuck on the sidelines, a sentiment known as “fear of missing out,” or FOMO.

Gold, alas, wasn’t invited to this party and has languished far below its 2011 high, while bouncing off resistance at the $1,360 level five (!) times over the past five years.

That may have changed this month. As central banks move back into easing mode – with interest rates already at historic lows, implying that future cuts will take even more of the world into negative territory – and the US blunders ever-closer to a major shooting war, safe haven assets are suddenly in vogue. And gold has popped.

Now the emotional tone of the precious metals market borders on giddy, with dozens of recent headlines quoting analysts on their upwardly-revised gold price targets and new buy ratings on precious metals mining stocks.

In other words, where just a few weeks ago would-be gold and silver buyers thought they had plenty of time and feared being stuck in a dead-money asset, they now feel like time is running out. FOMO has become their dominant impulse.

Here’s an excerpt from a King World News interview with Michael Oliver, a technical analyst who has been predicting a sharp, quick upward move in precious metals for the past few months and was – sharply and quickly – proven right in June. Not surprisingly, he thinks the current move has very long legs:

This is a new massive gold bull leg that’s an extension of the bull market that began in the 1970s…Most price chart analysts are looking at this and are thinking ‘I have to be in this or I’m’ going to miss it.’ We’ve rapidly taken out the highs of the past five years. Money managers who have not been in gold are being jolted into the sense that they have to be part of this. Especially with the gold miners, which are rising at double the rate of the metals. When these folks start to move assets into this sector it can have a dramatic effect. They’ll move explosively higher.

Most people will be shocked where the next rest stop for the gold miners. GDX was $20 recently and could be above $30 in short order. It’s a new dynamic and all the price-related technical indicators that most people look at will be shattered to the upside. Ignore those overbought signals.

By the end of the year we should see $1,700 in gold. That’s not the end, it’s just where it will be at year-end. We’re in a major situation.

Silver, meanwhile, is about to slingshot to catch up with gold. It will do twice as well as gold, too quickly to allow time for committee meetings to decide whether or not to buy. You won’t get a measured move – expect a move from the mid $15s to over $20 in a matter of weeks. But that will be just the beginning.

If you’re not there you’re going to miss it.

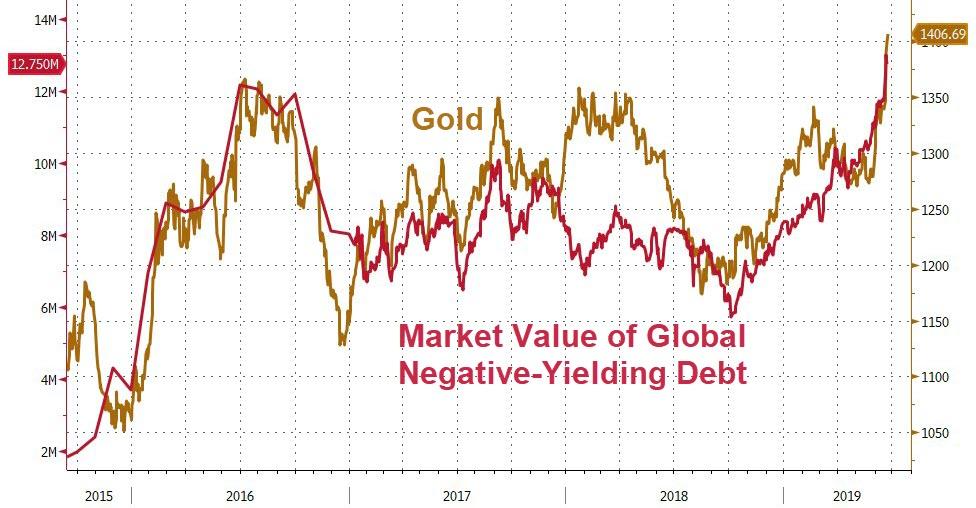

[ZH: Finally, while we are well aware that correlation does not imply causation, the following chart of the extremely close relationship between zero-yielding gold and the amount of negative-yielding debt in the world suggests the precious metal is acting just as it should – as a hedge against a world gone mad]

So, don’t fight the global central bank credibility collapse, buy gold.

via ZeroHedge News http://bit.ly/2IGmcgb Tyler Durden