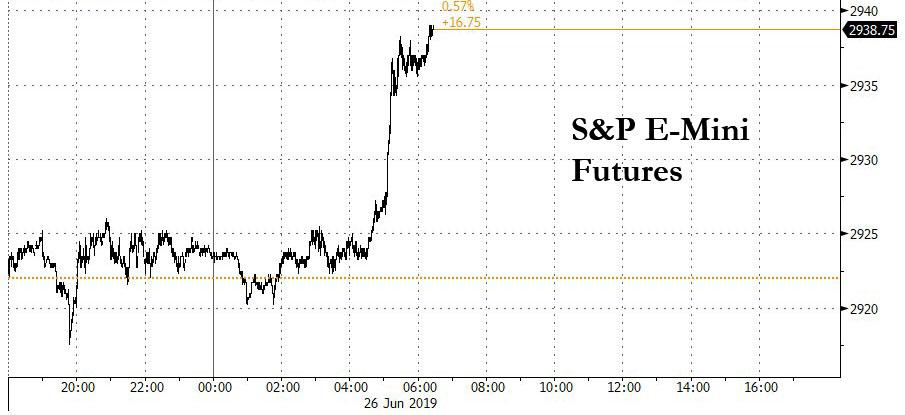

Global markets and US equity futures are so desperate for any trade war optimism that they positively soared just after 5am EDT when Treasury Secretary Steven Mnuchin regurgitated a long-running soundbite, saying that a trade deal between China and the United States was “90% completed”, days before a high-stakes meeting between the two countries’ leaders.

In an interview with CNBC on Wednesday morning, Mnuchin said this week’s G-20 summit in Osaka where Chinese President Xi Jinping and his US counterpart Donald Trump are expected to meet, would be “a very important G20” and adding that “we were about 90 per cent of the way there [to a trade deal] and I think there’s a path to complete this,” he said, without specifying the remaining 10 per cent.

Treasury Secretary Steven Mnuchin says a U.S.-China trade deal is “about 90% of the way there.” https://t.co/3Q0wvJKKxD pic.twitter.com/of6yH5y3rs

— CNBC International (@CNBCi) June 26, 2019

On the other hand, it appears that nothing Mnuchin said was actually new as he footnoted his statement by saying that “the message we want to hear is that they want to come back to the table and continue because I think there is a good outcome for their economy and the U.S. economy to get balanced trade and to continue to build on this relationship.”

And while to many traders that was just a rehash of the default US position, one which has been voiced on many times before and did not offer any new facts or hint at the concessions demanded by China, it was enough to push US equity futures which until then had traded unchanged sharply higher, with European stocks following the move tick for tick.

Up until the Mnuchin comment, global stocks fell while the dollar rose on Wednesday as comments from Powell and Bullard dampened excitement about an aggressive rate cut as early as July from the world’s most important central bank. Fed Chairman Powell and St. Louis Fed President James Bullard on Tuesday pushed back on market expectations and presidential pressure for a significant U.S. interest rate cut of half a percentage point as soon as its next meeting.

Powell said the central bank is “insulated from short-term political pressures”. But he said he and his colleagues are currently grappling with whether uncertainties around U.S. tariffs, Washington’s conflict with trading partners and tame inflation require a rate cut.

As a result, the The European STOXX 600 index had fallen 0.3% to its lowest level in a week, while Germany’s Dax was down 0.15%, as the MSCI world equity index was down 0.16%, while U.S. futures indicated a flat to lower open.

All that reversed however on Mnuchin’s comments and the result was a sea of green across European markets and US futures, a move which however will be promptly reversed as traders realize that a trade deal with China only makes a rate cut by the Fed that much more unlikely, especially if the US does – as Bloomberg reported yesterday – delay the implementation on an additional $300 billion in Chinese imports as talks between the two superpowers restart.

Following Mnuchin’s comments, look for July rate cut odds to slide even more – according to latest market data, federal funds futures implied that traders saw a 27% chance of the Fed lowering rates by half a percentage point in July, compared to 42% on Monday.

While Mnuchin’s comments revived risk appetite, a major breakthrough may not come this weekend and Trump’s advisers are pushing him to avoid a hard deadline on implementing a new tranche of tariffs. Many traders hope the Federal Reserve will mitigate any headwinds to global growth with deep cuts, though Fed member James Bullard made clear Tuesday that’s not a given, as Bloomberg noted.

“My biggest concern here is that people think higher tariffs, or the threat of higher tariffs, can be offset by the promise of lower rates,” said David Kelly, chief global strategist at JPM Asset Management. “That’s not going to work.”

After sliding earlier, Europe’s Stoxx 600 Index erased an earlier drop of as much as 0.4% led by banks and autos shares, with health-care and utilities declining the most. Thyssenkrupp AG jumped on a report that Finnish manufacturer Kone Oyj is preparing a bid for the company’s elevator business.

Earlier in the session, and before Mnuchin’s comments hit, Asian stocks dropped for a second day driven by Powell’s hawkish comments combined with his warning of rising downside risks to the U.S. economy. Consumer staples and consumer discretionary were among the worst-performing sectors. Most markets in the region declined, with Japan and Taiwan leading losses. The Topix gauge fell 0.6%, driven by SoftBank Group and Kao. The Shanghai Composite Index edged down 0.2%, as Washington is said to delay imposing additional tariffs on China while both sides prepare to resume trade negotiations. CSC Financial and China Merchants Bank were among the biggest drags. The S&P BSE Sensex Index climbed 0.3%, led by HDFC Bank and ICICI Bank, as a deficient monsoon and signs of slowing growth raised hopes for stimulus in the federal budget next month.

Meanwhile, the Fed remains in a bind and will be unable to reverse its stance should any good news emerge: Richard Dias, multi asset strategist at Pictet Asset Management, said the Fed had effectively backed itself into a corner, making a cut in July or September highly likely.

“They are in a weird dichotomy, so many cuts are priced in and the market has rallied on this news and the bond market has rallied so if they don’t deliver what they have telegraphed, their credibility will be impinged,” he said, adding that he expected a cut of 25 basis points. “They would never do 50 bps, we are not in a recession,”

Elsewhere, in rates, what was initially a modest sell-off in U.S. Treasuries accelerates, and pushed 10Y Treasury yields climbed above 2% after closing around 1.98% yesterday. Euro-area bonds slipped as Austria looked to offer its second 100-year bond. Germany’s 10-year benchmark bond yield held around -0.32%.

In FX, the dollar steadied and the New Zealand dollar edged higher after the Reserve Bank of New Zealand (RBNZ) stood pat on monetary policy, keeping rates at a record low 1.50%. But the kiwi’s gains were limited as the central bank expressed concern towards economic risks at home and abroad. “Overall, today’s announcement provides a strengthened signal that another cut is coming, most likely soon, unless there is a marked improvement in the global outlook,” wrote economists at HSBC. The kiwi last traded 0.2% higher at $0.6651. Month- and quarter-end flows provided choppy price action in the euro and the pound, which traded with a defensive tone overall.

The yuan fell to its lowest since December against a basket of trading partners’ currencies but pared an earlier drop against the dollar, with investors remaining cautious ahead of this week’s G-20 summit. Investors are reluctant to be too bullish on the meeting between Presidents Donald Trump and Xi Jinping at this week’s G-20 summit, said Irene Cheung, a senior strategist at ANZ Bank. A third consecutive decline saw the Bloomberg CFETS RMB Index tracker fall to its lowest level since December. Hao Zhou, senior emerging markets economist at Commerzbank AG, said the yuan was pressured by an unwinding of EUR-CNY trades. He added that the yuan could edge lower on continued G-20 caution and on a report that three Chinese banks could face fallout from an investigation into North Korean sanctions violations.

A US admin official said USD would be less strong and the EUR would be less weak if the Fed took back rate hike from last fall, while the official added that there are many opinions in the White House about the President’s authority to demote Powell but also stated that the White House has no plans to demote Fed Chair Powell.

In the latest geopolitical news, North Korea said US extension of sanctions against North Korea is a direct challenge to Singapore summit agreement and an extreme act of hostility. Elsewhere, Iran’s atomic energy organisation spokesman says Iran will speed up the enrichment of uranium as the deadline given to European countries ends tomorrow, while Russia said it could ramp up safety measures for its workers in Iran, according to Russian press. Oh, and Iran’s Supreme Leader Khameni says Iran will not retreat in the face of US pressure.

U.S. crude oil futures advanced roughly 2% to touch a four-week high of $59.10 per barrel after data showed a decline in U.S. crude stocks. Gold retreated from a multi-year high.

Elsewhere, Bitcoin surged above $12,000 for the first time in more than a year, and briefly came within striking distance of the $13,000 mark.

Economic data include durable goods orders, inventory figures. Scheduled earnings include General Mills, Paychex, IHS Markit

Market Snapshot

- S&P 500 futures up 0.5% to 2,936

- STOXX Europe 600 up 0.1% to 383.91

- MXAP down 0.4% to 158.68

- MXAPJ down 0.06% to 522.99

- Nikkei down 0.5% to 21,086.59

- Topix down 0.6% to 1,534.34

- Hang Seng Index up 0.1% to 28,221.98

- Shanghai Composite down 0.2% to 2,976.28

- Sensex up 0.1% to 39,490.07

- Australia S&P/ASX 200 down 0.3% to 6,640.49

- Kospi up 0.01% to 2,121.85

- German 10Y yield rose 0.8 bps to -0.323%

- Euro down 0.08% to $1.1358

- Italian 10Y yield rose 0.6 bps to 1.797%

- Spanish 10Y yield rose 0.8 bps to 0.388%

- Brent Futures up 1% to $65.72/bbl

- Gold spot down 0.8% to $1,412.41

- U.S. Dollar Index up 0.1% to 96.26

Top Overnight News

- In an interview with CNBC on Wednesday, Mnuchin expressed optimism that a U.S.-China trade deal could be reached by year end, saying the two sides “were about 90% of the way there and I think there’s a path to complete this,” with a need still for “the right efforts”

- U.S. prosecutors are investigating an international network of traders suspected of infiltrating banks and companies to glean confidential information on megadeals, according to people familiar with the matter

- Special Counsel Robert Mueller agreed to testify publicly before two House panels, setting up a dramatic hearing that promises to reinvigorate the national debate over his findings on Russian election interference and possible obstruction of justice by President Donald Trump

- Algorithmic trading programs can be fast, but they also have to be right. While the RBNZ kept rates on hold Wednesday as widely expected, one tweet from a financial data company said rates had been cut, causing New Zealand’s currency fell as much as 0.6% before rebounding

- The U.S. is willing to suspend the next round of tariffs on an additional $300 billion of Chinese imports while Beijing and Washington prepare to resume trade negotiations, people familiar with the plans said

- Federal Reserve Chairman Jerome Powell said the downside risks to the U.S. economy have increased recently, reinforcing the case among policy makers for somewhat lower interest rates

- Boris Johnson toughened his Brexit rhetoric with a “do or die” pledge to leave the European Union on Oct. 31 as Jeremy Hunt, his underdog rival to become U.K. prime minister, battled to persuade Tory party members the strategy is flawed

- President Donald Trump threatened Iran with forceful retaliation for any attack on the U.S. after the Islamic Republic ruled out talks to resolve escalating tensions between the two nations

- Oil ramped higher after an industry report suggested U.S. crude stockpiles continue to shrink, another bullish signal for a market that’s been boosted by the uncertain standoff in the Middle East.

- Australia is urging Indo-Pacific nations to step up their commitment to free trade as the worsening fallout from the U.S.-China impasse threatens global growth

- Special Counsel Robert Mueller has agreed to testify before two House committees on July 17, the chairmen of the panels said Tuesday night, promising to reinvigorate the national debate over his findings on Russia election interference and possible obstruction of justice by Donald Trump

Asian equity markets were mostly subdued following the headwinds from Wall St where stocks posted their worst performance in nearly a month as Fed speakers tempered rate cut bets. This was after Fed Chair Powell said many on the Fed see a case for more accommodation but also stressed the importance of not overreacting, and Fed’s Bullard who was the lone dovish dissenter at the last meeting, stated that he does not prefer a 50bps rate cut in July. ASX 200 (-0.3%) and Nikkei 225 (-0.5%) weakened with Australia led lower by gold miners after a pullback in the precious metal although resilience in healthcare, materials and industrials limited the downside, while sentiment in Tokyo was also downbeat with Japan Display among the laggards in the spotlight after several other groups withdrew from the Co. bailout. Elsewhere, Hang Seng (+0.1%) and Shanghai Comp. (-0.2%) were indecisive amid further PBoC liquidity inaction and ongoing uncertainty heading into the Trump-Xi meeting at this week’s G20, with the US said to be unwilling to give concessions on trade at the meeting and that no broad deal is expected, although it was also reported that the US is considering suspending the next round of tariffs on an additional USD 300bln of Chinese imports as the sides prepare to resume trade discussions. Finally, 10yr JGBs tracked the late losses seen in T-notes as market pricing of a 50bps Fed cut in July declined to 25% from around 43% the prior day, although the downside for Japanese bonds was cushioned by the negative risk tone and BoJ Rinban operation for JPY 775bln of JGBs concentrated in 1yr-5yr maturities.

Top Asian News

- Bank of Thailand Holds Key Rate as Growth Weakens, Baht Surges

- Asia’s Monster Trade Pact Could Be Done This Year, Minus a Few

- China Urges U.K. to Not Interfere in Hong Kong Affairs

- SGX Upholds Trades That Briefly Wiped $2 Billion From UOB Value

European equities rebounded off lows [Eurostoxx 50 +0.4%] after US Treasury Secretary Mnuchin sounded upbeat on US-China trade negotiations heading into this week’s G20. Mnuchin reiterated that the deal is “90% done”, albeit US officials have previously noted that the last 10% remains the hurdle. Although some suggested that Mnuchin was speaking in the past tense. Nonetheless, this boosted bourses out of the neutral/flat territory they had been in. Sectors are mixed, with energy and material names supported by price action in oil and base metals respectively, while financials outperform as yields nursed some recent losses post-Bullard and Powell, meanwhile the latest bout of Mnuchin-sparked “risk on” also weighed on bonds. Furthermore, chip names are supported amid optimistic earnings from Micron after-market yesterday (STMicroelectronics +2.5%, AMS +4.1%, Infineon +1.2%). In terms of other individual movers, Thyssenkrupp (+7.0%) shares spiked higher at the open amid speculation that Kone (-0.1%) is readying a bid for the Co’s elevator unit. Meanwhile, Brenntag (-4.1%) rest at the foot of the Stoxx 600 amid reports that the Co. sold dual-use chemicals to Syria.

Top European News

- U.K. Breakeven Yields Fall as Lords Seeks Response on Inflation

- Italian Bonds Briefly Extend Decline as 1Q Deficit Touches 4.1%

- Italy First Quarter Budget Deficit at 4.1% of GDP

- As Johnson Eyes No-Deal, MPs Vow to Fight Him: Brexit Update

In FX, FOMC easing prospects prompted by Powell and Bullard that have both cautioned against reacting too aggressively to downside growth and inflation risks. Hence, market pricing has shifted further towards 25 bp from 50 bp and the Greenback is clawing back some losses, especially against safer-havens amidst pre-G20 comments from US Treasury Security Mnuchin reiterating that 90% of the trade accord with China has been completed. The index is holding within 96.145-322 parameters, and for now at least not succumbing to bearish spot month end rebalancing requirements according to 3 if not more bank models.

- NZD/AUD/CAD – The Kiwi is extending its winning run in wake of the RBNZ’s latest policy meeting and accompanying statement that reinforced guidance for lower rates, but was tempered somewhat by a balanced assessment of the economic outlook due to softer property prices vs more expansive fiscal policy. Moreover, the aforementioned latest US-China reports have sparked a broad rise in risk appetite with Nzd/Usd just topping out around 0.6680 and Aud/Usd retesting offers/resistance ahead of 0.7000. Meanwhile, the Loonie is consolidating gains made on the back of yesterday’s upbeat Canadian wholesale trade data with the aid of rebounding oil prices, with Usd/Cad hovering close to the bottom of a 1.3193-42 range and not visibly reacting to China extending its import ban to include all meat from Canada.

- NOK – Another marked G10 outperformer and also fuelled by the post-API crude comeback, but deriving additional momentum from much better than forecast Norwegian jobs data, as Eur/Nok nestles around 9.6600 vs 9.7125 at one stage.

- JPY/CHF – As noted above, the Yen and Franc have been undermined by less dovish Fed perceptions and revived US-China trade aspirations even though the Mnuchin ‘revelation’ is likely a statement about how things stood before talks ended in accusations of blame for reneging on pledges by both sides. Nevertheless, Usd/Jpy has nudged up over 107.50 from sub-107.00 on Tuesday and into the upper echelons of option expiries extending to 108.00-10 in decent size – see our 7.11BST post on the headline feed for full details. Similarly, Usd/Chf has rebounded to 0.9780 or thereabouts and Eur/Chf is back above 1.1100.

- GBP/EUR – Sterling and the single currency are both relatively rangebound as Cable flits between 1.2705-2664 amidst BoE testimony to the TSC ostensibly on the now dated May QIR that merely underlined ongoing Brexit dependent policy guidance and Eur/Gbp pivots 0.8950. Eur/Usd has pulled back further from its modest 1.1400+ advance, but finding support ahead of 1.1350 and decent technical levels a fraction below, such as the 200 DMA and WMA. Note also, large expiry interest from 1.1370-80 (3.2 bn) and 1.1385-90 (1.8 bn) are likely to cap the headline pair.

WTI and Brent futures have held onto most of their API-inspired gains (crude stocks -7.7mln vs. Exp. -2.5mln) with the former hovering close to the USD 59/bbl mark (having briefly breached the level to the upside) whilst the latter eyes USD 66/bbl. News-flow for the complex has been light thus far, albeit prices are also underpinned by supply-side disruptions after Exxon’s Beaumont Texas refinery (366K bpd) suffered multiple upsets due to a power loss, while Philadelphia Energy Solutions, the largest refinery in the US East coast (335K BPD), is expected to be closed down after a recent fire. Elsewhere, gold remains just above the USD 1400/oz after retreating form 6yr highs as the USD recoiled after Fed’s Bullard and Powell tempered expectations of a 50bps cut. Meanwhile, copper prices extend gains above USD 2.7/lb, now eyeing 2.75/lb as strikes in the world’s largest open-pit mine (Codelco’s Chuquicamata mine) continue, with the workers reportedly blocking roads leading to other mines. In other news, Philadelphia Energy Solutions is expected to close its oil refinery following the recent fire, while the refinery is the largest in the east coast of the US with a capacity of 335k bpd.

US Event Calendar

- 7am: MBA Mortgage Applications 1.3%, prior -3.4%

- 8:30am: Durable Goods Orders, est. -0.2%, prior -2.1%; Durables Ex Transportation, est. 0.1%, prior 0.0%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.1%, prior -1.0%; Cap Goods Ship Nondef Ex Air, est. 0.1%, prior 0.0%

- 8:30am: Advance Goods Trade Balance, est. $71.8b deficit, prior $72.1b deficit

- 8:30am: Retail Inventories MoM, est. 0.3%, prior 0.5%, revised 0.5%; Wholesale Inventories MoM, est. 0.45%, prior 0.8%

DB’s Jim Reid concludes the overnight wrap

For those stuck on a trading floor or maybe in a hotel room this morning, I’ll be on CNBC at 9.30am London time. I was on Bloomberg TV a couple of weeks back and my wife said that one of the twins ran up to the TV and said “Dada” when he saw me. Meanwhile my daughter told my wife it was boring and insisted she put “Paw Patrol” back on. So clearly the bid-offer as to when children turn from adoration to boredom towards their parents is 1.75-3.75 years in my family.

Markets were a little less boring yesterday than on Monday as rates gyrated again and risk sold off even with Fed Chair Powell not revealing too much new information in his speech last night. He seems intent on maintaining optionality ahead of the pivotal July Fed meeting. Yields nevertheless rose and equities fell, as St. Louis Fed President Bullard was not as dovish as expected in comments at a separate event. This seemed to be a spark for sentiment deteriorating, alongside some weaker data.

In Powell’s remarks, on the dovish side, he said that “investment by businesses has slowed,” that “crosscurrents have re-emerged,” and that inflation expectations have declined. On the other hand, he said that “solid fundamentals are supporting continued growth” and that he does not want to “overreact to any individual data point or short-term swing in sentiment.” So something for everyone there, and on the policy front he repeated his previous comments in favour of acting “as appropriate to maintain the expansion.” Asset prices initially reacted in a way consistent with a hawkish interpretation of his comments, with yields trading higher, equities falling, and the dollar strengthening, but the moves were minor and subsequently retraced.

What’s ended up being more impactful for markets were earlier comments from regional president Bullard. He is a voter this year and is considered the most dovish member of the committee, having dissented in favour of a rate cut at the June meeting. He spoke ahead of Powell and said that while the current environment seems like a good time for an “insurance rate cut,” the situation does not call for an immediate 50bps cut, saying such a move would be “overdone.” He went on to confirm that he is one of the FOMC members who favours 50bps of easing overall this year. Accordingly, this signals that he prefers to begin with a 25bps cut in July, which is less than currently discounted by the market. Two-year yields initially shot up +5.8bps after his remarks and the dollar strengthened +0.37%.

Equities had already been trading lower before the Fedspeak, after several economic releases fell short of expectations earlier in the morning (more below). The S&P 500 ultimately ended -0.95%, with over half of the losses coming after Bullard and Powell spoke. The NASDAQ and DOW ended -1.51% and -0.67%, respectively. The moves in rates proved less persistent, with 2-year treasuries ending flat (albeit before a +3.2bps move this morning) and 10-year yields down -2.9bps, but with 10 years closing below 2% for the first time since the US election day in 2016 – although they are back above that in Asia this morning. However, the shift in fed funds futures pricing proved durable, with the yield on the August contract closing +3.5bps higher, reflecting the reduced odds of a 50bps cut next month. The market reaction was indicative of slightly higher odds of a policy mistake, with 10-year inflation breakevens falling -3.8bps and the yield curve (2s10s) flattening -3.1bps.

In Asia overnight, the Nikkei (-0.59%) and Shanghai Comp (-0.23%) have followed Wall Street’s lead however the Hang Seng (+0.05%) and Kospi (-0.01%) are flattish. The recent rally for the Japanese yen which saw it hit the strongest level since April 2018 has abated a bit this morning, weakening -0.25%. The big mover overnight is oil though where WTI is up +2.09% following a report from the American Petroleum Institute indicating that US crude stockpiles fell by 7.55 million barrels last week.

Away from the Fedspeak, Bloomberg has run a story overnight suggesting that the US is willing to suspend the next round of tariffs on an additional $300bn of Chinese imports. The report notes that the decision is still under consideration and may be announced after a meeting between Trump and Xi this Saturday. Supposedly a call between Lighthizer and China Vice Premier Liu He was described as “productive” on Monday. Meanwhile, the US senate passed a resolution yesterday that “will consider all necessary measures” to limit risks of the US government or military using networks “compromised” by Huawei or ZTE equipment. The measure, which will move on for further votes, called for more pressure for allies to shun the companies’ network equipment. In other news, Special Counsel Robert Mueller has agreed to testify before two House committees on July 17 over his findings on Russia election interference and possible obstruction by President Trump.

Back to yesterday, where Powell’s remarks came as data from the Conference Board earlier in the day showed consumer confidence falling to 121.5 in June (vs 131.0 expected), down from May’s revised 131.3 reading and the lowest since September 2017. There weren’t many positives to find elsewhere in the data either, with the present situation falling to 162.6, the lowest since June last year, while the expectations reading fell to 94.1, the lowest since January. My colleague Torsten Slok sent round an interesting chart over the weekend (which we’ve recreated in the pdf today if you want to click) which shows the gap between the two being as wide as it is now is a good historical predictor of an upcoming recession.

Also of note from the Conference Board, the proportion saying that jobs were “hard to get” rose to 16.4%, the highest since November 2017, while the proportion saying that jobs were “plentiful” fell to 44.0%. The differential between the two, a closely-watched gauge of labour market sentiment, had its sharpest shift in over a decade. In previous cycles, this differential being stretched ended up being a good signal for the bottom in unemployment, so if maintained, it would certainly refocus the Fed’s attention on incoming labour data, especially the next jobs report due next Friday. Other US data proved no more promising, with new home sales for May falling to 626k (vs 684k expected), the Richmond Fed manufacturing index falling -2pts to 3, and retail sales figures getting revised lower.

Before Powell’s speech, equity markets in Europe closed lower, with the STOXX 600 -0.10% as the index lost ground for a third consecutive session. It was a similar picture elsewhere on the continent, with the DAX (-0.38%), the CAC 40 (-0.13%) and the FTSE MIB (-0.73%) all posting losses. Banks led the declines, with the STOXX Banks index -0.51% to close at its lowest level since December last year.

Rates had earlier rallied in Europe too, with bund yields falling to another record low yesterday of -0.333bps, down -2.4bps. French ten-year debt also closed in negative territory for their first time ever at -0.009% having shed -2.8bps, while Spanish and Portuguese yields fell -2.9bps and -4.7bps respectively to fresh lows. Meanwhile, the UK sold 30-year debt at an average yield of 1.421%, also a record low. However, in a sign that the ECB’s dovish pivot may already be wearing off on markets, and in a similar vein to the price action in the US fixed income market, five-year forward five-year inflation swaps fell -5.4 basis points to 1.214%, 12 basis points lower from Friday’s intraday high. A big and worrying shift.

As the war of words continued between the US and Iran, President Trump tweeted yesterday that “Iran leadership doesn’t understand the words “nice” or “compassion,” they never have. Sadly the thing they do understand is Strength and Power”. He also described their statement as “very ignorant and insulting”, and said that “Any attack by Iran on anything American will be me with great and overwhelming force.”

With rising geopolitical tensions, and ultra dovish central banks, it’s worth noting that gold reached a fresh six-year high yesterday of $1423/oz, though it did pare its gains after Bullard’s hawkish comments. It nevertheless has just had its biggest one-week increase in over three years. Another striking fact is that the ratio of gold and silver prices has risen to its highest level since 1993 at 92.6.

It’s not just gold that’s rising, with Bitcoin also at its highest level in over a year at $12,154 this morning, with a 203% rise since the start of April. We’re still some way from the peak above $19,000 reached in trading at the end of 2017, but the scale of the recent appreciation is striking. Obviously recent dovishness from central banks has seen investors look towards alternative currencies, but perhaps Facebook’s unveiling of its Libra currency has seen investors look again at cryptocurrencies with fresh eyes.

In terms of yesterday’s other data, sterling pared back gains against the dollar and the euro to close -0.42% weaker after the CBI’s survey of retail sales showed a reported balance of -42 in the year to June, the lowest since March 2009, with just 16% of retailers reporting higher sales volumes compared with last year. However it’s worth noting this has been a volatile series, and the figures will have been affected by last summer’s unseasonably hot weather. In France, the Insee’s business confidence remained at 106 for a third consecutive month in June, in line with expectations.

In other political news, the frontrunner to be the UK’s next Prime Minister, Boris Johnson, appeared to harden his rhetoric on Brexit yesterday, saying in an interview with talkRADIO that his commitment to leave the EU on the 31 October deadline was “Do or die. Come what may.” Later on, in a letter to his leadership rival, Foreign Secretary Jeremy Hunt, Johnson said that “I have been clear that, if I am elected leader, we will leave on 31 October with or without a deal.” Yesterday the Conservative Party also confirmed that the new leader would be announced on July 23rd in just under four weeks’ time.

Turning to the day ahead, datawise we’ve got consumer confidence figures from France and Germany, and this afternoon there’ll be May’s durable goods orders and wholesale inventories from the US. Here in the UK, Bank of England Governor Carney will be speaking to the Treasury Select Committee of MPs in Parliament, along with Deputy Governor Cunliffe and MPC members Tenreyro and Saunders. We’ll also have the ECB’s Mersch and San Francisco Fed President Daly making remarks. Finally, in the US this evening there’ll also be the first of two Democratic primary debates, in which the 20 participating candidates will be split over the next two nights.

via ZeroHedge News https://ift.tt/2YgjzqE Tyler Durden