Without the quad-witch magic, stocks unable to hold gains as bonds, bullion, and bitcoin all see safe-haven bids…

Chinese stocks trod water largely overnight after a big week, with tech and small caps leading the drop…

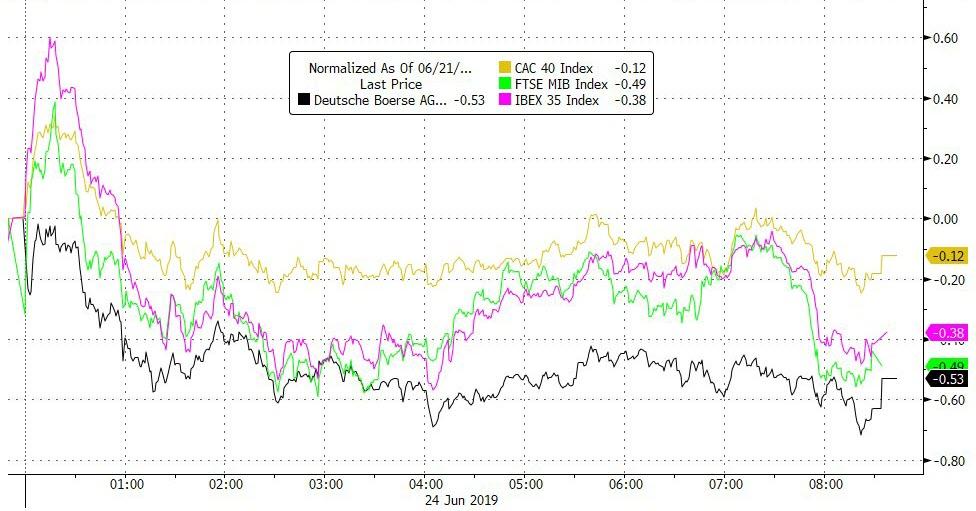

European stocks drifted lower for the 3rd day in a row, despite an excited open…

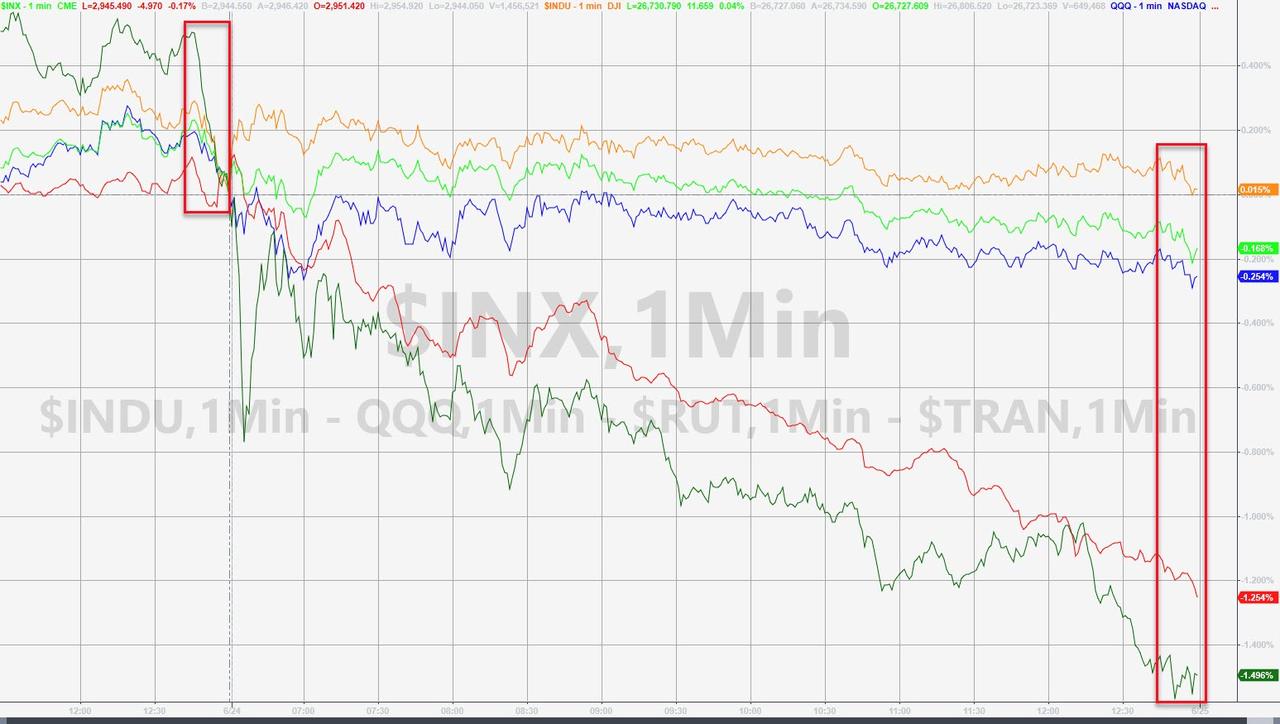

Ugly day for Trannies and Small Caps, Dow managed to cling to gains but S&P and Nasdaq scrambled around unch before a weak close (second in a row)…

The (cash) opening spike at the open could not hold…

Dow Industrials and Transports have notably decoupled…

It’s a serious decoupling…

Notably, the decoupling of Small Caps and Trannies occurred when the ammo for short-squeezes ran out…

VIX and Stocks remain decoupled…

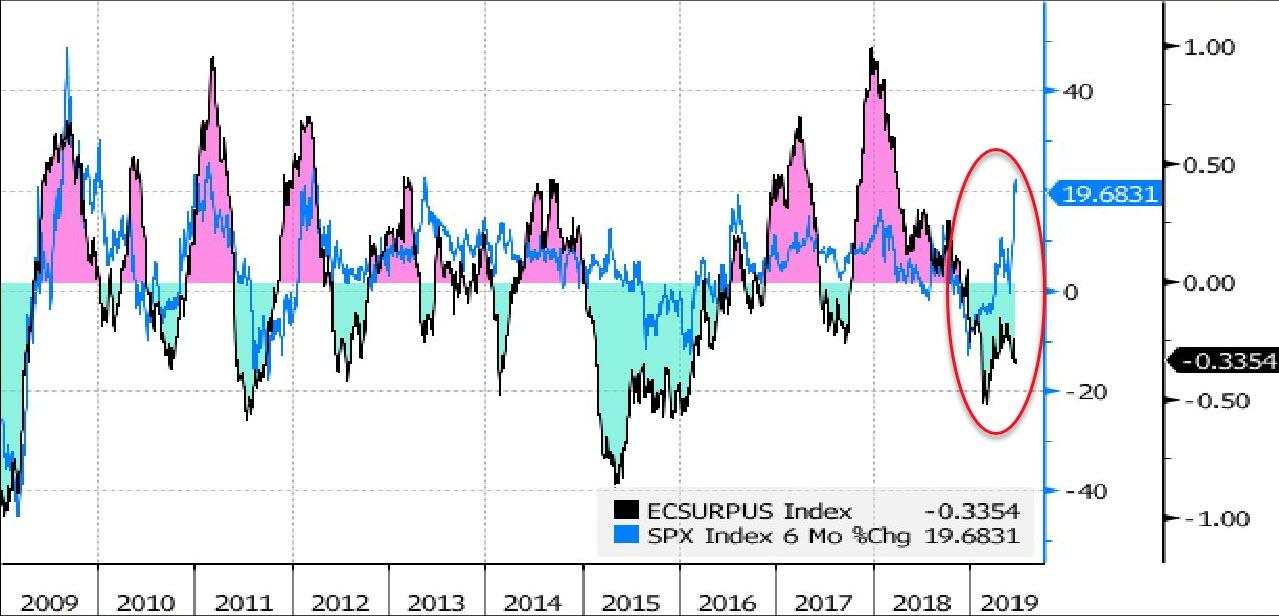

While the so-called Fed model “shows” that stocks are relatively attractive to bonds, Bloomberg’s Ye Xie notes, the risk is that the equity market hasn’t priced in enough potential bad news on earnings and the economy.

Notably though, equity risk has entirely decoupled from the risk of bonds and bullion – some suggest this as a simple way to quantify the ‘value’ of the ‘Fed Put’ – around equity 25 vol points compression

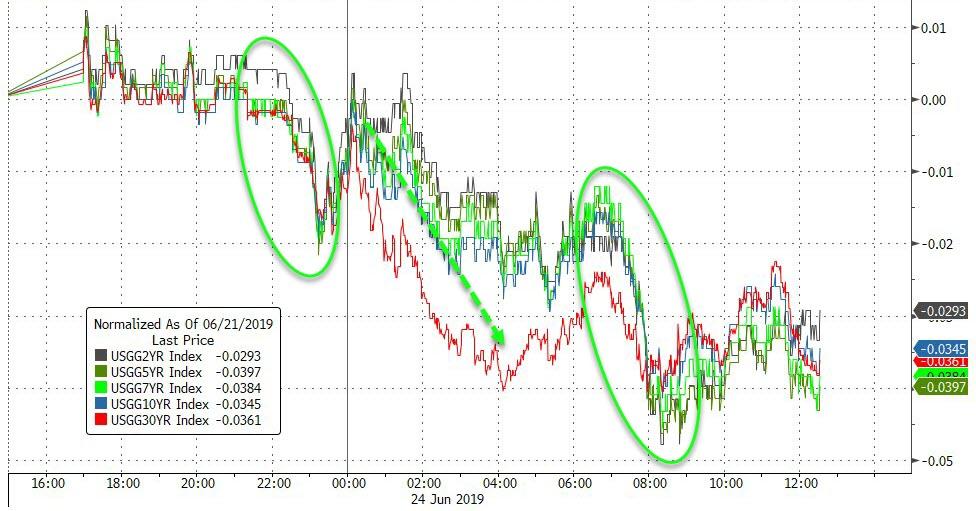

Treasury yields were down a pretty uniform 3-4bps or so across the curve…

10Y dropped back to a 2.01% handle once again…

And the yield curve flattened…now inverted for 22 days straight…

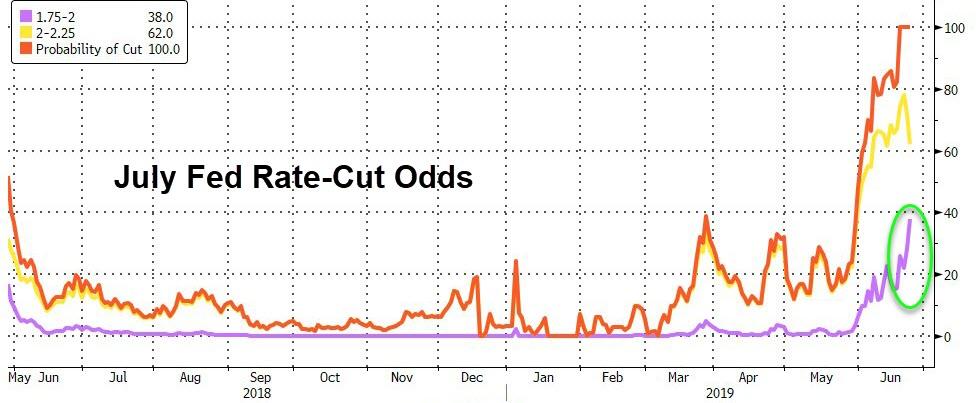

Expectations for a big (50bps) rate-cut in July are surging (now 38%!)

Before we leave bondland, this is worth noting – the US yield curve collapse has tracked the same move in the mid to late 1990s… all of which culminated with the collapse and bailout of LTCM (where leveraged bets on correlations exploded)

The Dollar Index extended its decline…

Falling well below its 200DMA now…

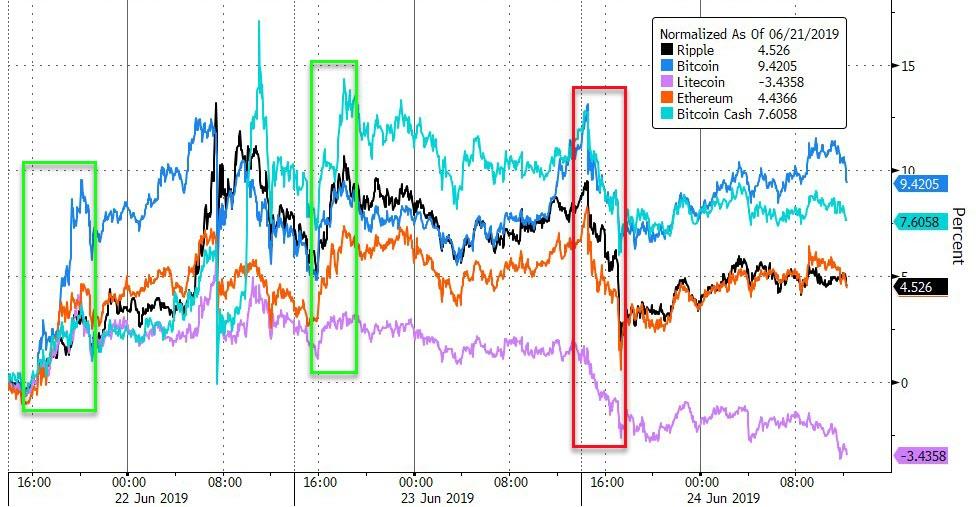

A big weekend for crypto saw some selling early today (Litecoin weakest)…

Bitcoin was bid multiple times back above $11,000…

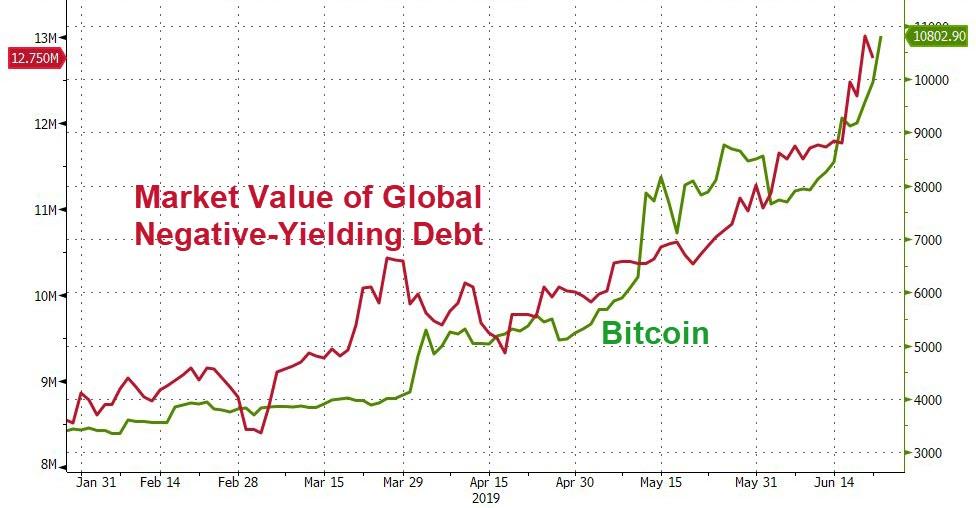

Bitcoin is tracking the amount of crazy in the world…

Gold and Bitcoin have recently become seriously correlated…

Gold was the best performing commodity on the day with oil playing a bg catch up into its close…

WTI rebounded off $57 once again…

Another big day for gold, with futures spiking up to almost $1425…

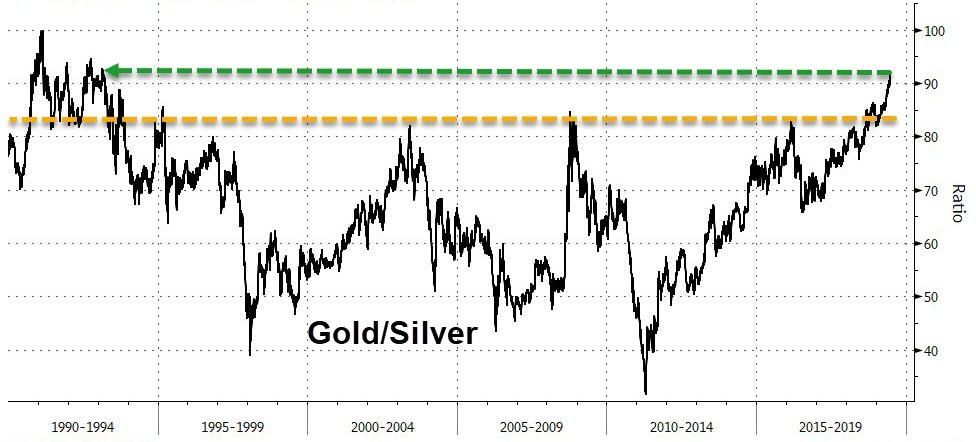

Gold continues to outpace silver…

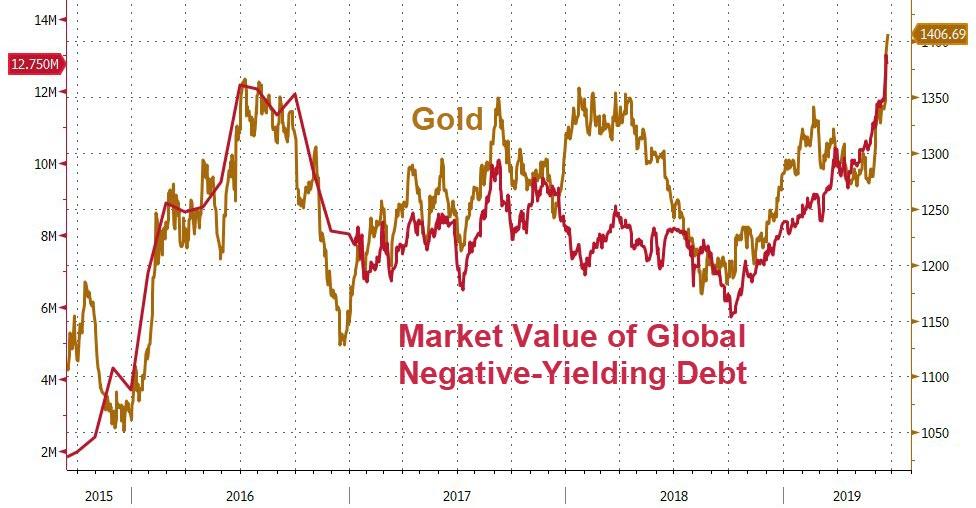

Finally, when everything is yielding below zero, a zero-yielding asset has more value…

“World-Gone-Mad” premium soars.

via ZeroHedge News http://bit.ly/2Y6XbQy Tyler Durden