Authored by John Rubino via DollarCollapse.com,

Not so long ago, Europe seemed to have its financial house more-or-less in order. German government spending was actually falling. Industries that had been nationalized in the socialist 70s were being privatized. The European Central Bank – run by sound money advocate Jean-Claude Trichet – was smarter and more cautious than the incoherently rambunctious Bernanke Fed. The euro, for a while, was actually preferred by many over the dollar.

Then – gradually at first and now very quickly – everything went sideways…

Mario Draghi took over for Trichet at the ECB and promised to do “whatever it takes” to generate at least 2% inflation. Then he proceeded to deliver on that promise with massive asset purchases and negative interest rates.

Inequality – which, we’re now coming to realize – fed by low interest rates and easy money, rose to near-US proportions. Immigration was mishandled to the point that it became THE political issue. And populist parties opposed to the existing system attracted enough votes to rattle the mainstream parties.

The entrenched political/financial class, shocked by the unwashed masses’ effrontery, are now responding exactly as you’d expect, with massive increases in social spending, promises of even easier money (Draghi actually claimed that there was “plenty of headroom” to cut rates from the current -0.4%) and, well, whatever else it takes to stay in power.

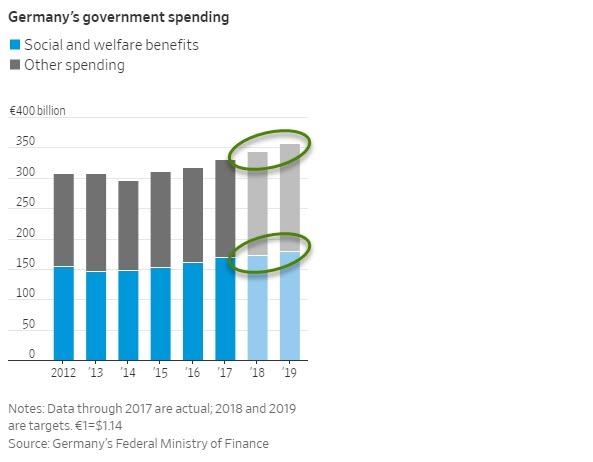

Here, for instance, is Germany’s government spending. Note the uptrend now that the Greens are contenders:

From today’s Wall Street Journal:

To win voters lost to an anti-globalization backlash, Europe’s mainstream parties are going back to the 1970s.

In Germany, the U.K, Denmark, France and Spain, these parties are aiming to reverse decades of pro-market policy and promising greater state control of business and the economy, more welfare benefits, bigger pensions and higher taxes for corporations and the wealthy. Some have discussed nationalizations and expropriations.

It could add up to the biggest shift in economic policy on the continent in decades.

In Germany, Europe’s biggest economy, the government has increased social spending in a bid to stop the exodus of voters to antiestablishment, populist and special-interest parties. Reacting to pressure on both ends of the political spectrum, it passed the largest-ever budget last year.

“The zeitgeist of globalization and liberalization is over,” said Ralf Stegner, vice chairman of the 130-year-old Social Democratic Party, the junior partner in Chancellor Angela Merkel’s government coalition. “The state needs to become much more involved in key areas such as work, pensions and health care.”

The policies mark the end of an era in Europe that started four decades ago, with the ascent of former British Prime Minister Margaret Thatcher and her U.S. ally, President Ronald Reagan.

After Thatcher abolished capital controls in 1979 and began selling off state companies in the 1980s, other European governments followed suit, embracing supply-side policies, deregulation, market liberalization and tax cuts. Revenues from privatization among European Union member states rose from $13 billion in 1990 to $87 billion in 2005, according to Privatization Barometer, a database run by consultancy KPMG Advisory S.p.A.

Today, concerns about growing inequality, stagnating wages, immigration, the debt crisis and China’s rising power have fueled the recent political shift. European businesses and governments also worry about potential changes in U.S. policy, amid looming threats of trade sanctions.

This erosion of the old technocratic consensus about how to run an economy, even in countries where populists aren’t getting any closer to power, could be one the most lasting consequences of the recent antiestablishment surge.

Even in countries where populist parties are already in government, such as Poland, those parties have shifted their focus from nationalist and anti-immigration rhetoric to championing generous welfare policies and state aid.

This reversion to the failed ideas of yesteryear is spreading across the Continent as debts mount and growth slows, which is pretty much how it always works: Borrow too much and the system starts to fail, leading to calls for a return to the good old days of … rising benefits paid for with borrowed money.

The next stage – again always and everywhere – is rising inflation and a currency crisis that wipes out the savings of the people the inflationary policies were supposed to help.

Which is another way of saying the currency war between the US and China will soon be joined by Europe, leaving most of us with nowhere to hide but gold.

via ZeroHedge News https://ift.tt/2ZTwlff Tyler Durden