Authored by Richard Breslow via Bloomberg,

It’s hard to tell whose bluff was called last week, but the end result is that almost every systemically important central bank did more than blink. They caved.

-

The question is, did they do so to keep the fun alive?

-

Because they know something that they are loathe to tell us?

-

Or have they finally and totally given up faith in their government counterparts?

It surely isn’t because they have suddenly realized, en masse, that inflation, as they choose to measure it, hasn’t reached the arbitrary 2% target.

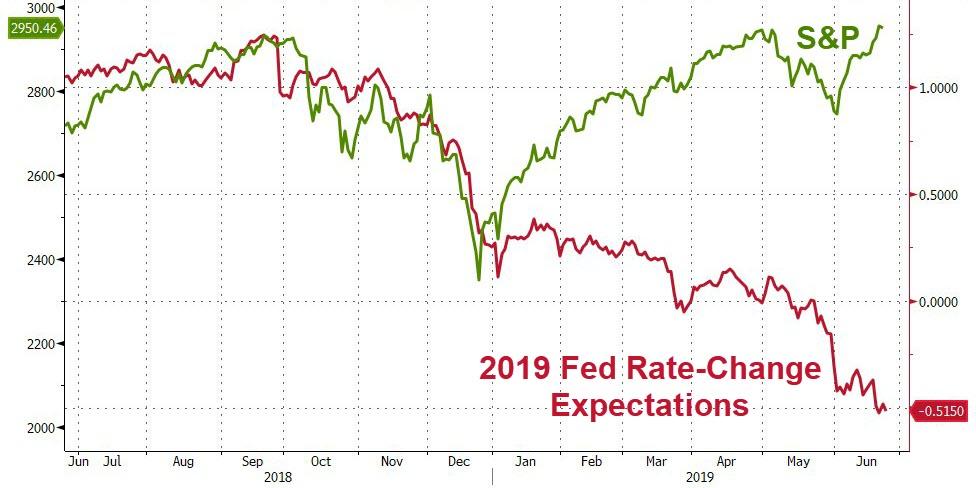

Whatever the reason, and despite equity markets and related risk assets having a field day, there isn’t a great deal to celebrate.

There should be no comfort taken that a Fed president argued for a 50 basis point rate cut and wasn’t laughed out of the room.

That 10-year Treasury yields are back down to current levels is a clear sign that the battle is being lost. It’s a shame that it would probably take an oil shock that would adversely affect consumer lifestyles to perk up the spirits of central bankers who think it’s fun to contemplate how far below zero rates can go without doing any harm.

Efforts are being made to lower market expectations for the outcome of trade talks at the G-20 meeting. That’s a shame. Rate cuts are worse than an inadequate substitute for real progress. At this point, they are positively harmful. As are currency wars. And they put the burden of responsibility to act on the wrong people.

Continuing to respond to all difficulties through fiddling with short-term interest rates exposes the defining characteristic of our economic times: that financial conditions being kept at elevated levels is the primary way policy-makers validate their understanding of how well they are doing. Is there any other way of understanding who they think of as their constituency?

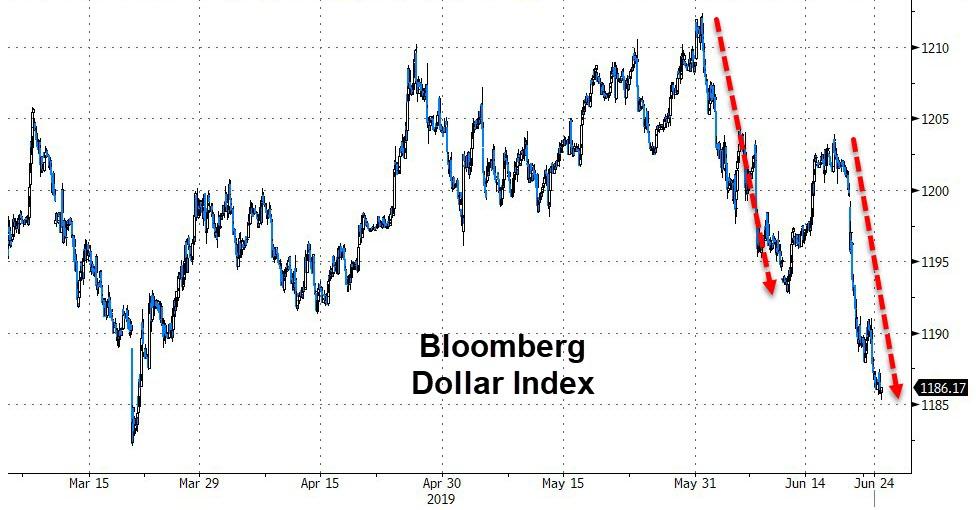

The dollar is trading horribly. And that’s a crying shame.

Last week’s CFTC data showed an out-sized rotation out of the U.S. currency and into the euro and yen. That helps no one.

One of the most-cited reasons is that the Fed has room to out-cut the other central banks. That’s pathetic.

Nevertheless, with the break below support at the 200-day moving average that had previously contained this year’s sell-offs in the Dollar Index, the next technical target is 95.75.

Through there and this thing will look ugly. It shouldn’t give way easily. But, if it does, it could prompt responses from competing central banks that would further solidify the beliefs of those who reasonably posit that there is no escape from the policy regimes that we were sold as easily reversed.

via ZeroHedge News http://bit.ly/2RFN5nz Tyler Durden