Submitted by Joseph Carson, Former Director of Global Economic Research, Alliance Bernstein

The Federal Reserve appears to be embarking on a new policy: policymakers appear to be tangling the prospect of more monetary accommodation in order to encourage more risk-taking and use the strength of the asset markets to help them achieve their mandates on growth, employment and inflation. In the past, policymakers would consider asset prices only insofar it was signal of future general inflation. Now it appears policymakers need or even wants higher asset inflation to help them achieve their mandate on growth and inflation. Will the gamble work?

At the press conference following the June 18-19 meeting of the Federal Open Market Committee meeting Federal Reserve Fed Chair Jerome Powell stated that the Fed “overreaching goal” was to sustain the economic expansion and if needed policymakers would use all of our tools —interest rates and the balance sheet if necessary—to fulfill their mandates. Mr. Powell also went out his way to telegraph how many policymakers (8) indicated a preference to cuts rates at some point and that a number of others felt the case for easy money had strengthened.

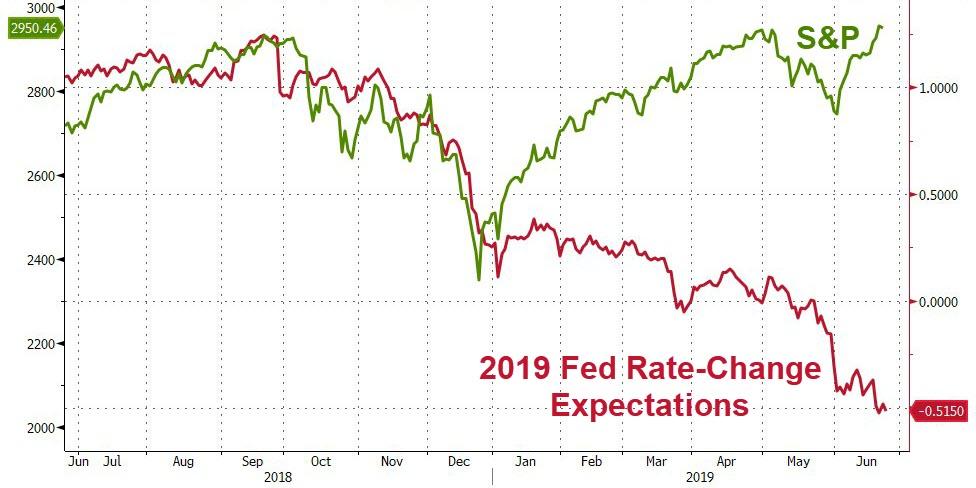

Such comments, with equity prices near record highs, are essentially an endorsement to take on more risk in your portfolio. In the past, policymakers would hint of “monetary accommodation” (the so-called Fed put) to support the market following sharp sell-offs. Yet, the new comments by the Fed Chair was made at a time when stock prices already had strong momentum; it was almost like the Fed chair was sending a “buy” signal to investors.

It would be wrong to overlook the significance or downplay the potential influence of the message sent by the Fed Chair. Comments by the Fed chair not only show the future direction of policy, but also can, and have in the past, influenced individual investment behavior. For example, in 2004 Mr. Greenspan stated, “Many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages”. Such a comment, with house prices soaring at the time, was essentially viewed as an endorsement to take on more risk in housing finance. People and lenders did listen—evident by individuals taking on record $3 trillion in mortgage debt in the next three years, and a lot of that was adjustable debt.

One of the potential consequences of this new Fed policy is to add to the “cyclicality” of the household portfolio and income flows. For example, today the market value of equities in individual’s accounts and in their mutual fund accounts is twice that of liquid and riskless investments such as time and saving deposits, money market funds and Treasury securities. It was not too long ago that individuals had equal holdings of risky (equity) holdings and riskless (liquid) assets.

The shifting composition of the household portfolio has also tilted the “cyclicality” of income flows. Today, households receive almost as much in dividend payments and they do in interest income payments. In the 1990s, household received $5 of interest income payments for every $1 of dividend payments.

The changing nature of the household’s portfolio and income flows is a big positive during growth cycles as large wealth gains and income flows help to augment the spending cycle and boost consumer confidence in the process. But, the downside is that household portfolios are less stable during asset price corrections and income flows do not have the strong stabilizing force as they did in past cycles.

For now, however, the “Fed Put” has been swapped for the “Fed Gamble” as policymakers seem to be purposely encouraging more risk-taking and asset inflation to better ensure the sustainability of the expansion, and help them achieve their mandated objectives on employment and inflation. It is a risky gamble, as the trade-off would appear to be an extended growth cycle in the short run, with the potential of heighten financial instability later.

via ZeroHedge News http://bit.ly/2IDmd4q Tyler Durden